- Home

- »

- Clothing, Footwear & Accessories

- »

-

U.S. Men's Metal Wedding Bands Market Size Report, 2030GVR Report cover

![U.S. Men’s Metal Wedding Bands Market Size, Share & Trends Report]()

U.S. Men’s Metal Wedding Bands Market Size, Share & Trends Analysis Report By Material (Gold, Platinum, Diamond, Silver, Titanium), By Composition (Men, Women), By Distribution Channel, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-055-4

- Number of Report Pages: 68

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Market Size & Trends

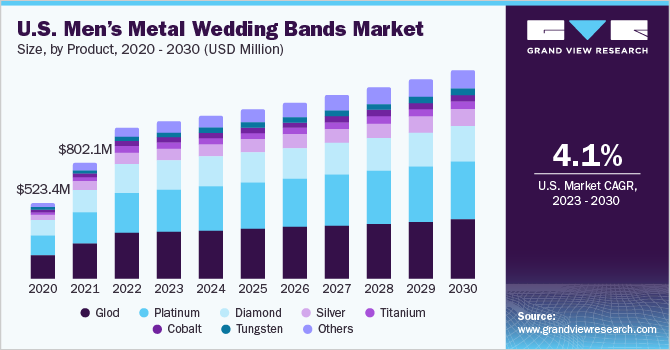

The U.S. men’s metal wedding bands market size was valued at USD 1.05 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.1% from 2023 to 2030. The growth of the U.S. wedding band market is fueled by advancements in technology, the use of modern equipment, design optimization through computer-aided design (CAD), celebrity endorsements, increased demand for customized wedding bands, investment in better raw material quality, and design and features of wedding bands. Moreover, increasing buyers’ willingness to pay for a premium wedding band and the availability of a variety of styles and designs for men’s wedding bands are expected to drive the market. In the U.S., men's wedding rings are commonly purchased by couples and are usually regarded the first purchase as a part of a wedding set. Due to the increased choice of style and design offerings, the demand for wedding bands has gained traction in the past few years.

Moreover, the popularity of engagement rings has also gained impetus in the LGBTQ+ community. For instance, a market survey by EraGem in 2019, stated that 90% of the same-sex couples who participated desired to wear an engagement ring. 40% of both men and women stated that they desired a diamond engagement ring. Meanwhile, 30% of males surveyed preferred to wear just a band, while 30% of women preferred a gemstone other than a diamond.

Wedding bands are an essential part of wedding culture in the U.S. Previously, men usually preferred simple designs of wedding bands. The historical significance of gold made it arguably the most popular metal for men's wedding bands. But with innovation and new fashion trends, the millennial generation is inclining toward wedding bands made from other precious metals. Considering consumer preferences, jewelry manufacturers are making bands from a wide range of precious metals such as white gold, silver, rose gold, platinum, titanium, and other precious and semi-precious metals.

A rise in the number of proposals and couples getting married in the country has had a positive effect on the market. The U.S. will witness more weddings in 2022 in comparison to any other year according to a report published by Wedding Report. The report estimated that 2.5 million weddings are predicted to happen in 2022 since many individuals rescheduled their wedding dates in the last two years. However, the rising number of weddings is also due to the weddings of couples who got engaged during the COVID-19 pandemic and shifted their wedding to a later year.

Material Insights

The gold segment dominated the market among products in 2022, accounting for 29.9% of total sales. According to an engagement ring poll by Ringspo in 2021, white gold was the most popular option for wedding rings/bands, with more than 60% of respondents choosing it for their ring/band in the U.S. The poll also found that yellow gold was the second-most preferred material for wedding bands and rings, surpassing platinum.

The tungsten segment is anticipated to expand significantly with a CAGR of 7.6% from 2023 to 2030. The use of tungsten carbide, a material made of tungsten and carbon, by jewelers to create magnificent rings, is one of the leading factors driving this segment. The strength of tungsten carbide increases, making it four times stronger than titanium. This makes it the perfect metal for wedding bands, especially for consumers engaged in rigorous outdoor activities. In 2021, Titanium Style introduced a new tungsten wedding bands collection in the American market for both men and women. Wedding rings/bands made of tungsten are increasingly attracting the attention of manufacturers.

