- Home

- »

- Homecare & Decor

- »

-

U.S. Luxury Travel Market Size, Share & Trends Report, 2030GVR Report cover

![U.S. Luxury Travel Market Size, Share & Trends Report]()

U.S. Luxury Travel Market Size, Share & Trends Analysis Report By Tour (Customized & Private Vacations, Safari & Adventure), By Age Group (Millennial, Generation X), By Booking Mode, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-180-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

U.S. Luxury Travel Market Size & Trends

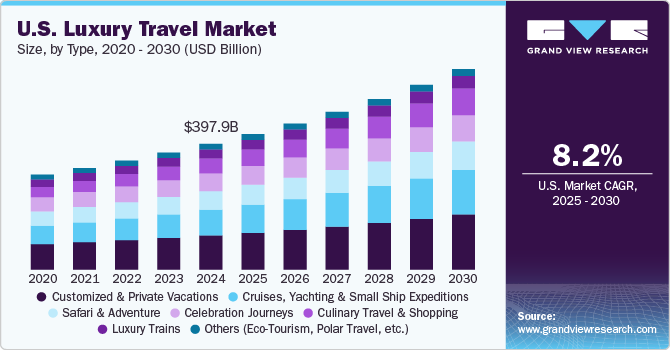

The U.S. luxury travel market size was estimated at USD 370.11 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.1% from 2024 to 2030. The evolving trend of transformational travel surrounding wellness trips to restore balance and transform the mind, sprit, and body is expected to drive the market over the forecast period. In addition, the increasing resurgence of international trips post vaccine and virus control would also drive the market growth.

According to a blog by BW HOTELIER, international short hauls to safe destinations and honeymoons are expected to emerge in phases such as phase 1 from May to September and phase 2 from September to December. The demand for luxury travel focused on wellness continues to surge, with travelers actively seeking experiences, itineraries, and products tailored to health, fitness, nutrition, appearance, sleep, and mindfulness.

According to a 2021 American Express survey, 76% of respondents expressed a desire to allocate more of their travel budget toward improving their overall well-being, while 55% indicated a willingness to invest extra in wellness activities for future vacations. Although many spas and health retreats faced closures during the pandemic, the Global Wellness Institute anticipates a robust recovery, projecting an annual growth rate of 17% and an estimated market value of USD 150 billion by 2025.

Key market players are focusing on various strategies, such as new personalized and customized tour packages and new locations, to gain traction among consumers and a significant market share. For instance, in April 2023, TCS World Travel, a U.S.-based prominent international provider of private jet expeditions, introduced eight new tailor-made itineraries for travelers in search of personalized travel experiences, featuring options for a private jet, chartered plane, or first-class commercial travel. Travelers can select from a varied selection of comprehensive journeys that blend exclusive access, unique experiences, and luxurious accommodations in coveted global destinations.

There has been a growing inclination among consumers to prioritize travel experiences over materialistic possessions, particularly among younger generations, and this has made luxury travel an important choice among elite consumers. Remote and unexplored destinations that allow travelers to avoid crowds and overly touristy locales are increasingly popular. The luxury travel network also witnesses significant interest in places that are rich in culture and are home to unmatched natural beauty, such as San Francisco, Milwaukee, and Minneapolis.

Social connectivity is another emerging trend among luxury travelers. For example, G Adventures (formerly known as Gap Adventures) is a social enterprise and small-group adventure travel company that brings travelers closer to society and its culture. G Adventures is capitalizing on the social connectivity trend by providing an opportunity for local communities to connect and socialize with travelers seeking cultural exploration. Luxury travel requires more luxurious (and expensive) accommodations than traditional travel. Things like first-class facilities, better furniture, and high-end amenities contribute to the higher cost. Many customers across the U.S. are investing in luxury travel on special occasions such as honeymoons and celebration journeys. At the same time, an average traveler is unable to afford luxury travel, thus restraining the market growth.

Moreover, luxury consumers spend over six times more on travel than the amount spent by an average consumer. The average vacation for one person in the U.S. costs about USD 1,919 per week or per trip; however, luxury consumers spend USD 5,365 per trip, according to the blog published by Pacaso in August 2022.

