- Home

- »

- Medical Devices

- »

-

U.S. Menopause Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Menopause Market Size, Share & Trends Report]()

U.S. Menopause Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Hormonal, Non-Hormonal, and Dietary Supplements), By Country (West, South, Midwest), And Segment Forecasts

- Report ID: GVR-4-68040-310-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Menopause Market Size & Trends

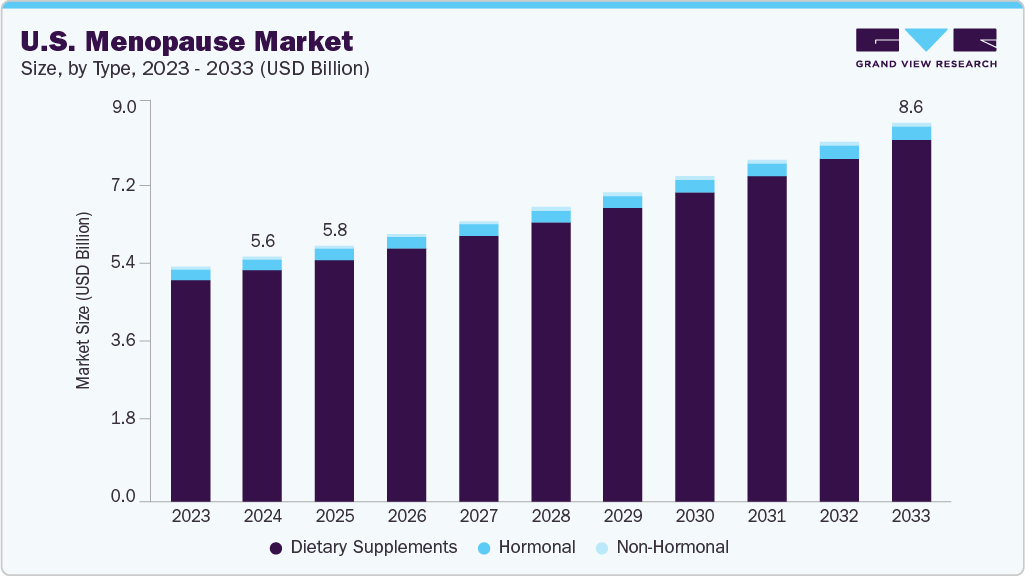

The U.S. menopause market size was estimated at USD 5.56 billion in 2024 and is projected to reach USD 8.58 billion by 2033, growing at a CAGR of 5.0% from 2025 to 2033. The increasing number of women who are reaching menopause age and the rise in awareness and education and its related symptoms are resulting in a growing demand for related products, services, and treatments. According to the report published by the National Library of Medicine in 2023, approximately 1.3 million women experience menopause each year, typically between the age group of 45 to 55 in the U.S. Moreover, the increasing preference for natural and organic menopause remedies and the availability of innovative products and technologies in the market, such as hormone-free therapies and telemedicine services, are also contributing to the growth of the market in the U.S.

