- Home

- »

- Petrochemicals

- »

-

U.S. Lubricants Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Lubricants Market Size, Share & Trends Report]()

U.S. Lubricants Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Industrial, Automotive, Marine, Aerospace), By Base Oil, And Segment Forecasts

- Report ID: GVR-4-68038-455-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Lubricants Market Size & Trends

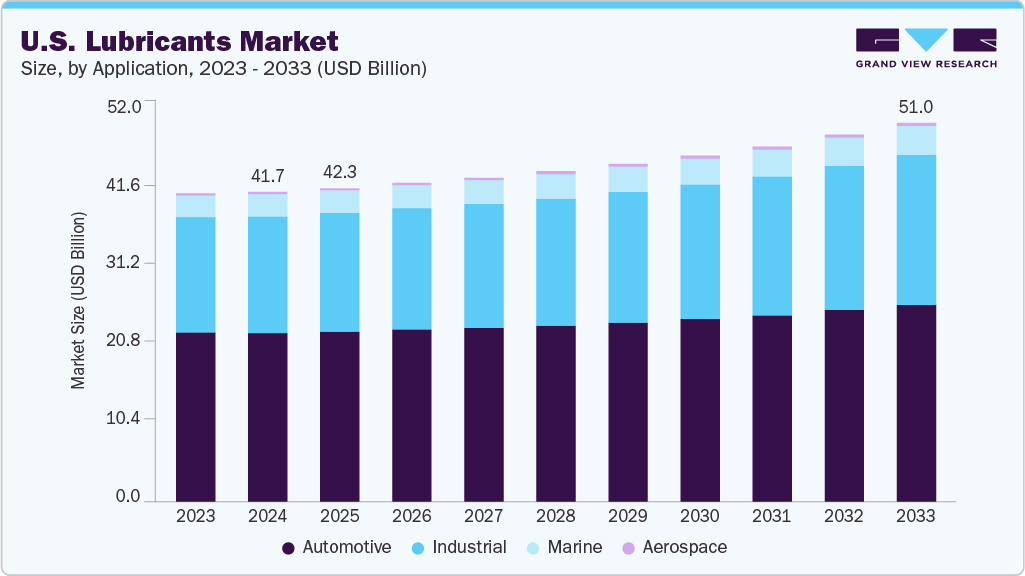

The U.S. lubricants market size was valued at USD 41.71 billion in 2024 and is anticipated to grow at a CAGR of 2.4% from 2025 to 2033. The automotive sector remains the largest contributor to the market growth, driven by the increasing production and sales of vehicles. The growing popularity of EV technology in the country has led to a surge in demand for specialized lubricants designed to enhance performance and efficiency in these vehicles.

Technological advancements in lubricant formulations are expected to play a crucial role in market growth over the coming years. Manufacturers are focusing on the development of high-performance synthetic oils that offer superior thermal stability and reduced friction compared to traditional mineral oils. This trend is represented by companies launching new lines of lubricants specifically tailored for modern engines, indicating a practical response to changing industry demands. Urbanization and industrialization have increased the demand for lubricants across various sectors, including manufacturing and construction.

Market players in the U.S. are increasingly investing in research and development to create innovative lubricant formulations with better performance characteristics, such as enhanced fuel efficiency, reduced friction, and longer service intervals. For instance, TotalEnergies introduced new lubricant lines designed specifically for electric vehicles in November 2022, showcasing how companies adapt their products to meet evolving consumer needs and regulatory standards. These innovations improve operational efficiency and align with sustainability goals by reducing environmental impact.

Application Insights

The automotive segment dominated the market with the largest revenue share of 47.6% in 2024, driven by increasing production and sales of vehicles, particularly electric vehicles (EVs), which surged the demand for high-performance lubricants that enhance efficiency and longevity. The adoption of synthetic lubricants for EV drivetrains has also witnessed growth, reflecting a rise in consumer demand for products that offer better thermal stability and ensure longer service intervals. In addition, government initiatives directed toward emission control and fuel efficiency have also encouraged manufacturers to innovate and develop advanced lubricant formulations. For instance, the U.S. EPA’s Vessel General Permit mandates the use of non-bio accumulative Environmentally Acceptable Lubricants (EALs), which are biodegradable and minimally toxic, in marine applications to reduce their environmental impact.

The aerospace segment is expected to grow at the fastest CAGR over the forecast period, which can be attributed to the increasing demand for air travel, leading to a rise in aircraft orders and fleet expansions by airlines. For instance, according to an article published by the Economic Times in July 2023, Air India ordered 800 LEAP engines to power its expanding fleet. In addition, advancements in aircraft technology require high-performance lubricants that can withstand extreme conditions, further boosting the demand for specialized aerospace lubricants.

