- Home

- »

- Medical Devices

- »

-

U.S. Long Term Care Market Size, Industry Report, 2030GVR Report cover

![U.S. Long Term Care Market Size, Share & Trends Report]()

U.S. Long Term Care Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Home Health Care, Hospices, Nursing care, Assisted living facilities), By Payer (Public, Private), And Segment Forecasts

- Report ID: GVR-1-68038-983-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Long Term Care Market Size & Trends

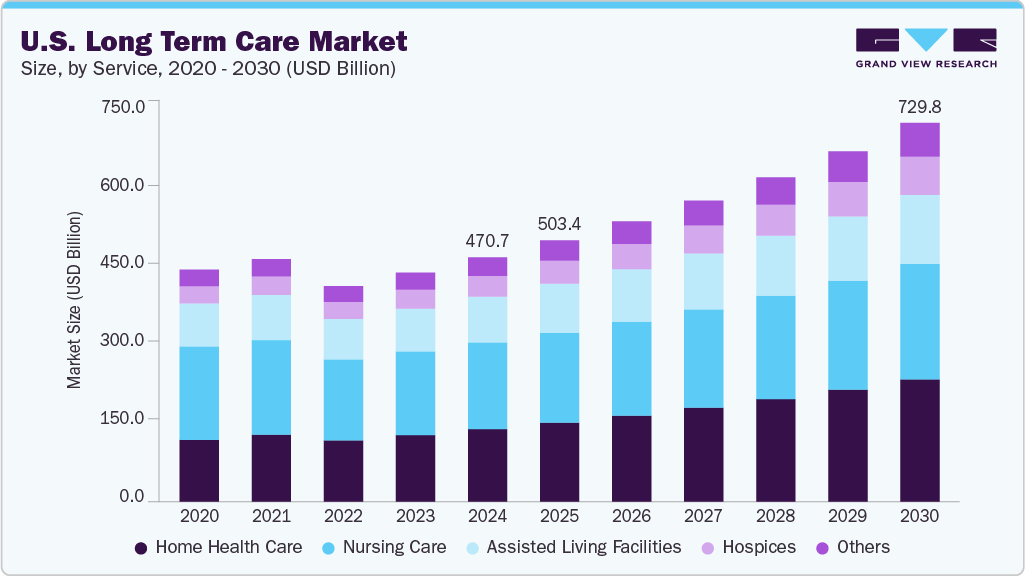

The U.S. long term care market size was estimated at USD 470.66 billion in 2024 and is expected to register a CAGR of 7.71% over the forecast period to reach an estimated value of USD 729.78 billion by 2030. The aging population is a major factor driving market growth. According to the Population Reference Bureau (PRB), the number of Americans ages 65 and older is projected to increase from 58 million in 2022 to 82 million by 2050. The increasing life expectancy and recognition of the unmet needs of the elderly, which are not fulfilled by hospital settings, are also driving market growth.

