- Home

- »

- Healthcare IT

- »

-

Revenue Cycle Management Market Size Report, 2030GVR Report cover

![Revenue Cycle Management Market Size, Share & Trends Report]()

Revenue Cycle Management Market Size, Share & Trends Analysis Report By Product (Software, Services), By Type (Integrated, Standalone), By Delivery Mode, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-433-8

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Revenue Cycle Management Market Trends

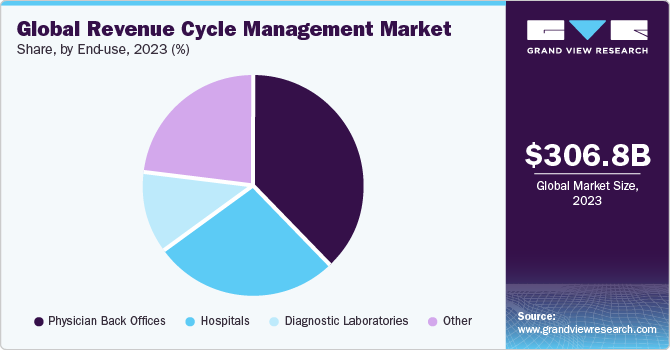

The global revenue cycle management market size was estimated at USD 306.8 billion in 2023 and is projected to grow at a CAGR of 11.39% from 2024 to 2030. The healthcare industry is rapidly moving towards digitalization, creating demand for advanced revenue cycle management (RCM) solutions. The increasing number of data silos and unorganized workflows in healthcare settings is leading to market development and growth.

RCM involves third-party payers, payment models, guidelines, and codes. The success of a healthcare practice depends on obtaining the right assets. As payment for medical services becomes more complex, it becomes increasingly valuable to have an efficient RCM solution.

The market growth in healthcare organizations is expected to be driven by the increasing demand for workflow optimization with the adoption of synchronized management software systems. The healthcare industry is constantly evolving with regular technological advancements, and as a result, many healthcare payers and providers are rapidly adopting these advancements. For instance, in November 2023, the Healthcare Financial Management Association (HFMA) partnered with FinThrive, Inc. to launch a five-stage RCM technology adoption model (RCMTAM). This model helps health systems assess current RCM technology maturity and build best-practice plans using industry benchmarks.

R1 Professional revenue cycle management solution would enable healthcare facilities and other stakeholders to implement a standardized RCM strategy of reimbursement and operations model. Innovations and advancements in the RCM solutions have played a key role in improving provider-patient relations and include the implementation of ICD-10 for classifying, coding, and reporting data on disease diagnosis and treatment procedures, which directly helps healthcare systems enhance care delivery. Healthcare facilities are outsourcing RCM software solutions owing to the multiple advantages associated such as easy availability of trained and skilled professionals, enhanced efficiency, compliance and adherence to required regulations, and cost-effectiveness.

A survey by Salucro Healthcare Solutions in January 2024, involving 176 healthcare professionals found that 50% of respondents are generally satisfied with their organization's revenue cycle management, with 34% considering it somewhat efficient and 16% very efficient. However, hands-on revenue cycle leaders are less likely to view the system as efficient compared to executive leaders. Timely patient collections, staff hiring/training, managing denials, security/compliance, and data analytics/reporting are key challenges. Existing patient payment platforms often need to catch up, with integration into current systems being a crucial requirement. Despite increasing technology use, many still rely on paper statements for patient communication. Digital-first patient payment solutions face barriers such as patient resistance, data security concerns, and costs. However, most respondents would consider adopting such solutions if they improve revenue or reduce collection costs. Around half of healthcare leaders are likely to invest in new revenue cycle technology in the near future to streamline tasks, reduce burden, and cut costs.

