- Home

- »

- Medical Devices

- »

-

Medical Device Outsourcing Market Size Report, 2033GVR Report cover

![Medical Device Outsourcing Market Size, Share & Trends Report]()

Medical Device Outsourcing Market (2026 - 2033) Size, Share & Trends Analysis Report By Class Type (Class I, Class II, Class III), By Service (Quality Assurance,Contract Manufacturing), By Application (Cardiology, Diagnostic Imaging, Orthopedic), By Region, And Segment Forecasts

- Report ID: 978-1-68038-279-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Device Outsourcing Market Summary

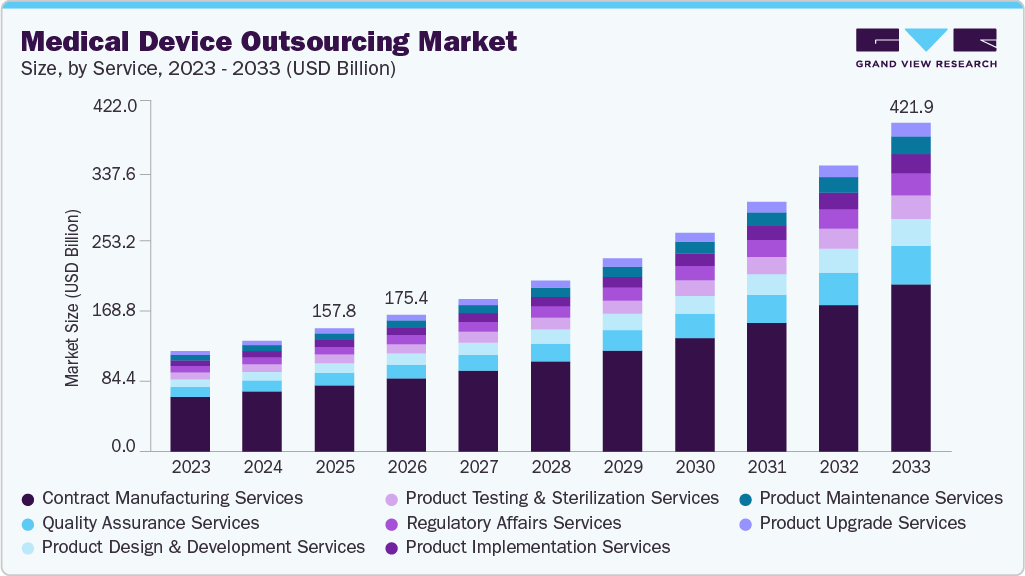

The global medical device outsourcing market size was estimated at USD 157.79 billion in 2025 and is projected to reach USD 421.90 billion by 2033, growing at a CAGR of 13.36% from 2026 to 2033. The market growth is driven by the increasing demand for medical devices, combined with the rising price competition and the requirement to reduce costs.

Key Market Trends & Insights

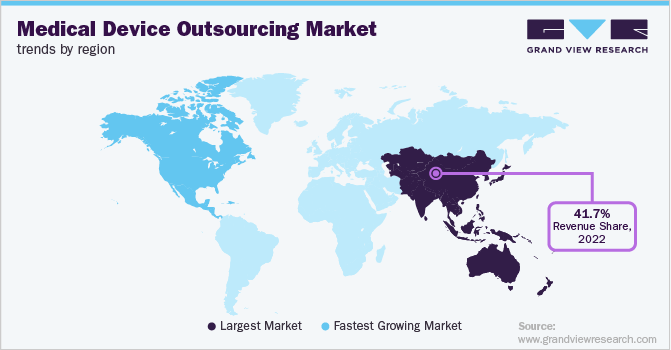

- Asia Pacific dominated the global market in 2025 with the largest revenue share of 26.62%.

- China is expected to dominate the Asia Pacific medical device outsourcing industry, owing to a rise in demand for new and cost-effective medical devices.

- By service, the quality assurance services segment is projected to attain the fastest CAGR of 15.54% from 2026 to 2033.

- By application, the cardiology segment accounted for the largest share in 2025 and is expected to remain dominant from 2026 to 2033.

