- Home

- »

- Biotechnology

- »

-

U.S. Medical Device Manufacturers Market Size Report, 2030GVR Report cover

![U.S. Medical Device Manufacturers Market Size, Share & Trends Report]()

U.S. Medical Device Manufacturers Market Size, Share & Trends Analysis Report By Application (Orthopedic, Cardiovascular, Neurology, Drug Delivery, Ophthalmic, Nephrology and Urology Devices) And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-032-3

- Number of Report Pages: 137

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

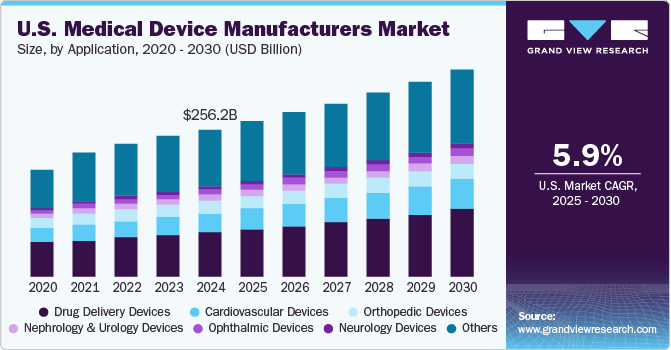

The U.S. medical device manufacturers market size was valued at USD 243.4 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. The market is expected to grow due to factors such as the growing geriatric population, high adoption of minimally invasive procedures, increasing number of sports and road accidents, and increasing geographic reach of the market players. According to the USA Today news article, the number of fatal car crashes consistently increased from 36,835 in 2018 to an estimated 42,795 in 2022 within the U.S.

The COVID-19 pandemic, which is now an endemic in major regions and countries had a marginally negative impact on few of the U.S. medical device manufacturers industries. According to Stryker’s financial report in 2020, the company witnessed a marginal downfall in revenues, nearly 3.58% from its 2019 sales. Orthopedic companies witnessed revenue losses due to shutdowns related to elective procedures. Furthermore, another leading cardiovascular firm, Medtronic, reported a decline in revenues by nearly USD 1.3 billion in fiscal year 2020. However, the pandemic had a positive impact on the drug delivery devices industry due to the medical necessities facilitated by COVID-19 complications.

The U.S. medical device manufacturers market is expected to witness significant growth due to the increasing geographic reach of market players and divestiture from existing businesses. Expanding into new geographic areas via acquisitions and collaborations allows manufacturers to tap into diverse markets, reach a broader customer base, and foster innovation. For instance, in February 2023, Abbott acquired Cardiovascular Systems, Inc. (CSI) as a part of its strategic expansion, which brought two major players in the key cardiovascular device industry. The equity value of the acquisition was estimated at USD 890 million.

Furthermore, in July 2023, 3M invested USD 468 million to expand its healthcare facility in Brookings, South Dakota, to broaden its geographic presence. This move suggested an intent to cater to the healthcare demands of the region, potentially introducing new medical devices or enhancing existing ones. In addition, certain players divested from their current businesses to enhance their position in other industries. For instance, in May 2023, Baxter International, Inc., a MedTech player, entered into a definitive agreement to sell its BioPharma Solutions (BPS) business to Advent International and Warburg Pincus. The cash transaction was valued at USD 4.25 billion, with estimated net after-tax proceeds of about USD 3.4 billion.

