- Home

- »

- Medical Devices

- »

-

Medical Gas Market Size And Share, Industry Report, 2030GVR Report cover

![Medical Gas Market Size, Share & Trends Report]()

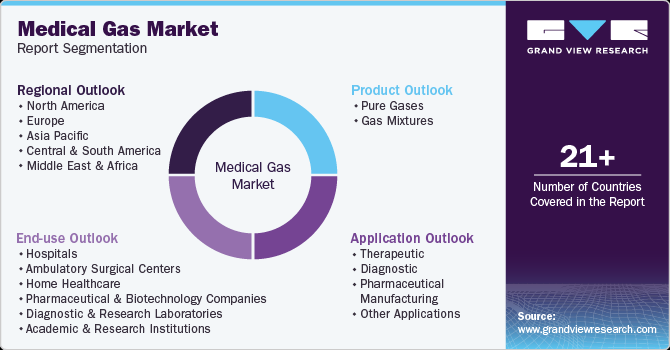

Medical Gas Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Pure Gases, Gas Mixtures), By Application (Therapeutic), By End Use (Hospitals, Ambulatory Surgical Centers, Home Healthcare, Pharmaceutical and Biotechnology Companies), By Region

- Report ID: 978-1-68038-125-2

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Gas Market Summary

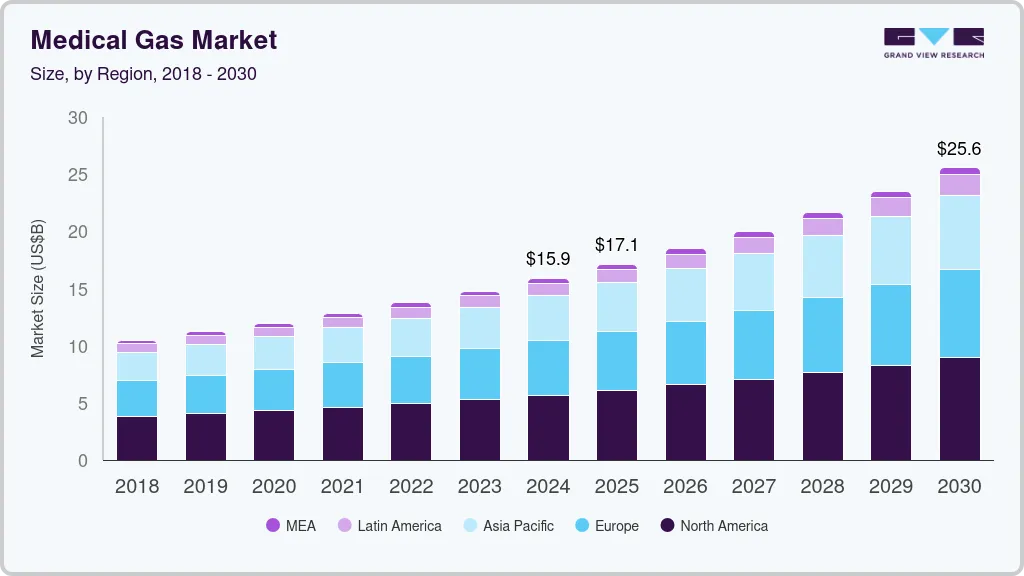

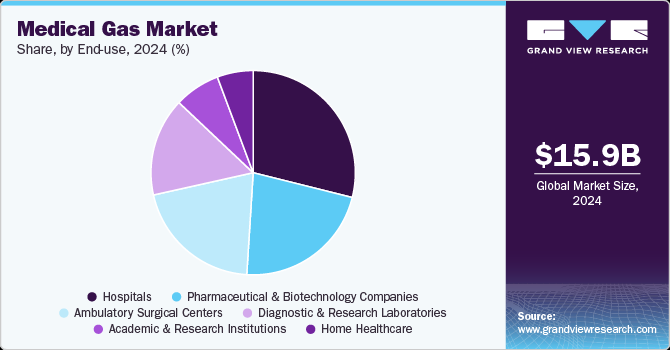

The global medical gas market size was estimated at USD 15,899.9 million in 2024 and is projected to reach USD 25,552.5 million by 2030, growing at a CAGR of 8.3% from 2025 to 2030. The rising prevalence of increasing Chronic Respiratory Diseases (CRDs) such as asthma and chronic obstructive pulmonary disease (COPD), growing awareness of home healthcare, increasing surgical procedures such as elective surgeries and minimally invasive procedures, and the growing aging population are some of the primary driving factors that contribute to market growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, pure gases accounted for a revenue of USD 9,721.6 million in 2024.

- Gas Mixtures is the most lucrative grade segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 15,899.9 million

- 2030 Projected Market Size: USD 25,552.5 million

- CAGR (2025-2030): 8.3%

- North America: Largest market in 2024

Percentage Of COPD, Emphysema, Or Chronic Bronchitis For Adults (Aged 18 And Over), U.S., 2019 - 2023

Year

COPD, emphysema, chronic bronchitis

2019

4.6

2020

5.0

2021

4.6

2022

4.6

2023

4.3

Source: National Center for Health Statistics

According to the National Center for Health Statistics (NCHS), as of 2023, the percentage of adults who have received a diagnosis of COPD, emphysema, or chronic bronchitis is 4.3%. Further, COPD is the fourth leading cause of death worldwide, according to the same source. In addition, around 64 million people are affected by COPD, which includes emphysema and chronic bronchitis, with 90% of them residing in low- and middle-income countries as per the NCD Alliance article.

