- Home

- »

- Healthcare IT

- »

-

U.S. Long Term Care Software Market, Industry Report 2033GVR Report cover

![U.S. Long Term Care Software Market Size, Share & Trends Report]()

U.S. Long Term Care Software Market (2026 - 2033) Size, Share & Trends Analysis Report By Mode Of Delivery (Cloud-based, Web-based, On-premises), By Application (Electronic Health Records (EHR), Revenue Cycle Management (RCM)), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-035-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Long Term Care Software Market Summary

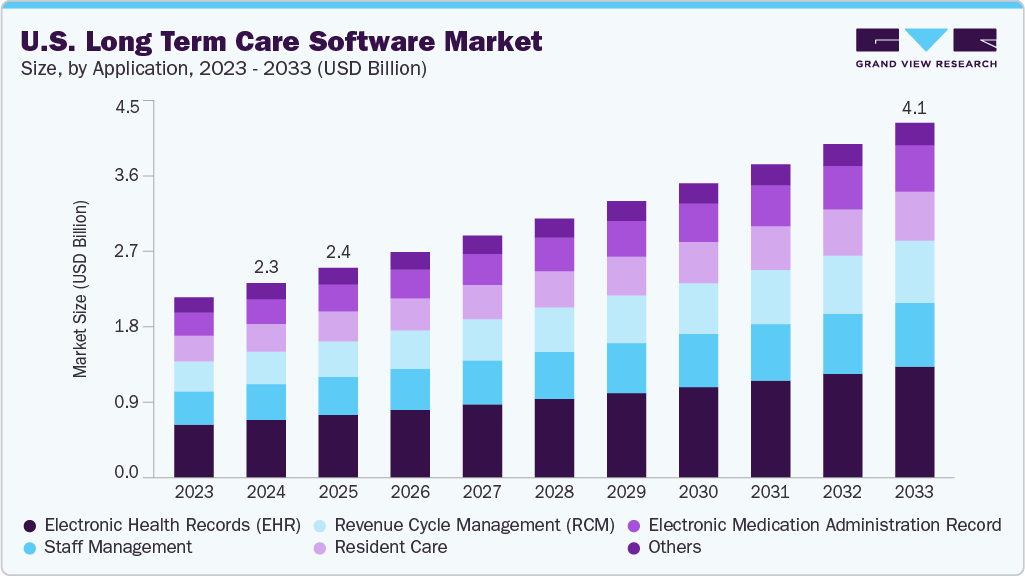

The U.S. long term care software market size was estimated at USD 2.41 billion in 2025 and is projected to reach USD 4.11 billion by 2033, growing at a CAGR of 6.92% from 2026 to 2033. Rising adoption of electronic health records (EHRs) by the LTC providers, coupled with increased focus on efficiency and quality and increasing prevalence of chronic diseases and growing geriatric population are significant factors driving market growth further.

Key Market Trends & Insights

- By mode of delivery, the cloud-based segment held the largest market share of 41.55% in 2025.

- By application, the electronic health records (EHR) segment held the largest market share in 2025.

