- Home

- »

- Homecare & Decor

- »

-

U.S. Janitorial Services Market Size, Industry Report, 2030GVR Report cover

![U.S. Janitorial Services Market Size, Share & Trends Report]()

U.S. Janitorial Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Residential, Commercial), By End-use (Standard Cleaning, Damage Restoration Cleaning, Floor Care Services), And Segment Forecasts

- Report ID: GVR-4-68040-238-8

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Janitorial Services Market Trends

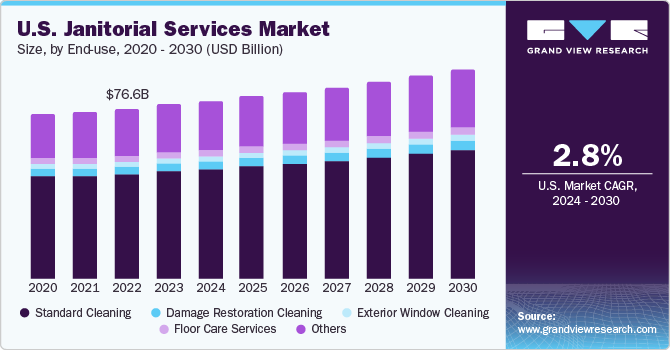

The U.S. janitorial services market size was estimated at USD 78.17 billion in 2023 and is expected to grow at a CAGR of 2.8% from 2024 to 2030. The market’s growth can be attributed to factors such as growing consciousness about importance of cleanliness and hygiene in workspaces and increasing significance of preventive healthy practices. The market is poised to grow at steady pace with the help of lucrative opportunities in commercial applications.

The U.S. market accounted for a share of 27.9% of the global janitorial services market in 2023. The market in the U.S. has been witnessing steady growth in terms of revenue generated. This industry is expected to continue its growth patterns owing to aspects such as abundance of service providers in large cities like California, Florida, New York, and Texas, extremely competitive nature of the market, upsurge in large-scale leisure and hospitality building construction projects, rising need for comprehensive cleaning and maintenance services, and increasing preferences for enhanced sanitization and disinfection measures.

Furthermore, after pandemic phase, the world has gone through, the constant need of cleanliness and hygiene is acknowledged by the giant retailing companies in the United States. For instance, there is 84% increase in adoption of janitorial cleaning and carpet shampooing by luxury retailers. Similarly, big - box retailers, grocery stores, restaurants, healthcare sector companies are also increasingly opting for the janitorial services.

According to a May 2023 blog published by Aspire Software, a U.S.-based marketing company, in the past five years (2019-2023), U.S. consumers have increasingly recognized the benefits of hiring professional cleaning technicians (janitors) for their homes. A survey by the American Cleaning Institute in November 2018 revealed that consumers spent an average of six hours per week cleaning their homes, with one-third expressing concerns about performing cleaning tasks correctly.

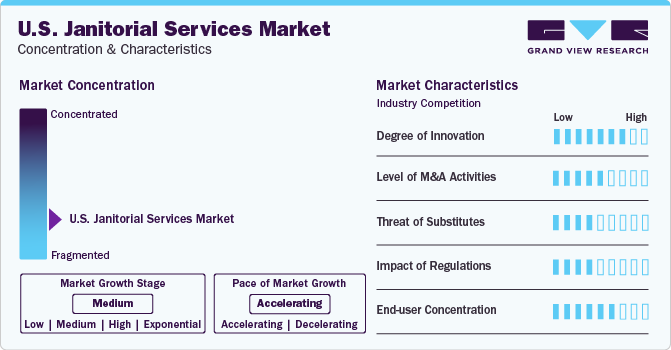

Market Concentration & Characteristics

The U.S. janitorial services industry is growing at accelerating pace and growth stage is identified as high. The industry is characterized by the presence of companies, which have been in the business for more than or almost a century. This includes ABM Industries Incorporated, The ServiceMaster Company, LLC and others. In addition, the competition landscape of the market is intensified with presence of emerging players who have been offering lucrative subscriptions and contracts while concentrating on strategies such as customer retention and innovation.

Degree of innovation is moderate in the industry. Innovation is often adopted by the companies in terms of technologies used in the processes, sustainable cleaning agents customer data analysis, technology-led solutions, and robotics. Emergence of mobile applications as a platform between service providers and service receiver is one of the most impacting innovation strategy adopted by the businesses.

The level of M&A (mergers & acquisitions) is moderate in the industry. Instead of using M&A as expansions strategy for regional markets or product portfolios, companies prefer to engage in collaborations and partnerships. For instance, the ABM Industries Incorporated signed a multi-year contract to provide baseball teams, Arizona Diamondbacks and Chase Field, with housekeeping services and event personnel.

Threat of substitutes is at medium level. Emergence of technology driven cleaning equipment and unceasing advancements in robotics technology might pose a potential threat of substitute for this market in future. However, the multinational and domestic companies operating at large scale have already started adopting these technologies in order to deliver such services which can coupled with use of technology and human effort.

