- Home

- »

- Next Generation Technologies

- »

-

U.S. Maritime Safety System Market Size, Share Report, 2033GVR Report cover

![U.S. Maritime Safety System Market Size, Share & Trends Report]()

U.S. Maritime Safety System Market (2025 - 2033) Size, Share & Trends Analysis Report By System Type (Automatic Identification Systems, Navigation & Surveillance Systems), By Component (Hardware, Software), By Application, By End Use And Segment Forecasts

- Report ID: GVR-4-68040-636-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Maritime Safety System Market Trends

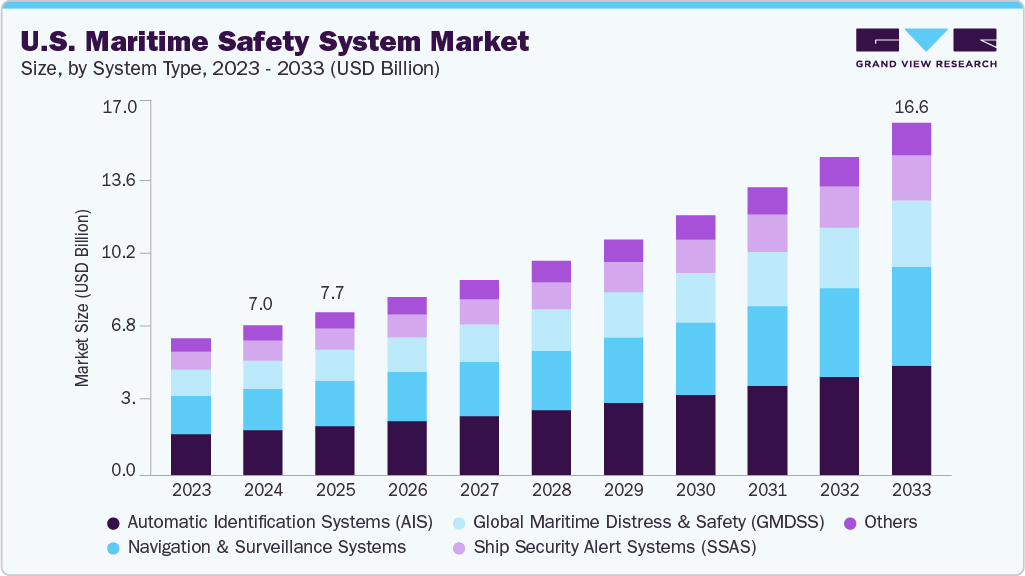

The U.S. maritime safety system market size was estimated at USD 7,038.4 million in 2024 and is projected to reach USD 16,630.7 million by 2033, growing at a CAGR of 10.1% from 2025 to 2033.The U.S. coast guard has prioritized cybersecurity as a cornerstone of maritime safety, culminating in the final rule on Cybersecurity in the Marine Transportation System, effective July 2025.

This regulation mandates that U.S.-flagged vessels and facilities develop Cybersecurity Plans, designate Cybersecurity Officers, and establish protocols for incident response and recovery. The rule responds to a surge in cyber threats, including an 80% increase in ransomware incidents targeting maritime entities between 2022 and 2023. Notably, the 2024 Cyber Trends and Insights in the Marine Environment (CTIME) report highlighted vulnerabilities in ship-to-shore cranes manufactured in China, prompting enhanced supply chain scrutiny. These measures align with the International Maritime Organization’s (IMO) guidelines on cyber risk management, which advocate integrating cyber resilience into existing safety management systems.

To address a critical shortage of skilled mariners, the Maritime Administration (MARAD) has expanded educational initiatives, including the Military to Mariner (M2M) program and partnerships with six state maritime academies. As of January 2025, over 500 institutions offer maritime-related curricula, supported by MARAD’s Centers of Excellence Program. This focus on education aims to replenish a workforce that has dwindled since World War II, when 243,000 mariners served compared to modern numbers. The Coast Guard further complements these efforts through its Maritime Cyber Readiness Branch, which trains personnel to address cyber-physical threats in operational technology systems.

