- Home

- »

- Medical Devices

- »

-

U.S. Liquid Embolic Agent Market Size, Industry Report 2033GVR Report cover

![U.S. Liquid Embolic Agent Market Size, Share & Trends Report]()

U.S. Liquid Embolic Agent Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Ethylene Vinyl Alcohol Copolymer, Cyanoacrylates), By Application (AVM, Hypervascular Tumors), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-692-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Liquid Embolic Agent Market Summary

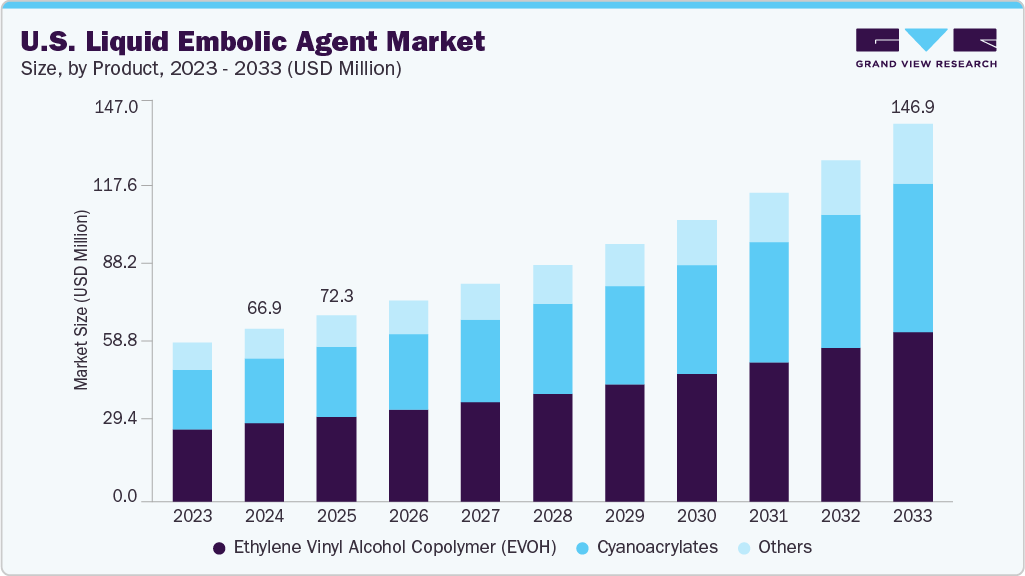

The U.S. liquid embolic agent market size was estimated at USD 66.97 million in 2024 and is projected to reach USD 146.85 million by 2033, growing at a CAGR of 9.26% from 2025 to 2033. This growth is driven by technological advancements, increasing prevalence of vascular disorders, rising preference for minimally invasive procedures, advancements in embolic agent materials, and expanding application areas.

Key Market Trends & Insights

- Based on product, the ethylene vinyl alcohol copolymer (EVOH) segment led the market with the largest revenue share of 45.64% in 2024.

- Based on application, the peripheral vasculature hemorrhage segment is expected to witness the fastest growth during the forecast period, registering a CAGR of 10.03%.