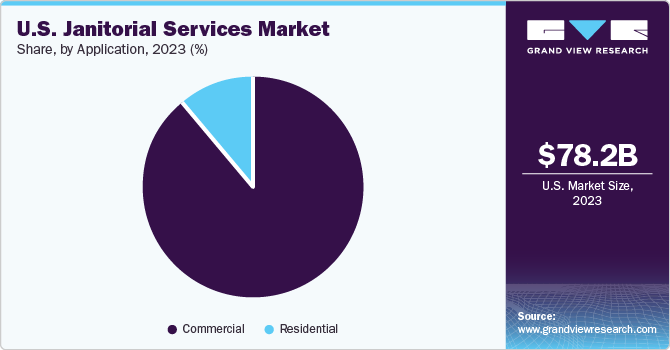

Application Insights

Commercial janitorial services accounted for a share of 89.1% in 2023. The industry is primarily driven by huge corporate offices in cities such as Dallas, San Francisco, Charlotte, Seattle, Houston, Washington DC, and New York City. In addition, commercial users such as excellent multi-specialty hospitals, media houses, government buildings, luxury hotels, aesthetically attractive restaurants, renowned universities, international and domestic banks, aviation bases and giant shopping centres contribute to the growing response for this market.

The residential janitorial services market is expected to grow at a CAGR of 3.5% from 2024 to 2030. The residential users of janitorial services in the U.S. are mainly from urban areas. According to Onedesk, Inc. data, over 10% of all American households paid a professional cleaning service to keep their residences clean in 2022. Residents are increasingly opting for deep-cleaning services, including polishing windows, shampooing sofas, and deep-cleaning washrooms, to spruce up their homes.

End-use Insights

The standard cleaning services market in the U.S. accounted for a share of 62.4% in 2023. Commercial users of janitorial services primarily influence this market. The standard cleaning services include window cleaning, vacuum and carpet shampooing, disinfecting, dusting, hard floor care, pressure washing, sanitization, restroom cleaning, and more. Commercial users opt for these services in order to ensure spotless, nontoxic, and well-maintained workspace.

The demand for exterior window cleaning services is expected to grow at a CAGR of 5.0% from 2024 to 2030. This market is also heavily influence by the commercial application as the exterior view of commercial buildings develop the first impression in minds of customers and other visitors as well. The industry generates colossal demand for this service every years, with companies maintaining long-lasting relations with their prime clients.

Key U.S. Janitorial Services Company Insights

The market is characterized by the presence of some century old companies with a strong network across the United States. Several companies have also been introducing premium subscriptions to magnify their commercial customer base in this market. These developments and innovative strategies as well as collaborations had a constructive effect on the market.

Key U.S. Janitorial Services Companies:

- ABM Industries Incorporated

- The ServiceMaster Company, LLC

- Jani-King International, Inc.

- Jan-Pro Franchising, Inc.

- Allan Industries, Inc.

- Ermc

- Moonlight Maintenance Service

- Get Clean Services LLC

- Top West Cleaning Services

- VIP, Inc.

Recent Developments

-

In March 2024, The ServiceMaster Company’s brand, ServiceMaster Clean teamed up with Aspire Software, to give the commercial cleaning business management system the technological support it requires to support the company's ongoing expansion.

-

In December 2023, ABM Industries Incorporated expanded its collaboration with LaGuardia Gateway Partners. Prior to this, in August 2022, the company announced a new partnership with the City of Chicago for a five-year custodial contract at O'Hare International Airport.

U.S. Janitorial Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 79.89 billion

Revenue Forecast in 2030

USD 94.15 billion

Growth Rate

CAGR of 2.8% from 2024 to 2030

Actuals

2018 - 2023

Forecasts

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast; company ranking; competitive landscape; growth factors; and trends

Segments Covered

Application, End-use

Country Scope

U.S.

Key companies profiled

ABM Industries Incorporated; The ServiceMaster Company, LLC; Jani-King International, Inc.; Jan-Pro Franchising, Inc.; Allan Industries, Inc.; Ermc; Moonlight Maintenance Service; Get Clean Services LLC; Top West Cleaning Services; VIP, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Janitorial Services Market Report Segmentation

This report forecasts growth at country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. janitorial services market report based on end-use and application:

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Standard Cleaning

-

Damage Restoration Cleaning

-

Exterior Window Cleaning

-

Floor Care Services

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Residential

-

Frequently Asked Questions About This Report

b. Some key players operating in the U.S. janitorial services market include ABM Industries Incorporated; The ServiceMaster Company, LLC; Jani-King International, Inc.; Jan-Pro Franchising, Inc.; Allan Industries, Inc.; Ermc; Moonlight Maintenance Service; Get Clean Services LLC; Top West Cleaning Services; and VIP, Inc.

b. Key factors that are driving the market growth include growing consciousness about the importance of cleanliness and hygiene in work spaces, coupled with the increasing significance of preventive health practices.

b. The U.S. janitorial services market size was estimated at USD 78.17 billion in 2023 and is expected to reach USD 79.89 billion in 2024.

b. The U.S. janitorial services market is expected to grow at a compound annual growth rate of 2.8% from 2024 to 2030 to reach USD 94.15 billion by 2030.

b. Standard cleaning dominated the U.S. janitorial services market with a share of 62.4% in 2023. This is attributable to the growing demand for standard services such as window cleaning, disinfecting, dusting, pressure washing, sanitization, and restroom cleaning, etc. in commercial facilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.