- Home

- »

- Medical Imaging

- »

-

U.S. Infection Imaging Services Market Share Report, 2030GVR Report cover

![U.S. Infection Imaging Services Market Size, Share & Trends Report]()

U.S. Infection Imaging Services Market (2022 - 2030) Size, Share & Trends Analysis Report By Indication (Osteomyelitis, Acute Appendicitis, CAD, Colitis, Pneumonia, Tuberculosis), And Segment Forecasts

- Report ID: GVR-4-68039-989-6

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

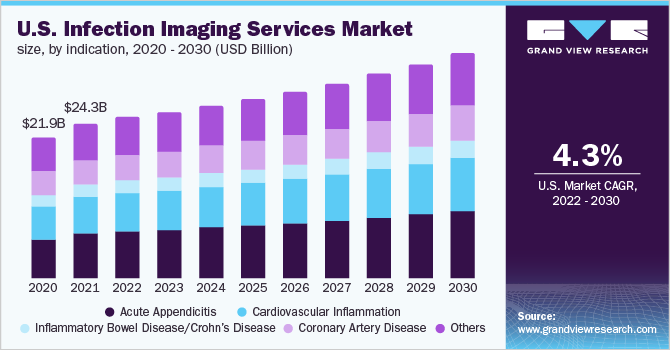

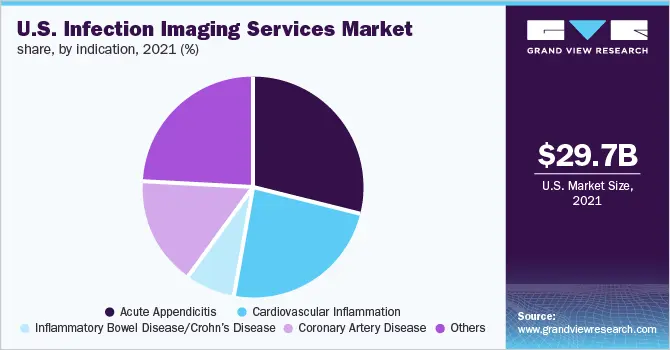

The U.S. infections imaging market size was valued at USD 29.72 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2022 to 2030. The development of various technologies for enhancing medical imaging services is anticipated to boost industry growth in the coming years. Furthermore, the rapidly increasing aging population and high incidence of infectious diseases such as acute appendicitis, cardiovascular inflammation, tuberculosis, pneumonia, and others are factors expected to drive the industry’s growth.

For instance, according to the National Center for Biotechnology Information, the annual incidence of pneumonia in the U.S. is 24.8 cases per 10,000 adults, which is likely to increase with the growth in the geriatric population. Growing funding to support ongoing research activities and rising private-public initiatives related to medical imaging are factors likely to propel the overall growth of the industry.

A growing number of outpatient settings with imaging services and their focus to form a partnership to enhance imaging services and patient care is further expected to boost the market growth during the forecast period. For instance, in November 2020, the Centers for Diagnostic Imaging acquired around eight outpatient radiology centers and entered the fast-growing Salt Lake City market. This acquisition assisted the company with geographical expansion.

The increasing demand for advanced and accurate medical imaging and constant technological advancements in radiopharmaceutical agents and medical imaging devices, such as the integration of artificial intelligence, and improved image quality, is propelling the growth. For instance, in March 2022, Philochem, a Philogen Group subsidiary, and Bracco Imaging announced a license and collaboration agreement to develop and commercialize a small organic molecule for imaging applications that have been shown to selectively detect a variety of metastatic solid tumors in cancer patients.

The guidelines laid down by the American and European Nuclear Medicine Society, state that fever of unknown origin, sarcoidosis, and vasculitis are among the major clinical indications that benefit from nuclear medicine procedures, specifically from performing positron emission tomography (PET) using 18F fluoro-deoxy-glucose with CT (FDG PET/CT). The cost of using these techniques saved nearly 5000 to 11000 USD per patient for diagnosis of fever of unknown origin. In the last 3 decades, the mortality rate of infective endocarditis has remained steady i.e. ~30%.

The American Society of Nuclear Cardiology recommends performing FDG/PET CTA to detect structural vascular changes and complications caused by vasculitis. Osteomyelitis shows nonspecific symptoms, and physical examination and laboratory results often delay identification. Thus, techniques like unenhanced MRI can be used to identify tissue changes and the involvement of surrounding bones within two days of infection onset. However, nuclear medicine test provides high image sensitivity and enables accurate diagnosis. Hence, it is advent that, nuclear medicine is an effective tool in the diagnosis of numerous infections showing low symptoms and reduced sensitivity to other imaging modalities.

