- Home

- »

- Healthcare IT

- »

-

U.S. Medical Coding Market Size, Industry Report, 2033GVR Report cover

![U.S. Medical Coding Market Size, Share & Trends Report]()

U.S. Medical Coding Market (2025 - 2033) Size, Share & Trends Analysis Report By Classification System (ICD, HCPCS, CPT), By Component (In-house, Outsourced), By Medical Specialty (Oncology, Cardiology, Anesthesia), And Segment Forecasts

- Report ID: GVR-3-68038-025-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Medical Coding Market Size & Trends

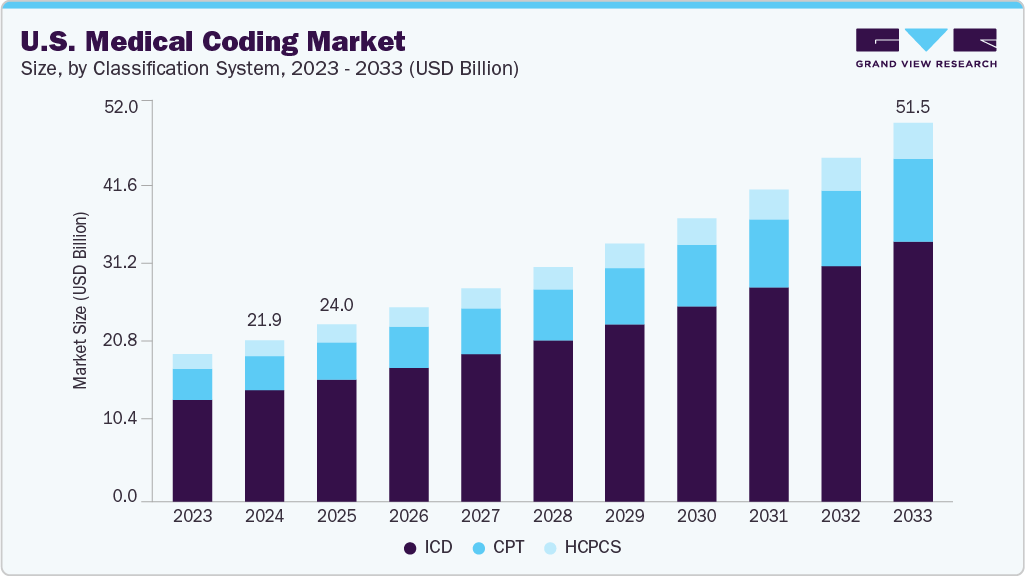

The U.S. medical coding market size was estimated at USD 21.89 billion in 2024 and is expected to grow at a CAGR of 10.00% from 2025 to 2033. Errors in billings, insurance fraud, and misinterpretations of medical documents result in large financial losses. Increasing losses due to ineffective medical billing and revenue cycle management are increasing the demand for revenue cycle management, including medical coding software and services. This, in turn, is estimated to drive market growth potential.

High adoption of digital technologies such as electronic health records, revenue cycle management software, mhealth applications, telehealth, and increasing efforts towards digitalization of healthcare in the U.S. are positively driving the growth of the U.S. medical coding industry. In 2021, about 88.2% of physicians' offices were using electronic health records in the U.S., as per data provided by the Centers for Disease Control and Prevention.

Moreover, increasing utilization of medical coding in the revenue cycle management process includes new revisions in codes to increase flexibility and scalability. The new ICD-11 was implemented in January 2022, including several new chapters that support electronic health records. It has approximately 55 thousand codes for the classification of disorders, diseases, injuries, and deaths. Moreover, many new codes were created during the COVID-19 pandemic for COVID-19 and telehealth. The World Health Organization introduced new ICD-10 codes, which came into effect between April and September 2020. Thus, the introduction and revisions of codes are positively impacting market growth

The Bureau of Labor Statistics, Office of Occupational Statistics and Employment Projections, estimated that the number of employees in medical records and health information is estimated to grow by 7% between 2021 and 2031. Certified medical coders are one of the most sought-after jobs in the U.S. Increasing demand for a universal language in medical documentation positively impacts the demand for medical coders and the coding industry.