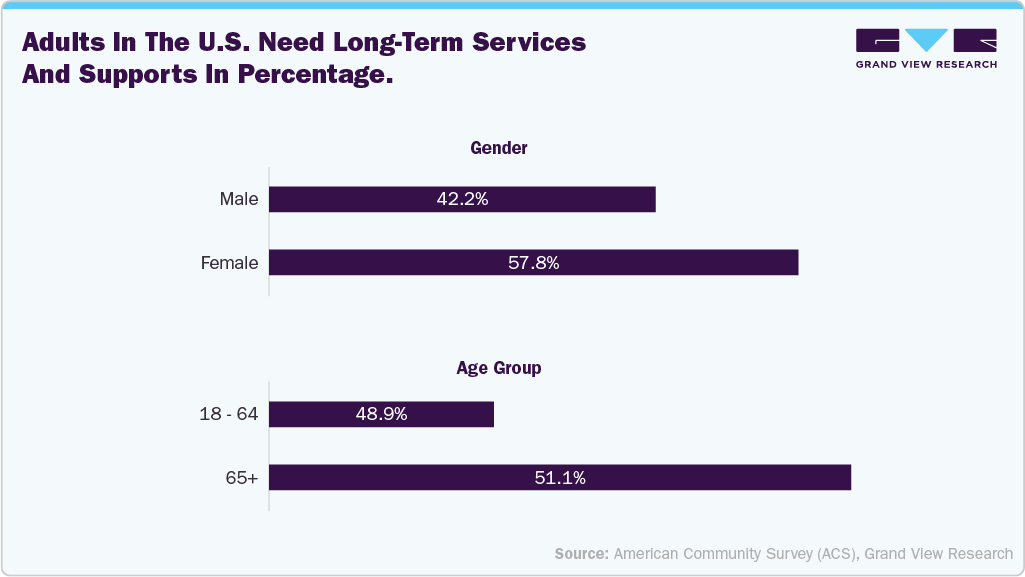

Moreover, the high prevalence of chronic diseases among the geriatric population, such as Alzheimer's disease, diabetes, and hypertension, is contributing significantly to the demand for long-term care services. Over the last decade, the geriatric population in the U.S. has been rapidly rising. This is attributed to the advanced healthcare facilities, which increase life expectancy. The majority of the elderly population in the U.S. is expected to require long term care services at some point in their lives, which, in turn, will boost the demand for long term care. As per the American Community Survey (ACS), 1614,440 adults in the U.S. require Long-Term Services and Supports (LTSS). The figure below shows the % of adults based on gender and age group requiring LTSS in the U.S.

Moreover, the rising incidence of target diseases, particularly Alzheimer's disease and other forms of dementia, is primarily driving market growth in the U.S. Conditions such as Alzheimer's and related dementias necessitate extensive and ongoing care due to the progressive decline in cognitive function and the difficulties in performing daily activities that typically exceed the capabilities of informal caregivers. According to the National Center for Biotechnology and Information study published in June 2023, over 3 million nursing home residents are currently diagnosed with Alzheimer’s disease and related dementias (ADRD) in the U.S. This number is expected to increase as the population ages and ADRD prevalence increases. This trend increases the demand for specialized long-term care services, including memory care units, skilled nursing facilities, and in-home care solutions.

Prevalence of Alzheimer’s and other dementias in the U.S., 2025:

Category

Statistic

Total Americans age 65+ with Alzheimer's

7.2 million

% of total U.S. population age 65+ affected

11% (about 1 in 9)

Younger-onset Alzheimer’s (age 30-64)

~200,000 Americans (approx. 110 per 100,000 people)

The growth of specialized care services is a significant factor driving the long-term care (LTC) market in the U.S. This trend highlights the increasing need for personalized healthcare solutions that cater to specific chronic and age-related ailments. LTC providers are expanding their services beyond basic custodial care to include memory care units, palliative and hospice care, rehabilitation therapy, and programs focused on managing specific diseases. This specialization improves care quality & patient outcomes. It enhances the reputation of facilities, making them more appealing to families in search of tailored and effective care options for their loved ones. In addition, the movement toward value-based care models and the increase in healthcare professionals with geriatric training further facilitate the development and expansion of these specialized services across different LTC environments, such as skilled nursing homes, assisted living facilities, and home healthcare.

Specialized services driving the expansion of long-term care in the U.S.

Specialized Service

Description

Target Population/Condition

Memory Care Units

Secure environments with structured activities and cognitive therapies

Alzheimer’s disease, dementia

Rehabilitation Therapy Services

Physical, occupational, and speech therapy for recovery

Post-surgical patients, stroke survivors, injuries

Palliative and Hospice Care

Comfort-focused care for terminal or serious illnesses

End-of-life patients, chronic illness sufferers

Ventilator/Respiratory Therapy

Long-term mechanical ventilation and respiratory therapy

Chronic respiratory failure, advanced COPD

Wound Care Management

Advanced care for chronic wounds and pressure ulcers

Bedridden, diabetic, or post-surgical patients

Dialysis Care

On-site or coordinated dialysis treatments

Patients with kidney failure or ESRD

Behavioral Health Services

Mental health and substance use support with therapeutic interventions

Residents with psychiatric conditions or addictions

Source: Grand View Research

Recent initiatives taken for the development and expansion of specialized care services:

-

In April 2025, Deacon Health launched a technology-driven care coordination platform to enhance specialty care for patients with multiple chronic conditions. The company focuses on improving patient outcomes and reducing healthcare costs through evidence-based, clinician-led care pathways. Their approach emphasizes non-surgical interventions when appropriate and aims to connect patients with the right care at the right time. Kyle Cooksey, President and CEO at Deacon Health, said:

“My commitment to quality healthcare started almost 30 years ago when my mom died suddenly after not receiving the necessary quality care. This made it clear to me just how disjointed our healthcare system was. Significant progress has been made toward a connected healthcare system, but there are still plenty of opportunities for advancement in a way that improves outcomes while reducing costs.”

