- Home

- »

- Clothing, Footwear & Accessories

- »

-

U.S. Lingerie Market Size & Trends, Industry Report, 2033GVR Report cover

![U.S. Lingerie Market Size, Share & Trends Report]()

U.S. Lingerie Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Briefs, Shapewear), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-205-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Lingerie Market Summary

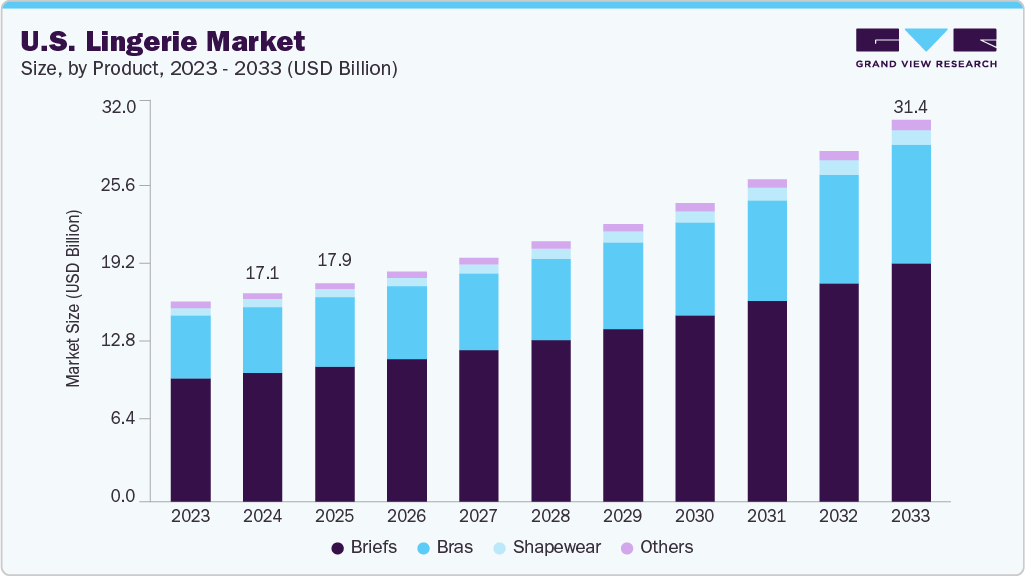

The U.S. lingerie market size was estimated at USD 17.11 billion in 2024 and is projected to reach USD 31.40 billion by 2033, growing at a CAGR of 7.2% from 2025 to 2033, due to the rising demand for comfort-driven, inclusive, and fashion-forward lingerie and the expanding reach of both offline stores and e-commerce platforms catering to diverse consumer preferences. A notable trend is the rise of inclusive lingerie for maternity and post-pregnancy wear.

Key Market Trends & Insights

- By product, bras led the market and accounted for a share of 61.80% in 2024.

- By distribution channel, the offline sales held the largest market share of 67.38% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 17.11 Billion

- 2033 Projected Market Size: USD 31.40 Billion

- CAGR (2025-2033): 7.3%

Brands such as Bravado and Kindred Bravely are expanding their offerings to provide comfortable, supportive bras and shapewear for new and expecting mothers, reflecting real consumer demand for functional, stylish products during life stages often overlooked by mainstream lines.The growing emphasis on body positivity is significantly reshaping the U.S. market, with inclusivity in sizing and styles becoming a central driver of consumer demand. Modern consumers are increasingly looking for lingerie that not only delivers aesthetic appeal but also offers comfort and support across a wide range of body types. The availability of extended size ranges and adaptive fits allows more women to feel represented and catered to, strengthening trust and loyalty toward brands that prioritize inclusivity. At the same time, marketing strategies that showcase diverse models across size, age, and ethnicity are reinforcing this cultural shift and broadening market appeal.

For instance, in August 2023, Macy’s and Gap announced their first-ever collaboration with the launch of an exclusive collection of sleepwear, underwear, and intimates for men and women. The range, which includes pajama sets, loungewear, bras, briefs, boxers, and undershirts, is designed with comfort in mind and made from fabrics such as organic stretch cotton and Gap’s breathable “Breathe” jersey knit. Available in sizes XS through XL, the collection is sold only through Macy’s channels-including Macys.com, the Macy’s mobile app, and select stores across the U.S.