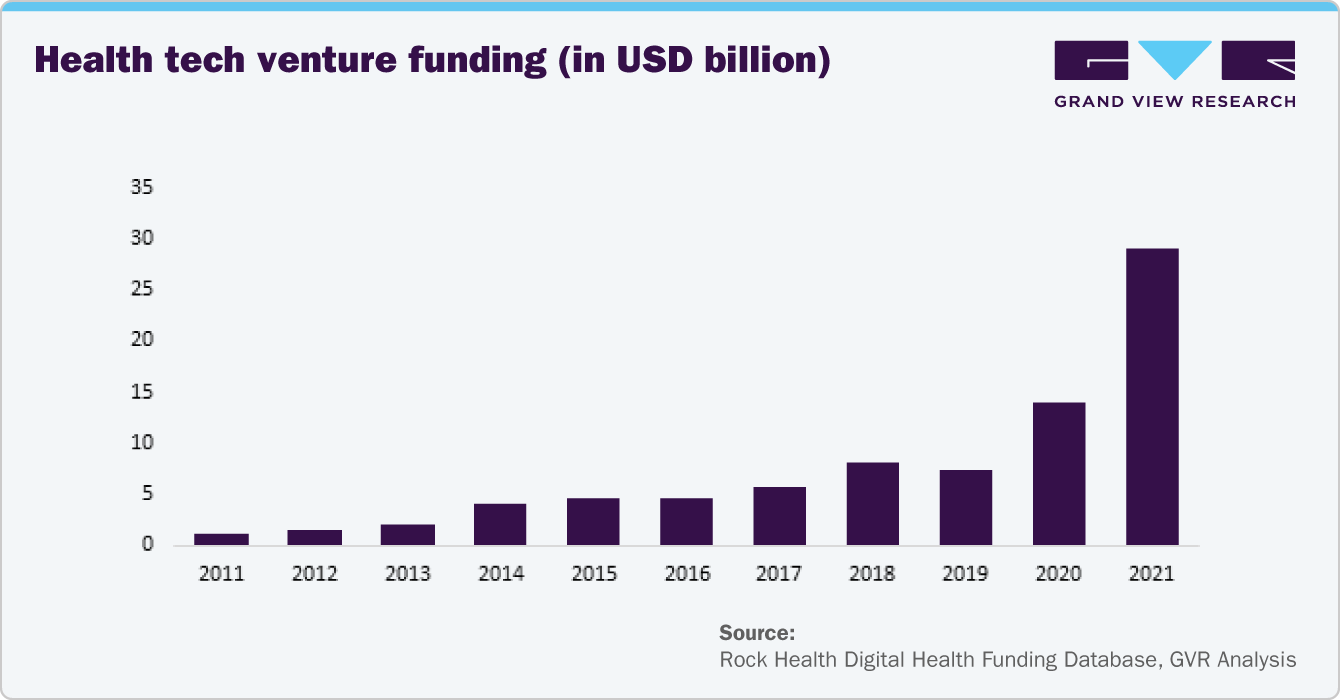

Moreover, the upsurge in initiatives and investments supporting healthcare IT, mHealth and digital health is receiving significant support from venture capitalists, private equity firms, and healthcare organizations. The global landscape of health-tech investment experienced a substantial surge in 2021, surpassing USD 44 billion, marking a twofold increase compared to the previous year. This influx of capital highlights the increasing significance of technological innovation in healthcare. Noteworthy is the emergence of major tech-enabled platform companies as key players, offering the potential to improve hospital and health system efficiencies, swiftly expand operations, and modernize existing systems and delivery models. Furthermore, these platforms are poised to play a crucial role in addressing concerns regarding health equity through a comprehensive and inclusive approach to healthcare delivery.

Market Concentration & Characteristics

The chart provided below illustrates the relationship between market concentration, characteristics, and participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including industry competition, degree of innovation, level of M&A activities, impact of regulations, and regional expansion. For instance, the global market is fragmented, with many small players entering the market and launching new innovative products. The degree of innovation is high, and the level of M&A activities is also medium. The impact of regulations in the market is low, and the regional expansion is medium.

The market is characterized by constant innovation, with a strong focus on convenient telehealth technologies. These innovations aim to streamline the implementation process for both patients and healthcare providers. The prevalent use of mobiles and tablets allows suitable access to improve and accelerate reimbursements, arrest revenue leakage, prevent denials, and improve the patient experience. Furthermore, various prominent players are launching advanced solutions and services to sustain a competitive advantage. For instance, in September 2022, AGS Health introduced a connected solution that blends automation and artificial intelligence (AI) called AGS AI Platform, which aims to deliver seamless integration and robust process automation to ease labour shortages and allow flexible, scalable growth.