Market Concentration & Characteristics

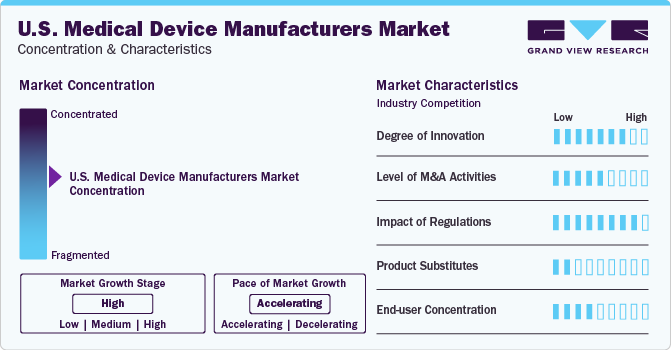

Market growth stage is high, and pace of the market growth is moderately-accelerating. The medical device market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors such as smart devices, increased use of AI & machine learning for diagnostics, growth in wearable medical technology, greater focus on cybersecurity for connected devices, and ongoing development of telehealth solutions which seamlessly integrates digital healthcare for better patient outcomes and accessibility.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading and emerging players. This is due to several factors, including the desire to gain access to newer technologies that either address newer indications or grow their portfolio in newer geographies. For instance, in 2023, Eli Lily and Company acquired Sigilon Therapeutics, Inc. to expand its diabetes cell therapy research and development.

The market is subjected to increasing regulatory scrutiny. Furthermore, the U.S. has one of the world’s most exhaustive medical device regulatory bodies and policies, which creates hurdles for market players while securing patient’s interests. Manufacturers must obtain FDA approval before marketing a new medical device. Class III devices, representing the highest risk, require Premarket Approval (PMA), involving a rigorous review of safety and effectiveness. Class II devices may undergo the 510(k)-clearance process, demonstrating substantial equivalence to a legally marketed device.

There are a limited number of direct product substitutes for medical devices for specific uses. Specialized medical devices with unique functionalities restrict the availability of direct substitutes. Furthermore, high switching costs and the critical nature of medical devices contribute to a diminished threat from substitute products.

End-user concentration is a key factor in the market. Since there are a number of end-user players that drive demand for medical devices. Buyers, including healthcare facilities, hold moderate power, which drives the need for high-quality and innovative devices. However, the high concentration of buyers in the medical device manufacturers market, coupled with their reliance on specialized devices, limits their ability to exert excessive bargaining pressure.

Application Insights

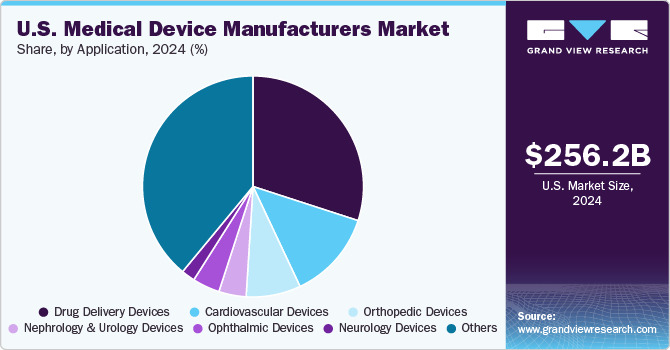

The others segment led the market and accounted for 39.07% of the revenue in 2023. The segment primarily comprises devices used in IVD diagnostics, medical imaging, dental, ear-nose-and-throat (ENT), wound-care, and general surgery. According to an article by Midwestern University Clinics, over 36 million U.S. citizens are currently edentulous, and an additional 120 million are missing at least one tooth. Projections for the next 15 years anticipate a substantial increase in prevalence, with over 200 million individuals predicted to experience partial tooth loss in the country. This emphasizes the relevance of dental devices within the market. Furthermore, the ENT devices segment is driven by the increasing demand for advanced solutions in otolaryngology. Innovations & advancements are expected to enhance diagnostic precision and therapeutic interventions for ENT conditions.

Cardiology devices is expected to register fastest-CAGR of 7.7% over the forecast period. Heart diseases are one of the leading cause of mortality in the U.S. According to a CDC article published in May 2023, the high mortality, with one death due to cardiovascular disease every 33 seconds, creates a substantial market demand for innovative medical devices that can contribute to the prevention, early diagnosis, & effective treatment of heart-related conditions. The substantial economic burden of heart disease, costing the U.S. about USD 239.9 billion annually, presents challenges and opportunities for growth in the medical device industry.

Key Companies & Market Share Insights

Some of the key players operating in the market include Stryker, Medtronic, and Abbott.

