- Home

- »

- Clinical Diagnostics

- »

-

U.S. Infectious Respiratory Disease Diagnostics Market Size Report, 2030GVR Report cover

![U.S. Infectious Respiratory Disease Diagnostics Market Size, Share & Trends Report]()

U.S. Infectious Respiratory Disease Diagnostics Market Size, Share & Trends Analysis Report By Product Type (Instruments, Consumables, Services), By Sample Type, By Technology, By Application By End-use, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-037-8

- Number of Report Pages: 112

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

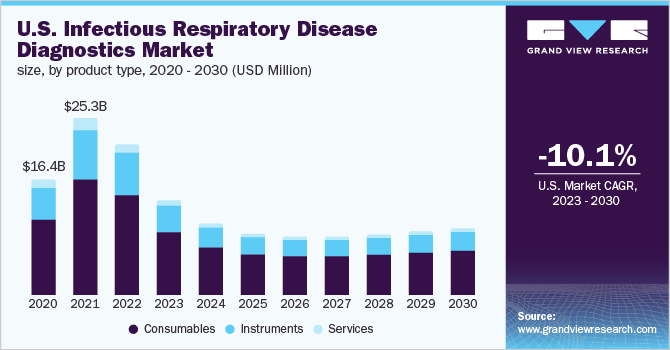

The U.S. infectious respiratory disease diagnostics market size was valued at USD 21,630.4 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of -10.1% from 2023 to 2030. Growing incidence of infectious respiratory diseases, such as pneumonia, tuberculosis, and rising research and development investments by operating players and organizations in diagnostics are the key factors driving the market. However, the infectious respiratory disease diagnostics market is expected to decline majorly due to the drop in COVID-19 testing.

The sudden outbreak of COVID-19 led to an increase in demand for infectious respiratory disease diagnostic products and resulted in a rise in approvals of COVID-19 tests for emergency use. For instance, in December 2022, OnsiteGene, Inc. received EUA from the U.S. FDA for Hi-Sense COVID-19 Molecular Testing Kit 1.0. This approved test uses nasopharyngeal swabs, nasopharyngeal wash, anterior nasal swabs, oropharyngeal swabs, mid-turbinate nasal swabs, nasal aspirates, and specimens for the qualitative detection of nucleic acid from SARS-CoV-2. Approval for the emergency use of tests for research purposes by healthcare professionals and the government helped in the management & prevention of COVID-19 during the pandemic.

Infectious respiratory diseases, such as TB and COVID-19, are the major health concerns. Numerous organizations and the U.S. government are engaged in providing research funding to enable early detection & treatment, which can propel the infectious respiratory disease diagnostics market. Increased focus on diagnostics owing to COVID-19 has led to a rise in funding for novel molecular diagnostics with the potential to improve diagnosis scenarios.

For instance, in July 2020, the U.S. government granted funding of USD 628,071 to Chembio Diagnostics, Inc. for the development of infectious respiratory disease point-of-care tests, including immunoassays for diagnosis of the patients with COVID-19. Thus, rising R&D investments in respiratory disease testing are expected to boost the infectious respiratory disease diagnostics market.

Rapid technological advancements in infectious respiratory disease testing offer accurate results, portability, and cost-effectiveness. These are expected to be the high-impact rendering drivers of the infectious respiratory disease diagnostics market. Companies are upgrading their products by implementing new techniques to gain specific and accurate results.

Key players are expanding their portfolio of tests that involve qPCR instruments by investing in R&D to develop infectious respiratory disease diagnostic kits that can identify emerging diseases or by entering into agreements with other kit manufacturing companies. For instance, in August 2021, Cardinal Health announced its efforts to extend access to OTC rapid COVID-19 tests through partnerships with Quidel & Abbott. Such initiatives are fueling the market in the region.

Product Type Insights

The consumables segment dominated the U.S. industry in 2022 and accounted for the maximum share of more than 65.78%, which can be attributed to high usage rates. Rising research and development activities for the development of novel testing kits and assays, coupled with the increase in demand for the point-of-care are driving the segment. Moreover, the introduction of innovative solutions for validating and monitoring molecular diagnostic tests used for the detection of COVID-19 further contributed to the infectious respiratory disease diagnostics market growth.

For instance, in March 2020, AcroMetrix Coronavirus 2019 (COVID-19) RNA Control was made available by Thermo Fisher Scientific, Inc., to validate and monitor molecular diagnostic tests used for COVID-19. This RNA control is available for research use only by healthcare workers, laboratories, and researchers. However, the consumables segment is anticipated to witness a decline due to the decreased COVID-19 testing rates owing to increased vaccination programs in the U.S.

The instrument segment is expected to decline at a CAGR of -11.1% in the study period. There was an upsurge in the installations and sales of instruments such as CT scanners, X-ray machines, immunoassay analyzers, and PCR equipment during the COVID-19 outbreak. Several manufacturers increased the production capacity of CT systems due to the growing demand for chest CT examinations in COVID-19 patients.