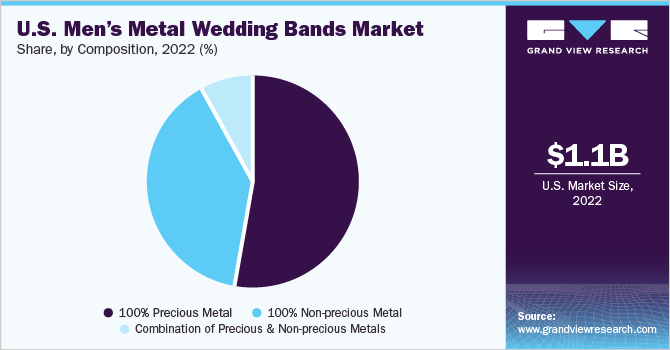

Composition Insights

Among composition, the 100% precious metal segment led the market and accounted for a 53.7% share of the revenue in 2022.Sales of 100% precious metals such as gold, silver, and platinum have increased in the U.S. According to Sprott Inc., a global leader in precious metals and real assets investments, the U.S. was the second-largest consumer of jewelry worldwide, following China, in 2020. In a 2019 survey, the World Gold Council found that American consumers are much more likely to be interested in purchasing gold jewelry than they really are. According to the report, 48% of American customers have already purchased gold jewelry but would still be open to doing so in the coming years.

The 100% non-precious metal segment is anticipated to grow with a CAGR of 4.6% from 2023 to 2030. According to Jewelers, jewelry made of stainless steel, titanium, and tungsten carbide is becoming increasingly popular, especially for men’s jewelry; they also offer an economical alternative to jewelry made of precious metals in the U.S.Men like tungsten wedding bands the most because tungsten is one of the hardest and most scratch-resistant metals. On the other hand, titanium is quickly replacing other metals as a choice for men’s wedding bands. Due to how light, it feels, it is trendy among males and offers greater comfort than other alternatives in the U.S. Modern rings, including those made of tungsten and titanium, are typically composed entirely of non-precious metals.

Distribution Channel Insights

Independent brick & mortar retail jewelry stores, which accounted for 38.9% of the total revenue in 2022, dominated the market. The main reason consumers prefer to shop in physical stores is to see, experience, and test products before making a purchase decision. Moreover, brand awareness and professional expertise offered by the jewelry store staff are other reasons why consumers prefer to buy metal wedding bands through retail chains.

The branded e-commerce marketers of non-precious men’s metal wedding bands is expected to witness the fastest growth over the forecast period. E-commerce retail channels play a significant role in the distribution of metal wedding bands as a considerable amount of the market revenue is generated through these channels. Online sales of Signet Jewelers were reported at USD 556 million in fiscal 2022, up 85.4% compared with fiscal 2020. Gina Drosos, CEO of Signet, stated in March 2022 that the company's primary focus is on e-commerce since it is a critical element of its overall goal to increase market share and, therefore, revenue.

Key Companies & Market Share Insights

The market is characterized by the presence of a few well-established players, such as Frederick Goldman Inc., Moses Jewelers, Novell Design Studio, Benchmark Rings, Guertin Brothers, Avant Garde Jewelers, Absolute Titanium Designs, Cascadia Design Studio, Jewelry by Johan, and STAGHEAD DESIGNS. Some of the key developments and strategic initiatives carried out by leading manufacturers are listed below:

-

In July 2020, Novell Design Studio launched its new bridal collection, that includes designs from diamond cut pieces to plain metal rings for men, such as the Duo Collection, Plain Band Collection, and Mirari Collection.

-

In May 2020, Frederick Goldman, Inc., a manufacturer of the wedding, bridal, and men’s jewelry, has begun hosting virtual sales calls for their independent jewelry accounts. This new way of selling is valuable for both the account, as well as FGI’s team of field sales representatives.

-

In January 2020, Frederick Goldman Inc. licensed tungsten carbide material to Thorsten Rings, LLC, a men’s wholesale wedding band brand in California.