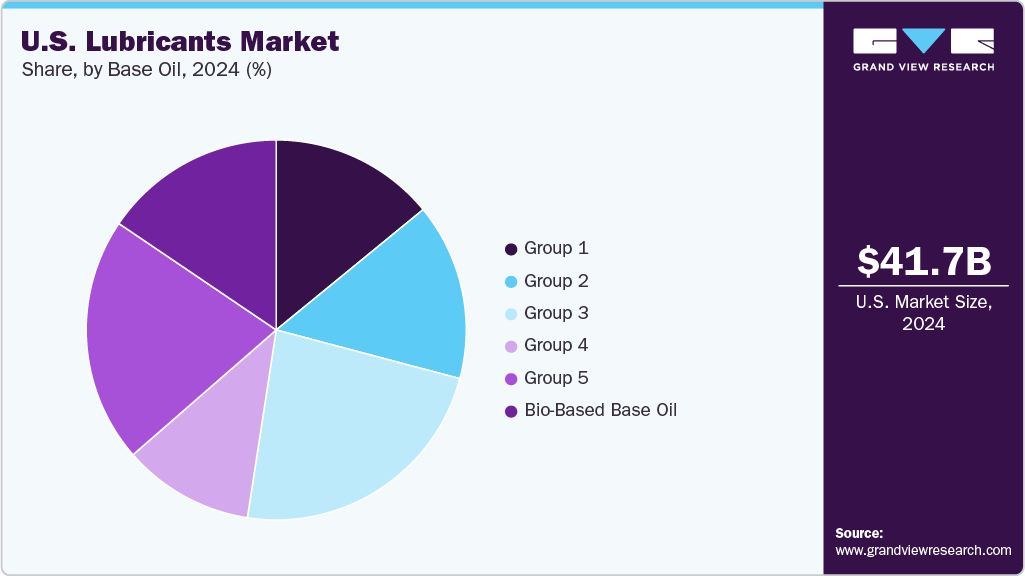

Base Oil Insights

The Group 1 segment led the lubricants market in 2024, capturing the largest revenue share of 29.6%, primarily due to its widespread adoption across automotive and industrial applications. These mineral-based lubricants are cost-effective, easily available, and compatible with a variety of engine and machinery types, making them the preferred choice for conventional systems. Additionally, their established supply chains and proven reliability in performance have reinforced their market dominance, particularly in regions with mature automotive and manufacturing industries.

The Bio-Based Base Oil segment is projected to experience the fastest growth, with a CAGR of 3.2% between 2025 and 2033, driven by increasing environmental awareness and regulatory pressures to reduce carbon emissions. These eco-friendly lubricants offer superior biodegradability and lower toxicity compared to traditional mineral oils, appealing to sustainable industries and green technology initiatives. Rising demand from sectors such as automotive, industrial machinery, and renewable energy further fuels this expansion, highlighting a shift toward more sustainable lubrication solutions.

Key U.S. Lubricants Company Insights

The U.S. lubricants market is driven by several key companies, including Exxon Mobil Corporation. BP p.l.c.; BASF, and Chevron Corporation. Exxon Mobil Corporation offers a range of lubricants, including high-performance engine oils, hydraulic fluids, and greases, emphasizing reliability and efficiency. BP p.l.c. provides a variety of lubricant products under the Castrol brand, which includes engine oils, transmission fluids, and industrial lubricants, focusing on enhancing performance and protecting machinery. BASF specializes in producing high-quality lubricant additives that improve the performance and longevity of lubricants used in automotive and industrial applications, while Chevron Corporation offers a wide range of lubricants through its Havoline and Delo brands, offering engine oils, gear oils, and greases that are formulated to meet the demands of both personal and commercial vehicles. These companies play a significant role in shaping the U.S. lubricants market.

-

Exxon Mobil Corporation operates across the entire oil & gas industry, focusing significantly on lubricants and chemicals. The company offers a wide range of products under well-known brands such as Mobil and Exxon, including synthetic motor oils, industrial lubricants, and specialty products designed for various applications. Furthermore, it offers a range of high-performance products under well-known brands, such as Mobil 1, which is recognized for its synthetic motor oils and has a strong presence in motorsports with sponsorships for popular brands.

