- Home

- »

- Medical Devices

- »

-

U.S. Laboratory Disposable Products Market, Report, 2030GVR Report cover

![U.S. Laboratory Disposable Products Market Size, Share & Trends Report]()

U.S. Laboratory Disposable Products Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Specimen Containers, Transport Vials), By Material (Glass, Plastic), By End-use, And Segment Forecasts

- Report ID: GVR-3-68038-814-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

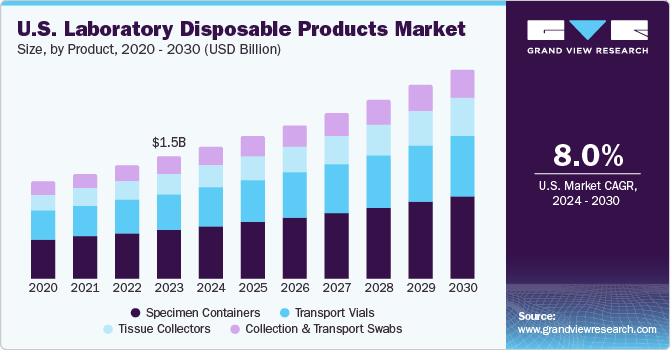

The U.S. laboratory disposable products market size was valued at USD 1.54 billion in 2023 and is projected to grow at a CAGR of 8.0% from 2024 to 2030. The increasing prevalence of chronic diseases and the rising number of diagnostic tests are boosting the demand for laboratory disposables. In addition, advancements in biotechnology and pharmaceutical research are resulting in the higher adoption of disposable products to ensure contamination-free environments. The growing emphasis on infection control and safety in healthcare settings further propels the market, as disposable products help minimize the risk of cross-contamination.

The COVID-19 pandemic has heightened the awareness and necessity for disposable laboratory products, contributing to their sustained demand. Also, the convenience and cost-effectiveness of disposable products compared to reusable ones are significant factors encouraging their adoption in various laboratory settings.

Laboratory disposable products are manufactured from materials such as paper, cotton, plastics, and polystyrene foam. These consumable items help prevent various types of contamination in laboratory environments. Utilizing disposable products has led to better results in clinical trials, tests, and experiments. Their single-use property reduces the need for re-processing, and many of these products are sterilized to avoid further contamination.

Growth in the medical sector and the rise in medical tourism have driven market growth in the U.S. An increased focus on patient safety has led hospitals and laboratories to adopt disposable products, which help avoid hospital-acquired infections (HAIs). Both government and private medical institutes invest heavily to improve patient safety and perform accurate treatments, tests, and diagnoses. This has increased the demand for products such as gloves, test tubes, vials, containers, and tissue collectors. Major companies are targeting the launch of technologically advanced and efficient products to improve the performance of medical procedures. Therefore, growth in the medical sector and an increased focus on patient safety and accurate treatments have driven the growth of the laboratory disposable products market in the U.S.

Product Insights

The specimen containers segment dominated the market in 2023 with a share of 40.3% due to the critical role specimen containers play in the collection, storage, and transportation of biological samples. These containers are essential in ensuring the integrity and sterility of specimens, which is crucial for accurate diagnostic testing and research. The widespread use of specimen containers across various medical and research facilities, including hospitals, clinics, and laboratories, underscores their importance. Additionally, the increasing prevalence of chronic diseases and the rising number of diagnostic tests have further fueled the demand for these containers. Innovations in material science have also led to the development of more durable and user-friendly specimen containers, enhancing their adoption.

The tissue collectors segment is expected to grow at a CAGR of 9.3% over the forecast period. The growing emphasis on cancer research, personalized medicine, and advancements in tissue engineering are key drivers of this segment’s growth. As the demand for precise and reliable tissue samples increases, so does the need for high-quality tissue collectors. Technological advancements have led to the development of more efficient and sterile tissue collection devices, which are crucial for maintaining sample integrity. Furthermore, the increasing number of surgical procedures and biopsies performed in medical facilities contributes to the rising demand for tissue collectors.

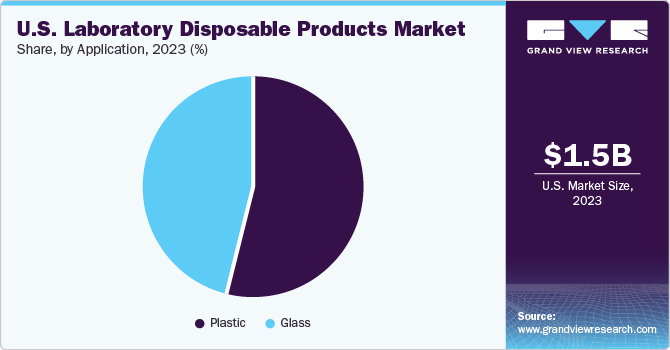

Materials Insights

The plastics segment accounted for a revenue share of 53.7% in 2023 owing to the high degree of versatility and cost-effectiveness plastics offer, making them an ideal choice for a wide range of laboratory applications. They are lightweight, durable, and resistant to breakage, which enhances their usability in various experimental and diagnostic procedures. Additionally, the ease of mass production and the ability to mold plastics into different shapes and sizes cater to the diverse needs of laboratory settings. The increasing emphasis on single-use products to prevent contamination and ensure sterility further boosts the demand for plastic disposables.