For instance, in March 2020, GE Healthcare increased the manufacturing capacity of its medical equipment, such as CT, ultrasound, mobile X-ray, and ventilators, to meet the unprecedented demand during the pandemic. However, with the declining COVID-19 infection, the need for these instruments will reduce and might hamper the segment’s growth.

Sample Type Insights

The nasopharyngeal swabs sample type segment dominated the U.S. industry in 2022 with a revenue share of more than 60.61%. Nasopharyngeal swabs are used for the sample collection in various tests, such as rapid antigen detection tests, direct fluorescent antibody, and PCR. These tests are performed for the detection of diseases including COVID-19, RSV, and tuberculosis. Several swab manufacturers export their infectious respiratory disease diagnostic products in the U.S., such as COPAN ITALIA spa, Noble Bio, and others.

In the U.S., the import of nasopharyngeal swabs increased considerably during the pandemic by up to USD 5.0 million per month, which was USD 840,000 till 2019. Hence, the substantial rise in testing demand from November 2020 to January 2021 led to a shortage of swab supplies. However ongoing investments in additional capacity were able to handle the situation better than previous spikes in testing demand. This demand has further accelerated the launch of newer diagnostics tests in U. S. and is expected to assist the segment in maintaining its dominance in the infectious respiratory disease diagnostics market.

The saliva swabs segment is anticipated to witness market growth owing to the rising use of samples in infectious respiratory disease diagnosis coupled with the urgent need for noninvasive tests. Researchers were engaged in improving infectious respiratory disease diagnostic performance due to the heavy loads of samples during the pandemic. In a study published in May 2020, researchers established the sensitivity and specificity of saliva sample test, which was found to be around 84.2% and 98.9%, respectively.

As a result, market players started commercializing no-swabs saliva-based tests to meet the untapped opportunities in the infectious respiratory disease diagnostics market. For instance, in October 2022, Shield T3 launched a saliva-based PCR test for flu, COVID-19, and RSV. These kits enable the identification of viruses within 24 hours of sending samples.

Technology Insights

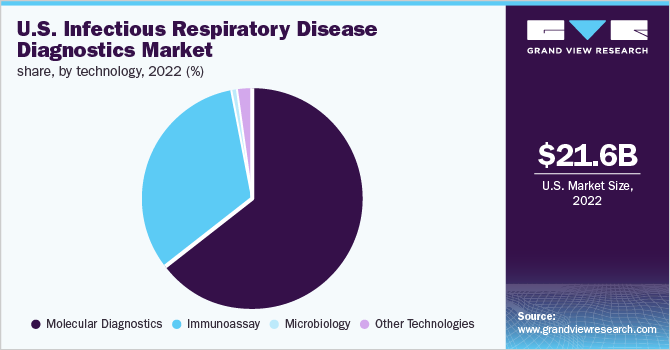

The molecular diagnostics segment dominated the U.S. industry in 2022 and accounted for the maximum share of more than 63.74% of the overall revenue. The rising use of high-throughput PCR technology, used for detecting respiratory viruses, is expected to drive the infectious respiratory disease diagnostics market. Influenza, RSV, and COVID-19 diseases have similar symptoms; hence, companies are trying to incorporate multiplex tests that can be used in diagnosing these diseases with a single swab.

For instance, in December 2020, GENETWORx, LLC launched a test that can detect three respiratory viruses (RSV, influenza A & B, and SARS-COV-2) from a single sample. Such capabilities of molecular diagnostics contributed to segment dominance in the infectious respiratory disease diagnostics market.

The immunoassay segment includes tests performed using techniques such as radioimmunoassay, enzyme immunoassays, and rapid tests. This segment is anticipated to witness significant growth during the forecast period due to technological advancements, increased demand for immunoassays, commercialization of innovative products, and a rise in patient awareness. In March 2021, BIOMÉRIEUX received a CE marking for VIDAS TB IGRA intended for diagnosing latent TB infection.

This fully automated assay eliminates manual sample preparation and delivers results faster without additional cost. Furthermore, as the incidence rate of COVID-19 is declining, demand for immunoassays for screening of the population at educational institutes and other offices may increase during the forecast period.

Application Insights

The COVID-19 segment accounted for the largest share of the U.S. infectious respiratory disease diagnostics market in 2022, with 91.65%. The large share is attributed to the increasing number of strategic initiatives by the operating players, such as collaborations, contracts, partnerships, and others, to develop and raise awareness about coronavirus test kits to meet the demand for diagnostic kits and combat COVID-19.

For instance, in December 2022, F. Hoffmann-La Roche Ltd entered into an agreement with Pfizer, Inc. to raise awareness and educate patients regarding the importance of early testing, thus helping in determining the proper course of treatment. However, demand for COVID-19 diagnostics testing is likely to decline with the rising number of vaccinations during the forecast period.

