- Home

- »

- Medical Devices

- »

-

Wheelchair Market Size, Share & Growth Report, 2030GVR Report cover

![Wheelchair Market Size, Share & Trends Report]()

Wheelchair Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Manual, Electric), By Category (Adult, Pediatric), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-682-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wheelchair Market Summary

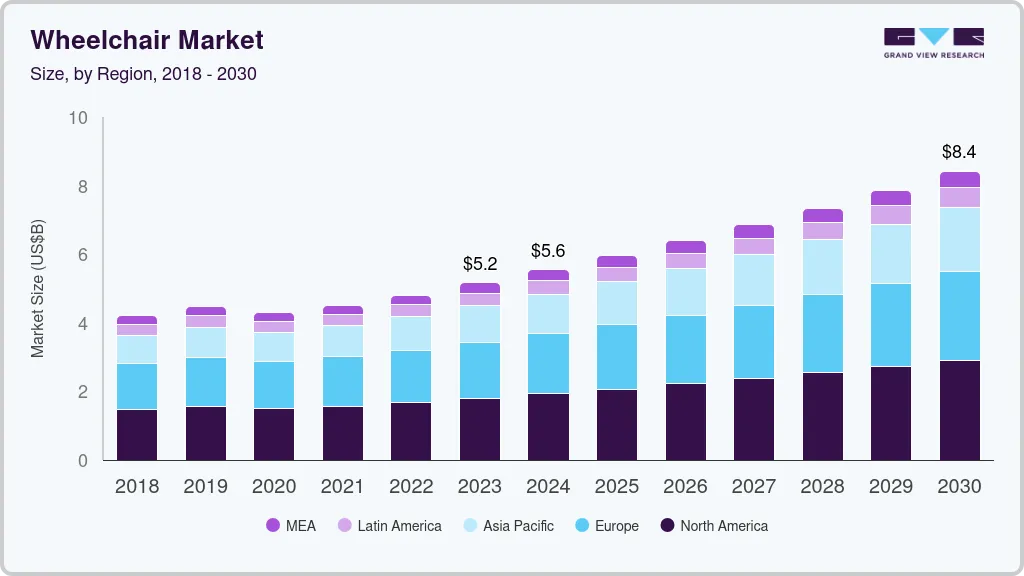

The global wheelchair market size was estimated at USD 4.8 billion in 2022 and is projected to reach USD 8.4 billion by 2030, growing at a CAGR of 7.2% from 2023 to 2030. The market has witnessed a decline in 2020 during the COVID-19 pandemic due to the disrupted supply chain and operations in different regions.

Key Market Trends & Insights

- North America dominated the global market in 2022 and accounted for the largest revenue share of 34.9%.

- In the Asia Pacific, the market is projected to register the fastest CAGR during the forecast period.

- By product, the manual product segment led the global market in 2022 with a revenue share of more than 61.1% and is estimated to expand at the fastest CAGR over the forecast period

- By category, the adult segment dominated the market and accounted for the largest revenue share of 69.1% in 2022.

