- Home

- »

- Next Generation Technologies

- »

-

U.S. Industrial Robotics Market Size, Industry Report, 2030GVR Report cover

![U.S. Industrial Robotics Market Size, Share & Trends Report]()

U.S. Industrial Robotics Market (2024 - 2030) Size, Share & Trends Analysis Report By Application, By End-use, By Robot Type, By Payload Capacity, By Component, And Segment Forecasts

- Report ID: GVR-4-68040-217-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Industrial Robotics Market Trends

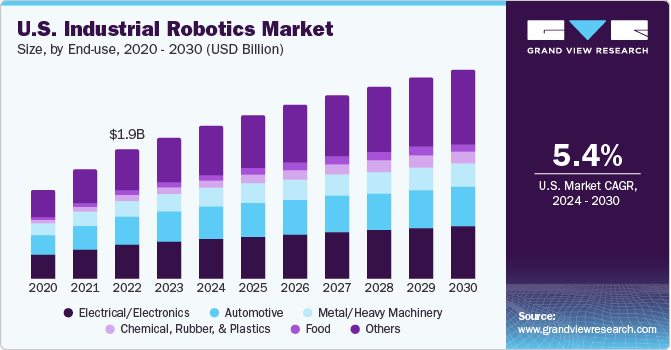

The U.S. industrial robotics market size was valued at USD 2.17 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2030. Due to the growing trend of Industry 4.0, the demand for robotics and smart manufacturing in the industrial sector has become crucial. Robotics in industries help in reducing expenses and increasing production rate. The emergence of robots assisting humans in various processes such as electronics product assembly further enhances industry demand.

In 2023, the U.S. accounted for over 7% of the industrial robotics market. Industrial robots use advanced technologies to complete tasks efficiently. Their demand is rising due to the enlarged manufacturing hub in the U.S. across various verticals. The rising trend of electric automobiles among new car owners is also expected to impact the industry significantly. Car manufacturers have begun using automated robotic systems for high volume production of vehicles.

The incorporation of AI & ML in industrial robotics is also influencing the industry positively. The introduction of 5G technology is also expected to encourage the use of robotics in the manufacturing sector. The low-latency provided by 5G network allows instantaneous communication between the systems for efficient coordination and connectivity.

The rapid shift toward smart manufacturing is another major factor driving the industry. Factories and manufacturing units are moving toward automation. They are implementing smart processes and are using industrial robots for various applications such as handling, assembling, welding, cleanroom, etc. This helps them perform at optimal level in order to meet production demand.

The rise in investment and ongoing development in the manufacturing sector is anticipated to propel the growth of the industry incumbents. Industries such as automotive, electronics, and metal & heavy machinery, are increasingly automating and transforming their manufacturing processes. Due to the higher demand for electrical & electronic products and automobiles, this industry plays an important role in the industry.

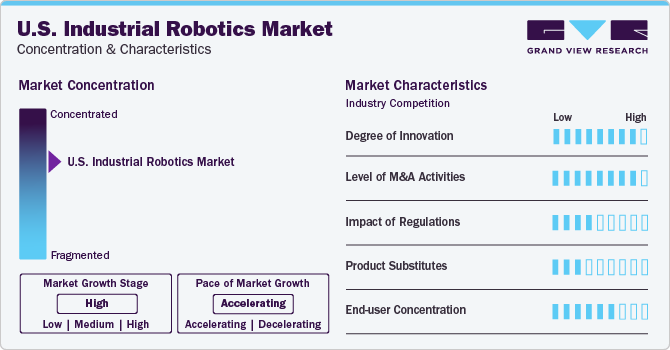

Market Concentration & Characteristics

The U.S. industrial robotics industry is characterized by a high degree of innovation due to improvisation in the quality of human-robot interaction, which is leading to the development of advanced industrial robots. Companies are spending on R&D to adapt robotic motions to respond more efficiently. They are developing robots with advanced technologies and modern features due to the growing industrial sector and complex processes. For instance, in June 2022, Epson Robotics launched its GX4 and GX8 SCARA robotics series.

Merger & acquisition activities are also high in the U.S. industrial robotics industry. In September 2023, Rockwell Automation Inc. announced its plans to acquire Clearpath Robotics Inc., the parent company of OTTO Motors. This move demonstrated the strength of demand for robots for materials handling. Similarly, in October 2023, Rockwell had also completed the acquisition of Kitchener, Ontario-based Clearpath.

The U.S. industrial robotics industry is characterized by a moderate level of impact of regulations. The National Institute of Standards and Technology (NIST), for instance, is developing a set of benchmarking protocols for cobots pertaining to robot-to-robot and human-to-robot collaborations.

End-use concentration is moderate to high in the U.S. industrial robotics industry as automotive and electrical/electronic industries dominate the market.The dominance of the segment is majorly due to the advent of technology in robotics and the increasing demand for industrial electronics. Industrial robotics in these segments are prevalent due to their high precision and high speed operational capabilities which allow manufacturers to maintain product standardization.

End-use Insights

Based on end-use, the electrical/electronics segment accounted for the largest industry share of around 26.0% in 2023. This is due to the ability of the segment to perform various tasks, such as dispensing, insertion, labeling, and screw driving, with high repeatability. Innovations and rising R&D activities by market companies to improve productivity, cost-efficiency, and low-manufacturing overheads are boosting the adoption of such industrial robots. The increasing competition in the industry with the emergence of various technological disruptors is expected to strengthen the segment outlook over the forecast period.

