- Home

- »

- Pharmaceuticals

- »

-

U.S. Leukemia Therapeutics Market, Industry Report, 2033GVR Report cover

![U.S. Leukemia Therapeutics Market Size, Share & Trends Report]()

U.S. Leukemia Therapeutics Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Chronic Myeloid Leukemia (CML), Chronic Lymphocytic Leukemia (CLL)), By Treatment, By Distribution Channels, And Segment Forecasts

- Report ID: GVR-4-68040-808-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Leukemia Therapeutics Market Summary

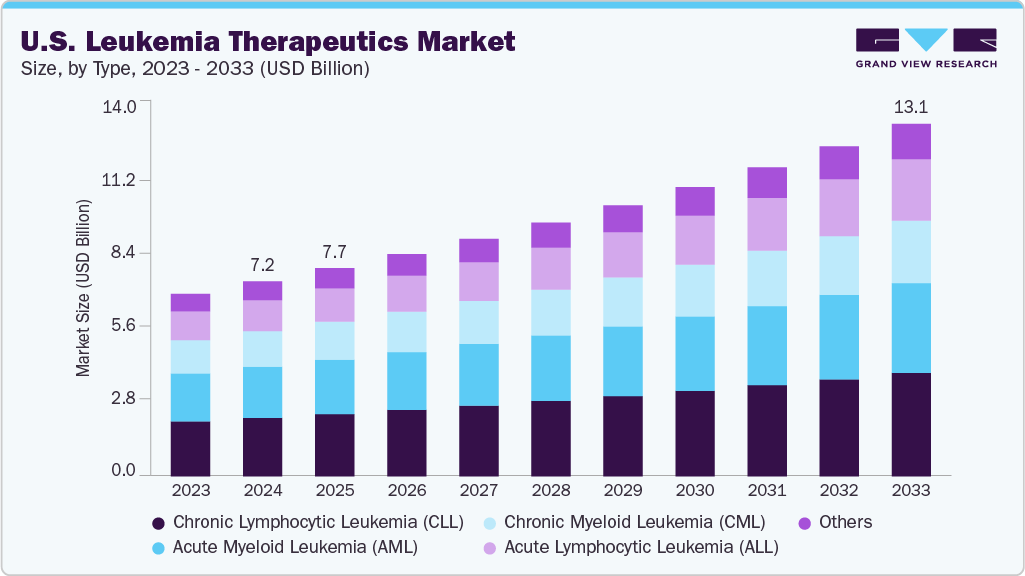

The U.S. leukemia therapeutics market size was estimated at USD 7.23 billion in 2024 and is projected to reach USD 13.07 billion by 2033, growing at a CAGR of 6.80% from 2025 to 2033. The industry is expanding due to the strong adoption of targeted therapies that offer high clinical precision.

Key Market Trends & Insights

- By type, the Chronic Lymphocytic Leukemia (CLL) segment held the largest market share of 30.01% in 2024.

- By treatment, the targeted therapy segment held the largest market share in 2024.