The rising prevalence of Asthma is also further driving the demand for medical gases. According to the Australian Institute of Health and Welfare (AIHW), in 2023, asthma represented 2.5% of the overall disease burden and constituted 35% of the total burden associated with all respiratory conditions. Some of the most common medical gases used in hospitals are medical air, oxygen, nitrous oxide, nitrogen, and carbon dioxide.

Air Liquide Healthcare, one of the prominent players, helps more than 2 million individuals manage chronic diseases and supplies medical gases to 20,000 hospitals along with emerging healthcare facilities. Medical gases such as oxygen, lung gas mixtures, and heliox are used extensively in treating and diagnosing these respiratory disorders.

There is also a growing preference for home-based healthcare, leading to an increased demand for portable medical gases, including oxygen concentrators. This shift emphasizes convenience and continuity of care for chronic patients, ensuring they receive necessary oxygen therapy at home. The demand for home healthcare has surged in recent years and is expected to persist in the future. Many medical conditions, including those that necessitate long-term oxygen therapy, mixed gas treatments, and ventilation support, can now be effectively managed at home. Further, growing reimbursement for home healthcare is expected to fuel the market growth over the forecast period. For instance, in November 2023, Iowa Medicaid officially included the Firesafe Cannula Valve in its coverage, assigning it the HCPCS code E0700 for reimbursement. This innovative device acts as a thermal fuse, automatically halting the flow of oxygen if the oxygen tubing downstream ignites. In the UK, the installation of thermal fuses is a compulsory requirement for all home oxygen setups. Notably, the risk of fatality from oxygen-related fires is 20 times higher in the US compared to England, where the use of firebreaks has been mandated since 2006.

The growing aging population susceptible to chronic conditions is foreseen to drive the demand for medical gases indirectly. The aging population is more vulnerable to chronic diseases owing to weakened immune responses. For instance, according to the World Health Organization report published in October 2024, by 2050, approximately 80% of the elderly population will reside in low- and middle-income countries.