-

Stryker is a medical device manufacturing company that offers powered surgical instruments, joint replacement solutions, micro & spine implant systems, trauma products, orthobiologics, endoscopic products, emergency equipment, surgical navigation systems, and patient handling equipment. Stryker Osteosynthesis is a subsidiary of Stryker and operates in craniomaxillofacial & traumatological products. The company has a market presence in over 100 countries.

-

Medtronic is a global healthcare products company that manufactures medical devices. It operates in various healthcare verticals, such as patient monitoring, renal care, and pulse oximetry. It also manufactures advanced energy-based surgical devices, gastrointestinal devices, brain monitoring equipment, and mechanical ventilation.

-

Abbott is a healthcare and pharmaceutical company with four core business segments: pharmaceuticals, medical devices, nutrition, and diagnostics. The company has a presence in more than 150 countries through research, manufacturing, sales, and distribution facilities.

-

Gelmetix and LOCI Orthopaedics are some of the emerging market participants in the U.S. medical device manufacturers market.

-

Gelemetix focuses on the treatment of chronic lower back pain. The degeneration of intervertebral discs causes such pain. The company markets its polymer gel, which restores disc integrity.

-

LOCI Orthopedics is a medical device company specializing in developing orthopedic devices and technologies. The company provides solutions for orthopedic extremities.

Key U.S. Medical Device Manufacturers Companies:

- Stryker

- Cardinal Health

- Eli Lily and Company

- Intuitive Surgical

- Edwards Lifesciences Corporation

- BD

- Danaher

- 3M

- Abbott

- Baxter

- B. Braun SE

- GE Healthcare

- Johnson & Johnson Services, Inc.

- Medtronic

- Boston Scientific Corporation

Recent Developments

-

In September 2023, Abbott acquired Bigfoot Medical, a global leader in developing smart insulin management systems for people suffering with diabetes. Bigfoot manufactures Bigfoot Unity, an FDA approved connected insulin pen with integrated continuous glucose monitoring system.

-

In June 2023, Eli Lily and Company acquired Sigilon Therapeutics, Inc. Sigilon develops functional cures for acute and chronic diseases. Moreover, both companies have worked together from 2018 to develop encapsulated cell therapies to treat type 1 diabetes.

-

In May 2023, Stryker acquired Cerus Endovascular Ltd., a manufacturer of neurointerventional devices. Some of the key products marketed by the acquired company are Contour Neurovascular System and the Neqstent Coil Assisted Flow Diverter.

U.S. Medical Device Manufacturers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 256.2 billion

Revenue forecast in 2030

USD 360.1 billion

Growth rate

CAGR of 5.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application

Key companies profiled

3M Healthcare; Abbott; Baxter International, Inc.; B. Braun SE; GE HealthCare; Johnson & Johnson Services, Inc.; Boston Scientific Corporation; Danaher; Intuitive Surgical; Cardinal Health; Stryker; Edwards Lifesciences Corporation; and Eli Lily and Company.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Medical Device Manufacturers Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. medical device manufacturers market report based on application:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Orthopedic Devices

-

Cardiovascular Devices

-

Neurology Devices

-

Drug Delivery Devices

-

Ophthalmic Devices

-

Nephrology & Urology Devices

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. medical device manufacturers market is estimated at USD 243.4 billion in 2023 and is expected to reach USD 256.2 billion in 2024.

b. The U.S. medical device manufacturers market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 360.1 billion in 2030.

b. The others segment dominated the U.S. medical device manufacturers market with a share of 39.07% in 2023. This is attributable to the growing demand for accurate diagnostic methods and devices, an increase in the number of elective dental procedures, and growing development of new-age devices to address ENT conditions which leads to market growth.

b. Some key players operating in the U.S. medical device manufacturers market include 3M, Abbott Laboratories, Baxter International, Boston Scientific Corporation, B. Braun Melsungen, GE Healthcare, Johnson and Johnson, and Medtronic.

b. Key factors driving the U.S. medical device manufacturers market growth include rising cases of chronic disease, favorable reimbursement policies, and increasing adoption of mobile surgery centers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."