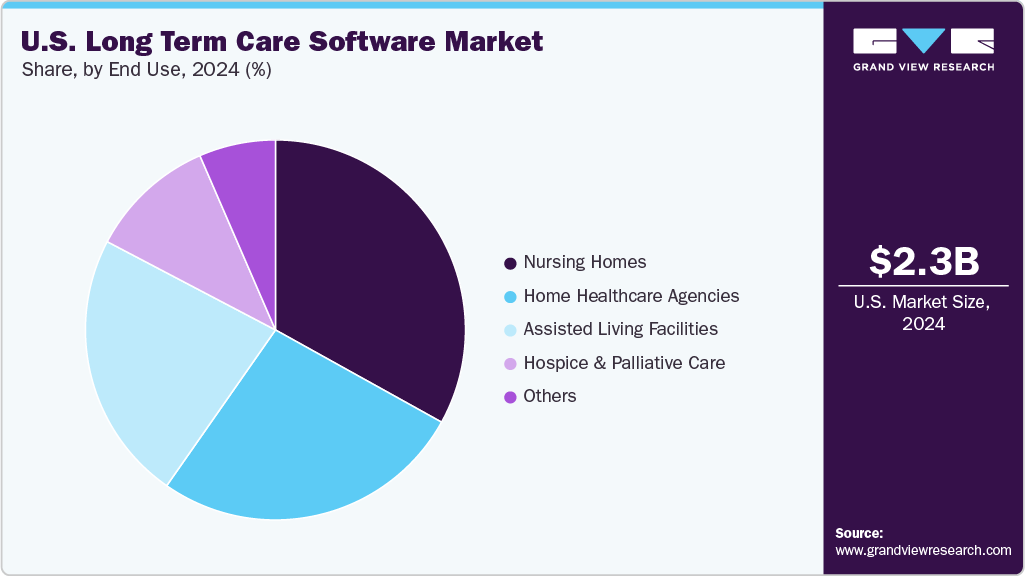

- By end use, the Skilled Nursing Facilities (SNFs) / nursing homes segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.41 Billion

- 2033 Projected Market Size: USD 4.11 Billion

- CAGR (2026-2033): 6.92%

In addition, technological advancements such as interoperability, real-time data exchange, and integration of artificial intelligence (AI) contribute to market growth. The rising adoption of electronic health records (EHRs) across U.S. long-term care (LTC) settings is a key driver supporting the growth of the long-term care software industry. LTC providers, including skilled nursing facilities, assisted living facilities, and post-acute care organizations are increasingly deploying integrated EHR platforms to streamline workflows, improve care coordination, and enhance regulatory compliance in an increasingly constrained operating environment.

In addition, the shortage of nursing staff and increasing burnout among healthcare professionals in the U.S. have driven the adoption of healthcare IT solutions in recent years. For instance, according to the data published by the American Association of Colleges of Nursing (AACN), federal authorities project a shortage of 78,610 full-time registered nurses (RNs) in 2025 and 63,720 in 2030. This shortage-driven by an aging population, rising patient volumes, and clinician burnout is creating widespread pressure on healthcare facilities to manage limited staff resources better while maintaining care quality and compliance. In this context, LTC providers are increasingly turning to healthcare IT solutions to offset staffing constraints by automating routine tasks, standardizing documentation, and improving staff productivity.

Furthermore, the increasing prevalence of chronic diseases, coupled with the rapid growth of the geriatric population, is a significant driver supporting the expansion of the U.S. long-term care (LTC) software industry. Older adults are disproportionately affected by chronic and neurodegenerative conditions that require continuous monitoring, coordinated care, and long-term clinical management, significantly increasing demand for long-term care services and supporting digital care infrastructure.

According to the U.S. Census Bureau, June 2025 statistics, the population aged 65 years and above increased by 3.1% between 2023 and 2024, reaching 61.2 million. This demographic shift is expected to persist over the coming decades, placing sustained pressure on healthcare systems to manage long-term conditions more efficiently.

For instance, according to the 2025 Alzheimer’s Disease Facts and Figures published in April 2025, approximately 7.2 million Americans aged 65 and older were living with Alzheimer’s dementia in 2025, with projections indicating an increase to 13.8 million by 2060. The growing prevalence of Alzheimer’s disease is expected to significantly increase demand for LTC facilities and associated software solutions that enable structured care management, compliance reporting, and caregiver coordination.

Similarly, the Parkinson’s Foundation estimates that 1 million Americans currently live with Parkinson’s disease, with the patient population projected to reach 1.2 million by 2030, driven by approximately 90,000 new diagnoses annually. Long-term care software plays a critical role in enabling providers to manage complex care needs through centralized clinical documentation, care planning, medication management, and resource allocation.

Technological Advancements

Modern LTC software platforms are evolving beyond basic electronic documentation to offer integrated, interoperable, and data-driven capabilities, including EHRs, medication management, billing, staffing, analytics, and real-time communication tools. Interoperability and real-time data exchange have emerged as key areas of technological progress in the U.S. LTC software market. For instance, in January 2026, CharmHealth and PointClickCare announced a bidirectional EHR integration to enable seamless post-acute care data exchange.