Several companies in the industry are currently involved in merger and acquisition activities. These companies want to expand their reach and explore new territories through M&A deals. For instance, in January 2024, Veradigm LLC acquired Koha Health, a full-service revenue cycle management (RCM) service provider. This acquisition aims to strengthen Veradigm and further add to its depth of offerings and expertise to serve the needs of the market better.

The regulations governing the use of healthcare IT vary across different countries and regions. However, having a well-structured regulatory framework can positively impact market growth, accessibility, and compliance. For instance, the regulatory landscape for the Middle East & Africa market is complex and diverse. This is due to differences in healthcare systems, regulatory priorities, and technological adoption across different countries. Saudi Arabia, the UAE, Qatar, and other key Middle East & Africa countries have established regulatory frameworks for telemedicine, digital health, & data protection.

The revenue cycle management is relatively low due to changes in regulatory frameworks, specific demands of healthcare organizations, and varying reimbursement policies across different regions. However, with the increasing adoption of digital healthcare solutions and the growing need for efficient revenue cycle management, the market is expected to witness the significant growth in the coming years.

Product Insights

Based on product, the services segment led the market with the largest revenue share of 67.1% in 2023, owing to the growing trend of outsourcing these services to healthcare facilities. There has been an increase in outsourcing of services as many healthcare services mandatorily require resources and skill sets for implementation of RCM solutions. Either the entire process is outsourced, or a part of it is the form of a long-term contract. RCM services make sure healthcare procedures achieve an optimum return on their investment.

Increasing amounts of data generated from multiple healthcare functions are driving the need for process digitalization and streamlining workflows for enhanced efficiencies and improved patient care. The growing amount of unorganized data requires consolidation, supporting the growing need for RCM software solutions. Multiple data silos reduce the ability to accurately analyze data and increase the risk of data losses.

An RCM software tool will help to manage a large amount of data and the procedure for evaluating data and designing valuable mitigation tasks will be easy. This would allow the staff to immediately document and review the performance and to effectively make decisions about the course selection process.

End-use Insights

Based on end-use, the physician back-office segment held the market with the largest revenue share of 37.7% in 2023. A rising focus on increasing the number of physicians and medical facilities across the region is expected to drive the market growth. Private physician offices undergo numerous economic challenges such as physician reimbursement, increasing operating expenses, and patient content. Private physician offices are outsourcing RCM solutions and services to align with medical and financial needs.

On the other hand, the hospital’s segment is anticipated to register at the fastest CAGR over the forecast period, owing to the rising number of protocols and guidelines introduced by regulatory bodies concerning patient safety. The growing demand for streamlining hospitals’ workflows and enhancing productivity and efficiency is driving the adoption of RCM solutions in hospitals. Hospitals commonly use an integrated type of RCM system bringing patients and providers collectively into a single platform. Through this platform, providers, payers, and patients are updated on medications billed to a patient and enable the maintenance of a complete database of patient purchase history.

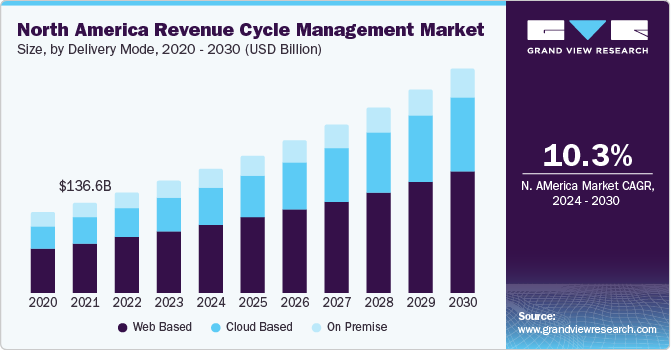

Delivery Mode Insights

Based on delivery mode, the web-based segment led the market with the largest revenue share of 52.9% in 2023, owing to the growing implementation of web-based solutions. Web-based solutions are becoming increasingly popular due to their affordability and ease of deployment. Unlike on-premises solutions, web-based solutions do not require additional hardware or storage and can be installed off-site and managed by a third party. This has led to a rise in adoption of web-based solutions over on-premises solutions.

