- Home

- »

- Medical Devices

- »

-

U.S. Mobile IV Hydration Therapy Market Size Report, 2030GVR Report cover

![U.S. Mobile IV Hydration Therapy Market Size, Share & Trends Report]()

U.S. Mobile IV Hydration Therapy Market (2025 - 2030) Size, Share & Trends Analysis Report By Therapy (Immunity Boosters, Energy Boosters), By Application (Medical, Wellness & Aesthetic), And Segment Forecasts

- Report ID: GVR-4-68040-590-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

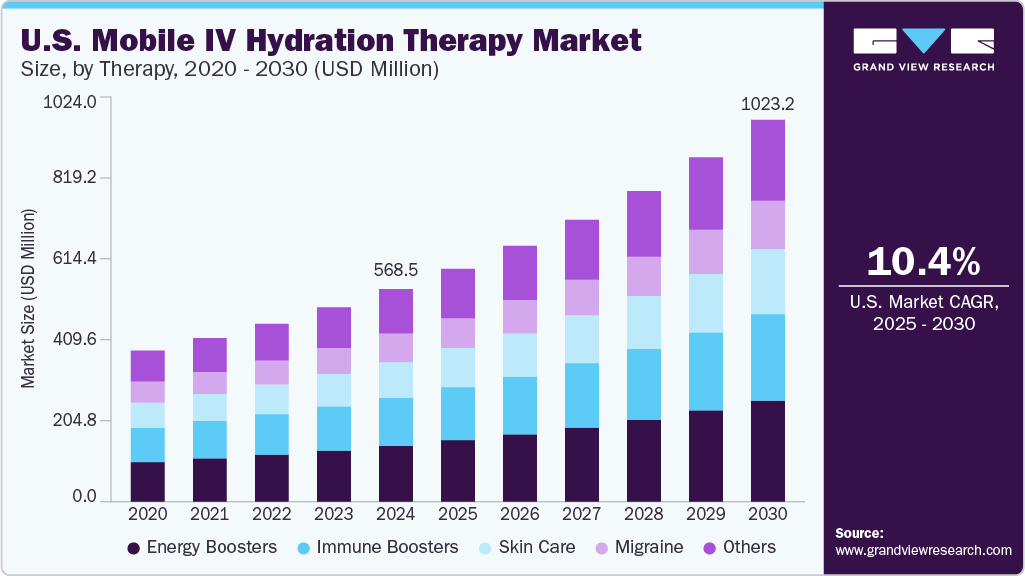

The U.S. mobile IV hydration therapy market size was estimated at USD 568.5 million in 2024 and is projected to grow at a CAGR of 10.4% from 2025 to 2030. The U.S. mobile IV hydration therapy market is driven by increasing consumer demand for convenient, on-demand wellness services amid rising health consciousness. Advancements in mobile healthcare delivery, including app-based scheduling and nurse dispatch models, are enhancing service accessibility and user experience. The expanding aging population and busy professionals seeking rapid recovery from fatigue, dehydration, or minor illnesses are further supporting market growth. In April 2024, Revive Drip expanded from mobile IV hydration services to a clinic in Gig Harbor, Washington. Run by former ER nurses, it offers medical-grade infusions at homes, events, and now a licensed facility to meet U.S. compounding regulations.

The U.S. mobile IV hydration therapy market is benefiting from a growing consumer inclination toward convenient and personalized wellness solutions. Increasing awareness of preventive healthcare and lifestyle optimization is driving interest in treatments that address dehydration, fatigue, hangovers, and immune support without requiring clinical visits. As individuals become more proactive about their health and wellness, especially millennials and Gen Z, there is rising demand for flexible, concierge-style medical services that fit into busy schedules or offer recovery support in non-emergency settings. In July 2024, purelyIV introduced its J-Tip add-on, a CO₂-powered device that delivers lidocaine for virtually pain-free IV insertions. This innovation is beneficial for clients who experience discomfort or anxiety related to needle injections, enhancing the comfort and appeal of mobile IV therapy. These developments underline the segment’s commitment to combining medical-grade care with technological convenience.