Anticipating the rise of autonomous vessels, the U.S. collaborates with the IMO to develop a Maritime Autonomous Surface Ships (MASS) Code, slated for finalization in 2026. While not yet mandatory, the code outlines safety protocols for remotely operated and fully autonomous ships, emphasizing collision avoidance and emergency override systems. The Coast Guard’s Marine Transportation Systems Specialists Cyber (MTSS-C) now advise districts on integrating autonomous technologies, reflecting a shift toward human-machine collaboration in navigation. These efforts ensure that regulatory frameworks evolve alongside advancements in artificial intelligence and satellite-based dynamic routing systems.

Modern risk management increasingly relies on IoT-enabled sensors and real-time data analytics to preempt operational failures. The 2025 cybersecurity regulations require facilities to deploy systems that monitor container conditions (e.g., temperature, pressure) and detect anomalies indicative of leaks or fires. Coast Guard Cyber Protection Teams (CPTs) reported a 60.1% success rate in brute-force password cracking during 2023 missions, underscoring the need for robust access controls. Ports have also adopted AI-driven predictive analytics to optimize traffic flow and reduce collision risks, contributing to a 22% decline in reported marine incidents since 2022.

System Type Insights

The automatic identification systems (AIS) segment led the market with the largest revenue share of 30.2% in 2024. AIS adoption is being propelled by growing regulatory compliance and port digitization mandates across the U.S. maritime sector. The U.S. Coast Guard requires AIS usage on a broad range of commercial vessels, boosting market growth as operator’s upgrade to Class A/B systems for enhanced tracking and real-time vessel identification. Rising integration with satellite-based AIS and collision-avoidance algorithms has further amplified its use in congested coastal waters, driving consistent demand across both inland and ocean-going fleets.

The navigation & surveillance systems segment is expected to experience at the fastest CAGR over the forecast period. The market for navigation and surveillance systems is witnessing strong momentum due to increasing investments in autonomous shipping and electronic chart display and information systems (ECDIS). These systems are critical for situational awareness, especially in restricted and weather-challenged waters. Integration with radar, GNSS, and dynamic positioning technologies is boosting their deployment across both commercial and defense applications, propelled further by the need for precision navigation and compliance with SOLAS safety standards.

Component Insights

The hardware segment accounted for the largest market revenue share in 2024. Hardware components, including radar units, transponders, VHF radio systems, and onboard sensors, continue to dominate market share, driven by the need for resilient, tamper-proof systems onboard vessels and coastal stations. The growing replacement of legacy systems with multi-function digital consoles is boosting hardware revenues. In addition, increasing incidents of spoofing and jamming have pushed demand for robust, encrypted hardware interfaces, further supporting market growth.

The software segment is expected to grow at the fastest CAGR over the forecast period. Software is emerging as a key growth segment, particularly as U.S. ports and fleet operators prioritize real-time analytics, route optimization, and predictive maintenance. Maritime safety software that integrates AIS, cybersecurity monitoring, and surveillance feeds is gaining traction. Demand is further propelled by the U.S. Coast Guard’s emphasis on cybersecurity and the rising role of cloud-based maritime domain awareness platforms.

Application Insights

The port & vessel security segment accounted for the largest market revenue share in 2024. Port and vessel security applications are witnessing heightened focus due to surging cyberattacks and physical threats on U.S. maritime infrastructure. Enhanced perimeter surveillance, biometric access control, and AI-based threat detection are increasingly being adopted by port authorities. The 2025 cybersecurity rule requiring vessel-specific incident response plans is further boosting the deployment of integrated safety systems across terminals and anchored fleets.

The search & rescue segment is expected to grow at the fastest CAGR during the forecast period. The search and rescue segment is gaining traction amid increasing coastal emergencies and extreme weather events, worsened by climate change. Investment in long-range unmanned aerial systems (UAS), high-resolution thermal cameras, and satellite distress signaling technologies is supporting rapid response operations. Programs by agencies like NOAA and the U.S. Coast Guard to enhance maritime SAR readiness are propelling growth in this segment.