-

In April 2024, the FDA launched its "Home as a Health Care Hub" initiative to transform the home into a central component of the U.S. healthcare system. This initiative addresses challenges such as physician shortages, rising healthcare costs, and health disparities, particularly in underserved communities. By integrating medical devices and digital health technologies into the home environment, the FDA envisions a more personalized and accessible approach to healthcare delivery.

Technological development plays a crucial role as a driver in the U.S. LTC market by enhancing the quality, efficiency, and accessibility of care services for people. Innovations such as telehealth, remote monitoring devices, wearable health trackers, and smart home technologies enable caregivers and healthcare professionals to provide more personalized and timely care, even from a distance. These advancements reduce the need for frequent in-person visits, lower healthcare costs, and improve patient outcomes by enabling early detection and management of chronic conditions.

McKnight’s Long-Term Care News article highlights several key technologies poised to transform LTC in the U.S during the forecast period. Experts emphasize the integration of artificial intelligence (AI) with other technological advancements to enhance interoperability and accessibility in care delivery.

Impact of digital integration on long-term care market:

Technology

Description

Impact on Long-Term Care

Artificial Intelligence (AI) & Data Integration

AI combined with other tech to analyze data, improve decision-making, and personalize care plans.

Enhances predictive analytics, streamlines operations, and improves outcomes.

Smart Room Technologies

Sensors and connected devices (e.g., smart beds) monitor resident health and safety in real time.

Enables timely interventions and personalized care.

Remote Monitoring & Wearable Devices

Continuous health tracking for residents via wearables and remote patient monitoring systems.

Supports proactive care and reduces need for frequent in-person visits.

Robotics and Assistive Technologies

Robots assist with medication delivery, mobility support, and companionship.

Reduces staff workload and improves operational efficiency.

Virtual Reality (VR) for Cognitive Rehabilitation

VR is used therapeutically for residents with dementia or cognitive impairments.

Stimulates memory, reduces anxiety, and enhances quality of life.

Seamless Data Integration & Workflow Optimization

Tools that streamline workflows and enable data-driven care decisions (e.g., nurse-first triage).

Improves efficiency and responsiveness in home healthcare and hospice.

Source: Haymarket Media, Inc.

Furthermore, increasing government contributions to therapeutic and vaccination efforts in LTC facilities is a significant market driver. Programs such as the Federal Pharmacy Partnership for Long-Term Care and increased Medicare and Medicaid support for immunizations have led to more systematic and reliable healthcare delivery in these facilities. This proactive stance improves resident outcomes and strengthens the overall quality standards, thereby encouraging more investment in LTC infrastructure.

Recent Government Programs:

Program Name

Scope/Impact on LTC

Federal Pharmacy Partnership for LTC (2020-2021)

Delivered millions of COVID-19 vaccine doses to LTC facilities.

CDC LTC Toolkit

Guidance for routine and outbreak-related vaccination in facilities.

CMS Quality Incentives

Ties reimbursement to vaccination rates and infection control.

HHS COVID-19 Therapeutics Program

Free distribution of antivirals and monoclonal antibodies to LTC.

In addition, in April 2024, Vice President Kamala Harris announced two important rules to improve long-term care (LTC) services:

-

The first rule establishes federal minimum staffing levels for nursing homes funded by Medicare and Medicaid, requiring 3.48 hours of staffing per resident per day.

-

The second rule mandates that 80% of Medicaid payments for home care services are directed at workers' wages, enhancing job quality.

These initiatives aimed to improve care quality, support the caregiving workforce, and boost confidence among families considering LTC facilities, ultimately addressing systemic issues in the sector.