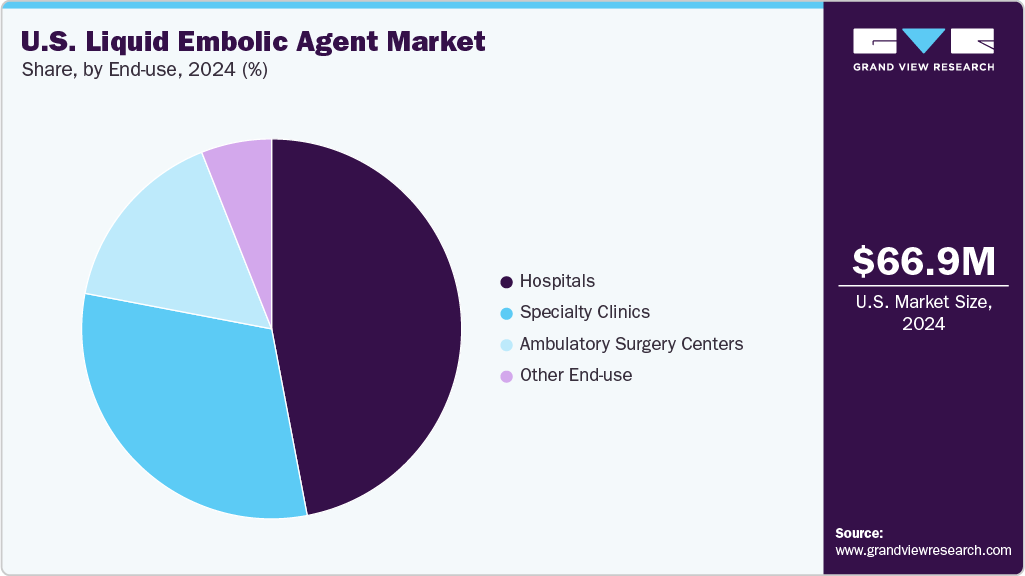

- By end use, the hospitals segment led the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 66.97 Million

- 2033 Projected Market Size: USD 146.85 Million

- CAGR (2025-2033): 9.26%

The increasing incidence of neurovascular and peripheral vascular conditions such as aneurysms, arteriovenous malformations (AVMs), and hypervascular tumors has increased demand for effective embolization solutions, fueling market expansion. These conditions often require minimally invasive procedures to block abnormal blood vessels, prevent rupture, or reduce tumor blood supply. Liquid embolic agents are particularly well-suited for these treatments because they precisely target complex vascular structures, providing effective devascularization with minimal collateral damage.As awareness of these conditions increases and diagnostic techniques improve, more patients are diagnosed early and require embolization therapy. In addition, advancements in embolic materials, such as n-butyl cyanoacrylate (n-BCA) and ethylene vinyl alcohol copolymer (EVOH), have enhanced the safety and efficacy of these procedures, making them more attractive options for clinicians. The expanding adoption of endovascular techniques further boosts the utilization of liquid embolic agents. Consequently, this surge in neurovascular and peripheral vascular condition cases, technological progress, and growing clinical acceptance fuel market expansion. For instance, in July 2025, Medtronic announced the enrollment of the first patient in the Peripheral Onyx Liquid Embolic (PELE) clinical trial. This study aims to assess the safety and efficacy of the Onyx Liquid Embolic System (LES) for the embolization of arterial hemorrhages in the peripheral vasculature.

Liquid embolic agents are widely used in the treatment of various conditions such as arteriovenous malformations (AVMs), hypervascular tumors, peripheral hemorrhages, and other vascular anomalies. The growing incidence of stroke, cancer, and traumatic injuries has increased demand for effective embolization therapies in the country. For instance, according to Barrow Neurological Institute, approximately 300,000 Americans are affected by AVMs of the brain and spinal cord (neurological AVMs), but only around 12 percent of those affected experience symptoms.