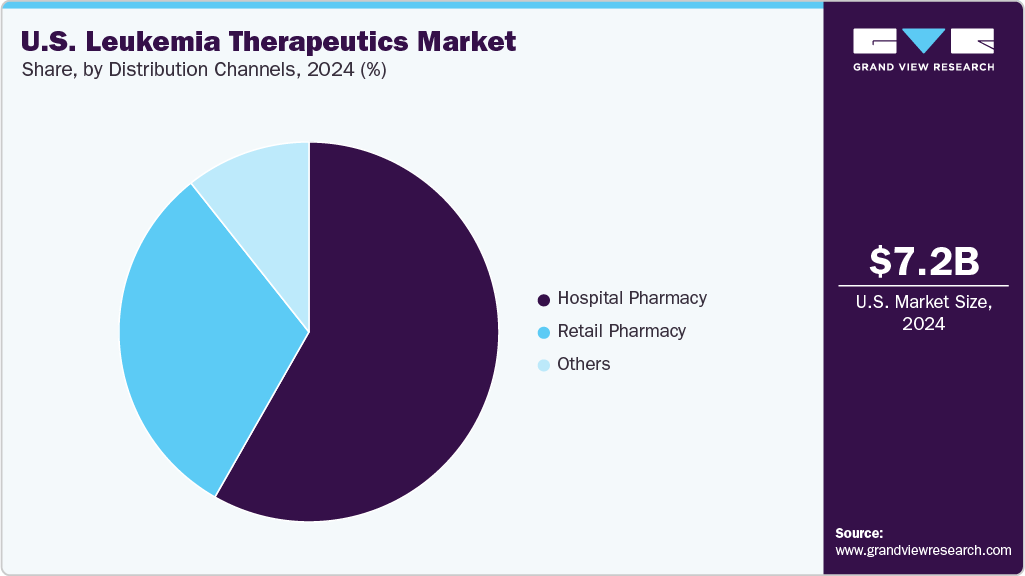

- By distribution channels, the hospital pharmacy segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.23 Billion

- 2033 Projected Market Size: USD 13.07 Billion

- CAGR (2025-2033): 6.80%

Increased use of genomic profiling supports accurate treatment selection and enhances overall therapeutic outcomes. Growth in CAR-T cell therapy utilization adds momentum through improved remission durability in high-risk patients. Advancements in bispecific antibodies strengthen options for relapsed and refractory cases. For instance, in March 2024, the National Cancer Institute (via the Surveillance, Epidemiology, and End Results Program) reported that in the U.S., there were an estimated 536,245 people living with leukemia in 2022, representing the prevalence of the disease. The broader integration of molecular diagnostics enhances patient identification for advanced therapies. Continuous development of next-generation agents sustains momentum in the market. The rising preference for personalized oncology care is expected to strengthen long-term treatment demand.

Therapeutic innovation strengthens market growth as clinical pipelines deliver novel mechanisms for acute and chronic leukemia. Wider availability of oral targeted agents improves adherence and supports strong commercial performance. Expansion of clinical evidence enhances prescriber confidence across major oncology networks. Increased survival rates create ongoing demand for maintenance and follow-up therapies. High disease burden within aging populations drives treatment initiation across multiple leukemia types. Advancements in combination regimens have improved the depth of response in both frontline and salvage settings. For instance, in November 2025, Business Wire reported that the U.S. Food and Drug Administration (FDA) granted Orphan Drug Designation to Leukogene Therapeutics Inc.’s lead product candidate LTI-214 (also named M2T-CD33) for the treatment of Acute Myeloid Leukemia (AML), providing incentives such as tax credits on qualified clinical trial costs, waiver of certain FDA fees, and U.S. market exclusivity upon approval. Strong investment from major pharmaceutical companies accelerates the development and commercialization of new agents.

Improved treatment access through specialized oncology centers contributes to market expansion across the U.S. Growth in real-world evidence supports broader adoption of immunotherapy and targeted strategies. Higher utilization of high-value biologics strengthens revenue contribution across leading manufacturers. Enhanced therapeutic durability reduces the frequency of relapse and encourages continued long-term therapy. Rising clinical trial activity in major cancer institutions supports rapid evaluation of emerging platforms. An increased emphasis on precision treatment pathways supports the consistent uptake of advanced therapeutics. Continuous improvements in patient management practices reinforce sustained demand for leukemia treatments.

