- Home

- »

- Medical Devices

- »

-

U.S. Long-term Care Private Insurance Market Report, 2030GVR Report cover

![U.S. Long-term Care Private Insurance Market Size, Share & Trends Report]()

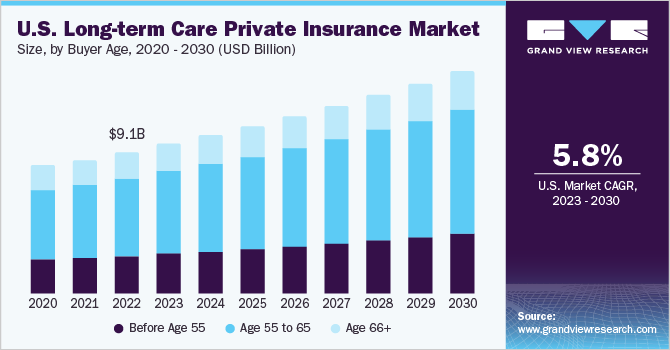

U.S. Long-term Care Private Insurance Market Size, Share & Trends Analysis Report By Buyer Age (Before Age 55, Age 55 To 65, Age 66+), By State, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-114-7

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The U.S. long-term care private insurance market size was estimated at USD 9.13 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.84% from 2023 to 2030. An increasing aging population, the cost of long-term care, and increased consumer awareness are some of the factors driving the growth of the market. Moreover, changing demographics & family dynamics are some other major factors expected to contribute to the market growth during the forecast period.

The outbreak of COVID-19 significantly impacted the long-term care private insurance market. The COVID-19 pandemic has increased awareness of the risks and challenges related to long-term care, especially in institutional settings such as nursing homes and assisted living facilities.

This heightened awareness of the risks associated with institutional care has increased the demand for long-term care insurance as individuals seek coverage for home-based care options and alternative care settings. Moreover, companies have adjusted and reviewed the terms and conditions of their long-term care insurance policies in response to the COVID-19 pandemic. This includes extending coverage for home-based care, clarifying coverage for infectious diseases, and providing telehealth options.

Increased consumer awareness regarding long-term care is a major contributing factor to the market growth. In 2021, the number of new consumers for individual long-term care approximately tripled. The increase was likely a one-time blip brought on by the introduction of a public option in the state of Washington, which led many citizens to seek private insurance instead of enrolling in the government-mandated program.In 2021, the Transamerica affiliates of Aegon NV issued novel individual long-term care policies covering 60,664 lives, or roughly 55,000 more consumers than in 2020.

Furthermore, the aging population in the U.S. is rising rapidly, mainly due to the baby boomer generation reaching retirement age.According to a report from the Administration on Aging, around 17% of individuals living in the U.S., or over 1 in 6, were 65 or above in 2020. By 2040, the number of people 65 and over is predicted to rise to almost 80.8 million. By 2040, it also forecasts a double increase in even older residents, with the number of those 85 and older predicted to rise from 6.7 million in 2020 to 14.4 million. Long-term care services become more necessary as people age, increasing the demand for LTC insurance coverage.

Buyer Age Insights

Based on buyer age, the age 55 to 65 segment accounted for the largest market share of 55% in 2022. Buying long-term care insurance in the age group of 55 to 65 provides a longer planning horizon. People have more time to assess their requirements, research insurance choices, and make informed decisions about the coverage that best suits their needs. Moreover, many people in this age group are in the early stage of retirement planning. As retirement nears, individuals become more aware of the potential need for long-term care in the future.

Before age 55 is also expected to show a significant market share in the forecast period due to the increasing awareness about long-term care insurance. Individuals are being educated earlier on regarding the costs and risks of long-term care, which is given more importance. Financial planning initiatives, Awareness campaigns, and changing societal attitudes have contributed to increased awareness of the need for early planning and LTCI coverage.