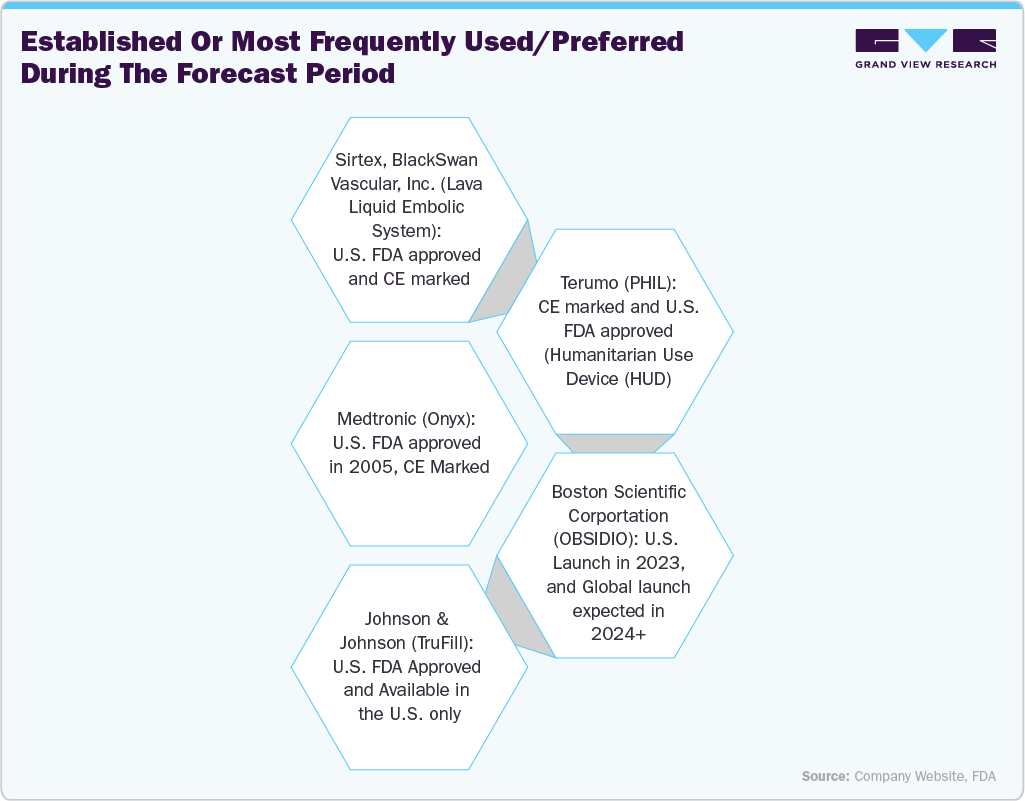

Some of the key players operating in the U.S. and having U.S. FDA-approved products include Medtronic, CERENOVUS (Johnson & Johnson), Boston Scientific Corporation, Terumo, and Sirtex (BlackSwan Vascular, Inc.). Furthermore, the adoption of advanced embolic materials, including cyanoacrylate-based, non-adhesive, and ethylene vinyl alcohol copolymer agents, has improved procedural outcomes and safety profiles, fueling market expansion.

The trend toward outpatient procedures is also contributing to market growth, with ambulatory surgical centers increasingly adopting embolization techniques due to their cost-effectiveness and patient convenience. According to a research article published in the Interventional Neuroradiology journal in April 2022, liquid embolic systems (LESs) such as n-butyl cyanoacrylate (n-BCA) and ethylene vinyl alcohol copolymer (EVOH) are utilized for the embolization of brain arteriovenous malformations (bAVMs) to facilitate presurgical devascularization in U.S. hospitals.

Recent Product Approvals/Launches

Liquid Embolic Agent

Manufacturer

Approval Date/Year

Description

LIPIOJOINT

Guerbet

- U.S. FDA granted Breakthrough Device Designation in February 2025

Guerbet announced that the U.S. Food and Drug Administration (FDA) has granted Breakthrough Device designation to LIPIOJOINT, an innovative transient liquid embolic agent developed to help relieve pain and improve mobility in patients suffering from knee osteoarthritis (KOA)

TRUFILL n-BCA Liquid Embolic System Procedural Set

CERENOVUS (Johnson & Johnson)

- Received U.S. FDA approval in September 2023

- Launch in March 2024

CERENOVUS Inc., a growing leader in neurovascular care and a subsidiary of Johnson & Johnson MedTech, announced the launch of the TRUFILL n-BCA Liquid Embolic System Procedural Set. This new addition to CERENOVUS's hemorrhagic stroke portfolio introduces a comprehensive procedural set for the TRUFILL n-BCA Liquid Embolic System.

OBSIDIO Conformable Embolic

Boston Scientific Corporation

- U.S. Launch in 2023

Used for the embolization of hypervascular tumors and blood vessels to occlude blood flow, thereby helping to control bleeding and hemorrhaging in the peripheral vasculature.

LAVA Liquid Embolic System

Sirtex

- Commercial availability of the LAVA Liquid Embolic System in October 2023

- Received U.S. FDA approval in April 2023

It is the first and only liquid embolic approved for the treatment of peripheral vascular hemorrhage

Source: U.S. FDA, Company Website

Recent product launches, approvals, and commercial availability indicate that the market is poised for significant growth potential during the forecast period, mainly n-BCA, EVOH, and recently emerged blended liquid embolic agents with expanding applications are expected to fuel the market growth further. For instance, in February 2025, Guerbet announced that the U.S. Food and Drug Administration (FDA) had granted Breakthrough Device designation to LIPIOJOINT, an innovative transient liquid embolic agent developed to help relieve pain and improve mobility in patients suffering from knee osteoarthritis (KOA).