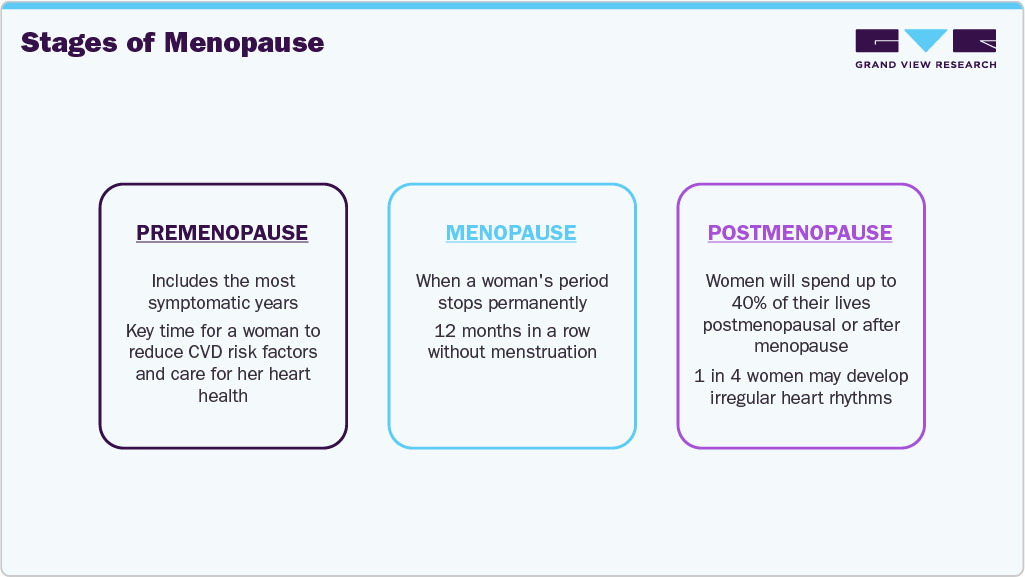

In addition, as per the Society for Women’s health Research, as the millennial population is aging, the country has around 6,000 women are expected to enter menopause each day in the U.S. A survey conducted by AARP, a U.S.-based nonprofit organization, in January 2024, revealed that approximately 90% of women aged 35 and older experience menopausal symptoms that impact their daily lives and work activities. According to the World Health Organization (WHO), menopause typically begins between the ages of 45 to 56 years. Wherein there is a small proportion of women, approximately 5%, who experience it early, naturally which occurs between the ages of 40 and 45 years old. Furthermore, there is a rare condition known as primary ovarian insufficiency, in which only 1% of women undergo a complete stop of menstruation before the age of 40 due to permanent ovarian failure. Research from the National Library of Medicine indicates that women from certain ethnic backgrounds experience premature and early menopause more frequently than their counterparts from different communities. The incidence of premature menopause is 1.4% for Black and Hispanic women, while it is only 1% for White women.

Stages of Menopause

Moreover, key players in the country are conducting campaigns to create awareness and the role of dietary supplements in easing the transition through it. In December 2024, Astellas Pharma US, in collaboration with board‑certified OB/GYN and women’s health advocate Dr. Jen Ashton, unveiled the “Cooler Moments” campaign. This educational initiative aims to bring visibility to moderate to severe menopausal hot flashes and night sweats, medically known as vasomotor symptoms (VMS),which affect nearly half of women undergoing menopause and can significantly impact sleep, mood, concentration, productivity, and relationships. According to the National Library of Medicine, around 50% to 75% of women experience vasomotor symptoms during the menopausal transition-night sweats, hot flashes, or both-and over 50% experience the Genitourinary Syndrome of Menopause (GSM).

The market is evolving with a rise in non-hormonal treatment options as women seek personalized care alternatives to traditional hormone replacement therapy. This shift emphasizes individualized treatments that consider each woman's medical history, symptoms, and preferences, leading to advancements in personalized medicine and precision healthcare. For instance, in July 2025, Flo Health has introduced an exciting new feature called “Flo for Perimenopause, Flo Health launched a new feature called “Flo for Perimenopause” on Apple’s App Store and Google Play to address the knowledge gap around perimenopause. This includes the Perimenopause Score, a digital tool that evaluates symptoms such as hot flashes and mood swings. Users will also have flexible period prediction windows and access to daily medically verified guidance from over 100 medical experts. In addition, the app offers anonymous “Secret Chats” for users to connect with others facing similar challenges.

Trend

Instance

Description

Rise in Non-Hormonal Therapies

VEOZAH (fezolinetant) by Astellas

First FDA-approved non-hormonal treatment for moderate to severe vasomotor symptoms (hot flashes) in menopause.

Tech-Enabled Personalization

Lisa Health’s Midday App

AI-powered menopause support app offering symptom tracking and personalized care recommendations.

Shift Away from HRT Due to Risk Concerns

Increased use of lifestyle and natural therapies

Women are turning to lifestyle adjustments, supplements, and mind-body approaches for symptom relief.

Pharma Innovation in Non-Hormonal Category

Bayer's Elinzanetant (in pipeline)

Non-hormonal neurokinin-1,3 receptor antagonist under development for vasomotor symptoms.