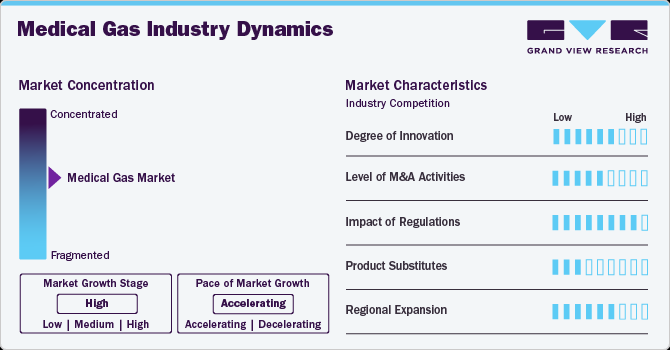

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The rise in chronic conditions such as respiratory diseases, heart ailments, and obesity contributes to a greater need for medical gases, especially oxygen therapy and ventilation support.

The medical gas market is witnessing a notable degree of innovation driven by advancements in technology, evolving patient needs, and the push for improved healthcare delivery. Key areas of innovation include the development of advanced gas delivery systems, new gas mixtures, and enhanced monitoring solutions, which are transforming how medical gases are utilized in various healthcare settings. One significant innovation is the advent of portable oxygen concentrators and home-based gas therapy devices. These systems allow patients to receive oxygen therapy conveniently at home, improving their quality of life while reducing hospital readmissions.

Regulatory bodies play a critical role in shaping the growth of the medical gas market. Regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), are responsible for ensuring that devices meet rigorous safety and efficacy requirements before they can be marketed. This involves comprehensive preclinical and clinical testing, which can extend the time to market but ultimately enhance patient safety. For instance, in July 2024, the U.S. FDA released a new legally binding regulation that establishes certification requirements for medical gases and modifies existing Good Manufacturing Practices (GMP), product safety reporting, and labeling standards. For several years, the FDA has collaborated with stakeholders and Congress to evaluate the necessity for regulatory updates in the medical gas manufacturing sector. The publication titled "Current Good Manufacturing Practice, Certification, Post marketing Safety Reporting, and Labeling Requirements for Certain Medical Gases" outlines the regulatory responsibilities for companies involved in the manufacturing, processing, packaging, labeling, or distribution of medical gases. According to the Federal Food, Drug, and Cosmetic Act 575(1), specific gases are classified as medical gases. In addition, in November 2023, The International Association of Plumbing and Mechanical Officials (IAPMO) released the Manual of Recommended Practice for Medical Gas Resiliency, which offers a thorough strategy for ensuring the availability and effectiveness of medical gases in healthcare facilities.

The medical gas market is poised to experience robust mergers and acquisitions (M&A) activity as companies look to expand their product portfolios and strengthen their competitive positioning. For instance, in October 2023, Atlas Copco announced the acquisition of William G. Frank Medical Gas Testing and Consulting, LLC, a provider of services and inspections for medical gas systems, along with Medical Gas Credentialing LLC. Both companies are located in Concord, New Hampshire, USA.

Emerging substitutes and alternative trauma care products, such as other medications (topical anesthetics), can be used for pain relief during medical procedures over nitrous oxide gas.

The global medical gas market is expanding across various regions, driven by increasing advancements in trauma care. While mature markets in North America and Europe continue to dominate, emerging markets in Asia Pacific, Latin America, and the Middle East are showing considerable growth potential due to the increasing global prevalence of chronic diseases, coupled with an aging population, has created greater demand for medical oxygen, nitrous oxide, and other gases used in healthcare settings.

Product Insights

The pure gases segment held the largest revenue share of over 56.80% in 2024. The increasing number of patient hospitalizations, rising prevalence of chronic diseases, and road accidents worldwide are major factors driving the segment expansion. For instance, as per the WHO report published in December 2023, about 1.19 million people die annually due to road traffic accidents. These injuries are the leading cause of death among children and young adults aged 5 to 29 years.

In pure gases, the oxygen segment is expected to witness the fastest CAGR of 8.48% during the forecast period. Oxygen is a base for all modern anesthetic procedures and life support for artificially ventilated patients because it plays an important part in respiratory support. In several conditions such as cyanosis, COPD, ventilators during anesthesia, shock, severe bleeding, respiratory/cardiac arrest, and significant trauma, the gas is critical in restoring tissue oxygen tension by increasing oxygen availability. According to a research article published in the Journal of Cardiac Failure (JCF) in January 2025, around 6.7 million Americans aged 20 and older are currently living with heart failure (HF), and this number is projected to increase to 8.7 million by 2030, 10.3 million by 2040, and reach 11.4 million by 2050. As a result, the growing number of cardiovascular-associated problems and diseases are expected to contribute to market growth over the forecast period.