In addition, the growing reimbursement scenario is further expected to boost market growth. Sirtex launched a reimbursement guide for its LAVA Liquid Embolic System (CPT code: CPT 37244) for hospital outpatient, physician services, and office-based lab. Below is the reimbursement information for the LAVA Liquid Embolic System:

HOSPITAL OUTPATIENT (OPPS)

Embolization or Occlusion for Hemorrhage - Peripheral Vasculature

Service

CMS CY25

Code

Description

SI

Weight

APC

Rate

37244

Vascular embolization or occlusion, inclusive of all radiological S & I, intraprocedural road mapping, and imaging guidance necessary to complete the intervention; for arterial or venous hemorrhage or lymphatic extravasation

J1

127.18

5193

USD 11,340.57

PHYSICIAN (MFPS) SERVICES

Embolization or Occlusion for Hemorrhage - Peripheral Vasculature

Service

CMS CY25

Code

Description

RVUs

Rate

37244

Vascular embolization or occlusion, inclusive of all radiological S & I, intraprocedural road mapping, and imaging guidance necessary to complete the intervention, for arterial or venous hemorrhage or lymphatic extravasation

19.29

USD 623.96

OFFICE-BASED LAB (OBL)

Embolization or Occlusion for Hemorrhage - Peripheral Vasculature

Service

CMS CY25

Code

Description

RVUs

Rate

37244

Vascular embolization or occlusion, inclusive of all radiological S & I, intraprocedural road mapping, and imaging guidance necessary to complete the intervention, for arterial or venous hemorrhage or lymphatic extravasation

185.27

USD 5,992.84

Source: Sirtex

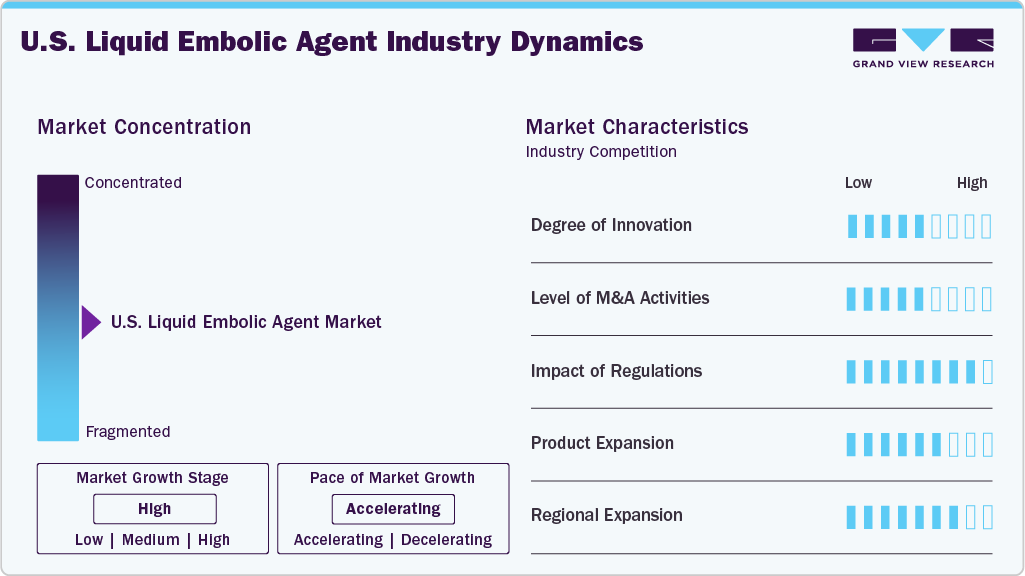

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The U.S. market for liquid embolic agents is characterized by rising awareness and investment in infection control, growing adoption in ambulatory surgery centers and clinics, and demographic and surgery volume growth.

Product innovations, such as developing more biocompatible and radiopaque embolic materials, have enhanced procedural safety and efficacy, further fueling market growth. For instance, the materials used in Sirtex’s LAVA Liquid embolic agents are non-toxic and biocompatible.

The U.S. Food and Drug Administration (FDA) oversees the regulation of liquid embolic agents used primarily in neurointerventional and vascular procedures. These agents are classified as medical devices and subject to specific regulatory pathways to ensure safety and efficacy.

