- Home

- »

- Medical Devices

- »

-

U.S. Medical Device Outsourcing Market Share Report, 2030GVR Report cover

![U.S. Medical Device Outsourcing Market Size, Share & Trends Report]()

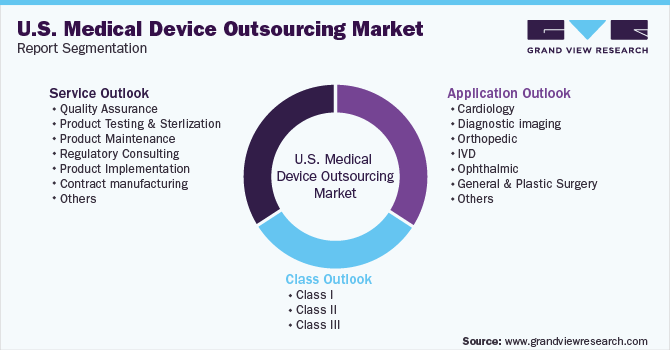

U.S. Medical Device Outsourcing Market Size, Share & Trends Analysis Report By Services (Quality Assurance, Contract Manufacturing), By Application (Cardiology, Diagnostic Imaging, IVD), By Class, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-600-4

- Number of Report Pages: 240

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

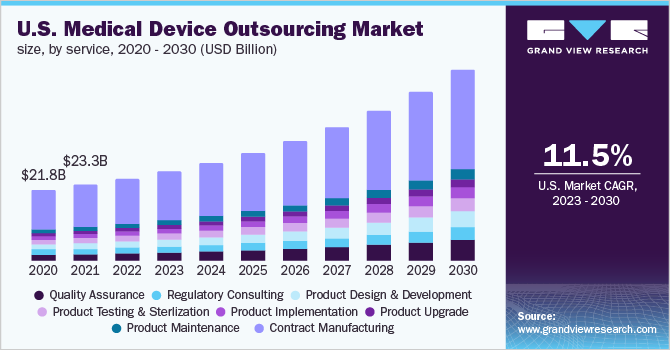

The U.S. medical device outsourcing market size was valued at USD 25.2 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 11.5% from 2023 to 2030. The high demand for technologically advanced medical devices in the country, the increasing focus among medical device companies to focus on their core competencies and outsourcing non-core activities, and the growing demand to reduce costs associated with the research and manufacturing of medical devices are some of the major factors promoting the growth of the U.S. medical device outsourcing industry.

The COVID-19 pandemic in 2020 delayed medical procedures, thereby creating a challenging environment for manufacturers. Many companies had temporarily ceased their research and development activities due to complete lockdowns. This led to a severe disruption in the supply chain, which caused shortages and a slowdown in production.

However, in the post-pandemic period, the situation has changed. The pipeline of medical devices has witnessed a steady rise from the third quarter of 2022. The medical devices pipeline in the U.S. accounted for 39.0% of the global medical device outsourcing market. A significant number of medical devices in the pipeline are expected to support the industry growth in the post-pandemic period.

Associated benefits, such as reduction in production cost and focus on core competencies by the medical device companies, are expected to propel the market growth over the forecast period. The medical device industry is currently facing challenging headwinds. Sharp cutbacks in public spending in the U.S. are a major issue faced by medical device manufacturers.

Increasing prices, profitability pressure, and growing competition coupled with a high degree of industry maturity have a great impact on this market. Amendments in the ISO standards are expected to boost the demand for quality assurance and regulatory affairs service providers in the U.S. as Small & Medium-sized Enterprises (SMEs) would require third-party assistance to comply with new ISO standards.

Service Insights

The contract manufacturing services segment dominated the market in 2022 and accounted for the largest share of 54.7% of the overall revenue. Based on services, the market is categorized into quality assurance, Regulatory Consulting Services, product design & development services, product testing & sterilization services, product implementation, product upgrade, product maintenance, and contract manufacturing services.

Players in the U.S. medical device market are striving to reduce costs as profit margins are shrinking. To curtail fixed costs, companies are expected to outsource medical device manufacturing activities. In addition, there are a significant number of medical device contract manufacturing organizations in the U.S. that offer quality services. These factors are expected to support the segment’s growth.