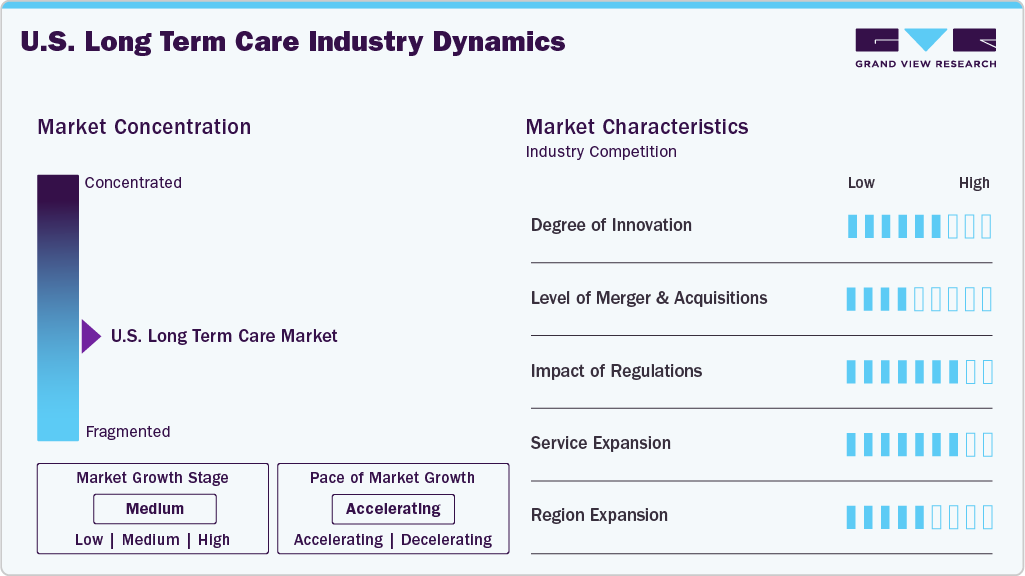

Market Concentration & Characteristics

The industry is experiencing a high degree of innovation. Companies actively use developed approaches and innovative launches to gain a larger market share. In August 2023, Hackensack Meridian Health (HMH) expanded its partnership with Google Cloud to use generative AI tools for improving caregiver and patient experiences. This collaboration integrates Google Cloud's Vertex AI with HMH's Ekam data platform to automate administrative tasks, support clinical decision-making, and personalize patient care. The initiative aims to reduce clinician burnout, enhance direct patient interactions, and improve diagnostics and treatment planning for better patient outcomes and operational efficiency.

The market saw notable consolidations as larger operators sought to expand their reach and capabilities. For instance, in January 2025, Sonida Senior Living acquired a senior living community in Cincinnati for USD 16.3 million, expanding its regional portfolio and creating a 203-unit campus with its adjacent property. -Brandon Ribar, President and Chief Executive Officer, said.

“Sonida ended the year with two additional transactions, further positioning the company for success in 2025 and beyond. The Company continues to execute on its growth strategy through creative deal structuring and expansion of its best-in-class operating platform to aggressively and strategically invest in high-quality communities at exceptionally attractive valuations.”

The industry is subject to a complex set of regulations. CMS remains the central federal agency overseeing LTC facilities certified for Medicare and Medicaid reimbursement. In 2023, CMS took a landmark step by proposing the nation’s first mandatory staffing minimums for nursing homes, mandating specific hours per resident per day from registered nurses and nurse aides alongside 24/7 RN coverage. CMS also continues to refine the Five-Star Quality Rating System to enhance transparency and incorporate new indicators such as abuse reports and more rigorous inspection criteria.

Service expansion efforts are evident as companies aim to penetrate underserved markets across the U.S. through partnerships, strategic alliances, and launches. In April 2025, Deacon Health launched a technology-driven care coordination platform to enhance specialty care for patients with multiple chronic conditions. The company focuses on improving patient outcomes and reducing healthcare costs through evidence-based, clinician-led care pathways. Their approach emphasizes non-surgical interventions when appropriate and aims to connect patients with the right care at the right time.

Service Insights

The nursing care segment held the largest revenue share of 35.48% in 2024. Advancements in medical technology and treatment options drive its growth. Improved technologies enable individuals with complex health conditions to manage their issues more effectively, allowing them to live longer and healthier lives with professional support. Moreover, the U.S. long-term care sector is grappling with a significant workforce shortage, facing over 133,000 job openings in nursing homes alone. This shortage has been exacerbated by the COVID-19 pandemic, which led to increased turnover and a decline in new entrants into the field. To address this crisis, the American Health Care Association and National Center for Assisted Living (AHCA/NCAL) launched the "Careers in Caring" campaign. This national initiative aims to educate job seekers about career opportunities in long-term care and provide facilities with resources to recruit new caregivers.