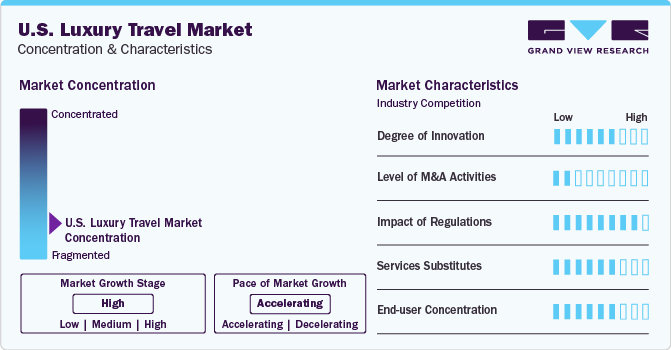

Market Concentration & Characteristics

Market growth stage is moderate, and pace is accelerating. The increasing preference for customized and private vacations, safaris and adventures, cruises and yachting, and culinary travel and shopping are expected to attract new players over the forecast period.

The market is also characterized by a low level of merger and acquisition (M&A) activity by the leading players. Acquisitions play a pivotal role in the market by enabling companies to expand their offerings, tapping into new demographics, and enhancing their portfolio with exclusive experiences.

The market is also subject to moderate regulatory scrutiny. Governments and international bodies are imposing stricter regulations on carbon emissions from travel. Luxury travel providers in the U.S. may face mandates to measure and offset their carbon footprint.

There are moderate number of tour type substitutes for U.S. luxury travel. Budget trips could act as affordable alternatives to luxury travel, especially for consumers looking for cheaper and cost-effective travel options.

End-user concentration is a significant factor in the U.S. market. Consumer trends in the U.S. market are driven by the preferences and behaviors of high-net-worth individuals seeking exclusive and exceptional travel experiences.

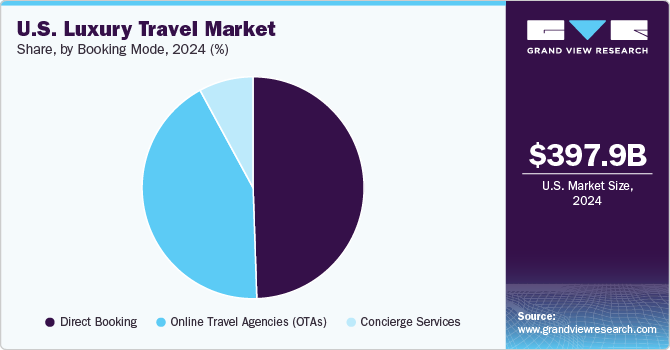

Booking Mode Insights

The direct booking segment dominated the market with a share of around 50% in 2023. The widespread availability of offline channels and their well-established and extensive networks across the U.S. are key factors boosting segment growth. Generation X and baby boomers comprise major share of tourists in the U.S. market. Individuals in these generations are most likely to book their tours through travel agencies and other offline channels that provide convenient and easy services.

The online travel agencies segment is estimated to expand at the fastest CAGR during the forecast period. Online booking is extremely common in the U.S. market and can be done through online travel platforms such as Expedia, Inc.; Booking Holdings, Inc.; Airbnb, Inc.; and TripAdvisor, Inc. A May 2023 article by Today’s Homeowner highlighted the growing prominence of online platforms and the importance of brand websites in capturing customer bookings and revenue in the U.S. market.

Tour Insights

The safari & adventure segment dominated the market with a revenue share of around 35% in 2023. In the U.S., luxury safari tourism packages have also become available for domestic and international destinations including remote areas of Africa, as well as in India, and often include luxury tent accommodations rather than hotels. Luxury tents, commonly known as "Glamping" accommodations, are primarily employed for group experiences during safaris or outdoor-focused tours. These tents typically have modern amenities, including private bathrooms and showers, and frequently feature elegant teak floorings. Luxury safari tours generally also have an on-site personal guide available for the duration of each tour. These luxurious stays highly impact the perception and experience of travelers looking for luxury travel. Such offerings are likely to propel segment growth.

The culinary travel & shopping segment is expected to grow at the fastest CAGR during the forecast period. Culinary travel, often referred to as food tourism packages, encompasses travel offerings, including food and beverages. These packages are tailored to include destinations, sites, attractions, or events with a focus on the culinary aspect. The central objective of culinary travel is to immerse oneself in the distinctive food and drink of a specific region or locale while gaining insights into its culture.

Age Group Insights

The baby boomers segment dominated the market with a revenue share of around 44% in 2023. Baby boomers are independent travelers who tend to visit many places, and most of them prefer taking a world cruise, a long vacation on a luxury cruise liner, exotic ports, upscale safaris, and visiting multiple adventurous destinations. According to Squaremouth, a travel insurtech company, in 2022, baby boomers noted the highest increase in both the total number of travelers and overall travel insurance in the first two quarters of the year 2022.