The quality assurance segment is expected to grow at the fastest CAGR of 13.7% during the forecast period.Medical devices are required to comply with various standards, such as Health Insurance Portability and Accountability Act (HIPAA), the Centers for Medicare and Medicaid Services (CMS), the American Society for Testing and Materials (ASTM), and others.

Medical device outsourcing service providers conduct ISO 13485 audits. This is expected to improve the confidence of medical device companies in outsourcing service providers. Hence, the segment market is expected to grow during the forecast period owing to various advantages of quality management systems services, including better quality & consistency of medical products as well as increased confidence in the ability to consistently achieve & maintain compliance with regulatory requirements.

Application Insights

The cardiology segment accounted for the maximum share of 21.8% in 2022 and is likely to remain dominant throughout the forecast period. Based on application the market is segmented into Cardiology, Orthopedic, IVD, Diagnostic imaging, Ophthalmic, General and plastic surgery, Drug delivery, Dental, Endoscopy, Diabetes care, and others. The U.S. CDC states that one person dies every 34 seconds in the U.S. from cardiac disorders.

This is due to the high prevalence of conditions such as angina pectoris, myocardial infarction, hypertensive heart disease, rheumatic heart disease, atrial fibrillation, and congenital heart disease in the country. The high prevalence of CVDs in the U.S. is increasing the demand for cardiovascular devices and thus promoting the segment’s growth.

General and plastic surgery devices outsourcing is anticipated to exhibit the fastest CAGR of 13.9% across the forecast. This market is anticipated to expand as a result of the abundance of reputable outsourcing companies in the United States that adhere to legal and regulatory regulations, as well as the growing demand for cosmetic procedures.

The demand for cosmetic operations in the United States has surged as a result of the huge rise in awareness and consciousness about physical appearance in recent years. The need for these surgical equipment is witnessing a rise due to the need for specific molding and machining procedures for items like fixation devices, extremities splints, and epilators. The sector market is supported by all of the aforementioned factors.

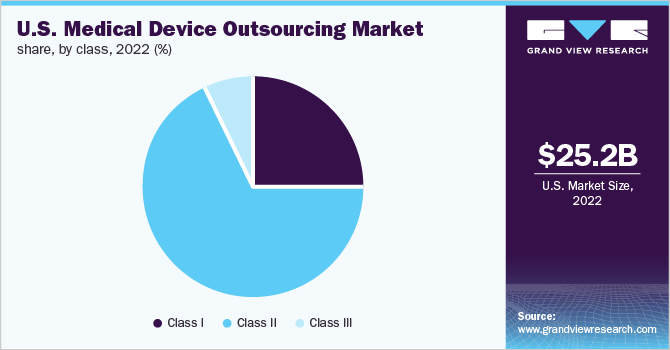

Class Insights

Class II type medical devices accounted for the largest revenue share of 67.6% in 2022 and the segment is expected to register the fastest CAGR of over 11.0% over the forecast period.Based on the class type, the market is segmented into Class I, Class II & Class III. The high cost of this type of medical device is one of the key reasons for the largest share of the segment.

Moreover, these devices have a higher risk as they are required to be in continuous contact with patients. Due to the complexity of these devices, medical device companies prefer to outsource the development and manufacturing of these devices to an expert. These factors are enhancing the growth of the segment market.

Class I medical devices is expected to grow at a CAGR of 10.9% during the forecast period. Class I medical devices are low- to moderate-risk for patients. These devices are noninvasive. Class I devices include stethoscopes, bandages, bedpans, tongue depressors, latex gloves, surgical masks, irrigating dental syringes, and others. These devices are used daily and are required more frequently. The high demand for these devices is improving the demand for the outsourcing of Class I medical devices.

Key Companies & Market Share Insights

The companies are constantly involved in providing a wide range of services and equipment, which can be an effective cost-curbing tool for the recipient organization. Participants are also involved in mergers, acquisitions, and expansions to increase their market share. For instance, Celestica Inc. in January 2022, declared that its AbelConn Electronics factory in Maple Grove, Minnesota, officially gained the ISO 13485:2016 certification for manufacturing medical devices. The certification broadened Celestica's international design and manufacturing capabilities, enabling it to offer support quality and legal compliance for its international healthcare clients. Some prominent players in the U.S. medical device outsourcing market include:

-

Integer Holdings Corporation

-

Avail Medsystems, Inc.

-

Active Implants.