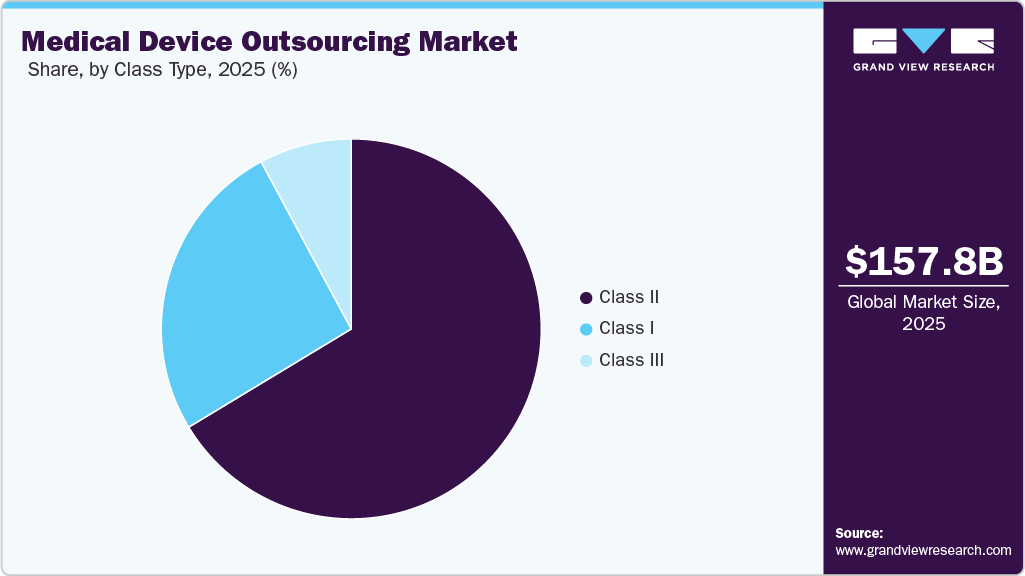

- By class, the class II type medical devices accounted for the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 157.79 Billion

- 2033 Projected Market Size: USD 421.90 Billion

- CAGR (2026-2033): 13.36%

- Asia-Pacific: Largest Market in 2025

Regulatory approval procedures are becoming more stringent & time-consuming, and market players aim to receive product approvals at the first attempt to gain higher market share. Medical device companies must manage continuous changes in regulatory requirements, which span various business activities and multiple geographies worldwide. Noncompliance with changing regulatory requirements may result in penalties and delays, potentially leading to a loss of revenue. Geographic expansion by medical device companies, aimed at securing speedy approvals in global markets, is expected to further contribute to an increase in the adoption of outsourcing models for regulatory affairs services.

The medical device business is under continual pressure to regulate costs without compromising on the R&D process, time to market, or the associated safety & quality. Novel technologies, process developments, and a rapidly aging population are factors driving segment growth. As a result, regulations become increasingly stringent and complex due to heightened market competition. Original Equipment Manufacturers (OEMs) of medical devices can benefit from increased agility, lower operational costs, and a reduced time to market, as well as a higher return on investment, by outsourcing some of their operations. OEMs can also transform their companies into strategic investments from cost centers. Hence, this is expected to create demand for medical affairs outsourcing services.

Service Insights

The contract manufacturing services segment dominated the medical device outsourcing industry, accounting for the largest revenue share of 53.62% in 2025. Medical device market players are striving to reduce costs as profit margins continue to shrink. To curtail fixed costs, companies are implementing shift work. Additionally, small and medium-sized companies often lack the skilled labor and technical resources necessary to complete the project. Contract manufacturing enables addressing the above-mentioned problems. Asia Pacific is considered the hub for contract manufacturing of the devices.

The quality assurance segment is anticipated to grow at the fastest CAGR during the forecast period. The increasing emphasis on regulatory compliance, the complexity of product development processes, and the need to maintain high standards of product safety and efficacy drive the segment growth. Additionally, the surge in outsourcing of quality assurance activities by pharmaceutical, biotechnology, and medical device companies to specialized service providers is further propelling segment growth.

Application Insights

The cardiology segment led the largest share of the medical device outsourcing industry in 2025. The growth of the segment is driven by the increasing demand for these devices, as well as the growing prevalence of cardiovascular diseases. Increasing incidences of conditions such as angina pectoris, myocardial infarction, hypertensive heart disease, rheumatic heart disease, atrial fibrillation, and congenital heart disease are other vital drivers for the growth of this industry.