Another major driver is the rise of size-inclusivity and body realism, which is expanding the customer base globally. Instead of limited “S-M-L” options, brands now offer inclusive fits across band and cup combinations, including plus-size and petite segments. Retailers such as Savage X Fenty, Marks & Spencer, and H&M have scaled sizing ranges based on demand analytics, while AI-powered virtual fitting tech from companies like TrueFit and Fit Finder has reduced return rates by solving size mismatch issues-converting more shoppers online and boosting lingerie revenue.

Innovation in fabric design and technology has become one of the strongest drivers of growth in the U.S. market. The introduction of breathable microfibers, lightweight power mesh, seamless knitting, and bonded finishes has improved both comfort and support, making lingerie suitable not just for special occasions but for everyday wear. Advances in shapewear materials, such as stretch textiles with targeted compression, are creating new categories that blend lingerie with wellness and activewear.

Consumer Insights

The U.S. market divides by purchase tier. About 65% of consumers choose value or essentials-focused products that emphasize everyday comfort and affordability. The other 35% lean toward premium or aspirational lingerie, looking for quality fabrics, designer appeal, and trendy designs. This division shows a market where practicality drives sales, but premium products still boost revenue growth significantly.

Age demographics are key in shaping buying habits. The largest group, those aged 25 to 44, makes up 53% of consumers. This group includes working professionals and young parents who value comfort and style. The 18 to 24 age group represents 22%. They are trend-conscious and tend to prefer fashionable purchases influenced by social media. Consumers aged 45 and older account for 25%, focusing mainly on fit, support, and practical designs.

U.S. consumers face several challenges when buying lingerie. Common problems include size mismatches, poor support, low comfort, limited style options, and high prices. Brands that tackle these issues with inclusive sizing, ergonomic designs, and a variety of styles tend to create stronger loyalty, reduce returns, and attract repeat buyers in a market where fit and comfort matter greatly.

In terms of brand preference, Victoria’s Secret, Calvin Klein, ThirdLove, Savage X Fenty, and Hanes lead the U.S. market. These brands successfully combine comfort, style, and inclusivity while using both offline and digital marketing. Social media campaigns, influencer partnerships, and targeted product innovation help these brands reach younger, tech-savvy consumers. This strategy reinforces their leadership and influences buying trends across the country.

Product Insights

Briefs accounted for a 56.97% share of the global revenue in 2024. A major factor is the rising emphasis on comfort and functionality. Consumers are increasingly seeking lingerie that can be worn comfortably throughout the day, particularly in the context of hybrid and work-from-home lifestyles. Briefs, offering fuller coverage and reliable support, naturally meet these requirements and have become a preferred choice for everyday use.

For instance, in June 2023, Victoria’s Secret and Amazon Fashion collaborated to improve the shopping experience for customers. The collaboration will include over 4,000 fashion items from Victoria's Secret and PINK, including panties, bras, swimwear, loungewear, and sleepwear. Particular bra and apparel styles will also be available on Amazon Prime’s Try Before You Buy program.

Shapewear is anticipated to grow at a CAGR of 8.3% from 2025 to 2033. Technological advancements in fabrics and garment construction have also been pivotal. Breathable spandex blends, seamless laser-cut designs, and moisture-wicking materials have made shapewear briefs more comfortable for extended wear. These innovations reduce the stigma of discomfort often associated with traditional shapewear, increasing adoption for everyday use rather than just special occasions.

In October 2024, Knix launched the world's first customizable shapewear collection, allowing users to adjust fit with its patented PerfectCut technology. Customers can change leg length and back plunge in up to eight ways, with pieces retaining support and shape after cutting. The collection starts at USD 90, comes in inclusive sizes and various colors, and is available online and in stores across the U.S. and Canada.

Distribution Channel Insights

The sale of lingerie through offline channels accounted for 67.38% of the market, as consumers highly value in-store fitting, personalized assistance, and instant purchase, especially for products where comfort and support are critical. Retailers such as Victoria’s Secret, Macy’s, and Nordstrom offer extensive size ranges, professional fitting services, and the ability to try multiple styles, making brick-and-mortar stores the preferred choice despite growing e-commerce adoption.