Oxygen is typically delivered in gas cylinders and is administered to patients using a face mask that can hold around 60% of oxygen or a tight-fitting anesthetic-type mask that can hold up to 100% of the oxygen. Furthermore, according to the Pharma Review, 20-40% oxygen is commonly used in the treatment of COPD, 40-60% oxygen is used in the treatment of bronchial asthma, and 100% oxygen is utilized in the treatment of severe hypoxia and noxious gas poisoning, all of which propelling this segment's growth. In addition, patients admitted to intensive care units (ICUs) and ambulatory care for numerous surgeries also require oxygen gas for life support. The source and storage of oxygen are the most critical factors in the oxygen system needed at a medical facility. The typical components of an oxygen system found across all healthcare settings are illustrated above in the figure titled components of the oxygen system.

Application Insights

The therapeutic application segment held the largest revenue share of around 40.10% in terms of revenue in 2024 owing to a broad range of medical gases that are used to treat and manage various disease conditions. Gases utilized for therapeutic purposes are classified as medicines and must meet stringent purity and quality requirements. Therapeutic gases mainly include oxygen, nitrous oxide, carbon dioxide, and mixtures of helium and oxygen. Medical oxygen is widely used in all healthcare settings, from anesthesia, and surgery, to inhalation therapy.

Medical nitrous oxide gas is commonly used for anesthesia, pain relief, Inflating the abdominal cavities during a laparoscopy (an investigative operation), and also as a refrigerant in cryosurgery. In minimally invasive surgery (laparoscopy, endoscopy, and arthroscopy), carbon dioxide is frequently utilized as an insufflation gas to widen and stabilize body cavities in order to enhance the visibility of the operating area.

The diagnostics segment is expected to grow at the fastest CAGR of 8.95% during the forecast period. This growth is attributable to its rising use in medical imaging and general laboratory applications. Controlled aerobic or anaerobic incubator environments for biological cell culture or tissue growth are among the culture growth applications used in laboratories. Controlled aerobic conditions are made with oxygen-rich mixtures, whereas anaerobic conditions are produced with hydrogen or carbon-dioxide-rich mixtures.

Moreover, they are usually used for patient diagnostics, such as blood gas analysis and lung function testing. For instance, liquid helium is required in MRI to cool down superconductive magnet coil scanners. In addition, test gases are utilized to calibrate and maintain medical instruments that provide anesthetic gases. Thus, varied usage of these gases in diagnostics is expected to propel segment growth.

End Use Insights

The hospital segment dominated the market and accounted for a revenue share of 26.75% in terms of revenue and it is also expected to grow at the fastest CAGR of 8.89% during the forecast period. In hospitals, all types of commercially available medical gases, such as oxygen (O2), nitrogen (N2), medicinal air, carbon dioxide (CO2), and nitrogen protoxide (N2O), are widely used. The use of medical gases in medical procedures such as surgeries, intensive care, and emergency response, as well as the high prevalence of medical procedures performed worldwide, contribute to the segment's dominance. For instance, as per an article published by News-Medical, globally, approximately 374 million people require medical oxygen each year, with around 82% of these individuals residing in low-income and middle-income countries. As the global population continues to grow and the demand for surgical procedures and long-term oxygen therapy increases, the need for medical oxygen is on the rise. Alongside acute medical requirements, approximately 9.2 million individuals with chronic obstructive pulmonary disease (COPD) require long-term oxygen therapy (LTOT) each year, but access to LTOT is virtually non-existent in many low-resource settings.

