- Home

- »

- Medical Devices

- »

-

U.S. Medical Copper Tubing Market Size, Trends, Industry Report, 2025GVR Report cover

![U.S. Medical Copper Tubing Market Size, Share & Trends Report]()

U.S. Medical Copper Tubing Market Size, Share & Trends Analysis Report By Tubing Type (Type K, Type L, DWV), By Application (Oxygen, Nitrogen, Carbon Dioxide, Nitrous Oxide), By End Use, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-205-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2015

- Forecast Period: 2016 - 2025

- Industry: Healthcare

Industry Insights

The U.S. medical copper tubing market size accounted for USD 0.5 billion in 2015 and is anticipated to grow at a CAGR of 4.1% during the forecast period. Medical copper tubing system is used for medical gas supply, including oxygen, nitrogen, carbon dioxide, and nitrous oxide.

The U.S. medical copper tubing market is driven by the growing demand for copper tubing for gas delivery due to its corrosion-resistant and antibacterial properties. These tubes are long-lasting and easy to install. In addition, all these products should meet regulatory standards like ASTM B819 and CSA.

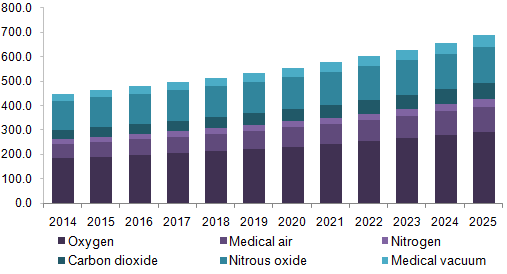

U.S. medical copper tubing market, by application, 2014 - 2025 (USD Million)

The ASTM B819 standard establishes the requirements for wall thickness range of specially cleaned & straight lengths of seamless copper tubes (Types K & L) suitable for medical gas systems. Thus, compliance of manufacturing and marketing standards & specifications for copper tubing products by manufacturers is expected to propel the industry growth. However, the intense competition among vendors is a major factor that could hinder industry growth.

Tubing Type Insights

The type K segment dominated the overall industry in terms of revenue in 2015. Increasing demand and high price of the products are some factors accounting for its large share. Type K segment has become the most profitable segment in this sector. The second-largest segment was type L, followed by DWV.

Application Insights

The oxygen segment dominated the overall industry in terms of revenue in 2015. The increasing demand for oxygen for patients and its growing applications are the major factors contributing to the large share. The presence of a large patient base with respiratory disorders and an increase in the patients undergoing emergency treatment are major factors responsible for the segment’s highest share.

On the other hand, medical vacuum is expected to grow at highest rate during the forecast period because of increasing use of copper tubing for safe and sufficient flow of medical vacuum at desired pressure levels to the gas outlets.

End-Use Insights

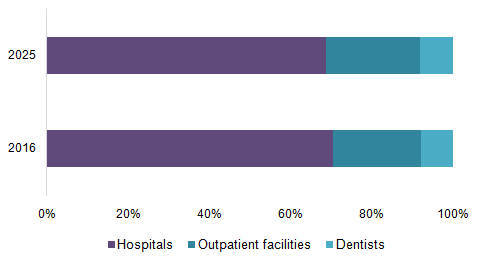

The hospital segment held the highest revenue share of over 70% in 2015. The high usage rate of the copper tubing system for medical gas delivery is most commonly seen in hospitals due to its benefits over traditional systems. The use of this system can provide continuous supply of required gas to the patient with lower risk of contamination. The demand for these products is growing in hospitals due to its advantageous in critical places, like ICU, OT, and CCU to ensure never-ending supply of gases. For instance, Nemours A.I. DuPont Children’s Hospital installed copper tubing system for various applications, such as gas and hot & cold water distribution.

U.S. medical copper tubing market by end use, 2016 & 2025 (USD Million)

On the other hand, its demand in the outpatient facilities is expected to grow at the fastest rate during the forecast period because of increasing adoption of copper tubing in outpatient facilities like surgery & imaging centers.

U.S. Medical Copper Tubing Market Share Insights

Some major players serving to this industry are Mueller Industries, Inc.; Cambridge-Lee Industries LLC; J & D Tube Benders, Inc.; BeaconMedaes; Cerro Flow Products LLC; C&H Medical (Guangzhou) Co., Ltd.; Samuel, Son & Co., Limited; Wieland Copper Products LLC; UACJ Corp.; KME Germany GmbH & Co KG; Amico Group of Companies; and The Lawton Tube Co. Ltd. There are many global and local manufacturers offering copper tubing products, resulting in intense competition amongst vendors.

Manufacturers are expanding their business by strategic collaborations and joint ventures. For instance, In February 2016, Mueller Industries announced acquisition of Jung woo Metal Ind. Co., Ltd., a copper-based pipe joining manufacturer in South Korea. Mueller Industries purchased 60 percent of equity interest of the company. This agreement is expected to help Mueller Industries expand its product portfolio and geographic reach for piping system products. In addition, focus on strengthening of distribution channels and product advancement is another major strategy applied by vendors to get maximum revenue share in this sector.

Report Scope

Attribute

Details

Base year for estimation

2015

Actual estimates/Historic data

2014 - 2015

Forecast period

2016 - 2025

Market representation

Revenue in USD Million & CAGR from 2016 to 2025

Regional scope

North America

Country scope

U.S.

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, trends

15% free customization scope: Equivalent to 5 analyst working days

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization.

Segments Covered in the Report

This report forecasts revenue growth and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the U.S. medical copper tubing market on the basis of tubing type, application, and end use:

-

Type Outlook (Revenue, USD Million; 2014 - 2025)

-

Type K

-

Type L

-

DWV

-

-

Application Outlook (Revenue, USD Million; 2014 - 2025)

-

Oxygen

-

Medical air

-

Nitrogen

-

Carbon dioxide

-

Nitrous oxide

-

Medical vacuum

-

-

End-use Outlook (Revenue, USD Million; 2014 - 2025)

-

Hospitals

-

Outpatient facilities

-

Dentists

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."