U.S. Inhalation Anesthesia Market Trends

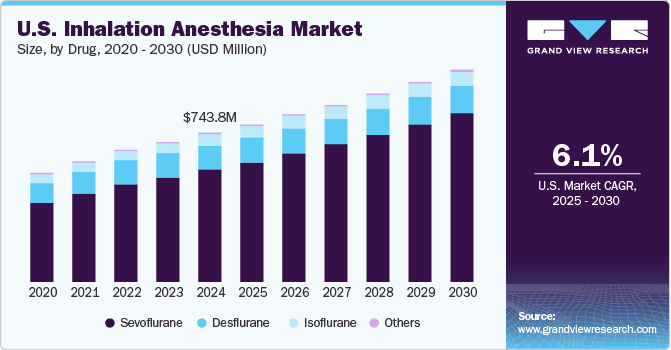

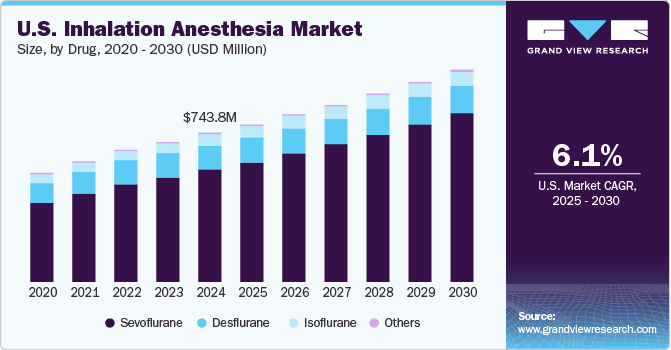

The U.S. inhalation anesthesia market size was estimated at USD 743.8 million in 2024 and is expected to grow at a CAGR of 6.1% from 2025 to 2030. The market's growth can be attributed to the increasing number of surgical procedures and the rising demand for shorter hospital stays. Inhalation anesthesia induces a reversible state of unconsciousness and loss of sensation, enabling pain-free surgical procedures. It is primarily used for general anesthesia during surgeries, particularly in outpatient settings, pediatric cases, and with needle-phobic patients. In addition, inhalation anesthetics are useful in diagnostic procedures and can be applied outside the operating room for ICU sedation or conditions such as status asthmaticus. Agents such as nitrous oxide also provide moderate to minimal sedation in dental settings.

The National Library of Medicine reported that approximately 40 to 50 million major surgeries are performed annually in the U.S. Inhalation anesthesia plays a crucial role in cancer diagnosis and biopsies, providing comfort to patients during these procedures. According to estimates from the National Cancer Institute, the U.S. is projected to see approximately 2,001,140 new cancer cases diagnosed in 2024. Among these cases, around 14,910 children and adolescents aged 0 to 19 are expected to be diagnosed with cancer. This rising incidence of cancer will undoubtedly increase the demand for the U.S. inhalation anesthesia industry, highlighting its importance in pediatric and adult oncology care.

Sedation is commonly used during dental surgery to ensure patient comfort. Los Angeles's three most prevalent dental surgeries include wisdom tooth extraction, root canal therapy, and dental implant surgery. Cedars-Sinai, a non-profit academic medical center and teaching hospital in Los Angeles, performs around 32,000 surgeries annually across its 42 operating rooms. This high volume of surgical procedures underscores the importance of effective sedation techniques in enhancing patient experiences during dental interventions, which increases the demand for the U.S. inhalation anesthesia industry.

Drug Insights

The sevoflurane drug dominated the U.S. inhalation anesthesia market, accounting for the largest revenue share of 75.5% in 2024. Sevoflurane is a fluorinated ether anesthetic known for its pleasant smell and rapid onset and offset of action, making it suitable for both induction and maintenance of anesthesia. Its popularity has surged in day surgery due to the quick attainment of deep anesthesia and faster recovery times. Each year, over 900,000 cardiac surgeries, including coronary bypass procedures, are conducted in the U.S., which increases the demand for the sevoflurane drug as it is increasingly used in cardiac surgery due to its favorable hemodynamic effects and cardio-protective properties. Importantly, it is non-irritating to the respiratory passages, minimizing complications such as coughing or breath-holding during induction.

The isoflurane drug is expected to grow at a significant CAGR of 4.6% over the forecast period. Isoflurane is a general inhalation anesthetic used for both induction and maintenance of anesthesia, promoting muscle relaxation and reducing pain sensitivity by altering tissue excitability. It is frequently employed in cardiac, thoracic, and neurosurgical procedures and general surgical practice. The increase in these surgeries has driven the demand for this drug in the U.S. inhalation anesthesia industry. In the U.S., cardiothoracic surgeons perform approximately 530,000 general thoracic surgeries annually, while 33,483 neurosurgical operations were carried out between 2012 and 2022.

Application Insights

The maintenance phase dominated the U.S. inhalation anesthesia industry with the largest revenue share in 2024. Rising surgical volumes drive the segment’s growth, advancements in anesthetic delivery systems, and a growing preference for inhaled anesthetics over intravenous options for extended sedation. This phase ensures patient stability throughout intricate procedures, including abdominal, spine, hernia repair, brain, and knee surgeries. Leading U.S. spine surgery hospitals such as Emory University Hospital, UCSF Medical Center, Och Spine Hospital, and Brigham and Women’s Hospital reflect this trend. Notably, over 1 million hernia repairs are performed annually, according to the U.S. Food and Drug Administration (FDA) in the U.S.