The millennials segment is expected to grow at the fastest CAGR during the forecast period. Millennials are reshaping the luxury travel industry. According to a blog post by Expedia in 2020, millennials in U.S. travel more than other generations. Also, as per the same source, in 2019, the average U.S. millennial planned to take five trips, including three overseas, with a total budget of USD 4,400, compared to an annual travel budget of USD 5,400 for Generation X and USD 6,600 for Baby Boomers. This age group also shows a preference for experiencing the history and traditions of the country they visit.

Key Companies & Market Share Insights

The market for U.S. luxury travel is highly competitive, with numerous businesses offering a range of tours. To stay competitive, several key players are prioritizing new tour offerings, collaborations, and expanding into untapped markets.

Abercrombie & Kent USA, LLC stands as a prominent luxury travel and tourism player, delivering a wide array of tours across 100 countries spanning all seven continents. The company provides destination tours, small group journeys, cruises, private jets, and personalized trips. The company offers luxury trips to Alaska and various national parks as part of its portfolio for U.S. tours. Alaska Small-Group Tours, Journeys with Private Air, and many others.

Key U.S. Luxury Travel Companies:

- Abercrombie & Kent USA, LLC

- Lindblad Expeditions

- Scott Dunn Ltd.

- Brownell Travel

- All Roads North

- Kensington Tours Ltd.

- Tully Luxury Travel

- Black Tomato

- Pique Travel Design

- The Luxury Travel Agency

Recent Developments

-

In November 2023, Lindblad Expeditions extended its partnership with National Geographic for 17 more years. This unlocks global opportunities, granting exclusive rights to the National Geographic brand for expedition cruises. The partnership further includes distribution through Walt Disney Co.'s sales channels, joint marketing initiatives, and on-board enhancements, strengthening the connection to the renowned NatGeo brand for an enhanced expedition experience.

-

In June 2023, Scott Dunn Ltd. announced its plans to open its second office in the U.S. in August 2023. The office is located in Bryan Park, Manhattan, and is the center for handling marketing, business development, and sales. The U.S. expansion undertaken by the company is a result of its strong performance in the region post-pandemic.

U.S. Luxury Travel Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 397.91 billion

Revenue forecast in 2030

USD 634.27 billion

Growth rate

CAGR of 8.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Tour, age group, booking mode

Country scope

U.S.

Key companies profiled

Abercrombie & Kent USA, LLC; Lindblad Expeditions; Scott Dunn Ltd.; Brownell Travel; All Roads North; Kensington Tours Ltd.; Tully Luxury Travel; Black Tomato; Pique Travel Design; The Luxury Travel Agency

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Luxury Travel Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2018 to 2030. For this report, Grand View Research has segmented the U.S. luxury travel market based on tour, age group, and booking mode.

-

Tour Outlook (Revenue, USD Billion, 2018 - 2030)

-

Customized & Private Vacations

-

Safari & Adventure

-

Cruises, Yachting and Small Ship Expeditions

-

Celebration Journeys

-

Culinary Travel & Shopping

-

Others

-

-

Age Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

Millennial

-

Generation X

-

Baby Boomers

-

Silver Hair

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct Booking

-

Online Travel Agencies (OTAs)

-

Concierge Services

-

Frequently Asked Questions About This Report

b. The U.S. luxury travel market was estimated at USD 370.11 billion in 2023 and is expected to reach USD 397.91 billion in 2024.

b. The U.S. luxury travel market is expected to grow at a compound annual growth rate of 8.1% from 2024 to 2030 to reach USD 634.27 billion by 2030.

b. The safari & adventure segment dominated the U.S. luxury travel market with a share of around 35% in 2023. Several travelers are seeking places that provide a sense of adventure and thrill to their otherwise routine coupled with exploring new places of relaxation is driving the growth of the segment.

b. Some key players operating in the U.S. luxury travel market include Abercrombie & Kent USA, LLC; Lindblad Expeditions; Scott Dunn Ltd.; Brownell Travel; All Roads North; Kensington Tours Ltd.; Tully Luxury Travel; Black Tomato; Pique Travel Design; The Luxury Travel Agency.

b. Key factors that are driving the U.S. luxury travel market include the evolving trend of transformational travel surrounding wellness trips, and rising preference of customized and private tours.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."