The U.S. liquid embolic agent industry faces competition from various product substitutes such as coil embolization devices, vascular plugs, and solid embolic materials like particles and sclerosants. These alternatives are chosen based on specific clinical needs, offering benefits like ease of use, cost-effectiveness, or suitability for certain procedures, influencing market dynamics and product selection.

Market concentration in the U.S. liquid embolic agent industry remains significant, with key players dominating the industry. Major companies such as Medtronic, Terumo, Boston Scientific Corporation, and Sirtex, among others, hold substantial market shares. This high level of concentration indicates limited competition and potential barriers for new entrants.

Product Insights

The Ethylene Vinyl Alcohol Copolymer (EVOH) segment dominated the U.S. liquid embolic agent market in 2024. One primary reason is that EVOH is the most commonly used liquid embolic agent to treat vascular malformations of the head and neck. EVOH’s superior handling characteristics, including its controlled and predictable polymerization process, allow precise delivery and reduce the risk of non-target embolization. This results in improved safety profiles during procedures.

Furthermore, EVOH-based agents, such as Onyx, offer excellent penetrability into complex vascular malformations, enabling more effective and complete embolization of arteriovenous malformations (AVMs). Their cohesive nature minimizes the risk of catheter entrapment and facilitates easier removal after the procedure.

Furthermore, EVOH's radiopacity, achieved through the addition of tantalum powder, provides real-time visualization during embolization, enhancing procedural accuracy. Its biocompatibility and durable occlusion properties improve long-term outcomes, reducing the likelihood of recanalization or recurrence.

Overview of EVOH Copolymers

Product name

Manufacturer

Component(s)

Radiopaque component

Formulations

Special characteristics

Onyx

Medtronic

EVOH copolymer, micronized tantalum powder, DMSO

Tantalum

18, 20, 34

Long experience, efficacy, and safety demonstrated in multiple studies

Squid

Balt

EVOH copolymer, micronized tantalum powder, DMSO

Tantalum

12, 12LD, 18, 18LD, 34, 34LD

Smaller grain size of tantalum powder compared to Onyx

Menox

Meril

EVOH copolymer, micronized tantalum powder, DMSO

Tantalum

18, 20, 34

Similar to Onyx

PHIL

MicroVention, Terumo

Polylactide-co-glycolide, polyhydroxyethyl-methacrylate, triiodophenol, DMSO

Triiodophenol (covalently bound to the co-polymers)

LV, 25%, 30%, 35%

No preparation needed, lower degree of imaging artifacts

Source: NIH, Company Website

Over time, clinicians have gained extensive experience and confidence with EVOH agents, establishing them as the standard of care for neurovascular embolization procedures. These advantages collectively contribute to EVOH’s dominant market position in the U.S. liquid embolic agent landscape. The most commonly used and widely available EVOH for embolization of cerebral vascular malformations is Onyx (Medtronic), among which the most common formulation used in Onyx 18 and 34 in U.S. hospitals.

Cost Analysis Results By Technique And Number Of Pedicles Embolized, U.S.

Technique

Number of pedicles

Per procedure analyses

Cohort analyses

Cost of LES

Cost of microcatheters

Cost of angiography suite time

Total cost

Times greater than n-BCA

12 cases per year

52 cases per year

n-BCA (3:1)