The cloud-deployed segment is expected to grow at the fastest CAGR during the forecast period, due to its higher flexibility and cost-effectiveness for end-users. Cloud-based solutions have made medical data-sharing easy and secure, automating backend processes and enabling the creation and protection of telehealth apps. In addition, cloud-deployed solutions help healthcare institutions manage patient portals, electronic medical records, big data analytics, and mobile applications, avoiding additional costs for maintaining servers. Cloud-based products have been developed to improve resource procurement, enhance infrastructure dependability, and strengthen operations.

Type Insights

Based on type, the integrated segment led the market with the largest revenue share of 70.45% in 2023, owing to the growing preference for volume-based payments over value-based payments. Integrated solutions offer a streamlined and synchronized format for various financial activities via a single platform resulting in a standardized data collection and analysis process. Integrated revenue cycle management provides a number of benefits, from growing collections to planning alternative payment and reimbursement methodologies.

Successful integration schemes allow healthcare workers to improve productivity, decrease costs, increase collections, and increase net operating margins. The integrated segment is anticipated to register at the fastest CAGR during the forecast period, owing to the growing demand for enhancing healthcare systems’ efficiency, increasing healthcare facilities, and growing healthcare costs. Moreover, the growing need to minimize or eliminate human errors and accelerate administrative functions is anticipated to boost the market growth of an integrated type of service.

Regional Insights

North America dominated the revenue cycle management market with the largest revenue share of 55.1% in 2023. This is due to the growing presence of physician’s offices in the U.S. Regulatory reforms such as amendments in ICD-10 have led to a digital transformation in healthcare systems and there has been a significant surge in demand for healthcare IT solutions such as RCM systems to enhance efficiency and improve care delivery. Moreover, the presence of large renowned hospitals and well-established facilities, increasing need to minimize healthcare costs, and favorable regulations are posing lucrative growth opportunities for the market in the region.

U.S. Revenue Cycle Management Market Trends

The revenue cycle management market in U.S. accounted for the largest revenue share in North America region in 2023. This is due to the growing trend of outsourcing healthcare RCM solutions, driven by the benefits of value addition, business prospects, and finances. The healthcare industry in the U.S. is rapidly growing and evolving, thanks to the increasing expenditure, rising number of well-established facilities, advancing healthcare IT infrastructure, and emphasis on the patient-provider relationship.

Europe Revenue Cycle Management Market Trends

The revenue cycle management market in Europe is expected to witness at a significant CAGR over the forecast period, due to the supportive government policies. For instance, the Digital Single Market Strategy initiated by the European Commission facilitates consumer & business access to online services and goods all over Europe, creating the right conditions for digital networks and services to flourish and maximizing the growth potential of European economy.

The Germany revenue cycle management market is one of the largest healthcare markets in Europe. High number of hospitals in Germany is a prime driving factor for the market growth in the country. In addition, the healthcare delivery system in Germany is streamlined and efficient. As per the Commonwealth Fund, around 85% of the German population is covered by Social Health Insurance (SHI) and 10% by substitutive private health insurance. The growing demand for digitalization and increasing support by government and private initiatives are likely to drive market growth.

Asia Pacific Revenue Cycle Management Market Trends

The revenue cycle management market in Asia Pacific is anticipated to register at the fastest CAGR during the forecast year, owing to growing favorable government initiatives and support, growing demand to improve care delivery quality, increasing digital literacy, growing adoption of healthcare IT solutions, advancing healthcare infrastructure, rising healthcare IT spending, and rising unmet healthcare needs of emerging economies. Furthermore, the Asia Pacific market offers low manufacturing costs and the availability of a cost-effective workforce which increases the ease of doing business.

The China revenue cycle management market is expected to witness at the significant CAGR during the forecast period, owing to rising patient volume and the consequent increase in health insurance claims. Moreover, the growing adoption of cloud deployed RCM due to its flexibility and cost-effectiveness. Cloud-based technologies facilitate secure data sharing, enhance telehealth applications, automate backend processes, and reduce server maintenance costs, thereby driving market growth.