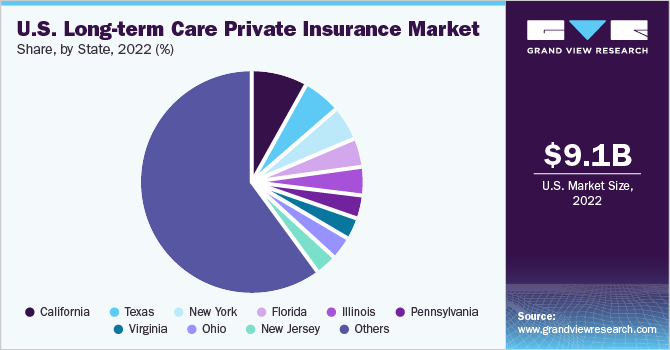

State Insights

California state held a significant market share in 2022 and accounted for 8.14% of the revenue. California's aging population has significantly increased, mostly as a result of the baby boomer generation nearing retirement age. Long-term care services are more necessary as people age, increasing the demand for LTCI coverage. With approximately 39 million citizens, California is the most populous state in the United States. Long-term care insurance has a greater potential market for the larger population.

Texas State is expected to grow at a substantial CAGR during the forecast period. With a sizable and diversified population, Texas is the second most populous state in the U.S. The sizeable population of the state generates a sizable market for LTCI providers, providing insurance firms with a sizable customer base. Moreover, Texas launched several initiatives to increase understanding and awareness of long-term care planning and insurance alternatives.

Key Companies & Market Share Insights

Key players engage in strategic initiatives such as partnerships, new service launches, expansions, mergers, and acquisitions to strengthen their market position. For instance, in September 2022, Northwestern Mutual introduced Long-Term AdvantageTM, giving customers new levels of flexibility to prepare for long-term care needs.An innovative product offers guaranteed premiums and the chance to increase policy value over time by paying annual dividends. Some prominent players in the U.S. long-term private insurance market include:

-

Mutual of Omaha

-

New York Life

-

Northwestern Mutual

-

Thrivent

-

National Guardian Life

-

Bankers Life

-

Transamerica

-

MassMutual

-

Genworth Financial

-

John Hancock

U.S. Long-Term Care Private Insurance Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 14.37 billion

Growth rate

CAGR of 5.84% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Buyer age, state

Country scope

U.S.

Key companies profiled

Mutual of Omaha; New York Life; Northwestern Mutual; Thrivent; National Guardian Life; Bankers Life; Transamerica; MassMutual; Genworth Financial; John Hancock

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Long-Term Care Private Insurance Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. long-term care private insurance market report based on buyer age, and state:

-

Buyer Age Outlook (Revenue, USD Billion, 2018 - 2030)

-

Before Age 55

-

Age 55 to 65

-

Age 66+

-

-

State Outlook (Revenue, USD Billion, 2018 - 2030)

-

California

-

Texas

-

New York

-

Florida

-

Illinois

-

Pennsylvania

-

Virginia

-

Ohio

-

New Jersey

-

Minnesota

-

Other

-

Frequently Asked Questions About This Report

b. The U.S. long-term care private insurance market size was estimated at USD 9.13 billion in 2022 and is expected to reach USD 9.66 billion in 2023.

b. The U.S. long-term care private insurance market is expected to grow at a compound annual growth rate of 5.84% from 2023 to 2030 to reach USD 14.37 billion by 2030.

b. California held a significant share in the U.S. long-term care private insurance market with a share of 8.14% in 2022. California's aging population has significantly increased, mostly as a result of the baby boomer generation nearing retirement age. Long-term care services are more necessary as people age, increasing the demand for LTCI coverage.

b. Some key players operating in the U.S. long-term care private insurance market include Mutual of Omaha, New York Life, Northwestern Mutual, Thrivent, National Guardian Life, Bankers Life, Transamerica, MassMutual, Genworth Financial, John Hancock

b. Key factors that are driving the market growth include an increasing aging population, the cost of long-term care, and increased consumer awareness, and changing demographics & family dynamics.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."