The increasing workload on healthcare staff and physicians for medical coding is increasing the adoption of various automation solutions. For instance, according to a survey conducted by Athenahealth, physicians are working overtime for an average of 90 minutes for coding. There is an increase in the adoption of computer-assisted coding solutions for rapid, accurate, and efficient medical coding. Computer-assisted coding can increase productivity by 11-30%, as per a survey conducted by 3M.

Furthermore, the development of artificial intelligence (AI)-enabled medical coding is estimated to drive market growth. For instance, in August 2025, HGM Limited, through its U.S. subsidiary Healthcare Capital Holdings LLC (HCH), announced the acquisition of Aidéo Technologies LLC, a leader in AI-powered autonomous coding solutions. This acquisition expands HGM’s capabilities in revenue cycle management (RCM), medical coding, and healthcare analytics.

“Acquiring Aidéo Technologies is a major step towards our goal of building a comprehensive AI-driven healthcare services platform. Aidéo’s Autonomous Coding Platform, built on advanced AI, natural language processing, real-time analytics, and Large Language Models (LLM), delivers accuracy that surpasses manual and traditional CAC tools. Its HL7 interoperability ensures seamless communication with industry standard EHR systems, supporting surgical specialties, emergency departments, anesthesia, radiology, and RCM companies across the U.S.”

-Dr. Bhargav Thakkar, EVP Healthcare of HGM Limited.

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaboration activities, degree of innovation, impact of regulations, and regional expansion. The U.S. medical coding market is fragmented, with the presence of several software and solution providers dominating the market. The degree of innovation, the level of merger & acquisition activities, and the impact of regulations on the industry are high. Moreover, the product substitutes in the industry is moderate.

The U.S. market for medical coding is constantly evolving with the frequent introduction of new technologies and methods. Technological advancements are expected to increase the number of platforms for medical coders, which is expected to aid in the growth of the market. In addition, big data and predictive analytics applications have expanded the healthcare value chain, particularly in drug discovery, genomic research, and clinical trials. For instance, in November 2024, Maverick Medical AI launched Maverick CodePilot, an innovative real-time medical coding solution that integrates with physicians' workflows at the point of care.

Several market players, such as Verisk Analytics, Inc.; Verisk Analytics, Inc.; and Oracle Corporation, are involved in merger and acquisition activities. Through M&A activity, these companies expand their geographic reach and enhance their product and service offerings. For instance, in October 2022, National Medical Billing Services, a leading healthcare revenue cycle management (RCM) company focused on the surgical market, announced the acquisition of MedTek, LLC, a prominent provider of RCM solutions to ambulatory surgery centers (ASCs), hospitals, clinics, and specialty groups across nearly 50 states.

"We are constantly evaluating strategies to add value for clients, and we are ecstatic to partner with the MedTek team to further expand our offering."

- Nader Samii, National Medical's CEO

Regulations have a significant impact on medical coding market players. Constantly changing healthcare regulations can affect the demand for medical coding services and revenue of companies in this market.

Substitutes to medical coders are difficult to find. Internal substitutes, including outsourcing of medical coding, can lead to internal competition. Companies in this industry are vertically integrated, performing all activities from R&D to aftersales services.

Classification System Insights

The ICD segment led the U.S. medical coding market with the highest revenue share of over 69.0% in 2024, owing to the growing use of ICD codes by coders. ICD-11, which was effective from 1st January 2022, is accurate and flexible. It allows health information to be utilized for multiple applications, such as enhancement in patient outcomes, quality analysis, safety, integrated care, strategic planning, population health reporting, and delivery of health care services.