The sale of lingerie through the online channel is expected to grow at a CAGR of 7.8% from 2025 to 2033, due to convenience, personalized fit tools, and digital-first brand strategies. Platforms like ThirdLove, Savage X Fenty, and Amazon offer subscription services, and extensive size inclusivity, attracting younger, tech-savvy shoppers who prefer shopping from home and driving steady online market growth.

Key U.S. Lingerie Company Insights

The U.S. lingerie industry is shaped by a combination of established national players, premium innovators, and digitally native challengers, each influencing different consumer segments. Brands such as Victoria’s Secret, Hanes, and Calvin Klein dominate the mid-range segment, leveraging strong brand loyalty, widespread retail presence, and consistent fit for everyday wear. Premium and fashion-forward lingerie from Savage X Fenty and ThirdLove attracts consumers seeking inclusive sizing, high-quality materials, and modern designs, often promoted via social media and influencer campaigns. Meanwhile, online-first challengers and regional specialists focus on younger, tech-savvy shoppers looking for convenience, subscription models, and personalized fit solutions, helping expand penetration and engagement across diverse U.S. consumer groups.

Key U.S. Lingerie Companies:

- Jockey International Inc.

- Victoria Secret

- Gap Inc.

- HanesBrands Inc.

- Calvin Klein

- ThirdLove

- AEO Inc.

- Wacoal America (Global)

- FULLBEUATY Brands (Cuup)

- Bare Necessities

Recent Developments

-

In August 2025, Wacoal unveiled its Autumn/Winter 2025 Lingerie Collection, a refined assortment designed to balance seasonal elegance with everyday practicality. The range introduced festive statement pieces and updated essentials, highlighted by luxurious lacework, rich seasonal tones, and fabrics crafted with sustainability in mind.

-

In July 2025, Wacoal America launched the Ever Flexing Underwire Bra, a category-first innovation engineered to flex across six traditional sizes, adapting to the realities of hormonal shifts, pregnancy, menopause, or weight fluctuations.

-

In July 2025, Victoria’s Secret introduced the Body by Victoria FlexFactor Bra, a breakthrough innovation designed with a flexible titanium underwire and adaptive memory foam for unmatched comfort and support. The line features a variety of inclusive sizes and styles, giving women options that balance movement, fit, and elegance.

-

In February 2025, Calvin Klein expanded into a new category with the launch of its first-ever Shapewear collection, marking a significant growth move for the brand beyond its core intimates and underwear. The line features a wide range of products, including thongs, briefs, bodysuits, leggings, and slips, crafted with four compression levels to balance style and function.

U.S. Lingerie Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.95 billion

Revenue forecast in 2033

USD 31.40 billion

Growth rate (Revenue)

CAGR of 7.2% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/ billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Key companies profiled

Jockey International Inc.; Victoria Secret; Gap Inc.; HanesBrands Inc.; Calvin Klein; ThirdLove; AEO Inc.; Wacoal America (Global); FULLBEUATY Brands (Cuup); Bare Necessities

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Lingerie Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. lingerie market report based on product and distribution channel.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Briefs

-

Bras

-

Shapewear

-

Others

-

-

Distribution Channel (Revenue, USD Million, 2021 - 2033)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The U.S. lingerie market size was estimated at USD 17.11 billion in 2024 and is expected to reach USD 17.95 billion in 2025.

b. The U.S. lingerie market is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2033 to reach USD 31.40 million by 2033.

b. Bras dominated the U.S. lingerie market with a share of more than 61.80% in 2024. This can be attributed to the variety of products available in the market that is characterised by superior quality fabrics such as cotton or nylon which offer comfort and elasticity like no other fabric.

b. Some key players operating in the U.S. lingerie market include Jockey International Inc.; Victoria Secret; Gap Inc.; HanesBrands Inc.; Calvin Klein; ThirdLove; AEO Inc.; Wacoal America, FULLBEUATY Brands (Cuup); Bare Necessities

b. Key factors that are driving the U.S. lingerie market growth include the increasing disposable income of women in the country, growing awareness about the best fit of the products, rising population of millennials are some of the growth driving factors for this market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.