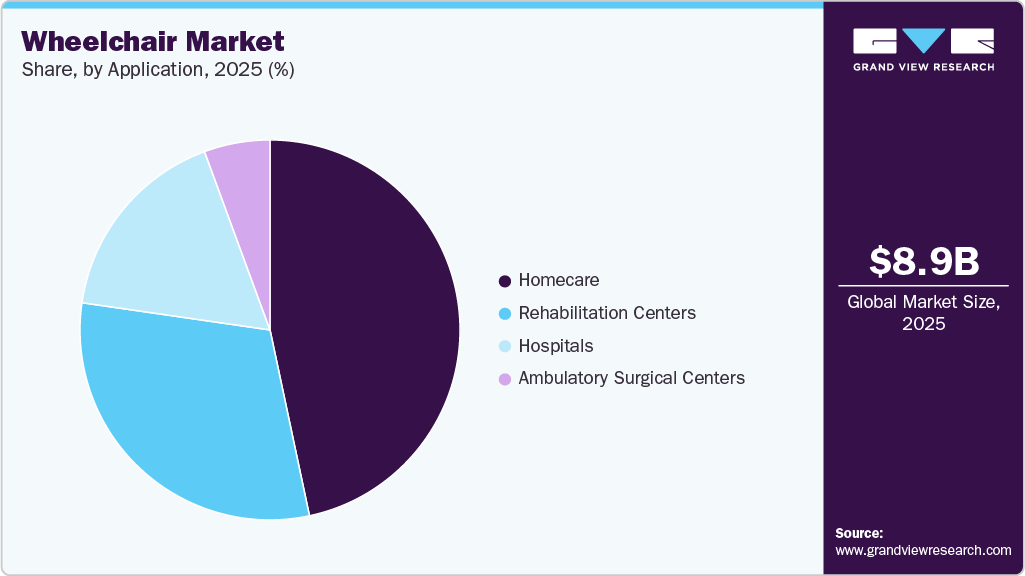

- By application, the rehabilitation centers segment dominated the market and accounted for the largest revenue share of more than 34.1% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 4.8 Billion

- 2030 Projected Market Size: USD 8.4 Billion

- CAGR (2023-2030): 7.2%

- North America: Largest market in 2022

The rising geriatric population and the increasing number of spinal cord injuries which needs mobility assistance are some of the major factors driving the market growth. According to the National Spinal Cord Injury Statistical Center, around 17,730 new spinal cord injuries occur in the U.S. every year, with vehicular crashes being the leading cause of injury. Thus, the U.S. stands as a key market for the wheelchair. The COVID-19 pandemic had significantly affected the transport and mobility sector. It had disrupted the supply channel of the wheelchair to a great extent.

Wheelchair operations were halted across several countries owing to strict lockdowns being implemented. Hospitals have witnessed consistent demand owing to a spike in the number of elderly populations getting admitted due to the COVID-19 infection. With the revised COVID-19 restrictions, companies are expected to resume operations. The demand for wheelchairs is expected to increase on account of the prevalence of chronic disease, rising geriatric population, and increased risk of lifestyle-associated disorders among a wide population due to the rising incidences of obesity and sedentary lifestyle.

Developing countries such as India are expected to be key revenue generators for wheelchair manufacturers over the forecast period. The country has one of the highest rates of road accidents at a global level, leaving several people disabled. It also has one of the highest disabled populations at a global level. In terms of availability and adoption, the country is still at the nascent stage, however, with the supportive government initiatives and growing awareness among consumers, the demand for wheelchairs is expected to boost in the years to come.

Evolving technological advancements in wheelchair designs are a key trend expected to drive future sales for the market. The launch of battery-operated electric wheelchairs is expected to assist the users to a better extent. Additionally, with the improvement in the design, the wheelchairs are now capable of storing and connecting the device with the patient’s medical history, and even monitoring the health of the users. In March 2020, Invacare Corporation launched an AVIVA FX Power Wheelchair. It is designed with a blend of new technologies for providing better comfort and can be used both indoors and outdoors.

Product Insights

The manual product segment led the global market in 2022 with a revenue share of more than 61.1% and is estimated to expand at the fastest CAGR over the forecast period due to the high demand for manual wheelchairs on account of their low cost & weight and non-dependability on charging. Also, they are available in a variety of configurations and weights, from standard to ultra-lightweight, which require little space as a lot of the product models are foldable. In 2019, Permobil, a leading player in advanced medical technology, launched SmartDrive PushTracker E2, an advanced power assist system for manual wheelchairs.

The electric wheelchair segment is also estimated to have significant growth over the forecast years. These wheelchairs are ideal for users having no upper body strength. Electric wheelchairs are more popular in developed countries, such as the U.S., owing to the availability of advanced healthcare facilities. In July 2020, Scewo launched Scewo Bro, an electric wheelchair that can also operate on stairs independently and effortlessly. It is available in Austria, Switzerland, and Germany.

Category Insights

The adult segment dominated the market and accounted for the largest revenue share of 69.1% in 2022. The segment is projected to continue its dominance over the forecast period. This is mainly due to the increasing elderly population globally, which forms part of the definition for adults. Adults comprise individuals from the age group of 18 onwards. Disability in older people due to arthritis pain, or stiffness in a knee, hip, ankle, or foot increases the demand for wheelchairs.

The pediatric segment is also expected to grow significantly owing to the growing number of childhood disorders such as cerebral palsy. Cerebral palsy is one of the most common movement disorders that require wheelchairs. According to the Cerebral Palsy Guidance, over 10, 000 babies in the U.S. are born with this disorder each year. It is the most commonly diagnosed movement disability in childhood in the U.S. Thus, the pediatric segment is expected to be a key revenue generator for wheelchair manufacturers in the coming years.