The home healthcare segment is expected to witness a significant growth rate during the forecast period. The trending shift from hospital to home care is a key enabler of this segment's growth. In line with this trend, regulatory bodies are gradually paving the way for a robust establishment of this segment. Patients with a variety of respiratory illnesses, such as pneumonia, COPD, and lung cancer, are also gravitating toward portable devices. This will increase demand for the product in-home care settings. Technological innovations have expanded the functionality options for numerous medical gas handling equipment used in-home care. The advent of lightweight and portable medical gas handling equipment has proven to be a boon to the home healthcare market's growth.

Furthermore, in the last five years, medical gas cylinder technology has advanced remarkably. Lightweight, non-limited life (NLL) composite cylinders have recently hit the market and are forecasted to play a significant role in the development of innovative homecare treatments, portable oxygen therapies, and medical gas applications in the coming years. These products offer considerable benefits to patients in the homecare setting, addressing the end user's desire for a lightweight cylinder that is far lighter than aluminum cylinders. Therefore, such advancements in medical gas equipment are contributing to fueling the market growth.

Regional Insights

North America medical gas market dominated the global market and accounted for a revenue share of 35.65% in 2024 and is expected to witness a considerable growth rate over the forecast period. This steady growth is attributed to the rising use of medical gases in the treatment of respiratory diseases such as COPD and asthma. The rising prevalence of COPD, asthma, and other medical conditions, such as cardiovascular and lifestyle-related diseases, are predicted to drive demand for medical gases in the U.S. during the projected timeline. Moreover, the presence of advanced healthcare facilities, particularly intensive care units, a well-established market, and a growing geriatric population have all contributed to the U.S. capturing the major share of the market.

U.S. Medical Gas Market Trends

Themedical gas market in the U.S.held a significant share of the market in 2024 driven by the increasing prevalence of respiratory and cardiovascular diseases, increasing demand for medical gases in healthcare settings, expansion in the hospital infrastructure, and advancements in medical technologies. For instance, according to the American Lung Association report, COPD affects over 11.7 million adults and results in hundreds of thousands of visits to emergency departments, as well as contributing to healthcare costs totaling tens of billions annually.

Medical gases such as oxygen, nitrous oxide, carbon dioxide, and medical air are essential for various applications, including anesthesia, respiratory therapies, and surgical procedures. Regulatory frameworks governing the safety and quality of medical gases significantly influence the market. The Food and Drug Administration (FDA) and other health authorities enforce strict regulations that ensure the safe production, distribution, and storage of medical gases. Compliance with these regulations is essential for manufacturers, fostering a competitive landscape characterized by several key players who work diligently to maintain high standards.

The medical gas market in Canada held a significant share of the market in 2024. As the demographic shift towards an older population accelerates, the prevalence of chronic respiratory diseases, cardiovascular conditions, and other health issues is rising. This increasing demand for medical interventions, particularly in respiratory therapy, propels the need for medical gases in Canada. Hospitals, clinics, and long-term care facilities require a consistent supply of medical gases for patient care, which further enhances market growth. According to the Canadian Institute for Health Information (CIHI), between 2022-2023, Canada’s hospitals witnessed a notable rise in admissions due to respiratory illnesses among individuals under the age of 18 eventually led to increasing demand for oxygen gas. In addition, COPD affects more than 2 million Canadians, and it is one of the leading causes of hospitalization in Canada. Hence, growing respiratory illnesses in the country are expected to fuel market growth.

Europe Medical Gas Market Trends

The Europe medical gas market is expected to grow steadily over the forecast period driven by rising incidence of chronic respiratory conditions such as COPD, asthma, and pneumonia. Furthermore, the aging European population is contributing to the growing demand for medical gases. As individuals age, they often require more medical interventions, including surgeries and respiratory support. This demographic trend necessitates an expanded and more efficient supply of medical gases across hospitals, clinics, and home healthcare settings.

Further, with the growing focus of the government on eco-friendly medical gas, Air Liquide Healthcare's ECO ORIGIN offer is seeing robust growth. Less than a year after introducing its solution for healthcare providers, the company has already secured contracts with 19 hospitals and clinics across six European countries-Belgium, France, Germany, Italy, the Netherlands, and Spain-in 2024. Additionally, Air Liquide Healthcare has announced its inaugural contract in Brazil, partnering with a renowned hospital in São Paulo for the supply of certified low-carbon oxygen and nitrogen.