-

Omnica Corporation

-

Teleflex Incorporated

-

Cantel Medical Corp. (STERIS plc)

-

SGS SA

-

Laboratory Corporation of America Holdings

-

Eurofins Scientific

-

Pace Analytical Services, Inc.

-

Intertek Group plc

-

WuXi AppTec

-

IQVIA Inc.

-

Charles River Laboratories

-

ICON plc.

-

PAREXEL International Corporation

-

Medpace

-

Premier Research

-

North American Science Associates, LLC

-

Sterigenics U.S., LLC (GTCR, LLC)

U.S. Medical Device Outsourcing Market Report Scope

Report Attribute

Details

Market Size value in 2023

USD 27.4 billion

Revenue forecast in 2030

USD 58.5 billion

Growth Rate

CAGR 11.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, application, class

Country scope

U.S.

Key companies profiled

Integer Holdings Corporation; Avail Medsystems, Inc.; Active Implants.; Omnica Corp.; Teleflex Incorporated; Cantel Medical Corp. (STERIS plc); SGS SA; Laboratory Corporation of America Holdings; Eurofins Scientific; Pace Analytical Services, Inc.; Intertek Group plc; WuXi AppTec; IQVIA Inc.; Charles River Laboratories; ICON plc.; PAREXEL International Corporation; Medpace ; Premier Research; North American Science Associates, LLC ; Sterigenics U.S., LLC (GTCR, LLC)

Customization scope

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of the customization.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Medical Device Outsourcing Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. medical device outsourcing market report based on service, application, and class:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Quality Assurance

-

Regulatory Consulting Services

-

Clinical Trials Applications And Product Registrations

-

Regulatory Writing And Publishing

-

Legal Representation

-

Other

-

-

Product Design And Development Services

-

Designing & Engineering

-

Machining

-

Molding

-

Packaging

-

-

Product Testing & Sterilization Services

-

Product Implementation Services

-

Product Upgrade Services

-

Product Maintenance Services

-

Contract Manufacturing

-

Accessories Manufacturing

-

Assembly Manufacturing

-

Component Manufacturing

-

Device Manufacturing

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiology

-

Class I

-

Class II

-

Class III

-

-

Diagnostic imaging

-

Class I

-

Class II

-

Class III

-

-

Orthopedic

-

Class I

-

Class II

-

Class III

-

-

IVD

-

Class I

-

Class II

-

Class III

-

-

Ophthalmic

-

Class I

-

Class II

-

Class III

-

-

General And Plastic Surgery

-

Class I

-

Class II

-

Class III

-

-

Drug Delivery

-

Class I

-

Class II

-

Class III

-

-

Dental

-

Class I

-

Class II

-

Class III

-

-

Endoscopy

-

Class I

-

Class II

-

Class III

-

-

Diabetes Care

-

Class I

-

Class II

-

Class III

-

-

Others

-

Class I

-

Class II

-

Class III

-

-

-

Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Class I

-

Class II

-

Class III

-

Frequently Asked Questions About This Report

b. The U.S. medical device outsourcing market size was estimated at USD 25.2 billion in 2022 and is expected to reach USD 27.4 billion in 2023.

b. The U.S. medical device outsourcing market is expected to grow at a compound annual growth rate of 11.5% from 2023 to 2030 to reach USD 58.5 billion by 2030.

b. Contract manufacturing dominated the U.S. medical device outsourcing market with a share of 55.7% in 2022. Medical device market players are striving to reduce costs as profit margins are shrinking. To curtail fixed costs, companies are implementing shift work.

b. Some key players operating in the U.S. medical device outsourcing market include Integer Holdings Corporation; Avail Medsystems, Inc. ; Active Implants.; Omnica Corp.; Teleflex Incorporated; Cantel Medical Corp. (STERIS plc); SGS SA; Laboratory Corporation of America Holdings; Eurofins Scientific; Pace Analytical Services, Inc.; Intertek Group plc; WuXi AppTec; IQVIA Inc.; Charles River Laboratories; ICON plc.; PAREXEL International Corporation; Medpace ; Premier Research; North American Science Associates, LLC and Sterigenics U.S., LLC (GTCR, LLC)

b. Key factors that are driving the market growth include rising price competition and requirement to reduce costs, increasing complexity, product design, &engineering, and rise in surgical procedures and increasing demand for surgical equipment.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."