Some of the prominent players in the U.S. men’s metal wedding bands market include:

-

Frederick Goldman, Inc.

-

Moses Jewelers

-

Novell Design Studio

-

Benchmark Rings

-

Guertin Brothers

-

Avant Garde Jewelers

-

Absolute Titanium Designs

-

Cascadia Design Studio

-

Jewelry by Johan

-

STAGHEAD DESIGNS

U.S. Men’s Metal Wedding Bands Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.44 billion

Growth rate

CAGR of 4.1% from 2023 to 2030(Revenue-based)

Market size volume in 2023

3.14 thousand unit

Volume forecast in 2030

4.08 thousand unit

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in thousand unit, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, composition, distribution channel

Key companies profiled

Frederick Goldman, Inc.; Moses Jewelers; Novell Design Studio; Benchmark Rings; Guertin Brothers; Avant Garde Jewelers; Absolute Titanium Designs; Cascadia Design Studio; Jewelry by Johan; STAGHEAD DESIGNS.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Men’s Metal Wedding Bands Market Report Segmentation

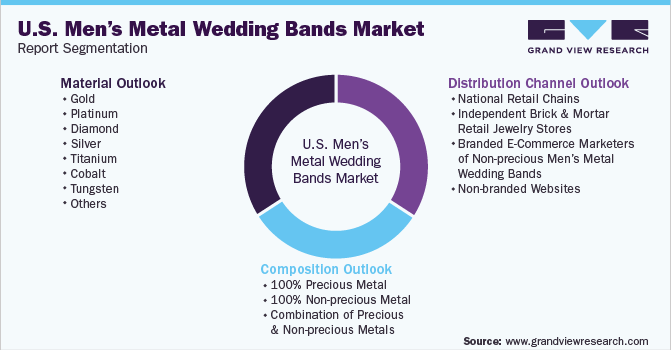

This report forecasts growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. men’s metal wedding bands market on the basis of material, composition, and distribution channel:

-

Material Outlook (Volume, Thousand Unit; Revenue, USD Million, 2017 - 2030)

-

Gold

-

Platinum

-

Diamond

-

Silver

-

Titanium

-

Cobalt

-

Tungsten

-

Others

-

-

Composition Outlook (Volume, Thousand Unit; Revenue, USD Million, 2017 - 2030)

-

100% Precious Metal

-

100% Non-precious Metal

-

Combination of Precious & Non-precious Metals

-

-

Distribution Channel Outlook (Volume, Thousand Unit; Revenue, USD Million, 2017 - 2030)

-

National Retail Chains

-

Independent Brick & Mortar Retail Jewelry Stores

-

Branded E-Commerce Marketers of Non-precious Men’s Metal Wedding Bands

-

Non-branded Websites

-

Frequently Asked Questions About This Report

b. The U.S. men’s metal wedding bands market size was estimated at USD 1.05 billion in 2022 and is expected to reach USD 1.09 billion in 2023.

b. The U.S. men’s metal wedding bands market is expected to grow at a compound annual growth rate of 4.1% from 2023 to 2030 to reach USD 1.44 billion by 2030.

b. Manual segment dominated the U.S. men’s metal wedding bands market with a share of 29.9% in 2022. This is attributable to the growing popularity of the gold in the country. According to an engagement ring poll by Ringspo in 2021, white gold was the most popular option for wedding rings/bands, with more than 60% of respondents choosing it for their ring/band in the U.S.

b. Some key players operating in the U.S. men’s metal wedding bands market include Frederick Goldman, Inc., Moses Jewelers, Novell Design Studio, Benchmark Rings, Guertin Brothers, Avant Garde Jewelers, Absolute Titanium Designs, Cascadia Design Studio, Jewelry by Johan, STAGHEAD DESIGNS

b. Key factors that are driving the U.S. men’s metal wedding bands market growth include advancements in technology, the use of modern equipment, design optimization through computer-aided design (CAD), celebrity endorsements, increased demand for customized wedding bands, investment in better raw material quality, and design and features of wedding bands.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."