LTC software vendors are further enhancing platform sophistication through AI-enabled and analytics-driven innovations. For example, in January 2024, PointClickCare launched Referral Advisor, an AI-powered solution integrated into its EHR for skilled nursing facilities to automate referral intake, extract and validate clinical and financial data, and accelerate admissions.

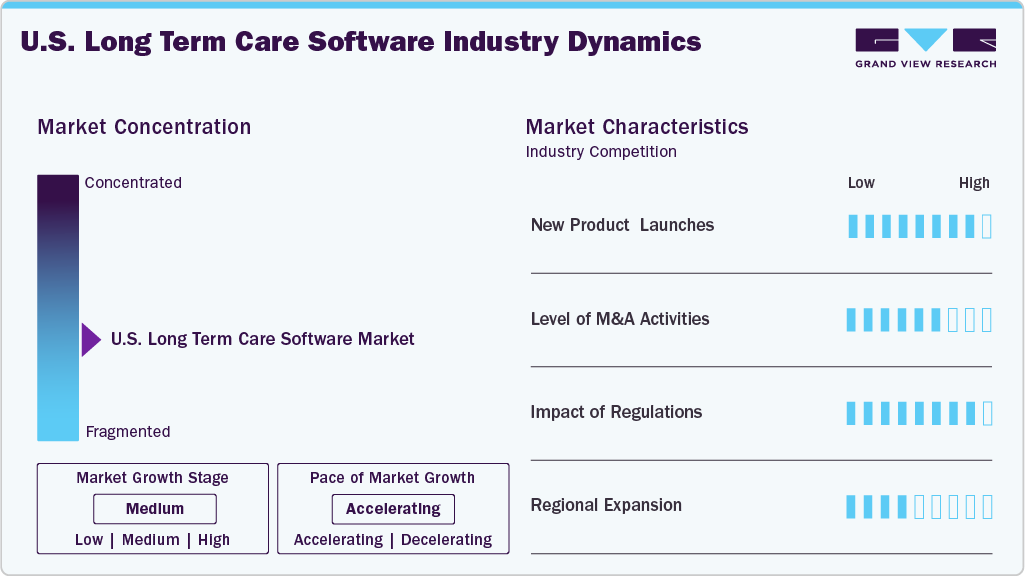

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaboration activities, degree of innovation, impact of regulations, and regional expansion. The U.S. market is fragmented, with the presence of several software and solution providers dominating the market. The degree of innovation and impact of regulations on industry is high. Moreover, the level of merger & acquisition activities and the regional expansion of industry is moderate.

The U.S. long term care software industry experiences a high degree of innovation driven by technological advancements. Market players are launching new products to enhance their market presence. For instance, in March 2025, ECP launched a Senior Living Integration Hub and Developer Portal, enabling seamless connectivity between ECP’s software and other solutions used by senior living operators. The portal offers API specs and code samples and supports bidirectional integrations, enhancing data flow, reducing manual entry, and supporting over 7,500 communities nationwide.

“ECP has been integrating with other senior living technology providers for two decades, and we are thrilled to formally launch ECP’s Integration Hub and Developer Portal to make it easier than ever for customers and other technology providers to partner with ECP.”

-Adam Aisen, CEO of ECP.

The market is also characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market. Moreover, increasing merger and acquisition activities by long-term care providers also impacts market growth. For instance, in December 2023, Creative Solutions in Healthcare acquired 12 facilities, including 11 skilled nursing facilities and one assisted living facility.

The regulatory framework for the U.S. long-term care (LTC) software industry is primarily shaped by updates and compliance requirements from the Centers for Medicare & Medicaid Services (CMS). Recent updates emphasize data exchange via FHIR APIs, automated prior authorizations, and robust reporting for infection control. Compliance with enhanced quality standards and privacy safeguards is mandatory to ensure safe, efficient care delivery.

The market experiences moderate regional expansion. Software providers are partnering with care providers, thereby establishing a strong foothold in the market. For instance, in January 2024, MatrixCare formed a strategic partnership with Tranzion, a National HealthCare Corporation (NHC) subsidiary, to expand Electronic Health Record (EHR) services for senior living and long-term care providers. MatrixCare is likely to provide advanced EHR technology, including artificial intelligence (AI) and machine learning, to enhance patient care, streamline operations, and improve clinical outcomes across Tranzion’s network.