Indication Insights

The acute appendicitis segment dominated with the largest revenue share of 24.06% in 2021. It is expected to continue its dominance over the forecast period. Acute appendicitis is one of the most prevalent causes of acute abdominal pain in adults and children is appendicitis. In the U.S., over 300,000 hospital visits for appendicitis-related complications occur each year. Before the introduction of modern diagnostic imaging techniques, the diagnosis of acute appendicitis was solely based on clinical findings; however, after the introduction of cross-sectional imaging, such as CT, MRI, and ultrasonography, the negative appendectomy rates, as well as the morbidity & mortality associated with this disease, decreased significantly.

Based on indications, other segments of the U.S. infections imaging services market include fever of unknown origin, orthopedic hardware, musculoskeletal infection, osteomyelitis, systemic vasculitis, skin, and soft tissue infection, cardiovascular inflammation, pneumonia, tuberculosis, endocarditis, myocarditis, LVAD infection, Crohn’s disease, colitis, atherosclerosis, coronary artery disease, organ transplant rejection, and others. These are further sub-segmented into nuclear medicine and others.

The atherosclerosis segment is expected to grow at the fastest CAGR of around 4.6% during the forecast period. Most myocardial infarctions, many strokes, and disabling peripheral arterial disease are all driven by atherosclerosis, the development of fibrofatty lesions in the artery wall. Hypertension, smoking, and diabetes mellitus are primary risk factors for atherosclerosis.Thus, early and precise diagnosis is crucial, and medical imaging has become increasingly important in the study of these diseases, thus boosting the segment’s growth.

Key Companies & Market Share Insights

The key players are concentrating on establishing partnerships to improve imaging services and patient care, leveraging crucial opportunities for collaboration, and exploring mergers and acquisitions. For instance, in July 2021, RAYUS Radiology, a leading provider of advanced diagnostic and interventional radiology, acquired Pittsburgh-based Foundation Radiology Group, a full-service radiology company with more than 100 radiologists who provide on-site and teleradiology services to more than 45 health systems, community hospitals, renowned academic medical centers, and outpatient imaging facilities in seven states. Some prominent players in the U.S. infections imaging services market include:

-

Rayus Radiology

-

CMS Diagnostic Services

-

Radnet, Inc.

-

Dignity Health

-

Alliance Medical

-

Inhealth Group

-

Sonic Healthcare

-

Medica Group

-

Unilabs

-

Simonmed Imaging

U.S. Infection Imaging Services Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 30.76 billion

Revenue forecast in 2030

USD 42.99 billion

Growth Rate

CAGR of 4.3% from 2021 to 2028

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Indication

Country scope

U.S.

Key companies profiled

Rayus Radiology; CMS Diagnostic Services; Radnet, Inc.; Dignity Health; Alliance Medical; Inhealth Group; Sonic Healthcare; Medica Group; Unilabs; Simonmed Imaging

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Infection Imaging Services Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. infection imaging services market report based on indication:

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Fever of unknown origin

-

Nuclear medicine

-

Others

-

-

Orthopedic Hardware

-

Nuclear medicine

-

Others

-

-

Musculoskeletal infection

-

Nuclear medicine

-

Others

-

-

Acute Appendicitis

-

Nuclear medicine

-

Others

-

-

Osteomyelitis

-

Nuclear medicine

-

Others

-

-

Systemic vasculitis

-

Nuclear medicine

-

Others

-

-

Skin and soft tissue infection

-

Nuclear medicine

-

Others

-

-

Cardiovascular inflammation

-

Nuclear medicine

-

Others

-

-

Pneumonia

-

Nuclear medicine

-

Others

-

-

Tuberculosis

-

Nuclear medicine

-

Others

-

-

Endocarditis

-

Nuclear medicine

-

Others

-

-

Myocarditis

-

Nuclear medicine

-

Others

-

-

LVAD infection

-

Nuclear medicine

-

Others

-

-

Crohn’s Disease

-

Nuclear medicine

-

Others

-

-

Colitis

-

Nuclear medicine

-

Others

-

-

Atherosclerosis

-

Nuclear medicine

-

Others

-

-

Coronary artery disease

-

Nuclear medicine

-

Others

-

-

Organ transplant rejection

-

Nuclear medicine

-

Others

-

-

Others

-

Nuclear medicine

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. infections imaging services market size was estimated at USD 29.72 billion in 2021 and is expected to reach USD 30.76 billion in 2022.

b. The U.S. infections imaging services market is expected to grow at a compound annual growth rate of 4.3% from 2022 to 2030 to reach USD 42.99 billion by 2030.

b. The acute appendicitis segment dominated the market for U.S. infection imaging services and accounted for the largest revenue share of 24.06% in 2021 and is further expected to continue its dominance over the forecast period.

b. Some key players operating in the teleradiology market include Rayus Radiology; CMS Diagnostic Services; Radnet, Inc.; Dignity Health; Alliance Medical; Inhealth Group; Sonic Healthcare; Medica Group; Unilabs; Simonmed Imaging.

b. Key factors that are driving the market growth include a rise in underlying diseases and the growing geriatric population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.