-

BASF offers a range of high-performance products, including additives and base oils, that enhance the performance and efficiency of lubricants used in automotive, industrial, and marine applications. For instance, it supplies lubricants for marine applications, including cylinder and truck piston engine oils. Furthermore, its portfolio includes coolants under the GLYSANTIN brand, which protect engines from corrosion and ensure efficient operation.

Key U.S. Lubricants Companies:

- Exxon Mobil Corporation.

- BP p.l.c.

- BASF

- Chevron Corporation.

- Croda International Plc

- LIQUI MOLY

- TotalEnergies

- China Petroleum & Chemical Corporation (Sinopec)

- FUCHS

- American Refining Group

- Castrol Limited

- Phillips 66 Company.

- Valvoline Global Operations

- Petrobras

- PETRONAS Lubricants International

- Quaker Chemical Corporation

- Petrofer

Recent Developments

-

In October 2024, BP p.l.c. is expected to continue its oil and gas ventures with Reliance Industries in India despite the expiration of their agreement. The former is also expected to invest further in the KG-D6 block, which produces a third of India's natural gas while expanding its lubricant offerings through its Castrol brand and enhancing its mobility joint venture with Reliance.

-

In July 2024, Liqui Moly partnered with the British Touring Car Championship (BTCC) to become the official oil and lubricants partner, starting from the next race at Croft and continuing until the end of the 2027 season. The agreement includes naming rights for each race at Croft and prominent branding at all BTCC venues, reflecting Liqui Moly's strategy to enhance its presence in the market.

U.S. Lubricants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 42.28 billion

Revenue forecast in 2033

USD 51.03 billion

Growth Rate

CAGR of 2.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Report updated

December 2024

Quantitative units

Volume in Kilotons, Revenue in USD Million/Billion, and CAGR from 2025 to 2033

Report coverage

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, Base Oil

Country scope

U.S.

Key companies profiled

Exxon Mobil Corporation.; BP p.l.c.; BASF; Chevron Corporation.; Croda International Plc; LIQUI MOLY; TotalEnergies; China Petroleum & Chemical Corporation (Sinopec); FUCHS; American Refining Group; Castrol Limited; Phillips 66 Company.; Valvoline Global Operations; Petrobras; PETRONAS Lubricants International; Quaker Chemical Corporation; Petrofer

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Lubricants Market Report Segmentation

This report forecasts the volume and revenue growth of the U.S. lubricants market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the U.S. lubricants market report based on application and base oil:

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2033)

-

Industrial

-

Process Oils

-

General Industrial Oils

-

Metalworking Fluids

-

Industrial Engine Oils

-

Greases

-

Others

-

-

Automotive

-

Engine Oil

-

Gear Oil

-

Transmission Fluids

-

Brake Fluids

-

Coolants

-

Greases

-

-

Marine

-

Engine oil

-

Hydraulic oil

-

Gear oil

-

Turbine oil

-

Greases

-

Others

-

-

Aerospace

-

Gas turbine oils

-

Piston engine oils

-

Hydraulic fluids

-

Others

-

-

-

Base Oil Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2033)

-

Group 1

-

Group 2

-

Group 3

-

Group 4

-

Group 5

-

Bio-Based Base Oil

-

Frequently Asked Questions About This Report

b. The U.S. Lubricants market size was estimated at USD 41.71 billion in 2024 and is expected to reach USD 42.28 billion in 2025.

b. The U.S. lubricants market is expected to grow at a compound annual growth rate of 2.4% from 2025 to 2033 to reach USD 51.03 billion by 2033.

b. Group 1 base oil dominated the U.S. lubricants market with a share of 29.6% in 2024. This is attributed to the increasing demand for Base 1 lubricants, is their use in industrial process oils, grease formulations, and marine cylinder oils, where formulation characteristics and cost-effectiveness outweigh the need for premium quality base stocks. Industries such as rubber processing, textile, and certain manufacturing sectors continue to rely on Group I due to its better solvency, which enhances additive solubility and performance in these applications.

b. Some key players operating in the U.S. lubricants market include BP P.L.C., Total Energies, ExxonMobil Corporation, Chevron Corporation, FUCHS, Royal Dutch Shell, AMSOIL, Inc., Phillips 66 Company, JX Nippon Oil & Gas Exploration Corporation, Valvoline LLC.

b. The market growth is attributed by steady demand in the automotive and industrial sectors, with increasing use of high-performance synthetic and semi-synthetic lubricants to meet OEM and emission standards. Rising adoption of bio-based and environmentally acceptable lubricants is further encouraged by regulatory measures focused on sustainability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.