Software Pricing Analysis

On-premises systems typically involve higher upfront expenses, including licensing, installation, and training. However, these systems may offer a lower total cost of ownership over time due to reduced recurring costs. In contrast, cloud-based (SaaS) solutions usually have lower initial costs but require ongoing subscription fees that can accumulate over time. According to RiverAxe, the total estimated cost for purchasing, implementing, and installing EHR software for medical provider ranges from USD 15,000 to USD 70,000 per provider.

Pricing varies based on the choice between on-premise software or web-based solutions (SaaS) that leverage cloud technology for access via different web browsers and devices. With SaaS EHR systems, healthcare providers typically incur a monthly subscription fee for ongoing use of the software.

On-Premise EHR

Cloud-Based (SaaS) EHR

Upfront cost: USD 50,000 - USD 100,000

Upfront cost: USD 20,000 - USD 30,000

Monthly operational cost: USD 200 - USD 800

Monthly cost: USD 500 - USD 3,000

Source: Secondary Research - “Counting the Cost of EHR Software for Small Healthcare Providers”, RiverAxe; Grand View Research

Moreover, several providers offer flexible pricing depending on various factors, such as the number of residents, the type of services needed, the size of the community, and many other factors for monthly or annual subscription plans. For example, Medtelligent, Inc. is a software company that offers ALIS solutions for assisted living facilities, residential care homes, and memory care communities. Moreover, the company provides a 30-day grace period & a risk-free guarantee, assuring complete satisfaction with ALIS or the option to cancel without fees within 90 days of the ALIS Agreement signing. The subscription plan includes:

Type of Subscription

Average Pricing

Factors

ALIS subscription

USD 8.0 - USD 15.0 (per resident per month)

Depending upon the type of company module selected

Community Subscription

USD 650.0 - USD 3,500.0

The one-time onboarding amount per community depends on the level of assistance each community needed

Source: Grand View Research Analysis, Company Websites

Recent Developments in the U.S. Long term Care (LTC) Software Market

New Product Launch

Companies

Year

Month

Details

PointClickCare

2026

January

PointClickCare launched Referral Advisor, an AI-powered solution integrated into its EHR for skilled nursing facilities. It streamlines referral intake by consolidating packets, extracting/validating clinical and financial data from 70+ pages, and providing insights to accelerate admissions, boost occupancy, and strengthen hospital ties.

PointClickCare

2025

November

PointClickCare launched its next-generation senior living platform, featuring purpose-built workflows, real-time resident data from North America's largest LTPAC dataset, and connectivity to reduce hospitalizations/extend stays. Key enhancements: streamlined management, paperless move-ins, pharmacy integration, billing, and AI-powered dashboards.

Oracle

2025

August

Oracle Health unveiled a new AI-powered electronic health record (EHR) built on Oracle Cloud Infrastructure, featuring voice-activated navigation, conversational AI for patient queries, and automated clinical notes to reduce clinician burden.

Partnerships/Collaborations

Companies

Year

Month

Details

MatrixCare

(by ResMed)2024

May

MatrixCare's EHR platform was selected by NHS Management's affiliated skilled nursing and rehabilitative facilities (southeast U.S.) to boost operational efficiency, clinical outcomes, and collaboration. It offers integrated clinical/compliance.

“Providers of long-term care were greatly impacted due to the recent transition of electronic medical record (EMR) providers, forcing operators to evaluate new technologies in the industry. The suite of holistic solutions at MatrixCare, including a purpose-built EMR, a fully integrated dietary and nutrition solution, best-in-class enterprise financial solutions, and AI-powered safety solutions are all designed to help communities deliver the best care possible for their residents.”

- Bharat Monteiro, General Manager, Facilities at MatrixCare.

Netsmart

Technologies, Inc2024

March

Netsmart partnered with Serviam Care Network to launch the Higher Path Operating System, a value-based care platform for senior living operators. It integrates Netsmart's CareFabric tech (EHRs, AI analytics) with Serviam's network (34 operators, 92K+ residents across 47 states) to enhance senior wellness, care coordination, and outcomes.