Advancements in mobile healthcare infrastructure are also playing a critical role in market expansion. The integration of app-based platforms, real time booking systems, and GPS enabled nurse dispatch mechanisms has significantly improved service accessibility and responsiveness. These digital capabilities are streamlining logistics, enabling providers to scale efficiently while maintaining customer engagement. in November 2024, purelyIV launched a dedicated mobile app for iOS and Android users, enabling clients to easily book IV therapy sessions, manage appointments, browse wellness services, and purchase packages from their smartphones. This digital solution reflects a broader trend in the sector toward user-centric convenience and remote healthcare access.

Demographic trends, particularly the expanding aging population and the rise of high stress urban lifestyles, are further boosting demand. Older adults increasingly seek hydration therapies for fatigue, chronic conditions, or post operative recovery, while younger, time constrained consumers use IV therapy for wellness maintenance or quick rejuvenation. For instance, in July, according to Northwestern Medicine, over 75% of Americans do not drink enough water daily, often only hydrating when they feel thirsty, which is already too late. Cities with hotter climates, such as Phoenix, Las Vegas, and Miami, report increased ER visits due to dehydration, pushing wellness providers to expand hydration services outside hospitals.

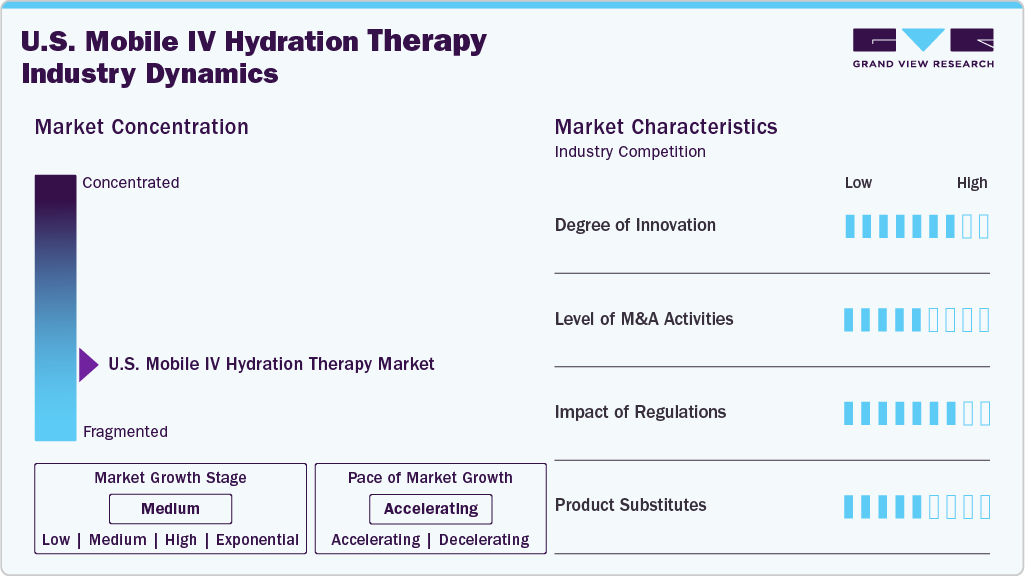

Market Concentration & Characteristics

Degree of Innovation:The degree of innovation in the U.S. mobile IV hydration therapy industry is high, fueled by the integration of digital tools and demand for highly personalized care. Leading providers now offer mobile apps that include blend selectors based on symptoms, integration with wearable devices, and dynamic scheduling options. These platforms enable users to customize hydration treatments for use cases such as post-exercise recovery, travel fatigue, or immune system support.

Level of M&A Activities:The level of mergers and acquisitions is moderate in U.S. mobile IV hydration therapy industry, with a focus on regional expansion and platform consolidation rather than national-scale rollups. Acquiring small, established players in target metro areas has become a key strategy to quickly gain access to local licenses, nursing teams, and loyal customer bases. This trend is particularly visible among multi-service wellness companies that are integrating mobile IV therapy into broader offerings such as concierge medicine, weight management, or hormone optimization.

Impact of Regulations: The impact of regulations on the mobile IV hydration therapy industry is high due to the need to navigate varying legal standards across different states. Regulatory complexity surrounds who can administer IV therapy, which formulations are permitted, and the extent of physician oversight required. Some states require a physician to consult or approve each treatment remotely, while others demand that medical directors be licensed within the operating state.