The metal/heavy machinery end-use segment also captured a significant share of the industry in 2023. The segment’s growth is attributed to the demand for robots for tasks such as metal cutting, handling, metal processing, washing, cleaning, among others. Moreover, due to the trend of industry 4.0, companies are aiming for efficient manufacturing and less resource and material wastage. Industrial robotics in this segment are also able to replace humans in difficult and life threatening tasks.

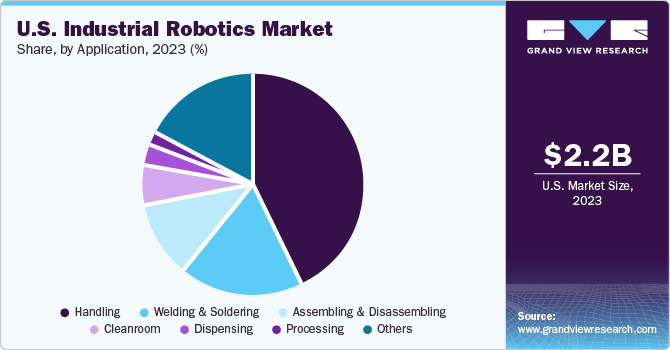

Application Insights

The handling application segment dominated the industry with the highest revenue share in 2023. This can be attributed to the rising trend of e-commerce shopping and quick deliveries. In June 2022, Amazon unveiled an autonomous robot for handling and moving packages in the company facilities. The robots can handle the material without any human intervention and significantly reduce the error rate.

The welding & soldering segment recorded the second highest market share in 2023. The growing automotive and semiconductor manufacturing industry is expected to drive the demand for welding & soldering robotics. The requirement for high precision operations and increased production is a significant factor for the increasing demand for the segment growth. For instance, leading mobile phone manufacturers use soldering robots for semiconductor and chipset operations.

Key U.S. Industrial Robotics Company Insights

Some of the key companies operating in the market include ABB Ltd., Yaskawa Electric Corporation, Mitsubishi Electric Corporation, and Omron Corporation.

-

ABB Ltd. is involved in sustainable electrification, process automation, robotics & discrete automation, and drives & motor verticals.

-

Omron Corporation is involved in industrial automation, healthcare, social system, and electronic component verticals.

-

Fanuc Corporation and Denso Corporation are some other participants in the U.S. industrial robotics industry.

-

Fanuc Corporation is primarily involved in factory automation vertical. The company provides products such as sensors, robots, and IoT products used in factory automation. The company is also involved in the services vertical for which it provides maintenance and to reduction of down time services.

Key U.S. Industrial Robotics Companies:

- ABB Ltd.

- Yaskawa Electric Corporation

- Mitsubishi Electric Corporation

- Nachi-Fujikoshi Corp.

- Comau SpA

- KUKA AG

- Fanuc Corporation

- Denso Corporation

- Kawasaki Heavy Industries, Ltd.

- Omron Corporation

Recent Developments

-

In September 2022, Doosan Robotics partnered with Industrial Automation Supply to be its reseller partner in the northeast U.S. Such partnerships are expected to help increase the potential market for companies in the industry.

-

In November 2022, Epson America, Inc. announced the expansion of the VT6L-Series through the launch of the VT6L-DC All-in-One 6-Axis Robot. The newly launched product is ideal for mobile solutions and delivers next-level technology that helps to improve operational efficiency.

-

In December 2022, Kuka AG completed the delivery of its industrial arm robots to Tesla Inc. to help the company produce its electric vehicles on mass level. Other major automobile companies are also using automated robotic solutions.

U.S. Industrial Robotics Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.21 billion

Growth rate

CAGR of 5.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in thousand units, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, robot type, payload capacity, component

Regional scope

U.S.

Key companies profiled

ABB Ltd.; Yaskawa Electric Corporation; Mitsubishi Electric Corporation; Nachi-Fujikoshi Corp.; Comau SpA; KUKA AG; Fanuc Corporation; Denso Corporation; Kawasaki Heavy Industries, Ltd.; Omron Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Industrial Robotics Market Report Segmentation

This report forecasts volume and revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. industrial robotics market report based on application, robot type, payload capacity, component, and end-use:

-

Application Outlook (Volume in thousand units; Revenue, USD Million, 2018 - 2030)

-

Handling

-

Assembling & Disassembling

-

Welding & Soldering

-

Cleanroom

-

Dispensing

-

Processing

-

Others

-

-

End-use Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Electrical/Electronics

-

Metal/Heavy Machinery

-

Chemical, Rubber, & Plastics

-

Food

-

Others

-

-

Robot Type Outlook (Volume in thousand units; Revenue, USD Million, 2018 - 2030)

-

Articulated

-

SCARA

-

Parallel

-

Cartesian

-

Collaborative

-

Others

-

-

Payload Capacity Outlook (Volume in thousand units; Revenue, USD Million, 2018 - 2030)

-

Up to 16.00 Kg

-

16.00 Kg to 60.00 Kg

-

60.00 Kg to 225.00 Kg

-

More than 225.00 Kg

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Controllers

-

Drive Units

-

Sensors

-

Camera System

-

Power Supply

-

Accessories

-

Others

-

Software

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include the rapid adoption of automation technologies, increased use of robotics in various industries, and rapid shift towards smart manufacturing across the region.

b. The U.S. industrial robotics market size was estimated at USD 2.17 billion in 2023 and is expected to reach USD 2.35 billion in 2024.

b. The U.S. industrial robotics market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 3.21 billion by 2030.

b. The handling application segment dominated the industry with the highest revenue share in 2023. This can be attributed to the rising trend of e-commerce shopping and quick deliveries.

b. The key players in this U.S. industrial robotics market include ABB Ltd., Yaskawa Electric Corporation, Mitsubishi Electric Corporation, Omron Corporation, Fanuc Corporation, and Denso Corporation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.