The glass segment is expected to grow at a CAGR of 8.3% over the forecast period. Glass has long been a staple in laboratory environments due to its chemical inertness, transparency, and ability to withstand high temperatures and pressures. These properties make glass an indispensable material for applications requiring precise measurements and reactions, such as in analytical chemistry and microbiology. The anticipated growth in this segment can be linked to advancements in glass manufacturing technologies that enhance durability and reduce costs.

End use Insights

The Contract Research Organizations (CROs) segment dominated the market in 2023 primarily driven by the increasing outsourcing of research and development activities by pharmaceutical and biotechnology companies to CROs. These organizations provide a wide range of services, including clinical trials, preclinical research, and regulatory support, which require extensive use of laboratory disposable products. The growing complexity of drug development processes and the need for specialized expertise have further propelled the demand for CRO services. Additionally, the cost-efficiency and scalability offered by CROs make them an attractive option for companies looking to streamline their R&D operations. The stringent regulatory requirements and the need for high-quality, sterile laboratory disposables to ensure the accuracy and reliability of research outcomes also contribute to the segment’s growth.

The hospital segment is expected to grow at a CAGR of 8.7% from 2024 to 2030. Hospitals are major consumers of laboratory disposable products due to their extensive diagnostic and therapeutic activities. The rising incidence of chronic diseases, increasing surgical procedures, and the growing emphasis on infection control are key factors driving the demand for disposable products in hospitals. These products, including syringes, specimen containers, and tissue collectors, are essential for maintaining sterility and preventing cross-contamination. The ongoing advancements in medical technology and the adoption of more sophisticated diagnostic tools further boost the need for high-quality disposables. Additionally, the increasing focus on patient safety and the implementation of stringent healthcare regulations underscore the importance of using reliable disposable products in hospital settings.

Key U.S. Laboratory Disposable Products Company Insights

Some of the major companies in the U.S. laboratory disposable products market are Cardinal Health, Thomas Scientific, Medicus Health, Therapak, an Avantor company, and others. Companies are focusing on market expansion through growth strategies such as collaborations, mergers, acquisitions, and product launches.

-

Cardinal Health is a producer and distributor of medical and laboratory products. The company also provides performance and data solutions for healthcare institutes and deals with medical and surgical products such as gloves, apparel, and more.

-

Thomas Scientific is a medical company that specializes in the production and distribution of laboratory supplies and equipment. The company caters to sectors such as advanced technology, biologicals, clinical, cannabis, controlled environments, cleanrooms, and more.

Key U.S. Laboratory Disposable Products Companies:

The following are the leading companies in the u.s. laboratory disposable products market. These companies collectively hold the largest market share and dictate industry trends.

- Cardinal Health

- Thomas Scientific

- Medicus Health

- Therapak, an Avantor company.

- Dynarex Corporation.

- Thermo Fisher Scientific Inc.

- MCKESSON CORPORATION

- Medline Industries, Inc.

- BD

- Agilent Technologies, Inc.

Recent Developments

-

In May 2024, Fuse Diagnostics secured a USD 2.2 million seed investment from a consortium of angel investors and Innovate UK. This funding will accelerate the development of Fuse's innovative diagnostic platform. The technology aims to deliver laboratory-grade accuracy in rapid, point-of-need tests at a fraction of the current cost.

-

In February 2024, Green Elephant Biotech GmbH introduced the industry's first plant-based 96-well plate. Manufactured from sustainable, corn starch-based plastics, this innovative product offers a greener alternative to traditional, petroleum-derived laboratory consumables. By leveraging a plant-based production process it achieves a 50% reduction in carbon emissions compared to conventional options, addressing the growing environmental impact of single-use laboratory plastics.

U.S. Laboratory Disposable Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.67 billion

Revenue forecast in 2030

USD 2.64 billion

Growth rate

CAGR of 8.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end use

Key companies profiled

Cardinal Health; Thomas Scientific; Medicus Health; Therapak, an Avantor company.; Dynarex Corporation.; Thermo Fisher Scientific Inc.; MCKESSON CORPORATION; Medline Industries, Inc.; BD; Agilent Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Laboratory Disposable Products Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. laboratory disposable products market report based on products, materials, and end use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Specimen Containers

-

Transport Vials

-

Collection and Transport Swabs

-

Tissue Collectors

-

Optical Grade

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Glass

-

Plastic

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

CROs

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.