The general & plastic surgery segment is anticipated to grow at the fastest CAGR during the forecast period. The segment’s growth is attributed to the rising demand for cosmetic surgeries, which is expected to drive the outsourcing of both general and cosmetic surgical devices. Surgical devices, such as fixation devices, extremity splints, and epilators, require specialized molding and machining processes. These devices are usually outsourced to component manufacturers.

Class Type Insights

The Class II segment held the largest revenue share in the global medical device outsourcing market in 2025, owing to the high cost of medical devices, with nearly 43% of medical devices falling under this category. Class II type includes catheters, syringes, surgical gloves, blood pressure cuffs, pregnancy test kits, contact lenses, and blood transfusion kits. These devices have a higher risk involved than Class I devices, as they are to be in continuous contact with patients. This can include diagnostic tools and equipment that are always in contact with the patient's internal organs or cardiovascular system.

The Class I segment is anticipated to grow at a considerable CAGR over the forecast period. These devices are noninvasive. Currently, 47% of the devices fall under this category, and 95% of the devices in this category are exempt from regulatory procedures due to a low risk level. Class I devices are the easiest and fastest to purchase from the market due to a low risk to the patient, and they rarely provide critical or life-sustaining care. The majority of Class I devices are exempt from the FDA's premarket notification (510 (k)) and Premarket Approval (PMA) requirements.

Regional Insights

The North America medical device outsourcing industry is projected to grow considerably over the forecast period. The growth is majorly driven by the presence of numerous medical device companies, which are outsourcing parts of their regulatory and consulting functions to regulatory service providers, thereby contributing to the market growth. The high cost of R&D is a major challenge, which has encouraged various medical device companies in North America to outsource functions to third-party vendors with high levels of expertise in the domain.

U.S. Medical Device Outsourcing Market Trends

The medical device outsourcing industry in the U.S. held the largest revenue share in 2025. The country’s growth is due presence of several medical device companies which are outsourcing parts of their regulatory functions, such as report writing & publishing, clinical trial application services, product design, and product maintenance, to regulatory service providers, thereby contributing to the market growth. These companies are also increasingly inclined toward medical device outsourcing due to the requirement of high maintenance and efficient systems for the management of raw materials, which results in minimizing the overall setup costs.

Europe Medical Device Outsourcing Market Trends

The medical device outsourcing industry in Europe is expected to grow significantly due to increasing investments in medical device R&D. The presence of advanced manufacturing infrastructure and stringent regulatory standards drives the demand for specialized contract manufacturing services, contributing to the market growth.

The medical device outsourcing market in Germany held a significant revenue share in 2025, primarily due to the country’s well-established medical device sector, its strong focus on innovation, and advanced manufacturing infrastructure. Moreover, high R&D investments in respiratory therapies, coupled with strict regulatory standards for quality and safety, drive medical device companies to partner with experienced contract manufacturers.

The UK medical device outsourcing market held a significant revenue share in 2025. The growth of the market is due to the increasing demand for cost-effective manufacturing solutions, a robust regulatory environment ensuring quality and compliance, and the UK's strong innovation ecosystem, driving advanced medical device development and production.

Asia Pacific Medical Device Outsourcing Market Trends

The Asia Pacific medical device outsourcing industry captured the largest revenue share of 41.53% in 2025. The regional growth is due to the presence of a large manufacturing base, lower labor costs, and the growing adoption of advanced medical technologies. In addition, strong government support for healthcare infrastructure, increasing demand for affordable medical devices, and the rising healthcare needs from a rapidly aging population in countries like China and India are significant drivers of the market.

The medical device outsourcing market in China held the largest revenue share in 2025. The growth can be attributed to the country’s robust manufacturing infrastructure, increasing demand for effective and advanced therapies, and rising investments in advanced R&D for treatments. Moreover, supportive government initiatives, a large patient population, and the presence of cost-competitive contract manufacturers are also among the factors contributing to the country’s leading position in the regional market.

The Japan medical device outsourcing market is expected to grow over the forecast period. The country’s growth is attributed to an increasing focus on advanced drug delivery systems, the rising prevalence of asthma and COPD, and strong collaboration between domestic medical device companies and specialized contract manufacturers. Japan’s well-established regulatory framework, high adoption of innovative technologies, and continuous investment in precision medicine further support the market’s expansion.