Patient-Centric Healthcare

Telehealth Menopause Clinics (such as., Evernow, Gennev)

Offer personalized, ongoing support and treatment plans based on individual health profiles, symptoms, and preferences.

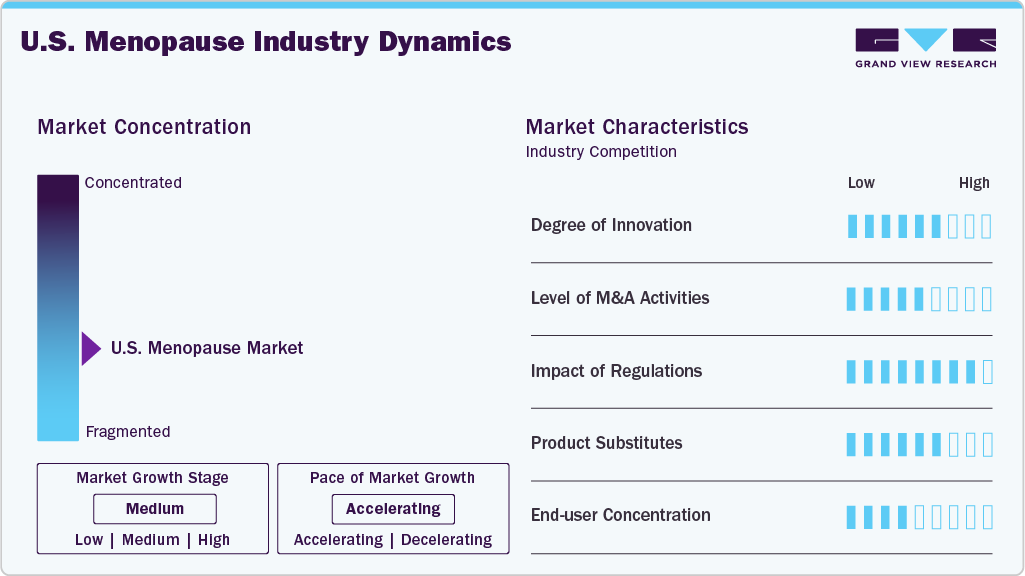

Market Concentration & Characteristics

The market is fragmented, with many small players entering the market and launching new innovative products. The degree of innovation is medium, the level of mergers & acquisitions activities is medium, and the impact of regulations on the market is high. Moreover, there are several product substitutes available in the market, and end user concentration is medium.

Innovations include the growing focus on personalized medicine, with treatments tailored to each patient's individual needs. For instance, in December 2023, Evernow and Talkspace partnered to support women in perimenopause, menopause, and beyond with mental health services and resources. This partnership aims to provide personalized care and convenient access to assist women navigate mental health challenges during the menopause stage. Talkspace's self-guided therapy app offers more than 400 sessions covering a broad spectrum of topics, including content relevant to women going through these health issues.

M&A activities in the industry is high, driven by growing demand and consolidation among companies. For instance, in March 2023, Sumitovant Biopharma Ltd. acquired Myovant Sciences Ltd. to enhance pipeline growth in women's health and prostate cancer. Following the acquisition, Myovant was delisted from the New York Stock Exchange. This strategic move combines Sumitovant's drug development strengths with Myovant's established therapies, including ORGOVYX and MYFEMBREE.

Regulations significantly impact the market, with agencies such as the FDA overseeing treatment approvals. Strict guidelines for hormone therapies have reduced their use due to safety concerns. However, the FDA has approved non-hormonal options, such as low-dose paroxetine and gabapentin. Notably, in May 2023, the FDA approved Veozah, the first oral medication for vasomotor symptoms, targeting hot flashes as a neurokinin 3 receptor antagonist.

There are several product substitutes available in the market, including both prescription and over-the-counter treatments. Prescription treatments include hormone therapies such as estrogen and progestin, as well as non-hormonal options such as selective serotonin reuptake inhibitors (SSRIs) and serotonin and norepinephrine reuptake inhibitors (SNRIs). Over-the-counter options include herbal supplements such as black cohosh and soy isoflavones and lifestyle modifications such as exercise and diet changes.