MatrixCare

(by ResMed)2024

January

MatrixCare announced a strategic partnership with Tranzion (a NHC subsidiary) to provide EHR technology with AI/ML to senior living providers. It enhances patient outcomes, operational efficiency, and change management in small- and mid-size post-acute facilities, expanding MatrixCare's post-acute market reach.

“Our experience of utilizing MatrixCare’s technology solutions and robust EHR drove our decision to partner with MatrixCare to discover innovative ways to impact quality care and offer advanced technology solutions to post-acute providers. We are confident that our partnership with MatrixCare aligns seamlessly with our vision of modernizing the post-acute industry.”

- Andy Flatt, Chief Information Officer at NHC.

Mergers/Acquisitions

Companies

Year

Month

Details

Veradigm LLC

2024

March

Veradigm completed its acquisition of ScienceIO, thereby integrating ScienceIO's healthcare AI platform and foundation models with Veradigm's vast dataset to build proprietary LLMs.

Veradigm LLC

2024

January

Veradigm strengthened its Revenue Cycle Services (RCS) with the acquisition of Koha Health, a full-service revenue cycle management (RCM) company. This acquisition expanded Veradigm’s capabilities, AI-driven analytics, and dedicated expertise to optimize financial performance for medical practices. The enhancements focus on end-to-end management from claims processing to denial prevention, seamlessly integrating with EHR systems.

Mode of Delivery Insights

Based on delivery mode, the cloud-based segment accounted for the largest revenue share of 41.55% in 2025. In addition, it is projected to experience growth at the fastest CAGR during the forecast period. Cloud-based solutions offer cost-effectiveness, flexible cost & usage options, fewer operational issues, low initial investment, and enhanced security. Moreover, the demand for cloud-based solutions is rising, leading to the development of new products.

For instance, In December 2025, CMS announced the 10-year ACCESS model to expand technology-enabled care for patients with chronic conditions. The model provides outcome-aligned payments to palliative care and other providers, enabling flexible, tech-supported chronic care management and integrated patient-centered services. This initiative is expected to accelerate adoption of digital tools such as telehealth, remote monitoring, and AI-driven care coordination across post-acute and home-based care settings.

The web-based segment is expected to witness substantial growth, driven by the increasing usage of online platforms. On the other hand, on-premises solutions, which are installed at user locations, primarily on workstations, are likely to face challenges due to their high initial costs, thereby affecting their market growth. As technology evolves, more clinics are expected to opt for cloud-based solutions, which offer cost-effectiveness, flexibility, and enhanced accessibility.

Application Insights

Based on application, the EHR segment accounted for the largest revenue share of 29.85% in 2025 due to the rising need for centralized and interoperable patient data management. In addition, this segment is anticipated to grow at the fastest CAGR from 2026 to 2033. Long-term care facilities require systems that can consolidate medical histories, care plans, and treatment progress for elderly and chronically ill patients.

The expansion of the EHR segment is also supported by advancements in cloud-based solutions, AI-enabled analytics, and mobile accessibility, which make implementation more cost-effective and user-friendly. Moreover, the ability of modern EHRs to link with telehealth platforms, medication management systems, and billing solutions enhance workflow efficiency

The workforce/staff management segment is expected to witness a significant growth rate during the forecast period. The increasing demand for healthcare professionals and various advantages of staff management systems, such as flexible scheduling & transparency for healthcare workforce, are anticipated to promote the use of staff management solutions in the LTC facilities. For instance, in August 2025, August Health raised USD 29 million to expand its AI-enabled August Intelligence platform across U.S. assisted living communities. The platform provides real-time insights on staffing and care needs, enabling operators to optimize workforce allocation, improve resident outcomes, and streamline daily operations.

End Use Insights

Based on end use, the Skilled Nursing Facilities (SNFs)/nursing homes segment dominated the market with a share of 43.09% in 2025. Increasing awareness about nursing care services, rising EHR implementation in skilled nursing facilities (SNFs), and high patient safety are key factors contributing to the growth of the segment.