The hospices segment is expected to grow at a significant CAGR over the forecast period, which is driven by various demographic, policy, and economic factors. Furthermore, the number of hospice centers in the U.S. has steadily increased. According to the Biennial Overview of Post-acute and Long-term Care in the U.S., as of 2020, approximately 5,200 hospice care agencies were operating in the U.S. In 2022, this number had risen to 5,899 Medicare-certified hospice agencies. This growth is largely attributed to the aging population and an increasing prevalence of chronic diseases, which drive demand for hospice services. In addition, the hospice industry has seen significant expansion, with a notable shift towards for-profit ownership; about 70.4% of these agencies were for-profit in 2020. This expansion allows for greater accessibility to hospice services across various regions, particularly benefiting patients who require specialized end-of-life care.

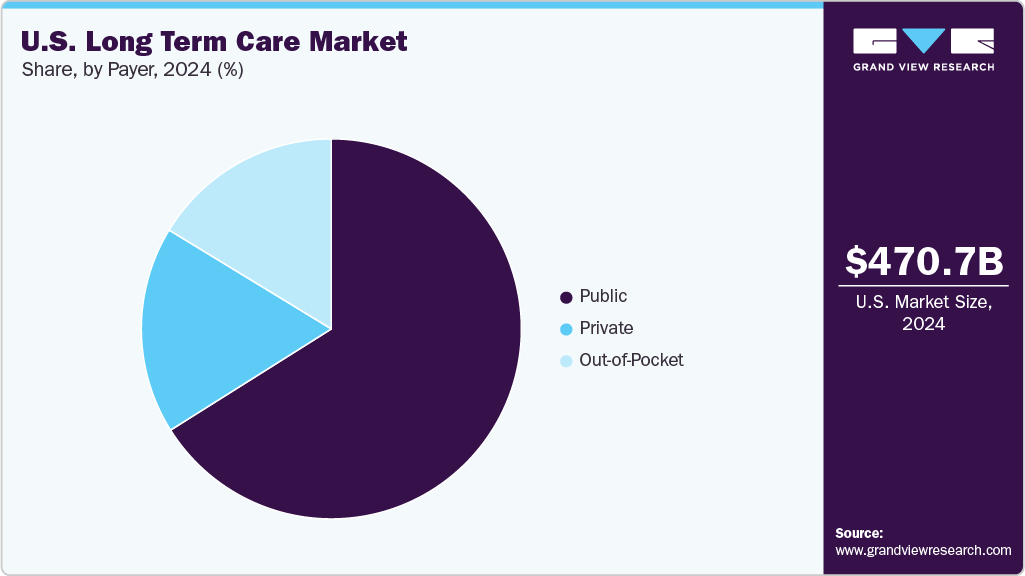

Payer Insights

The public segment held the largest revenue share of 66.06% in 2024. Its dominance is driven by the population age, particularly with the baby boomer generation reaching retirement age. Public payers such as Medicaid and Medicare play a crucial role in supporting many elderly individuals who either do not have private insurance or exhaust their resources over time, leading them to depend on government-funded programs. Medicaid is the largest public payer for long-term care due to its broad coverage of nursing home care and home- and community-based services for low-income seniors. In addition, policy shifts emphasizing aging in place and cost containment have led to greater investments in home- and community-based services funded by public programs, further expanding their role.

The private segment is expected to grow at a lucrative CAGR over the forecast period, driven by an aging population. As per the U.S. Census Bureau's projections, people aged 65 and older will outnumber children under 18 for the first time by 2034. Many seniors prefer to receive care in more personalized, home-like settings, and private pay allows them to access higher-quality or more flexible services than those covered by public programs like Medicaid. In addition, there is a growing affluent elderly demographic with sufficient savings, pensions, or long-term care insurance to afford private-pay options. The limitations and eligibility criteria of Medicaid and concerns over nursing home quality in publicly funded facilities are also pushing families to seek private alternatives. Furthermore, the rise of assisted living, memory care communities, and in-home care services, often not covered by Medicaid, has fueled demand within the private payer segment.