Prowler 10

n-BCA

1

$3,657

$924

$1,360

$5,941

$71,297

$308,953

2

$3,657

$1,848

$1,360

$6,865

$82,385

$357,001

3

$3,657

$2,772

$2,721

$9,150

$109,798

$475,790

4

$3,657

$3,696

$2,721

$10,074

$120,886

$523,838

Onyx 18

Onyx 34

Marathon

EVOH - plug and push

1

$5,240

$5,030

$757

$1,684

$12,711

2.14

$152,536

$660,988

2

$10,480

$10,060

$1,514

$1,684

$23,738

3.46

$284,860

$1,234,392

3

$15,720

$15,090

$2,271

$3,369

$36,450

3.98

$437,395

$1,895,380

4

$20,960

$20,120

$3,028

$3,369

$47,477

4.71

$569,719

$2,468,784

Onyx 18

Onyx 34

Apollo

EVOH - detachable-tip microcatheters

1

$5,240

$5,030

$1,946

$1,684

$13,900

2.34

$166,804

$722,816

2

$10,480

$10,060

$3,892

$1,684

$26,116

3.8

$313,396

$1,358,048

3

$15,720

$15,090

$5,838

$3,369

$40,017

4.37

$480,199

$2,080,864

4

$20,960

$20,120

$7,784

$3,369

$52,233

5.18

$626,791

$2,716,096

Onyx 18

Scepter XC

EVOH - Balloon microcatheter

1

$5,240

$1,504

$1,684

$8,428

1.42

$101,140

$438,272

2

$10,480

$3,008

$1,684

$15,172

2.21

$182,068

$788,960

3

$15,720

$4,512

$3,369

$23,601

2.58

$283,207

$1,227,232

4

$20,960

$6,016

$3,369

$30,345

3.01

$364,135

$1,577,920

Source: NIH, Company Website

The cyanoacrylates segment is the fastest-growing due to its superior adhesive properties, rapid polymerization, and excellent biocompatibility. These characteristics make cyanoacrylates highly effective for embolization procedures, especially in treating vascular malformations, tumors, and hemorrhages. In recent years, there has been increasing emphasis on developing and commercializing n-BCA to expand its range of applications. For instance, in March 2024, CERENOVUS, a division of Johnson & Johnson MedTech, announced the launch of the TRUFILL n-BCA Liquid Embolic System Procedural Set. This new offer expands CERENOVUS’s hemorrhagic stroke portfolio by providing a comprehensive procedural set with two configuration options and all necessary accessories for preparing and delivering the TRUFILL n-BCA Liquid Embolic System. Furthermore, the low cost and high success rates of n-BCA are expected to contribute to market growth over the forecast period.

Application Insights

The Arteriovenous Malformations (AVM) segment dominated the liquid embolic agent market in 2024. AVMs are complex vascular anomalies characterized by abnormal connections between arteries and veins, which pose significant health risks including hemorrhage, neurological deficits, and even death if left untreated. The critical need for effective treatment options drives the high demand for liquid embolic agents specifically designed for AVM management. These agents, such as n-butyl cyanoacrylate (n-BCA) and ethylene vinyl alcohol copolymer (EVOH), enable precise embolization of the abnormal vessels, reducing the risk of bleeding and improving patient outcomes. Moreover, advancements in minimally invasive neurointerventional techniques have made embolization a preferred treatment modality for AVMs, further boosting the application segment. The high prevalence of AVMs in the U.S., coupled with increasing awareness and early diagnosis, contributes to sustained demand. Furthermore, the evolving technological landscape, with innovations in liquid embolic agents that offer enhanced safety and efficacy, supports their widespread application in AVM treatment.

Peripheral vasculature hemorrhage is expected to register the fastest growth during the forecast period due to several factors. Firstly, the increasing prevalence of traumatic injuries, such as accidents and sports-related incidents, has led to a higher incidence of peripheral hemorrhages requiring prompt and effective treatment. Liquid embolic agents provide minimally invasive options that can rapidly control bleeding, reducing the need for more invasive surgical procedures. Secondly, advancements in catheter-based delivery systems have enhanced the precision and efficacy of embolization procedures, making them more suitable for peripheral hemorrhages.

Thirdly, the growing adoption of endovascular techniques among healthcare providers, driven by improved clinical outcomes and shorter recovery times, further fuels demand in this segment. In addition, the expanding use of liquid embolic agents in managing hemorrhages due to vascular anomalies and trauma-related injuries supports the rapid market growth. Moreover, growing product launches in the segment are also expected to fuel the market growth over the forecast period. In addition, in 2023, Boston Scientific Corporation announced the U.S. launch of its OBSIDIO Conformable Embolic, indicated for embolization of hypervascular tumors and blood vessels to occlude blood flow, thereby controlling bleeding and hemorrhaging in the peripheral vasculature.

End Use Insights

The hospitals segment dominated the liquid embolic agent market in 2024, accounting for the largest share of 47.37%. Hospitals serve as the primary setting for complex endovascular procedures involving liquid embolic agents, including treatments for AVMs, hypervascular tumors, and peripheral hemorrhages. Their equipped infrastructure and specialized personnel facilitate the use of these advanced therapies.

The ambulatory surgery centers (ASCs) segment is expected to register the fastest CAGR during the forecast period owing to growing preference for minimally invasive procedures as ASCs specialize in minimally invasive treatments, making them ideal settings for embolization procedures that use liquid embolic agents, which are less invasive and offer quicker recovery times. In addition, procedures performed in ASCs are generally more cost-effective compared to hospital settings.