As the demand for nursing homes continues to rise with the aging population, LTC software solutions are expected to support streamlining operations, improve care coordination, and enhance resident experiences. The adoption of such software is anticipated to drive the growth of the nursing home segment in the market, facilitating efficient and comprehensive care for elderly individuals in need.

The home healthcare agencies segment is projected to exhibit growth at the fastest CAGR during the forecast period. Increasing preference for care at home among the elderly and the rising number of remote monitoring solutions enabling independent living are driving high growth of the segment. The segment is likely to further benefit from technological advancements such as telemedicine, mHealth apps, and internet-enabled home monitoring.

Key U.S. Long Term Care Software Company Insights

The U.S. long term care software industry landscape is fragmented, with the presence of a small number of companies holding majority stake. New expansion activities, product approvals, product launches, partnerships, and acquisitions have positively impacted the U.S. long term care software industry in recent years. Furthermore, there has been a significant increase in the demand for long term care software due to the growing digitalization which in turn is fueling market growth.

Key U.S. Long Term Care Software Companies:

- Veradigm LLC

- Oracle

- IQVIA Inc.

- Netsmart Technologies, Inc.

- MatrixCare (ResMed)

- Yardi Systems, Inc.

- VITALS SOFTWARE

- (acquired by Aline)

- PointClickCare

- Medtelligent, Inc.

- AL Advantage, LLC

- Genexod Technologies LLC

- Revver, Inc.

- ShiftCare

- SimiTree

- THOMSON DATA

- Intrahealth Systems Limited (a HEALWELL Company)

- Epic Systems Corporation

Recent Developments

-

In November 2025, Veradigm launched enhanced capabilities for its AI-powered Ambient Scribe within Veradigm EHR, passively capturing patient-provider conversations to generate structured clinical notes.

-

In October 2025, SimiTree launched CLARITY, a real-time revenue cycle analytics dashboard for post-acute/behavioral health. It integrates EMRs/clearinghouses for daily KPI tracking (revenue, billing, payments), eliminating manual reporting and providing actionable insights for proactive decisions.

“CLARITY delivers real-time analytics that provide full transparency into revenue cycle performance. The platform’s unique capability to integrate seamlessly with multiple data sources, including EMRs, clearinghouses, and proprietary systems, sets CLARITY apart as a comprehensive and adaptable solution.”

- Anthony Smith, SVP of Post-Acute RCM

-

In February 2025, August Health officially launched its next generation eMAR for senior living operators in the U.S., following early adoption by providers such as Sonida Senior Living and Koelsch Communities. The system integrates with August Health EHR, streamlining medication administration, supporting polypharmacy management, and providing analytics to enhance resident safety and clinical oversight.

“We created a system that makes it easier to handle the increasingly complex workload of passing medications in senior living. We’ve also given clinical leadership the enterprise analytics they’ve long needed to provide oversight and promote medication safety across thousands of residents."

-MD, August Health Co-Founder and Co-CEO

-

In March 2024, Creative Solutions in Healthcare acquired five skilled nursing facilities from Diversicare, expanding its Texas portfolio to 174 properties, including 153 skilled nursing centers.

-

In February 2024, Creative Solutions in Healthcare expanded its presence in El Paso, Texas, by acquiring two skilled nursing facilities: El Paso Health & Rehab and Vista Hills Health Care Center.

-

In June 2023, Netsmart and nVoq partnered to enable integrated voice recognition, in order to help in-home healthcare clients with their documentation problems.

-

In March 2023, VITAS Healthcare, a provider of end-of-life care, partnered with WellSky to leverage WellSky’s electronic health record (EHR) technology to streamline operations and enhance clinical workflows. The organizations are anticipated to collaborate to advance innovations in hospice and palliative care technology, supporting VITAS in expanding into new markets.

U.S. Long Term Care Software Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2.57 billion

Revenue Forecast in 2033

USD 4.11 billion

Growth rate

CAGR of 6.92% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mode of delivery, application, end use

Country scope

U.S.