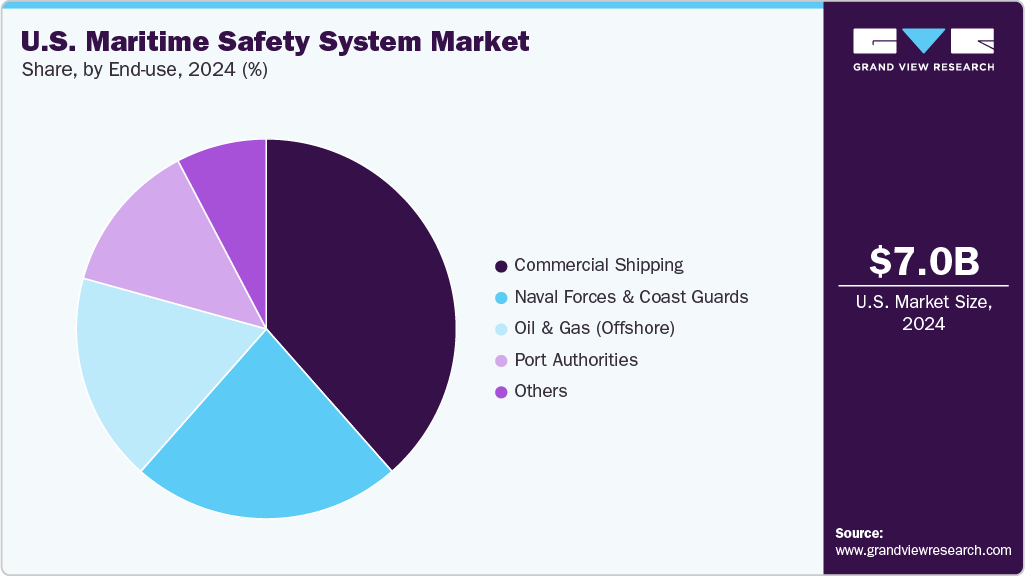

End Use Insights

The commercial shipping segment accounted for the largest market revenue share in 2024. Commercial shipping remains the dominant end use, as regulatory compliance with IMO standards, digital logbooks, and navigational risk mitigation systems becomes non-negotiable for operators. Upgrades to navigation, AIS, and cybersecurity systems are being boosted by insurance incentives and stricter Coast Guard inspections, especially for vessels operating in high-traffic routes such as the Gulf of Mexico and the Eastern Seaboard.

The oil & gas (offshore) segment is expected to grow at the fastest CAGR over the forecast period. In offshore oil and gas operations, maritime safety systems are increasingly deployed to safeguard assets from both environmental hazards and cyber-physical risks. The demand for automated safety systems, real-time hazard detection, and remote surveillance is rising, especially in deepwater rigs and FPSOs (Floating Production Storage and Offloading units). The need to comply with BOEM and BSEE safety requirements is further propelling adoption in this highly sensitive sector.

Key U.S. Maritime Safety System Company Insights

Some of the key companies in the U.S. maritime safety system industry include Anschütz, ARES Security Corporation, ATLAS ELEKTRONIK, BAE Systems, and others. These players are recognized for developing advanced safety and surveillance technologies, including command-and-control systems, coastal radar, underwater detection, and maritime domain awareness platforms tailored to U.S. Navy and homeland security needs. Their solutions are often aligned with U.S. government procurement standards, enabling widespread adoption across military, commercial, and port security applications. Their ability to innovate, meet mission-critical performance requirements, and deliver scalable systems that enhance situational awareness has established them as leaders in the domestic market.

-

Northrop Grumman plays a vital role in the U.S. maritime safety system industry through its expertise in naval defense technologies, integrated command systems, and advanced situational awareness solutions. The company supplies critical systems such as combat management, radar, sonar, and cyber-resilient communications tailored for naval fleets and coast guard operations. Its contributions are often integrated into high-priority defense programs, reflecting strong partnerships with the U.S. Department of Defense. With a focus on interoperability, threat detection, and real-time decision-making, Northrop Grumman strengthens the country’s maritime security infrastructure across both open-sea and littoral zones.