Key Opinion Leaders

Company Name

KOLs

Growth Opportunities

Mark Dickinson, Worldwide President, CERENOVUS

“The treatment of neurovascular disease can be highly complex,” said Mark Dickinson, Worldwide President, CERENOVUS. “Our new TRUFILL n-BCA Liquid Embolic System Procedural Set was designed to address real-world challenges in treating hemorrhagic stroke - simplifying procedure preparation and making it easier for physicians to better serve their patients.” (TRUFILL n-BCA Liquid Embolic System, Johnson & Johnson)

- Expansion in new application

Chistopher Stark, M.D., vascular and interventional radiologist at Albany Medical Center

“Embolic agents are an important tool to address hemorrhage. In this case, the patient experienced bleeding due to a ruptured blood vessel following a routine medical procedure. Onyx LES was administered into the target vessel to successfully facilitate embolization,” said Chistopher Stark, M.D., vascular and interventional radiologist at Albany Medical Center. “Albany Medical Center is proud to be enrolling patients in the PELE IDE Clinical Study, the aim of which is to gather evidence to support the safety and efficacy of Onyx LES in treatment of peripheral arterial hemorrhage.” (Onyx, Medtronic)

- Expansion in new application

Dr. Clayton Commander, Assistant Professor of Radiology at University of North Carolina School of Medicine, treated the first patient in the LAVA Study.

“I was able to experience first-hand the impact of embolization with the Lava LES for patient treatment, and I’m very pleased with the result,” said Dr. Clayton Commander, Assistant Professor of Radiology at the University of North Carolina School of Medicine, who treated the first patient in the LAVA Study. “The system has been well studied in pre-clinical testing, and we are thankful to BlackSwan for leading this clinical program with support from Sirtex that has the potential to bring meaningful advancement to the peripheral vascular (PV) field.”

- Expansion in new application

Kevin Smith, Chief Executive Officer of Sirtex

“We are thrilled for the launch of the LAVA Study, which has the potential to lead to the first FDA-approved liquid embolic for a PV application in the U.S.,” said Kevin Smith, Chief Executive Officer of Sirtex. “We are proud to partner with BlackSwan on its clinical journey and look forward to the potential expansion of treatment options in the endovascular field for interventionalists and patients in need.”

- Expansion in new application

Suresh Pai, Chief Executive Officer of BlackSwan

“Currently there is no liquid embolic agent that is indicated for PV applications in the U.S. Lava has key differentiators of optimized radiopacity, availability in two viscosities, reduced preparation time and controlled delivery, which can enable treatment of a wide array of PV diseases,” said Suresh Pai, Chief Executive Officer of BlackSwan. “

- Expansion in new application

Dan Dan Raffi, Global Chief Commercial Officer & President, France, Guerbet.

“Being part with LIPIOJOINT of the FDA breakthrough program is a major milestone for Guerbet but most importantly for patients suffering from Osteoarthritis. Working closely with the U.S. administration will give a unique opportunity to bring an innovative approach aiming to release pain for a large part of the population. A unique collaboration for a medical unmet need”

- Regulatory Approval

Matt

Matt Schmidt, Chief Commercial Officer of Sirtex

“The approval and availability of LAVA is especially meaningful to our team because it is addressing previously unmet needs in vascular medicine, with the potential to create significant impact on patients’ lives,” said Matt Schmidt, Chief Commercial Officer of Sirtex. “We are delighted to expand our Sirtex product portfolio with this treatment milestone that directly furthers our mission to improve the quality and longevity of patient lives through innovative medical solutions, and we thank everyone who played a role to achieve it.”

- Commercial Availability

Key U.S. Liquid Embolic Agent Company Insights

Medtronic, Boston Scientific Corporation, Terumo, Sirtex, and Johnson & Johnson, among others, are some of the prominent players operating in the U.S. liquid embolic agent industry. These companies are expanding their application portfolios by introducing advanced liquid embolic agents. In response to the growing demand, many manufacturers are also scaling up their product capacities and strengthening distribution networks to ensure reliable supply across hospitals, specialty clinics, ambulatory surgery centers, and others.