ICD-11 codes are easy to use, allowing the embedding of the coding tool into local digital records and information technology systems. This results in an increase in user compliance, as well as lowered cost and time for training. Multiple ICD codes and multiple revisions to suit the rapidly evolving health industry are driving segment growth.

The CPT segment is anticipated to grow at the fastest CAGR during the forecast period. CPT codes are part of HCPCS codes and are used for describing tests, surgery, and other procedures. They are also used for medical billing. The government tracks CPT codes for assessing disease prevalence and health spending. HCPS codes are used by Medicaid, Medicare, and third-party insurers, and their usage is mandatory under the Health Insurance Portability and Accountability Act (HIPAA) in the U.S., which in turn is driving their adoption.

Medical Specialty Insights

The anesthesia segment led the U.S. medical coding industry with the largest share of 10.80% in 2024. Accurate coding is essential for reimbursement, as anesthesia billing depends on multiple factors such as procedure type, duration, and patient condition. The complexity of anesthesia coding, including the use of time units and modifiers, drives demand for specialized coders. Hospitals and ambulatory surgery centers rely on accurate documentation to prevent claim denials. This growing procedural volume and complexity support significant segment expansion.

The cardiology segment is expected to witness growth at the fastest CAGR during the forecast period. Cardiology-related costly treatment procedures require medical coding services, as it improves the effectiveness of these procedures and helps manage medical billing, patient care, & other workflows, particularly when patients are among the largest group of payers. With the rising prevalence of cardiovascular diseases, the workload on payers and hospital staff increases, thereby propelling the segment growth.

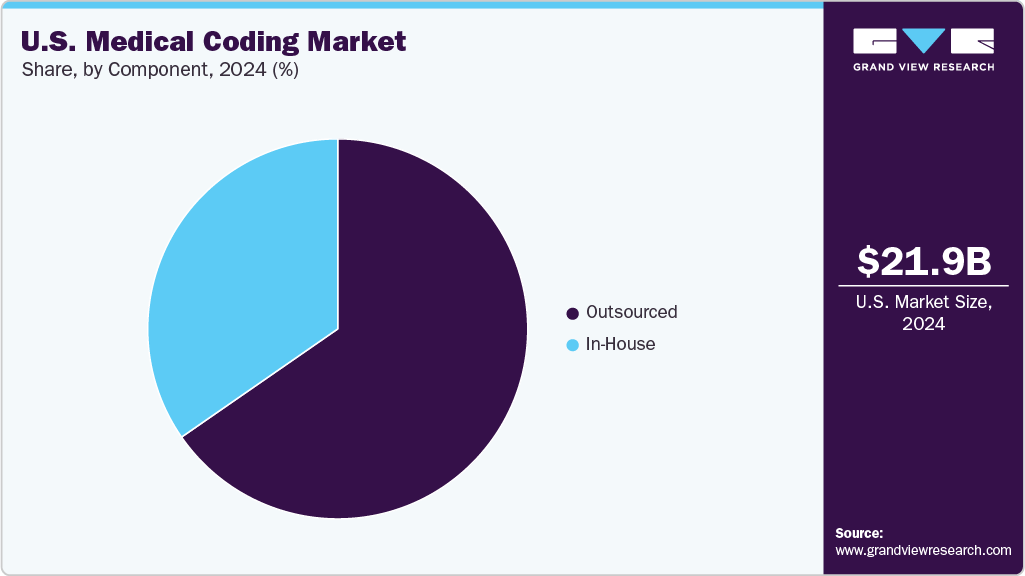

Component Insights

The outsourced segment accounted for the largest revenue share of 69.69% in 2024. Healthcare providers are increasingly outsourcing their medical coding requirements to reduce administrative costs. Outsourcing helps in cost reduction, saves time, and streamlines workflow. Thus, healthcare providers can focus on quality patient care and patient engagement. Rising in offshoring and onshoring of revenue cycle management, along with medical coding, are positively impacting the growth of the U.S. medical coding industry. For instance, in August 2021, GeBBS Healthcare Solutions acquired Aviacode, a Salt Lake City-based medical coding and compliance service provider, to expand its technology-enabled Revenue Cycle Management (RCM) services. This acquisition enhances GeBBS's end-to-end RCM offerings, expands its U.S.-based delivery capabilities, and strengthens its medical coding, audit, and clinical documentation improvement portfolio.