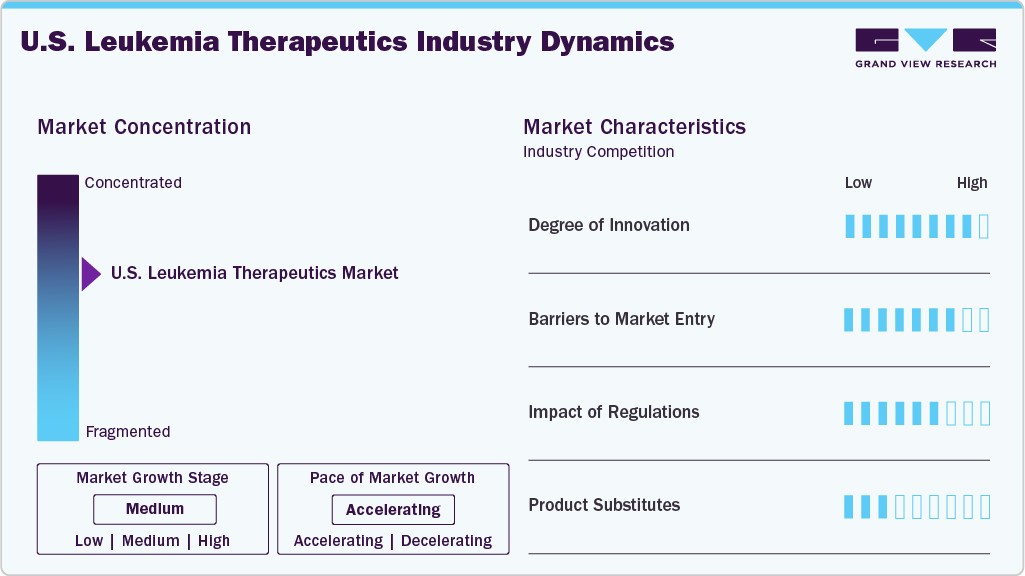

Market Concentration & Characteristics

The U.S. leukemia therapeutics industry is defined by rapid innovation driven by targeted therapies, immunotherapies, and advanced cell-based treatments. Drug development increasingly focuses on precision medicine, exploiting genetic mutations such as FLT3, IDH1/2, and BCR-ABL. CAR-T therapies and bispecific antibodies have accelerated the shift toward personalized oncology. Innovation is also evident in combination regimens that improve remission durability. Overall, the market’s competitive advantage is strongly dependent on continuous scientific advancements.

Entry barriers in the market remain high due to significant R&D expenses, complex biological manufacturing, and stringent clinical evidence requirements. Startups face challenges in accessing capital, trial networks, and manufacturing capacity for biologics or cell therapies. Intellectual property protections create competitive moats for established players. Furthermore, partnerships with major cancer centers are crucial and difficult for new entrants to secure. These factors limit new competition and reinforce consolidation.

The regulatory environment is highly influential, with FDA guidelines dictating the pace and cost of market access. Leukemia therapies, particularly gene and cell therapies, undergo rigorous safety and efficacy evaluations due to the potential for severe adverse events. Accelerated approval pathways exist but require robust post-marketing commitments. Compliance with manufacturing standards for biologics and gene-modified products adds operational complexity. As a result, regulation shapes product timelines, development costs, and competitive dynamics.

Substitution within leukemia care is limited because treatment selection depends heavily on disease subtype, mutation profile, and patient response history. For many indications, targeted therapies or CAR-T options have become preferred over traditional chemotherapy, but they are not interchangeable across all patient groups. Biosimilars provide some pricing pressure in niche segments but do not replace innovative therapies. Supportive care drugs cannot substitute curative treatments. Overall, substitutes are narrow and highly clinically constrained.

Type Insights

The Chronic Lymphocytic Leukemia (CLL) segment dominated the market, accounting for the largest revenue share of 30.01% in 2024, primarily due to its high prevalence among the U.S. adult population, particularly among individuals aged 65 years and older. For instance, in March 2023, StatPearls Publishing reported that in the U.S., the subtype Chronic Lymphocytic Leukemia (CLL) comprised approximately 25 to 30% of all leukemia, and in 2020, an estimated 21,040 new CLL cases and 4,060 deaths occurred. The strong commercial uptake of targeted therapies, such as BTK inhibitors, BCL-2 inhibitors, and next-generation combination regimens, further strengthened segment growth. The widespread adoption of genomic testing has improved early diagnosis and treatment stratification, thereby increasing therapeutic demand. In addition, favorable reimbursement policies for oral targeted agents and ongoing development of novel agents have continued to support CLL’s leading position in the market.