Middle East & Africa Revenue Cycle Management Market Trends

The revenue cycle management market in the Middle East and Africa (MEA) is expected to grow at a significant CAGR during the forecast period. The growth is anticipated to the well-developed healthcare infrastructure in the region that play’s a significant role in driving the market growth. Moreover, the supportive regulatory frameworks and regulations in the MEA region contribute to the market growth by ensuring compliance and facilitating smooth operations.

The Saudi Arabia revenue cycle management market is anticipated to grow at a substantial CAGR over the forecast period. The introduction of mandatory health insurance in the public sector, as part of Vision 2030 and the National Transformation Program, is driving the need for new capabilities in revenue generation under the new reimbursement system. This transformation of the healthcare sector is expected to significantly impact the reimbursement system of health services, leading to the development of new capabilities for revenue generation.

Key Revenue Cycle Management Company Insights

The key participants in the market are divided into various strategic initiatives to expand their business footprint and gain a competitive edge in global market. Some emerging companies include MD Clarity, Guidehouse, Waystar, Ensemble Health Partners, and FinThrive.

Key Revenue Cycle Management Companies:

The following are the leading companies in the revenue cycle management market. These companies collectively hold the largest market share and dictate industry trends.

- The SSI Group, Inc.

- Veradigm LLC (AllScripts Healthcare, LLC)

- athenahealth, Inc.

- Experian Information Solutions, Inc.

- R1 RCM Inc.

- Epic Systems Corporation

- McKesson Corporation

- NXGN Management, LLC

- CareCloud Corporation

- Quest Diagnostics, Inc.

- Oracle (Cerner Corporation)

Recent Developments

-

In January 2024, R1 RCM Inc. acquired Acclara from Providence, a health systems provider. This acquisition aims to strengthen R1 RCM Inc.'s market and enable the company to implement state-of-the-art technology solutions and enhance execution, which enables to improve outcomes for both patients and customers

-

In July 2023, TELCOR launched its new version 21.3 of TELCOR RCM. The new version includes expanded use of the web application programming interfaces (APIs) and Report Designer, an Executive Module to improve laboratory productivity and collections

-

In June 2022, R1 RCM Inc acquired Cloudmed to offer a leading platform for healthcare provider revenue cycle management (RCM) and drive digital transformation through automation and AI

Revenue Cycle Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 343.8 billion

Revenue forecast in 2030

USD 656.7 billion

Growth rate

CAGR of 11.39% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, type, delivery mode, end-use, region

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; Australia; Thailand; South Korea; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

The SSI Group, Inc.; Veradigm LLC (AllScripts Healthcare, LLC); Experian Information Solutions, Inc.; R1 RCM Inc.; McKesson Corporation; athenahealth, Inc; Epic Systems Corporation; NXGN Management, LLC; CareCloud Corporation; Quest Diagnostics, Inc. and Oracle (Cerner Corporation)

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Revenue Cycle Management Market Report Segmentation

This report forecasts revenue growth at the regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the revenue cycle management market report based on product, type, delivery mode, end-use, and regions:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Integrated

-

Standalone

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Web-based

-

Cloud-based

-

On-premise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Physician Back Offices

-

Hospitals

-

Diagnostic Laboratories

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The services segment dominated the revenue cycle management market with a share of 67.1% in 2023. There has been an increase in outsourcing of services as many healthcare services mandatorily require resources and skillsets for implementation of revenue cycle management solutions.

b. Some key players operating in the revenue cycle management market include The SSI Group, Inc., Veradigm LLC (AllScripts Healthcare, LLC), Experian Information Solutions, Inc., R1 RCM Inc, McKesson Corporation, athenahealth, Inc, Epic Systems Corporation, NXGN Management, LLC, CareCloud Corporation, Quest Diagnostics, Inc. and Oracle (Cerner Corporation)

b. Key factors that are driving the RCM market growth include rising regulatory mandates for the adoption of Healthcare Information Technology (HIT) systems in healthcare settings and the failure of the traditional billing systems to provide insights about ongoing billing operations.

b. The global revenue cycle management market size was estimated at USD 306.8 billion in 2023 and is expected to reach USD 343.8 billion in 2024.

b. The global revenue cycle management market is expected to grow at a compound annual growth rate of 11.39% from 2024 to 2030 to reach USD 656.7 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."