The medical gas market in the UK is expected to grow over the forecast period. The growing prevalence of chronic diseases and the aging population are key factors propelling the demand for medical gases, particularly for therapeutic applications in hospital settings and home care. One prominent trend is the increased adoption of medical gases in outpatient care. Hospitals are seeking to optimize resource use and improve patient outcomes by utilizing oxygen therapy, nitrogen, and other gases in non-invasive treatments outside traditional settings. This shift not only enhances patient convenience but also reduces healthcare costs, making it a priority for healthcare systems. According to a British Heart Foundation (BHF) report published in January 2025, In the UK, more than 7.6 million individuals are affected by heart and circulatory diseases, consisting of over 4 million men and more than 3.6 million women. With an aging population and enhanced survival rates following heart-related events, these figures may continue to increase. Projections indicate that by 2030, the number of people living with heart and circulatory diseases could rise by an additional 1 million and potentially reach 2 million more than the current total by 2040. These growing numbers of cardiovascular diseases are expected to fuel the growth of the market during the forecast period.

Germany medical gas market is anticipated to grow significantly over the forecast period, driven by several key trends and factors. With an aging population and a rising prevalence of chronic diseases, the demand for medical gases in healthcare facilities, including hospitals and nursing homes, has surged. The increasing adoption of advanced medical technologies, such as oxygen therapies and anesthetic gases, further propels market expansion.

Asia Pacific Medical Gas Market Trends

The medical gas market in Asia Pacific is experiencing rapid growth fueled by rising demand for respiratory therapies. With an escalating rate of respiratory diseases such as COPD and asthma, the need for medical gases is more pronounced than ever. As per WHO reports, these conditions are projected to increase due to lifestyle changes and air pollution, particularly in urban areas, thereby propelling the demand for oxygen therapy and anesthetic gases in hospitals and clinics.

China medical gas market is growing at a lucrative growth rate. One of the key factors propelling the market is the increasing occurrence of road accidents and industrial injuries and the increasing prevalence of COPD. For instance, according to a WHO report published in November 2023, China has nearly 100 million people affected by COPD, representing approximately 25% of all COPD cases worldwide. In addition, technological advancements are also shaping the China medical gas market. Innovations in delivery systems, including portable oxygen concentrators and advanced gas distribution systems, are enhancing the efficiency and safety of gas usage in medical applications. Such technologies improve patient care and offer health practitioners reliable tools for treatment, promoting further market expansion.

Latin America Medical Gas Market Trends

The medical gas market in Latin Americais witnessing significant growth, driven by increasing healthcare infrastructure development, rising prevalence of chronic diseases, and a growing geriatric population. Government initiatives aimed at enhancing healthcare accessibility and quality are further fueling demand for medical gases, including oxygen, nitrous oxide, and medical air. For instance, in November 2024, The Pan American Health Organization (PAHO) recently conducted a simultaneous mission in Dominica aimed at strengthening the national blood bank and assessing the medical gas systems.

Key Medical Gas Company Insights

The intensifying competition is leading to rapid technological advancements, and companies are constantly working to improve their products with a strong focus on research and development. In addition, market players are adopting strategies such as mergers & acquisitions, partnerships, product launches, and innovations to strengthen their foothold in the market. These advancements in the medical gas market are anticipated to boost market growth over the forecast period.

Key Medical Gas Companies:

The following are the leading companies in the medical gas market. These companies collectively hold the largest market share and dictate industry trends.

- Linde PLC

- Air Liquide

- Atlas Copco Group

- INOX-Air Products Inc.

- TAIYO NIPPON SANSO CORPORATION

- MATHESON TRI-GAS, INC.