The Acute Lymphocytic Leukemia (ALL) segment is projected to grow at the fastest CAGR of 7.93% over the forecast period, primarily due to the rising adoption of advanced immunotherapies, including CAR-T cell therapies and bispecific antibodies, which have significantly improved remission rates in both pediatric and adult patients. For instance, in March 2024, the National Cancer Institute (via the Surveillance, Epidemiology, and End Results Program) cited projections made by the American Cancer Society (ACS), suggesting an estimated 6,100 new cases and 1,400 deaths from acute lymphocytic leukemia (ALL) in 2025 in the U.S., representing 0.3% of all new cancer cases and 0.2% of all cancer deaths. The age-adjusted incidence rate was 1.9 per 100,000 (based on 2018-2022 data), and the age-adjusted death rate was 0.4 per 100,000 (2019-2023 deaths). The estimated prevalence in 2022 was 120,759 people living with ALL in the U.S., and the 5-year relative survival for cases diagnosed in 2015-2021 was 72.6%. The increasing availability of precision diagnostics has enabled the earlier detection of key genetic abnormalities, supporting more targeted treatment approaches. Besides, the expansion of clinical trial activity and accelerated FDA approvals for novel agents were expected to drive robust market growth. Growing survival rates and improved treatment accessibility across major U.S. cancer centers further reinforced the strong growth outlook for the ALL segment.

Treatment Insights

The targeted therapy segment dominated the market, accounting for the largest revenue share of 40.27% in 2024, driven by the increasing reliance on precision medicines that deliver strong efficacy with manageable toxicity profiles. Oral kinase inhibitors and BCL-2 inhibitors have become standard options across both initial and relapsed disease settings, contributing to extended treatment durations and improved patient continuity. The expanding use of companion diagnostics has enhanced clinical decision-making, enabling the more accurate identification of mutation-defined subgroups and boosting clinician confidence. Leading targeted agents continue to show strong uptake through ongoing label expansions, especially among older adults and high-risk clinical populations. For instance, in May 2023, Frontiers in Oncology reported that a next-generation BCL-2 inhibitor administered to 78 U.S. patients with relapsed or refractory CLL produced an overall response rate of 67%, a complete response rate of 12%, and a median progression-free survival of 22 months, while grade 3/4 neutropenia and thrombocytopenia occurred in 54% and 29% of patients, reinforcing the growing adoption of targeted therapies in U.S. hematologic oncology.

The immunotherapy segment is projected to grow at the fastest CAGR of 7.97% over the forecast period, supported by increasing adoption of monoclonal antibodies, bispecific T-cell engagers, and CAR-T cell therapies. Growing evidence of durable responses in refractory leukemia is strengthening physicians’ preference for immune-driven modalities, while the ability to achieve long-term remission is accelerating their use in relapsed and high-risk patients. Improvements in U.S. cell-processing infrastructure and manufacturing capacity are enhancing treatment availability, further bolstered by the increasing availability of real-world data and broader reimbursement coverage. The momentum is reinforced by the rapid development of combination immunotherapies and sustained investment in next-generation immune platforms. For instance, in August 2023, Frontiers in Oncology reported that early U.S. immunotherapy trials using bispecific T-cell engagers in relapsed or refractory AML demonstrated overall response rates of 20-40%. A dual-antigen immunotherapy approach yielded a 40.0% ORR in 40 newly diagnosed AML patients, including 53.8% among those with TP53/RUNX1/ASXL1 mutations, while cytokine-release syndrome occurred in up to 96% of patients (grade ≥3 in 4%), underscoring the growing clinical integration of immunotherapies in U.S. leukemia treatment.

Distribution Channels Insights

The hospital pharmacy segment dominated the market with the largest revenue share of 58.24% in 2024, driven by the high concentration of leukemia treatments administered within specialized oncology and transplant centers across the United States. Most advanced therapeutics, including CAR-T therapies, monoclonal antibodies, and intensive chemotherapy regimens, require hospital-based infusion capabilities and close clinical monitoring, thereby reinforcing the hospital’s reliance. Large academic medical centers also handle a significant share of acute leukemia cases, supporting higher dispensing volumes. Additionally, bundled reimbursement structures and integrated care pathways encourage hospitals to procure high-cost biologics and cell therapies. Growing adoption of complex immunotherapies further strengthened the position of hospital pharmacies as the primary distribution channel in U.S. leukemia care.