The in-house segment is estimated to witness steady growth during the forecast period. Through in-house medical billing, coding, and revenue cycle management, healthcare providers can retain control over entire operations. Moreover, in case of errors, in-house coders are easily accessible. However, the high cost associated with in-house coding owing to the requirement of skilled coders, software, and infrastructure is increasing the adoption of outsourcing. The outsourcing component is the fastest-growing segment owing to its advantages, such as reduction in operating costs, claim denials, and increased scalability.

Key U.S. Medical Coding Company Insights

The U.S. medical coding market landscape is fragmented, with the presence of several small companies holding a majority stake. New expansion activities, product approvals, product launches, partnerships, and acquisitions have positively impacted the market in recent years.

Key U.S. Medical Coding Companies:

- STARTEK

- Oracle

- Maxim Healthcare Services

- Parexel International Corporation

- Aviacode Inc.

- Precyse Solutions, LLC

- Verisk Analytics, Inc.

- Medical Record Associates, LLC.

Recent Developments

-

In August 2025, Infinx partnered with Maverick AI to introduce instant autonomous medical coding for revenue cycle management. This strategic collaboration combines Maverick’s advanced AI-powered coding agents with Infinx’s AI-driven revenue cycle platform, enabling real-time clinical summarization, autonomous code assignment, and scalable workflow automation.

“Medical coding undoubtedly remains one of the significant challenges within today’s revenue cycle landscape. The solution devised by Maverick’s team is exceptional-AI that comprehends clinical context and delivers outcomes with unparalleled speed and precision.” -Jaideep Tandon, CEO of Infinx.

-

In October 2024, Corti partnered with Tanner Health and Healthliant Ventures to accelerate medical coding, reducing administrative workload by 80% and improving billing accuracy.

-

In January 2023, AQuity expanded their coding solutions portfolio with the launch of QCode AI Autonomous Coding.

U.S. Medical Coding Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 24.01 billion

Revenue forecast in 2033

USD 51.46 billion

Growth rate

CAGR of 10.00% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Classification system, component, medical specialty

Country scope

U.S.

Key companies profiled

StarTek; Oracle; Maxim Healthcare Services; Parexel International Corporation; Aviacode Inc.; Verisk Analytics, Inc.; Medical Record Associates, LLC.; Precyse Solutions, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Medical Coding Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research, Inc. has segmented the U.S. medical coding market report based on classification system, component, and medical specialty:

-

Classification System Outlook (Revenue, USD Million, 2021 - 2033)

-

ICD

-

HCPCS

-

CPT

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

In-house

-

Outsourced

-

Onshore

-

Offshore

-

-

-

Medical Specialty Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Cardiology

-

Anesthesia

-

Radiology

-

Pathology

-

Pain Management

-

Emergency Services

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. medical coding market size was estimated at USD 21.89 billion in 2024 and is expected to reach USD 24.01 billion in 2025.

b. The U.S. medical coding market is expected to grow at a compound annual growth rate of 10.00% from 2025 to 2033 to reach USD 51.46 billion by 2033.

b. ICD dominated the U.S. medical coding market with a share of over 69% in 2024.

b. Some key players operating in the U.S. medical coding market include StarTek; Oracle; Maxim Healthcare Services; Parexel International Corporation; Aviacode Inc.; Verisk Analytics, Inc.; Medical Record Associates, LLC.

b. Key factors that are driving the U.S. medical coding market growth include the growing importance of evidence-based medicine, pharmacoeconomic risk-benefit analysis of different drugs and medical devices, and the need for insurance settlements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.