Key companies profiled

Veradigm LLC; Oracle; IQVIA Inc.; Netsmart; Technologies, Inc.; MatrixCare (ResMed); Yardi Systems, Inc.; VITALS SOFTWARE (acquired by Aline); PointClickCare; Medtelligent, Inc.; AL Advantage, LLC; Genexod Technologies LLC; Revver, Inc.;

ShiftCare; SimiTree; THOMSON DATA; Intrahealth Systems Limited (a HEALWELL Company); Epic Systems Corporation.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Long Term Care Software Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. long term care software market report based on mode of delivery, application, and end use:

-

Mode of Delivery Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud based

-

Web based

-

On premise

-

-

Application by End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Electronic Health Records (EHR)

-

Skilled Nursing Facilities (SNFs) / Nursing Homes

-

Assisted Living Facilities

-

Home Health

-

Hospice & Palliative Care

-

Life Plan Communities

-

Private Duty

-

-

Electronic Medication Administration Record (eMAR)

-

Skilled Nursing Facilities (SNFs) / Nursing Homes

-

Assisted Living Facilities

-

Home Health

-

Hospice & Palliative Care

-

-

Revenue Cycle Management

-

Skilled Nursing Facilities (SNFs) / Nursing Homes

-

Home Health

-

Hospice & Palliative Care

-

Assisted Living Facilities

-

Life Plan Communities

-

Private Duty

-

-

Resident Care

-

Skilled Nursing Facilities (SNFs) / Nursing Homes

-

Assisted Living Facilities

-

Hospice & Palliative Care

-

Life Plan Communities

-

Private Duty

-

-

Workforce / Staff Management

-

Skilled Nursing Facilities (SNFs) / Nursing Homes

-

Assisted Living Facilities

-

Home Health

-

Hospice & Palliative Care

-

Life Plan Communities

-

Private Duty

-

-

Referral Intake Management

-

Skilled Nursing Facilities (SNFs) / Nursing Homes

-

Hospice & Palliative Care

-

Home Health

-

-

Data-as-a-Service

-

Skilled Nursing Facilities (SNFs) / Nursing Homes

-

Assisted Living Facilities

-

Life Plan Communities

-

-

Others

-

Business Intelligence & Analytics

-

Skilled Nursing Facilities (SNFs) / Nursing Homes

-

Assisted Living Facilities

-

Life Plan Communities

-

Hospice & Palliative Care

-

-

Workforce / Scheduling Software

-

Skilled Nursing Facilities (SNFs) / Nursing Homes

-

Assisted Living Facilities

-

Home Health

-

Hospice & Palliative Care

-

Life Plan Communities

-

Private Duty

-

-

Patient Engagement Software

-

Skilled Nursing Facilities (SNFs) / Nursing Homes

-

Assisted Living Facilities

-

Home Health

-

Hospice & Palliative Care

-

Life Plan Communities

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Skilled Nursing Facilities (SNFs) / Nursing Homes

-

Assisted Living Facilities

-

Home Health

-

Hospice & Palliative Care

-

Life Plan Communities

-

Private Duty

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include the increasing geriatric population, growing prevalence of chronic diseases, and rising government efforts to boost healthcare software adoption in the healthcare system.

b. The U.S. long term care software market size was estimated at USD 2.41 billion in 2025 and is expected to reach USD 2.57 billion in 2026.

b. The U.S. long term care software market is expected to grow at a compound annual growth rate of 6.92% from 2026 to 2033 to reach USD 4.11 billion by 2033.

b. The EHR segment dominated the U.S. long term care software with a share of 29.85% in 2025. The growth of segment is attributed due to increased government initiative for the implementation of EHR in healthcare facilities.

b. Some key players operating in the U.S. long term care software include Veradigm LLC; Oracle; IQVIA Inc.; Netsmart; Technologies, Inc.; MatrixCare (ResMed); Yardi Systems, Inc.; VITALS SOFTWARE (acquired by Aline); PointClickCare; Medtelligent, Inc.; AL Advantage, LLC; Genexod Technologies LLC; Revver, Inc.; ShiftCare; SimiTree; THOMSON DATA; Intrahealth Systems Limited (a HEALWELL Company); Epic Systems Corporation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.