Moreover, the increasing prevalence of TB is anticipated to boost the infectious respiratory disease diagnostics market growth. For instance, according to CDC, it is estimated that 7,882 cases of tuberculosis were reported in 2021 in the U.S., which accounts for 2.4 cases per 100,000 persons. Hence, early diagnosis with adequate therapy and prevention measures against further transmission is essential for TB control in the country during the review period.

Moreover, the increasing launch of new highly sensitive and flexible molecular tests for the diagnosis of TB is expected to fuel infectious respiratory disease diagnostics market growth. For instance, in December 2022, Mylab launched PathoDetect MTB RIF and INH kit for the diagnosis of multidrug-resistant and TB variants in a single test.

End-Use Insights

Diagnostic laboratories accounted for the largest share of the U.S. infectious respiratory disease diagnostics market in 2022, with 41.90%. The large share is primarily due to the high market procedure and penetration volumes, as well as the presence of a large number of laboratories in U.S. markets. According to CDC around 70% of medical decisions are influenced by laboratory test results and around 14.0 billion laboratory tests are ordered annually for laboratory testing.

It is estimated that 40,000-80,000 deaths are preventable if diagnosis errors are minimized. In addition, an increase in the number of initiatives undertaken by the government to provide reimbursement for diagnostic tests is another major factor anticipated to drive the infectious respiratory disease diagnostics market.

Physician offices segment is expected to witness significant growth owing to the availability of Point-of-Care (PoC) devices used for rapid diagnosis of COVID-19, influenza, and RSV. Patients can avail a PoC test immediately and at their convenience. Moreover, the output time is short, enabling spontaneous clinical management decisions.

The segment growth is also due to the increasing need to develop new assays that offer quick PoC results. For instance, in April 2021, Chembio Diagnostics, Inc. launched a COVID-19/Flu A&B test, a rapid PoC test, which is suitable for distinguishing patients with influenza or COVID-19 in a shorter turnaround time in decentralized settings.

Key Companies & Market Share Insights

The unceasing demand for infectious respiratory disease diagnostics solutions by numerous end-users has created several market opportunities for the major players to capitalize in the country. For instance, in October 2022, Siemens Healthcare GmbH announced the launch of two combination tests for the detection of seasonal respiratory pathogens & SARS-CoV-2. Some of the key players in the U.S. infectious respiratory disease diagnostics market include:

-

Abbott

-

Koninklijke Philips N.V.

-

Siemens Healthcare GmbH

-

BIOMÉRIEUX

-

Danaher

-

QIAGEN

-

BD

-

F. Hoffmann-La Roche Ltd

-

Quidel Corporation

-

Thermo Fisher Scientific, Inc.

U.S. Infectious Respiratory Disease Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 13,458.9 million

Revenue forecast in 2030

USD 9.20 billion

Growth rate

CAGR of -10.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product type, sample type, technology, application, end-use

Key companies profiled

Abbott; Koninklijke Philips N.V.; Siemens Healthcare GmbH; BIOMÉRIEUX; Danaher; QIAGEN; BD; F. Hoffmann-La Roche Ltd; Quidel Corporation; Thermo Fisher Scientific, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Infectious Respiratory Disease Diagnostics Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. infectious respiratory disease diagnostics market based on the product type, sample type, technology, application, and end-use:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Respiratory Measurement Devices

-

Imaging Tests

-

Other Instruments

-

-

Consumables

-

Services

-

-

Sample Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Saliva

-

Nasopharyngeal Swabs (NPS)

-

Anterior Nasal Swabs

-

Blood

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunoassay

-

Molecular Diagnostics

-

Microbiology

-

Other Technologies

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

COVID-19

-

Influenza

-

Respiratory Syncytial Virus (RSV)

-

Tuberculosis

-

Streptococcus Testing

-

Other Respiratory Disease Testing

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Laboratories

-

Physician Offices

-

Other End Users

-

Frequently Asked Questions About This Report

b. The U.S. infectious respiratory disease diagnostics market size was estimated at USD 21,630.4 million in 2022 and is expected to reach USD 13,458.9 million in 2023.

b. The U.S. infectious respiratory disease diagnostics market is expected to grow at a compound annual growth rate of (-10.1%) from 2023 to 2030 to reach USD 9.20 billion by 2030.

b. Based on technology, molecular diagnostics accounted for the largest share of 63.74% in 2022, owing to the high usage of PCR tests for Covid-19 testing.

b. Some key players in space include Abbott; Koninklijke Philips N.V.; Siemens Healthcare GmbH; BIOMÉRIEUX; Danaher; QIAGEN; BD; F. Hoffmann-La Roche Ltd; Quidel Corporation; and Thermo Fisher Scientific, Inc. amongst others.

b. Key factors that are driving the U.S. infectious respiratory disease diagnostics market growth include rising disease prevalence and approval of multiplex tests for the simultaneous diagnosis of Covid, RSV & influenza.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."