Key Medical Device Outsourcing Company Insights

The major players operating across the market are focused on adopting inorganic strategic initiatives, such as mergers, partnerships, and acquisitions. Moreover, companies focus on technological innovations to augment their market position.

Key Medical Device Outsourcing Companies:

The following are the leading companies in the medical device outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- SGS SA

- Laboratory Corporation of America Holdings

- Eurofins Scientific

- Pace Analytical Services, Inc.

- Intertek Group plc

- WuXi AppTec

- Charles River Laboratories

- Freyr

- PAREXEL International Corporation

- Criterium, Inc.

- Medpace

- ICON plc.

- IQVIA Inc.

- Integer Holdings Corporation

Recent Developments

-

In August 2025, IQVIA announced a strategic collaboration with Flagship Pioneering to accelerate life science company development, offering IQVIA’s analytics, information assets, and services from discovery through early development and commercialization.

Medical Device Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 175.43 billion

Revenue forecast in 2033

USD 421.90 billion

Growth rate

CAGR of 13.36% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, application, class type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; Kuwait; UAE; Oman; Qatar

Key companies profiled

SGS SA; Laboratory Corporation of America Holdings; Eurofins Scientific; Pace Analytical Services, Inc.; Intertek Group plc; Wuxi AppTec; Charles River Laboratories; Freyr; PAREXEL International Corporation; Criterium, Inc.; Medpace; ICON plc.; IQVIA Inc.; Integer Holdings Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Device Outsourcing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global medical device outsourcing market report based on service, application, class type, and region:

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Quality Assurance

-

Regulatory Affairs Services

-

Clinical trials applications and product registrations

-

Regulatory writing and publishing

-

Legal representation

-

Other

-

-

Product Design and Development Services

-

Designing & Engineering

-

Machining

-

Molding

-

Packaging

-

-

Product Testing & Sterilization Services

-

Product Implementation Services

-

Product Upgrade Services

-

Product Maintenance Services

-

Contract Manufacturing

-

Accessories Manufacturing

-

Assembly Manufacturing

-

Component Manufacturing

-

Device Manufacturing

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Cardiology

-

Diagnostic Imaging

-

Orthopedic

-

IVD

-

Ophthalmic

-

General and Plastic Surgery

-

Drug Delivery

-

Prefilled Syringe

-

Autoinjector

-

Infusion Pump

-

Others

-

-

Dental

-

Endoscopy

-

Diabetes care

-

Others

-

-

Class Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Class I

-

Class II

-

Class III

-

-

Application by Class Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Cardiology

-

Class I

-

Class II

-

Class III

-

-

Diagnostic imaging

-

Class I

-

Class II

-

Class III

-

-

Orthopedic

-

Class I

-

Class II

-

Class III

-

-

IVD

-

Class I

-

Class II

-

Class III

-

-

Ophthalmic

-

Class I

-

Class II

-

Class III

-

-

General and plastic surgery

-

Class I

-

Class II

-

Class III

-

-

Drug delivery

-

Class I

-

Class II

-

Class III

-

-

Dental

-

Class I

-

Class II

-

Class III

-

-

Endoscopy

-

Class I

-

Class II

-

Class III

-

-

Diabetes care

-

Class I

-

Class II

-

Class III

-

-

Others

-

Class I

-

Class II

-

Class III

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global medical device outsourcing market size was estimated at USD 157.79 billion in 2025 and is expected to reach USD 175.43 billion in 2026.

b. The global medical device outsourcing market is expected to grow at a compound annual growth rate of 13.36% from 2026 to 2033 to reach USD 421.90 billion by 2033.

b. North America dominated the medical device outsourcing market with a share of 26.62% in 2025. This is attributable to the presence of numerous medical device companies, which are outsourcing parts of their regulatory and consulting functions to regulatory service providers, thereby contributing to the growth of the market.

b. Some key players operating in the medical device outsourcing market include SGS SA, Laboratory Corporation of America Holdings, Eurofins Scientific, Pace Analytical Services, Inc., Intertek Group plc, Wuxi AppTec, Charles River Laboratories, Freyr, PAREXEL International Corporation, Criterium, Inc., Medpace, ICON plc., IQVIA Inc., Integer Holdings Corporation

b. Key factors that are driving the market growth include increasing demand for medical devices combined with the rising price competition and requirement to reduce cost increasing demand for medical devices combined with the rising price competition and requirement to reduce cost is expected to drive the market during the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.