The industry is dominated by major companies such as Pfizer, Novo Nordisk, and Allergan, which provide various hormone therapies. At the same time, smaller companies focus on niche markets, such as alternative therapies. In August 2023, Clearblue launched the Menopause Stage Indicator, a product that helps women assess their menopause stage at home using their menstrual history, age, and urine hormone test results. The app generates a report that can be shared with healthcare professionals to discuss treatment options.

Type Insights

The dietary supplements segment dominated the market with a revenue share of 94.34% in 2024 and is expected to grow at the fastest CAGR during the forecast period. The growth of this segment is attributable to the increasing awareness of natural treatments, availability of a vast array of dietary supplements, and affordability compared to pharma products. Moreover, dietary supplements are widely available in pharmacies, grocery stores, and online retailers, making them easily accessible to consumers. One of the most significant trends is the increasing availability of non-hormonal treatment options for menopause symptoms. Many women are hesitant to use hormone replacement therapy (HRT) drugs due to concerns about side effects and long-term health risks. They are instead turning to alternative treatments such as herbal supplements, acupuncture, and cognitive-behavioral therapy.

The hormonal segment is anticipated to grow at a significant CAGR during the forecast period, owing to the increasing preference for products that mimic or supplement natural hormone levels to manage menopausal symptoms such as hot flashes, night sweats, mood swings, and vaginal dryness. As awareness about menopause and its impact on quality of life grows, more women are turning to phytoestrogen-based supplements (such as soy isoflavones and red clover) and low-dose hormone alternatives as safer, over-the-counter options compared to prescription hormone replacement therapy (HRT), which may carry greater risks. Retailers and e-commerce platforms also play a role in enhancing accessibility, while consumer demand for “natural” hormonal support aligns with broader wellness and preventive health trends in the U.S.

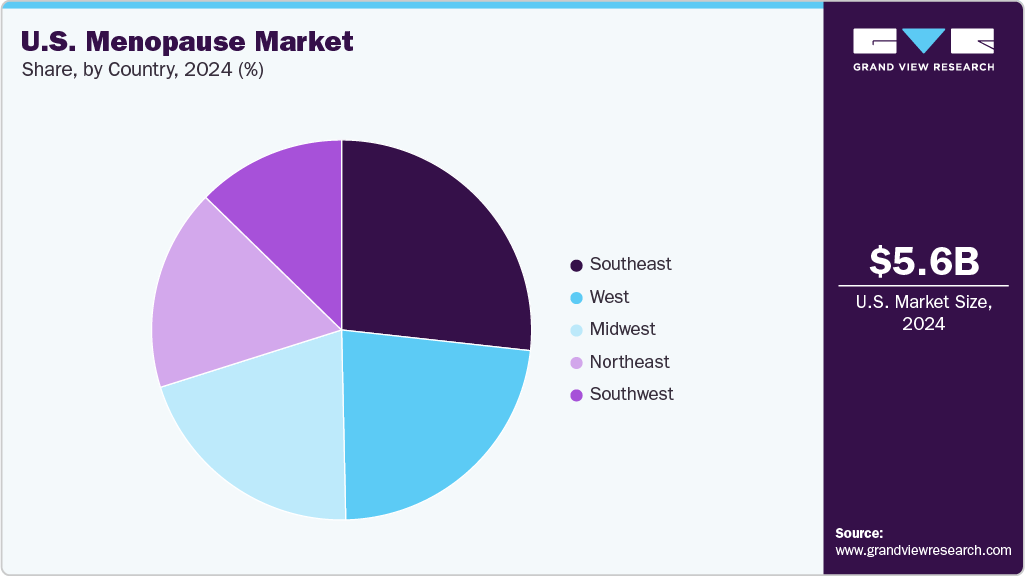

Country Insights

The southeast region dominated the segment with the largest market share of 26.75% in 2024. As the sizeable population of women in the Southeast ages, the number entering menopause is rising steadily. Increased awareness of menopause symptoms and the desire for effective management are pushing demand for both products and services. Simultaneously, there's a clear shift toward natural, non‑hormonal, and plant‑based therapies. Concerns over hormone replacement therapy (HRT) safety have bred strong interest in supplements such as black cohosh, phytoestrogens, and related wellness products. These appeal to the health-conscious and are widely accessible via e‑commerce and retail channels.