Application Insights

The rehabilitation centers segment dominated the market and accounted for the largest revenue share of more than 34.1% in 2022. However, the segment will witness sluggish growth over the forecast period. Based on application, the global market has been divided into homecare, hospitals, Ambulatory Surgical Centers (ASCs), and rehabilitation centers. The hospital's segment is expected to register the fastest CAGR from 2023 to 2030.

This growth is credited to the increasing cases of medical emergencies that require wheelchairs. The post-surgical procedures boost the demand for wheelchairs. In hospitals, these chairs are mainly used for transporting patients, and for a visit to a doctor’s office in a large-scale medical facility.

Regional Insights

North America dominated the global market in 2022 and accounted for the largest revenue share of 34.9%. This growth is owing to the high target population and increased adoption of advanced wheelchairs. Moreover, the presence of a large number of market players in the region will; further boost the market growth during the forecast period. According to our analysis, a lot of small enterprises are coming up with specialized wheelchairs to cater to niche audiences. For instance, in January 2020, a U.S.-based startup, Segway, Inc., launched an egg-shaped pod that allows people to sit while they effortlessly cruise around campuses, theme parks, airports, and even cities. This pod can also be used by individuals with wheelchair needs and particularly caters for transportation with a high speed of 24 mph.

In the Asia Pacific, the market is projected to register the fastest CAGR during the forecast period. The region is backed by a large population base in countries, such as India and China, owing to the improvements in healthcare facilities and growing government initiatives for offering quality mobility devices. Moreover, the high geriatric population in countries, such as Japan, also supports market growth.

Key Companies & Market Share Insights

The market players are introducing innovative technologies to expand their product portfolio. For instance, in July 2021, Sunrise Medical launched the QUICKIE Nitrum ultra-light wheelchair which offers the highest rigidity and strength. Wheelchair manufacturers had to halt their operations during the COVID-19 pandemic. In 2019, Ottobock, a German-based wheelchair manufacturer has witnessed double-digit growth in its wheelchair segment. However, the pandemic situation narrowed down its sales to a significant extent. Several other companies faced similar challenges. As of late 2020, the company has started its operations and has also offered e-services such as e-appointments via video calls, home delivery, and tips on its social media pages for its customers. Some of the prominent players in the wheelchair market include:

-

Carex Health Brands, Inc.

-

Drive Medical Design & Manufacturing

-

Graham-Field Health Products Inc.

-

Invacare

-

Medline

-

Sunrise Medical LLC

-

Karman Healthcare

-

Quantum Rehab

-

Numotion

-

Pride Mobility Products Corp.

- Seating Matters

Wheelchair Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.1 billion

Revenue forecast in 2030

USD 8.4 billion

Growth rate

CAGR of 7.2% from 2023 to 2030

Base year for estimation

2022

Historic data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, category, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; India; China; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Carex Health Brands, Inc.; Drive Medical Design & Manufacturing; Graham-Field Health Products, Inc.; Invacare; Medline; Sunrise Medical LLC; Karman Healthcare; Quantum Rehab; Numotion; Pride Mobility Products Corp.; Seating Matters

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Wheelchair Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wheelchair market report on the basis of product, category, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Electric

-

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Pediatric

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Homecare

-

Hospitals

-

Ambulatory Surgical Centers

-

Rehabilitation Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global wheelchair market size was estimated at USD 4.8 billion in 2022 and is expected to reach USD 5.2 billion in 2023.

b. The global wheelchair market is expected to grow at a compound annual growth rate of 7.2% from 2023 to 2030 to reach USD 8.4 billion by 2030.

b. North America dominated the wheelchair market with a share of 34.9% in 2022. This is attributable to the growing geriatric population, increasing adoption of advanced wheelchairs, and rising disabled population.

b. Some of the players operating in this market are Carex Health Brands, Inc.; Drive Medical Design & Manufacturing; Graham-Field Health Products, Inc.; Invacare; Medline; Sunrise Medical LLC; Karman Healthcare; Quantum Rehab, Numotion; and Pride Mobility Products Corp.

b. Key factors that are driving the wheelchair market growth include the increasing geriatric population, the rising number of disorders requiring a wheelchair, and the increasing handicapped population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.