Key U.S. Long Term Care Company Insights

The market is fragmented, with many long-term care service providers present. To maintain their position and grow in the market, the market players undertake several strategic initiatives, such as partnerships and collaborations, service launches, mergers and acquisitions, and geographical expansion.

Key U.S. Long Term Care Companies:

- Brookdale Senior Living, Inc

- Sunrise Senior Living, LLC

- Kindred Healthcare

- Amedisys, Inc

- Genesis Healthcare, Inc

- Capital Senior Living Corporation

- Diversicare Healthcare Services, Inc

- Home Instead, Inc.

- Senior Care Centerz

- Atria’s Senior Living

Recent Developments

-

In May 2025, Sunrise Senior Living partnered with Griffin Living, adding two boutique-style communities in California, Varenita of Simi Valley and Varenita of Westlake Village, to Sunrise's portfolio. This collaboration expanded Sunrise's presence in California and provided residents with access to specialized senior living options.

-

In February 2025, Governor Mike DeWine, in collaboration with the Ohio Department of Aging, launched the enhanced Ohio Long-Term Care Quality Navigator, a comprehensive online tool designed to assist Ohioans in selecting suitable long-term care facilities. This upgraded platform now includes detailed information on over 1,700 facilities statewide, encompassing nursing homes and assisted living centers. The Navigator offers users access to essential data such as Centers for Medicare & Medicaid Services (CMS), Five-Star Quality Ratings, staffing levels, resident and family satisfaction scores, and available services.

-

In November 2024, Sonida Senior Living acquired two senior living communities in Atlanta's Lawrenceville and Peachtree Corners for USD 29 million, adding 178 assisted living and memory care units with 86% occupancy and over USD 5,700 average revenue per occupied room.

-

In April 2024, the FDA launched its "Home as a Health Care Hub" initiative to transform the home into a central component of the U.S. healthcare system. This initiative seeks to address challenges such as physician shortages, rising healthcare costs, and health disparities, particularly in underserved communities. By integrating medical devices and digital health technologies into the home environment, the FDA envisions a more personalized and accessible approach to healthcare delivery.

U.S. Long Term Care Market Report Scope

Report Attribute

Details

Revenue forecast in 2025

USD 503.42 billion

Revenue forecast in 2030

USD 729.78 billion

Growth rate

CAGR of 7.71% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, payer

Country scope

U.S.

Key companies profiled

Brookdale Senior Living, Inc.; Sunrise Senior Living, LLC; Kindred Healthcare; Amedisys, Inc.; Genesis Healthcare, Inc.; Capital Senior Living Corporation; Diversicare Healthcare Services, Inc.; Home Instead, Inc.; Senior Care Centerz; Atria’s Senior Living

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Long Term Care Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. long term care market report based on service and payer:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Home health care

-

Hospices

-

Nursing care

-

Assisted living facilities

-

Others

-

-

Payer Outlook (Revenue, USD Million, 2018 - 2030)

-

Public

-

Private

-

Out-of-Pocket

-

Frequently Asked Questions About This Report

b. The U.S. long term care market size was estimated at USD 470.66 billion in 2024 and is expected to reach USD 503.42 billion in 2025.

b. The U.S. long term care market is expected to grow at a compound annual growth rate of 7.71% from 2025 to 2030 to reach USD 729.78 billion by 2030.

b. Nursing care dominated the U.S. long-term care market with a share of 35.48% in 2024. This is attributable to the rising demand for home healthcare and the increasing prevalence of chronic diseases.

b. Some key players operating in the U.S. long term care market include Brookdale Senior Living, Inc.; Atria Senior Living Group; Sunrise Carlisle, LP; Senior Care Centers of America; Genesis Healthcare Corp.; Kindred Healthcare, Inc.; Home Instead Senior Care, Inc.; Amedisys, Inc.; Capital Senior Living Corporation; LHC Group; Almost Family, Inc.; and Diversicare Healthcare Services, Inc.

b. Key factors that are driving the U.S. long term care market growth include increased owing to the recognition of unmet needs of the elderly, which are not fulfilled by hospital settings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.