Product/Service Expansion:Product and service expansion in the mobile IV hydration therapy industry is moderate, with offerings extending beyond hydration into adjacent wellness areas. Popular add-ons include nutrient injections, detox-focused blends, and therapies for specific concerns such as migraines, jet lag, and hangovers. Providers are also increasingly targeting institutional and group clients such as fitness centers, corporate wellness programs, and private events to diversify service delivery beyond individual in-home visits.

Therapy Insights

Energy boosters segment held the largest share of 26.3% in 2024. This dominance is attributed to the high demand from working professionals, fitness enthusiasts, and individuals seeking quick recovery from fatigue or jet lag. The convenience of mobile administration, combined with formulations containing B-complex vitamins, amino acids, and electrolytes, has made these treatments especially popular. The segment continues to benefit from marketing efforts focused on productivity, wellness, and lifestyle optimization. For instance, Westwood IV Therapy offers a mobile Get-Up-And-Go IV treatment designed to boost energy, burn fat, and enhance metabolism. Delivered at the customer’s location, this 45-minute IV drip combines B-complex vitamins and amino acids to promote wellness and performance.

The skincare segment is expected to grow at the highest CAGR over the forecast period driven by rising consumer interest in aesthetic wellness and non-invasive beauty solutions. Mobile IV services offering formulations for skin hydration, anti-aging, and glow enhancement are gaining traction, particularly among urban and millennial populations. Increased awareness through social media and influencer endorsements is also amplifying demand in this segment. In April 2022, IVDRIPS teamed up with JTAV Clinical Skincare in New York City to provide mobile IV hydration treatments specializing in skincare. The service offers vitamin, hydration, and anti-aging NAD+ drips, delivered either at the spa or through mobile visits, aimed at improving skin radiance, boosting collagen production, and promoting overall wellness.

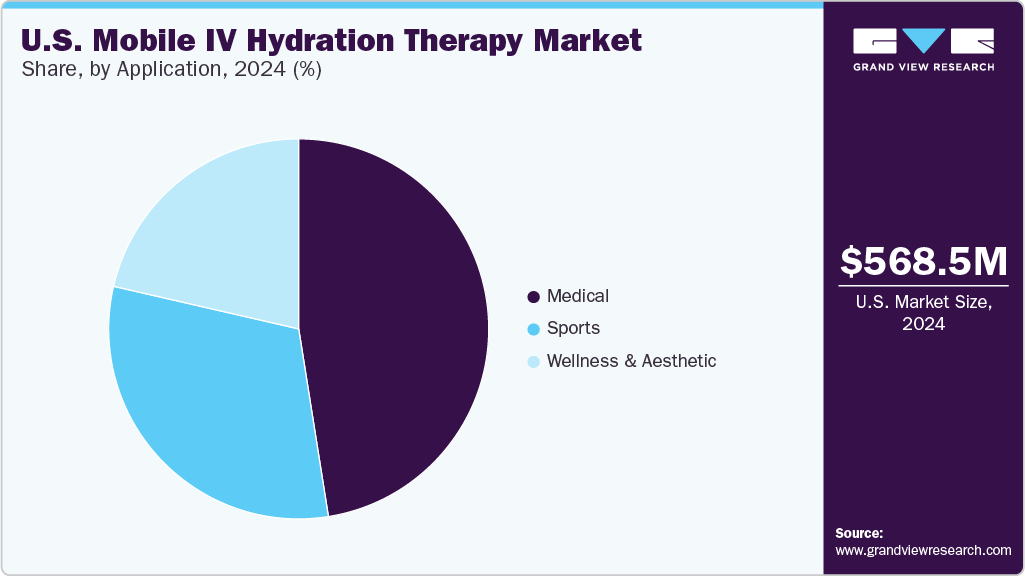

Application Insights

In 2024, medical segment held the largest market share of 47.5%. Medical segment dominated the market due to its essential role in addressing dehydration related to conditions such as flu, food poisoning, migraines, and chronic illnesses. These treatments are often physician-recommended and administered under clinical supervision, increasing trust and repeat usage. The segment’s growth is also supported by partnerships with urgent care centers and concierge medical services offering IV therapy as part of at-home treatment plans. AZ IV Medics provides mobile IV therapy tailored for stomach flu relief, combining hydration with essential nutrients and drugs to combat symptoms such as nausea and body aches. Their customizable treatments, including the popular Myers’ Cocktail, are designed to replenish energy, support the immune system, and reduce inflammation, facilitating a quicker recovery.