The retail pharmacy segment is projected to grow at the CAGR of 6.52% over the forecast period, fueled by expanding access to oral targeted therapies that support outpatient dispensing. The growing preference for convenient prescription refills among patients on long-term leukemia treatment enhances channel utilization. Wider insurance acceptance for community-based prescription fulfillment strengthens patient adherence. Growth in pharmacist-managed support programs improves medication counseling and therapy continuity. Increasing the availability of specialty pharmacy services within large retail chains enhances access to high-value agents. Improved coordination between oncology centers and retail networks streamlines the prescription transition process after hospital discharge. These factors collectively reinforce strong growth prospects for the retail pharmacy segment in the U.S. leukemia therapeutics market.

Key U.S. Leukemia Therapeutics Company Insights

Novartis contributes to the U.S. leukemia therapeutics market through targeted and cell-based therapies supported by extensive research. Roche/Genentech advances biologics and antibody platforms addressing diverse leukemia subtypes. AbbVie expands therapeutic reach with targeted agents and ongoing development programs. Bristol-Myers Squibb drives immuno-oncology and precision strategies backed by active clinical data generation. Pfizer supports treatment options through a broad oncology portfolio and mutation-focused R&D. Amgen offers biologics and immunotherapies used across multiple settings. Johnson & Johnson (Janssen) advances targeted and immune-based regimens. Gilead Sciences, via Kite, strengthens cell-therapy presence. AstraZeneca develops precision assets, while Sanofi focuses on therapies for relapsed and refractory disease.

Key U.S. Leukemia Therapeutics Companies:

- Novartis

- Roche / Genentech

- AbbVie

- Bristol-Myers Squibb (BMS)

- Pfizer

- Amgen

- Johnson & Johnson (Janssen)

- Gilead Sciences (Kite Pharma)

- AstraZeneca

- Sanofi

Recent Developments

-

In October 2024, Novartis reported that the FDA approved Scemblix for newly diagnosed Ph+ CML-CP, citing superior efficacy, deeper molecular response, and a more favorable safety and tolerability profile compared with standard therapy in a global Phase III study.

-

In June 2024, Amgen announced that the U.S. FDA approved BLINCYTO® for CD19-positive, Philadelphia chromosome-negative B-cell precursor ALL in the consolidation phase, after Phase III data showed higher 3-year and 5-year overall survival rates in the BLINCYTO plus chemotherapy arm compared with chemotherapy alone.

-

In May 2024, Lupin received U.S. FDA approval for its 25 mg generic Midostaurin Capsules, a product linked to USD 75 million in U.S. annual sales. The drug was cleared for ASM, SM-AHN, and MCL, and Lupin noted 15 manufacturing sites and 7 R&D centers, with 7.8% FY24 revenue invested in R&D.

U.S. Leukemia Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.72 billion

Revenue forecast in 2033

USD 13.07 billion

Growth rate

CAGR of 6.80% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, treatment, distribution channels

Key company profiled

Novartis; Roche / Genentech; AbbVie; Bristol-Myers Squibb (BMS); Pfizer; Amgen; Johnson & Johnson (Janssen); Gilead Sciences (Kite Pharma); AstraZeneca; Sanofi

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Leukemia Therapeutics Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. leukemia therapeutics market report based on type, treatment, and distribution channels:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Chronic Myeloid Leukemia (CML)

-

Chronic Lymphocytic Leukemia (CLL)

-

Acute Lymphocytic Leukemia (ALL)

-

Acute Myeloid Leukemia (AML)

-

Others

-

-

Treatment Outlook (Revenue, USD Million, 2021 - 2033)

-

Chemotherapy

-

Targeted Therapy

-

Immunotherapy

-

Others

-

-

Distribution Channels Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.