-

Honeywell International Inc. supports the maritime safety ecosystem with sophisticated automation, control, and safety technologies. It provides marine-specific solutions like environmental monitoring systems, fire and gas detection, and integrated bridge controls that are critical for safe vessel operations. Leveraging its broad industrial experience, Honeywell's offerings ensure compliance with maritime regulations and enhance operational efficiency on board both commercial and defense vessels. Its trusted reputation, wide-ranging portfolio, and emphasis on smart, connected safety systems contribute to its strong standing in the U.S. maritime safety industry.

Key U.S. Maritime Safety System Companies:

- Anschütz

- ARES Security Corporation

- ATLAS ELEKTRONIK

- BAE Systems

- HALO Arabia

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- Leonardo DRS

- Northrop Grumman

- Saab Group

- Thales

Recent Developments

-

In June 2023, Northrop Grumman was awarded a production contract for the AN/WSN-12 Inertial Sensor Module (ISM), a next-generation sensor enhancing maritime navigation for the U.S. Navy in GPS-denied environments. This system upgrades the existing AN/WSN-7 Inertial Navigator System, improving positioning accuracy and operational safety for naval ships, supporting the U.S. Maritime Safety System’s focus on secure and reliable navigation.

-

In July 2023, Honeywell acquired SCADAfence, a leading provider of cybersecurity solutions for OT and IoT networks, enhancing its capabilities in asset discovery, threat detection, and security governance for maritime operations. This move strengthens Honeywell’s portfolio in protecting maritime infrastructure from cyber threats, aligning with the growing emphasis on cybersecurity in the industry.

U.S. Maritime Safety System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7,678.6 million

Revenue forecast in 2033

USD 16,630.7 million

Growth rate

CAGR of 10.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

System type, component, application, end use

Country scope

U.S.

Key companies profiled

Anschütz; ARES Security Corporation; ATLAS ELEKTRONIK; BAE Systems; HALO Arabia; Honeywell International Inc.; L3Harris Technologies, Inc.; Leonardo DRS; Northrop Grumman; Saab Group; Thales

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Maritime Safety System Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. maritime safety system market report based on system type, component, application, and end use.

-

System Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Automatic Identification Systems (AIS)

-

Navigation & Surveillance Systems

-

Global Maritime Distress & Safety (GMDSS)

-

Ship Security Alert Systems (SSAS)

-

Others

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Port & Vessel Security

-

Search & Rescue

-

Communication & Emergency Response

-

Environmental & Accident Monitoring

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial Shipping

-

Naval Forces & Coast Guards

-

Oil & Gas (Offshore)

-

Port Authorities

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. maritime safety system market size was estimated at USD 7,038.4 million in 2024 and is expected to reach USD 7,678.6 million in 2025.

b. The U.S. maritime safety system market size is expected to grow at a significant CAGR of 10.1% to reach USD 16,630.7 million in 2033.

b. Automatic Identification Systems (AIS) held the largest market share of 30.2% in 2024. AIS adoption is being propelled by growing regulatory compliance and port digitization mandates across the U.S. maritime sector. The U.S. Coast Guard requires AIS usage on a broad range of commercial vessels, boosting market growth as operators upgrade to Class A/B systems for enhanced tracking and real-time vessel identification.

b. Some of the players in the U.S. maritime safety system market are Anschütz, ARES Security Corporation, ATLAS ELEKTRONIK, BAE Systems, HALO Arabia, Honeywell International Inc., L3Harris Technologies, Inc., Leonardo DRS, Northrop Grumman, Saab Group, and Thales.

b. The key driving trend in the U.S. maritime safety system market is the expansion of digital surveillance platforms like SeaVision, which integrate AIS, satellite tracking, and AI to enhance vessel monitoring and enforce maritime regulations, driven by growing Coast Guard collaborations and federal safety mandates.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.