- HORIBA Group

- SOL India Private Limited

- Messer SE & Co. KGaA

- Others

Recent Developments

-

In January 2025, Atlas Copco Group announced the acquisition of Medi-teknique Ltd. (“Medi-teknique”), a British company specializing in medical gas maintenance and services. With this acquisition, the company expanded its footprint in the UK.

-

In January 2025, Air Liquide announced that it has partnered with 20 hospitals and clinics in six European countries (Germany, Belgium, France, Italy, the Netherlands, and Spain) to assist them in reducing their carbon footprint.

-

In December 2023, Technik Spirits Inc., a medical technology company specializing in the manufacture of Medical Gas Plant Room equipment, announced that it had been awarded a patent for its innovative medical gas systems. These systems, utilized within hospitals, produce essential gases, including medical air, oxygen, and vacuum.

-

In November 2023, The International Association of Plumbing and Mechanical Officials (IAPMO) released the Manual of Recommended Practice for Medical Gas Resiliency, which offers a thorough strategy for ensuring the availability and effectiveness of medical gases in healthcare facilities.

-

In July 2023, BeaconMedaes announced the introduction of its next-generation Automatic Manifold Changeover System, the MAT-S. This medical gas supply system integrates a tried-and-true design with advanced features to provide exceptional performance and reliability, while also reducing operational and maintenance costs.

-

In March 2023, Atlas Copco Group announced the acquisition of operating assets of FS Medical Technology Business (FS Medical), which is based in California, U.S. This business specializes in servicing, selling, verifying, and testing piped medical and laboratory gas equipment and systems.

Medical Gas Market Report Scope

Report Attribute

Details

Market size in 2025

USD 17.14 billion

Revenue forecast in 2030

USD 25.55 billion

Growth rate

CAGR of 8.32% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report Coverage

Revenue, competitive landscape, growth factors, and trends

Segment Scope

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Linde PLC; Air Liquide; Hammarplast Medical AB; INOX-Air Products Inc.; TAIYO NIPPON SANSO CORPORATION; MATHESON TRI-GAS, INC.; HORIBA Group; SOL India Private Limited; Messer SE & Co. KGaA, Others

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Gas Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical gas market report based on the product, application, end use, and region:

-

Product Outlook (Revenue USD Million, 2018 - 2030)

-

Pure Gases

-

Medical Air

-

Oxygen

-

Nitrous Oxide

-

Nitrogen

-

Carbon Dioxide

-

Helium

-

-

Gas Mixtures

-

Aerobic Gas Mixtures

-

Anaerobic Gas Mixtures

-

Blood Gas Mixtures

-

Lung Diffusion Mixtures

-

Medical Laser Mixtures

-

Medical Drug Gas Mixtures

-

Other Gas Mixtures

-

-

-

ApplicationOutlook (Revenue USD Million, 2018 - 2030)

-

Therapeutic

-

Diagnostic

-

Pharmaceutical Manufacturing

-

Other Applications

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Home Healthcare

-

Pharmaceutical And Biotechnology Companies

-

Diagnostic and Research Laboratories

-

Academic and Research Institutions

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical gas market size was estimated at USD 15.9 billion in 2024 and is expected to reach USD 17.1 billion in 2025.

b. The global medical gas market is expected to grow at a compound annual growth rate of 8.32% from 2025 to 2030 to reach USD 25.5 billion by 2030

b. North America dominated the medical gas market with a share of 35.7% in 2024. This is attributable to increasing prevalence of respiratory and cardiovascular diseases and increasing demand for medical gases in healthcare settings in this region.

b. Some key players operating in the medical gas market include Linde PLC; Messer; Atlas Copco Group; INOX-Air Products Inc.; Air Liquide; Taiyo Nippon Sanso Corporation and Matheson Tri-Gas Inc.

b. Key factors that are driving the medical gas market growth include rising prevalence of increasing Chronic Respiratory Diseases (CRDs) such as asthma and chronic obstructive pulmonary disease (COPD), growing awareness of home healthcare, increasing surgical procedures such as elective surgeries and minimally invasive procedures, and growing aging population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.