Key U.S. Liquid Embolic Agent Companies:

- Medtronic

- Terumo

- Boston Scientific Corporation

- Johnson & Johnson

- Sirtex (BlackSwan Vascular, Inc.)

Recent Developments

-

In July 2025, Medtronic announced the enrollment of the first patient in the Peripheral Onyx Liquid Embolic (PELE) clinical trial. This study aims to assess the safety and efficacy of the Onyx Liquid Embolic System (LES) for the embolization of arterial hemorrhages in the peripheral vasculature.

-

In February 2025, Guerbet announced that the U.S. Food and Drug Administration (FDA) had granted Breakthrough Device designation to LIPIOJOINT, an innovative transient liquid embolic agent developed to help relieve pain and improve mobility in patients suffering from knee osteoarthritis (KOA).

-

In March 2024, CERENOVUS, a division of Johnson & Johnson MedTech, announced the launch of the TRUFILL n-BCA Liquid Embolic System Procedural Set. This new offer expands CERENOVUS’s hemorrhagic stroke portfolio by providing a comprehensive procedural set with two configuration options and all necessary accessories for preparing and delivering the TRUFILL n-BCA Liquid Embolic System. Designed to streamline procedure preparation, the set simplifies the process by consolidating essential components into a single sterilized package.

-

In July 2024, Arsenal Medical announced that the EMBO-01 clinical trial, an open-label, multicenter, prospective study of NeoCast, successfully met its primary feasibility and safety goals. The study demonstrated that NeoCast achieved predictable and well-controlled vascular occlusion, showcasing its effectiveness as a shear-responsive liquid embolic material engineered for deep distal penetration into the microvasculature.

-

In October 2023, Sirtex Medical announced the commercial launch of the LAVA Liquid Embolic System, the first and only liquid embolic approved for treating peripheral vascular hemorrhage.

-

In April 2023, Sirtex’s (BlackSwan Vascular) Lava Liquid Embolic System received U.S. FDA approval to market this product.

-

In April 2021, Sirtex Medical and BlackSwan Vascular, Inc., announced the enrollment of the first patient in the pivotal LAVA Study. The LAVA Study, short for Liquid Embolization of Arterial Hemorrhages in Peripheral Vasculature, is a prospective, multicenter, single-arm trial involving 113 participants across 20 investigational sites in the U.S.. The first patient was enrolled at the University of North Carolina School of Medicine in Chapel Hill, North Carolina, where a clinical team successfully treated a patient with a bleeding hypervascular liver tumor using the Lava Liquid Embolic System (LES).

U.S. Liquid Embolic Agent Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 72.30 million

Revenue forecast in 2033

USD 146.85 million

Growth rate

CAGR of 9.26% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product, application, end use

Regional scope

U.S.

Key companies profiled

Medtronic; Terumo; Boston Scientific Corporation; Johnson & Johnson; Sirtex (BlackSwan Vascular, Inc.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Liquid Embolic Agent Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. liquid embolic agent market report based on product, application, and end use:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Ethylene Vinyl Alcohol Copolymer (EVOH)

-

Cyanoacrylates

-

N-BCA

-

N-HCA

-

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Arteriovenous Malformations (AVM)

-

Hypervascular Tumors

-

Peripheral Vasculature Hemorrhage

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Specialty Clinics

-

Ambulatory Surgery Centers

-

Other End Use

-

Frequently Asked Questions About This Report

b. The U.S. liquid embolic agent market size was valued at USD 66.97 million in 2024 and is projected to reach the value of USD 146.85 million by 2033.

b. The U.S. liquid embolic agent market is projected to grow at a CAGR of 9.26% from 2025 to 2033

b. The Ethylene Vinyl Alcohol Copolymer (EVOH) segment dominated the U.S. liquid embolic agent market in 2024. One of the primary reasons is that they are most commonly used liquid embolic agents to treat vascular malformations of the head and neck.

b. The key players operating in the U.S. lqiuid embolic agent market include Medtronic, Terumo, Boston Scientific Corporation, Johnson & Johnson, and Sirtex (BlackSwan Vascular, Inc.).

b. The increasing incidence of neurovascular and peripheral vascular conditions such as aneurysms, arteriovenous malformations (AVMs), and hypervascular tumors has led to a higher demand for effective embolization solutions, fueling market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.