The wellness and aesthetic segment is expected to experience the fastest growth during the forecast period. This trend is fueled by increasing consumer focus on preventive health, beauty maintenance, and lifestyle enhancement. Demand is rising for IV formulations that promote skin radiance, detoxification, weight management, and stress relief. The segment is also benefiting from cross-promotion through spas, fitness centers, and influencer-driven platforms, which are expanding awareness and normalizing these services as part of routine self-care.In November 2023, The DRIPBaR Statesboro launched a mobile IV hydration service, offering on-site wellness treatments such as hydration, immune support, and recovery. The service, available on select weekends, brings IV therapy directly to homes, offices, and events within a 30-mile radius, focusing on hydration and overall well-being.

Key U.S. Mobile IV Hydration Therapy Company Insights

Some of the key market players operating in the U.S. mobile IV hydration therapy market include Drip Hydration, DriPros IV Hydration Wellness, wHydrate, and Hydration Room. These companies focus on tech-enabled service models, personalized wellness solutions, and expanding mobile reach. DRIPBaR, Restore, and Renew Ketamine & Wellness Center emphasize service innovation, while R2 Medical Clinic, AliveDrip, and Hydrate IV target niche demand and localized delivery to stay competitive.

Key U.S Mobile IV Hydration Therapy Companies:

- Drip Hydration

- DriPros IV Hydration Wellness

- wHydrate

- Renew Ketamine & Wellness Center

- R2 Medical Clinic

- AliveDrip

- Hydrate IV

- Hydration Room

- DRIPBaR, Restore

Recent Developments

-

In April 2025, RevIVe Mobile IV launched its operations in Pittsburgh and Philadelphia, providing on-demand IV hydration, vitamin infusions, and wellness treatments directly to clients’ homes and offices. Administered by licensed professionals, these services target fatigue, dehydration, and immune support, making advanced wellness solutions easily accessible to busy individuals.

-

In May 2024, On The Glow by Glow Lab Studio introduced a mobile IV hydration therapy service in New York to meet rising demand for at-home, discreet wellness care. Offering treatments such as hydration, migraine relief, hangover recovery, and weight management, the company operates through in-home appointments and a mobile van model, prioritizing client convenience and privacy.

-

In July 2023, Victory Square Technologies announced the upcoming U.S. launch of MobileMedIV.com, a hydration-focused nurse dispatch platform by VS Digital Health in partnership with Hydreight Technologies. Targeting the mobile IV therapy market, the service aimed to offer vitamin-infused drips for energy, immunity, detox, and anti-aging, with bookings supported by Registered Nurse consultations.

U.S. Mobile IV Hydration Therapy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 623.3 million

Revenue forecast in 2030

USD 1,023.1 million

Growth rate

CAGR of 10.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapy, application

Key companies profiled

Drip Hydration; DriPros IV Hydration Wellness; wHydrate; Renew Ketamine & Wellness Center; R2 Medical Clinic; AliveDrip; Hydrate IV; Hydration Room; DRIPBaR, Restore

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Mobile IV Hydration Therapy Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. mobile IV hydration therapy market report based on therapy, and application:

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Immune Boosters

-

Energy Boosters

-

Skin Care

-

Migraine

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical

-

Wellness & Aesthetic

-

Sports

-

Frequently Asked Questions About This Report

b. The U.S. mobile IV hydration therapy market size was estimated at USD 568.5 million in 2024 and is expected to reach USD 623.3 million in 2025.

b. The U.S. mobile IV hydration therapy market is expected to grow at a compound annual growth rate of 10.4% from 2025 to 2030 to reach USD 1.02 billion by 2030.

b. Energy boosters segment held the largest share of 26.3% in 2024. This dominance is attributed to the high demand from working professionals, fitness enthusiasts, and individuals seeking quick recovery from fatigue or jet lag.

b. Some of the major participants in the mobile IV hydration services market include Drip Hydration; DriPros IV Hydration Wellness; wHydrate; Renew Ketamine & Wellness Center; R2 Medical Clinic; AliveDrip; Hydrate IV; Hydration Room; DRIPBaR, Restore

b. The U.S. mobile IV hydration therapy market is driven by increasing consumer demand for convenient, on-demand wellness services amid rising health consciousness. Advancements in mobile healthcare delivery, including app-based scheduling and nurse dispatch models, are enhancing service accessibility and user experience.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.