The induction phase is expected to grow at a significant CAGR over the forecast period. The growing prevalence of inhalation anesthesia during the induction phase of surgery is driven due to infants and young children. Common surgeries involving inhalation anesthesia in children include those addressing congenital heart defects, neurological conditions, airway obstructions, and gastrointestinal issues. In the U.S., nearly 1 in 100 babies, approximately 40,000 each year, are born with a heart defect. In addition, acute gastroenteritis remains a significant concern, leading to about 1.5 million doctor visits, 200,000 hospital admissions, and 300 pediatric deaths annually, further driving the prevalence of inhalation anesthesia during the induction phase.

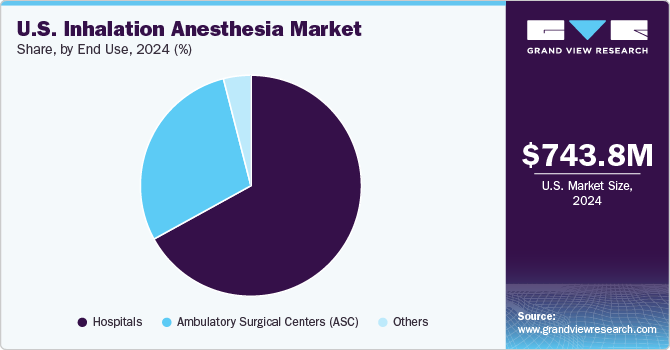

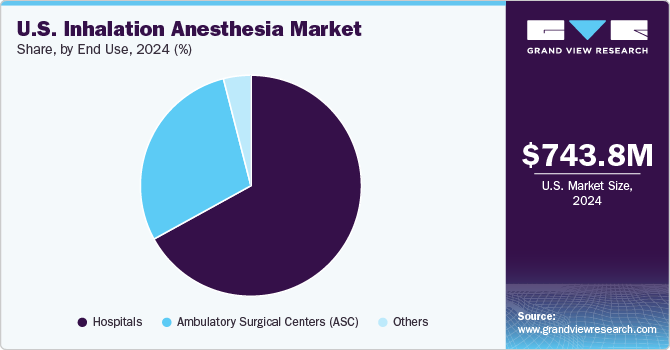

End Use Insights

The hospitals led the U.S. inhalation anesthesia industry with the largest revenue share in 2024. One major contributor is the widespread use of inhalation anesthesia for surgical procedures and intensive care unit (ICU) sedation, where anesthetic gases or volatile liquids are delivered through breathing masks, laryngeal mask airways, or tracheal tubes. In addition, the rising number of motor vehicle crashes significantly impacts this demand. In 2022, over 2.6 million emergency department visits in the U.S. were related to injuries from motor vehicle accidents, many of which required surgical interventions involving anesthesia. Furthermore, approximately 869,000 traffic crash-related cervical spine injuries occur annually, many of which also necessitate the use of inhalation anesthesia for treatment and surgery.

The Ambulatory Surgical Centers (ASC) segment is expected to grow at the fastest CAGR over the forecast period. The growing prevalence of surgeries is driving the increasing demand for inhalation anesthesia in ASCs. According to the Hoag Review, over 190 ASCs in the U.S. performed minimally invasive spine surgeries in February 2022, reflecting significant growth. Common procedures in ASCs include orthopedics, ophthalmology, gastroenterology, ENT, cosmetic surgeries, urology, gynecology, and podiatry. With over 27,000 active orthopedic surgeons in the U.S. by 2023, including specialists in spine and pediatrics, orthopedics remains one of the most sought-after specialties in the U.S. According to the American Board of Orthopedic Surgery, orthopedics remains one of the most sought-after and high-demand medical specialties.

Key U.S. Inhalation Anesthesia Company Insights

Some of the major companies in the U.S. inhalation anesthesia industry are Baxter; AbbVie Inc.; and Piramal Enterprises Ltd. These companies continuously innovate with safer, more efficient anesthetic agents, improving delivery systems, and complying with regulatory standards. They also focus on enhancing patient outcomes, expanding their product offerings, and adapting to growing surgical and critical care demands across various healthcare settings.

-

Baxter is a healthcare company that offers a range of anesthesia products, including inhalation anesthetics. They focus on providing advanced solutions for perioperative care, emphasizing safety, efficiency, and improved patient outcomes. Baxter’s products support routine surgeries and critical care procedures in various medical settings.

-

AbbVie Inc. is a biopharmaceutical company that offers inhalation anesthetics, including sevoflurane, under the brand name Ultane. It emphasizes safety and efficiency in anesthesia delivery and supports healthcare professionals with comprehensive product information and vaporizer compatibility.

Key U.S. Inhalation Anesthesia Companies:

- Baxter

- AbbVie Inc.

- Piramal Enterprises Ltd.

- Hikma Pharmaceuticals PLC

- Halocarbon, LLC

- Sandoz Group AG

- Fresenius Kabi AG

Recent Developments

- In August 2024, OhioHealth became the first health system in central Ohio to eliminate desflurane, a potent greenhouse gas used in anesthesia, replacing it with the more environmentally friendly sevoflurane.

U.S. Inhalation Anesthesia Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 788.5 million

|

|

Revenue forecast in 2030

|

USD 1.06 billion

|

|

Growth rate

|

CAGR of 6.1% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Drug, application, end use

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

Baxter; AbbVie Inc.; Piramal Enterprises Ltd.; Hikma Pharmaceuticals PLC; Halocarbon, LLC; Sandoz Group AG; Fresenius Kabi AG

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Inhalation Anesthesia Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. inhalation anesthesia market report based on drug, application, and end use:

-

Drug Outlook (Revenue, USD Million, 2018 - 2030)

-

Sevoflurane

-

Desflurane

-

Isoflurane

-

Others

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)