The Midwest region is expected to witness the fastest growth owing to the states such as Michigan and Illinois where the aging female population entering menopause. Consumers increasingly favor natural, non‑hormonal solutionssuch as dietary supplements, herbal remedies, and OTC productsdue to concerns about side effects from hormone replacement therapies. Midwest, with insurers such as Blue Cross Blue Shield of Michigan launching digital women's health platforms, reflects a broader shift toward personalized care through telehealth and wellness app. In addition, the destigmatization of menopause, bolstered by social media engagement, influencers, celebrity-backed brands, and mainstream beauty retailers adding menopause-focused categories, is transforming consumer expectations and driving market expansion.

Key U.S. Menopause Company Companies:

- Pfizer Inc.

- Novo Nordisk A/S

- TherapeuticsMD, Inc.

- Bayer AG

- AbbVie, Inc.

- Pure Encapsulations, LLC.

- PADAGIS LLC

Recent Developments

-

In October 2024, Olly introduced Mellow Menopause, its inaugural supplement aimed at supporting women through menopause. Formulated as a daily, hormone‑free capsule, it combines the botanical blend EstroG‑100-known for easing symptoms such as hot flashes, night sweats, fatigue, mood fluctuations, sleep issues, and vaginal drynesswith GABA, an amino acid that promotes mental relaxation and stress relief.

-

In September 2024, Otsuka Pharmaceutical subsidiary, Bonafide Health, launched Thermella, a plant-based dietary supplement to help manage menopausal symptoms such as hot flashes and mood changes. This launch demonstrates Otsuka’s commitment to providing effective, non-hormonal solutions for women's health, particularly during midlife transitions, and marks an important step in expanding its presence in the wellness market.

-

In January 2024, Dr. Reddy's Laboratories Ltd. acquired MenoLabs, a portfolio of dietary supplements for women's health, from Amyris, Inc. in the U.S. Dr. Reddy's now owns all seven MenoLabs supplements, which are designed to help with symptoms of perimenopause and menopause, including probiotics such as MenoGlow, as well as MenoFit and Happy Fiber. The acquisition also includes the MenoLife health tracker app, which provides consumers with education, community, and information regarding menopause.

U.S. Menopause Market Report Scope

Report Attribute

Details

Revenue forecast in 2033

USD 8.58 billion

Growth rate

CAGR of 5.0% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, country

Country scope

U.S.

Regional scope

Southeast; West; Midwest; Southwest; Northeast

Key companies profiled

Pfizer Inc.; Novo Nordisk A/S; TherapeuticsMD, Inc.; Bayer AG; AbbVie, Inc.; Pure Encapsulations, LLC.; PADAGIS LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Menopause Market Report Segmentation

This report forecasts revenue growth, country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033 for this study, Grand View Research has segmented the U.S. menopause market report based on type, country.

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hormonal

-

Non-Hormonal

-

Dietary Supplements

-

-

Country Outlook (Revenue, USD Billion, 2021 - 2033)

-

Southeast

-

West

-

Midwest

-

Southwest

-

Northeast

-

Frequently Asked Questions About This Report

b. The U.S. menopause market size was estimated at USD 5.56 billion in 2024 and is expected to reach USD 5.80 billion in 2025.

b. The U.S. menopause market is projected to grow at a compound annual growth rate (CAGR) of 5.0% from 2025 to 2030 to reach USD 8.58 billion by 2033.

b. The dietary supplements segment dominated the market, with a revenue share of more than 94.34% in 2024, owing to the increasing awareness of natural treatments, the availability of a wide array of dietary supplements, and their affordability compared to pharma products.

b. Some of the key players in the U.S. Menopause market include Pfizer Inc.; Novo Nordisk A/S; TherapeuticsMD, Inc.; Bayer AG; AbbVie, Inc.; Pure Encapsulations, LLC.; PADAGIS LLC

b. The increasing number of women who are reaching menopause age and the rise in awareness and education about menopause and its related symptoms are resulting in a growing demand for menopause-related products, services, and treatments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.