- Home

- »

- Clinical Diagnostics

- »

-

U.S. Mobile Physician Practice Market Size Report, 2030GVR Report cover

![U.S. Mobile Physician Practice Market Size, Share & Trends Report]()

U.S. Mobile Physician Practice Market (2023 - 2030) Size, Share & Trends Analysis Report, By Type (Emergency Medicine, Telehealth), By Services , By End-use (Home Healthcare, Hospices), And Segment Forecasts

- Report ID: GVR-4-68038-004-0

- Number of Report Pages: 91

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

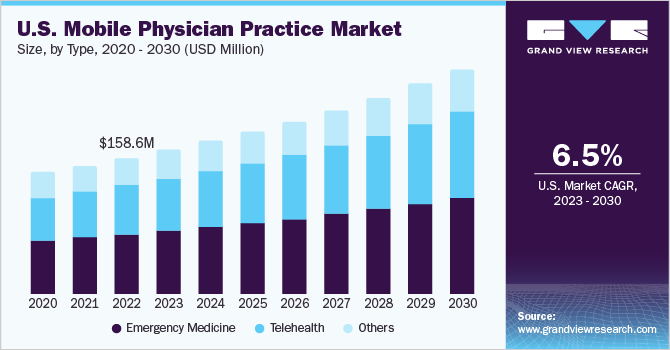

The U.S. mobile physician practice market size was valued at USD 158.6 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.5% over the forecast period from 2023 to 2030. The market growth is attributed to factors such as the increasing incidence of chronic disorders, the increasing number of people who require home aid, and the rising cost of visits to healthcare facilities. Chronic diseases are among the most prevalent and costly health conditions in the U.S. and have become a major cause of disabilities, requiring medical attention. According to the Partnership to Fight Chronic Disease (PFCD), 164 million people in U.S., around 49% of the total population, are expected to be affected by chronic diseases by 2025.

Moreover, the introduction of technologically advanced medical devices that allow physicians to remotely monitor their patients is expected to drive the market for mobile physician practices over the forecast period. By using advanced management software, medical practitioners can easily book appointments and keep track of patient medical records. The geriatric population suffers from general age-related disabilities, such as dementia, diabetes, heart conditions, Alzheimer’s disease, and mental stress. Such medical conditions are anticipated to subsequently drive the demand for house calls by physicians who provide quality medical care to this cohort at a reduced cost. Also, supportive initiatives undertaken by regulatory authorities, such as the development of the Centers for Medicare & Medicaid Services (CMS) is expected to impel market growth. CMS facilities provide advanced mobile medical services at a reduced cost.

Mobile physician practice services are covered under Medicare Part B. Most medical practitioners accept Medicare as a payment method, wherein approximately 80% is covered by Medicare and 20% is covered by secondary insurance via copay, according to annual deductibles. Secondary or third-party insurance coverage from insurance bodies, such as Cigna, Aetna, and Blue Cross Blue Shield, is also accepted by mobile physician practice services.

These practices provide on-site medical care to patients in their homes, meeting the increasing demand for personalized healthcare services. Mobile physician practices offer convenience and accessibility, especially for individuals with limited mobility or residing in remote areas. Additionally, advancements in telemedicine enable physicians to remotely monitor patients and provide consultations, leading to improved healthcare outcomes thereby aiding the growth of the U.S. mobile physician practice market.

Mobile practices offer a cost-effective solution by eliminating overhead expenses associated with physical clinics, resulting in more affordable healthcare services for patients. Furthermore, these practices can help reduce healthcare expenses by providing proactive and timely care, reducing the need for costly hospital or emergency room visits. The rising cost of healthcare facility visits has driven the demand for affordable and accessible alternatives such as mobile physician practices, boosting the market growth.

Type Insights

The emergency medicine segment dominated the market with the largest revenue share of 44.1% in 2022. The dominance is attributed to the increasing presence of the geriatric population, which requires frequent medical interventions. The increasing cost of visits to emergency medical departments, longer wait times, and understaffed emergency rooms (ER) have made it difficult for patients to get quality care.

The telehealth segment is expected to grow at the fastest CAGR of 7.4% during the forecast period from 2023 to 2030. Rapidly evolving healthcare technology has enabled medical practitioners to use telehealth software and devices to remotely monitor patients and provide continuous quality care. Furthermore, mobile physician practice services are operating through mobile applications and websites that enable patients to schedule appointments at their convenience.

Services Insights

The primary care segment dominated the market with the largest revenue share of 19.3% in 2022. Primary care mobile practice provides routine check-ups, preventive care, and general consultation. Additionally, by providing primary care directly to patients, these practices enhance accessibility for patients with limited mobility.

The rehabilitation services material segment is estimated to register the fastest CAGR of 7.8% over the forecast period from 2023 to 2030. The growth of the segment can be attributed to the increasing use of these practices in the treatment of patients recovering from surgeries, injuries, or strokes. Mobile rehabilitation practices provide targeted interventions, exercises, and therapies in the comfort of patients' homes, promoting faster recovery, improved functional outcomes, and reduced hospital readmissions.

Services offered by mobile physician practice services are an effective alternative in the U.S. healthcare delivery model. Physician house calls have significantly reduced healthcare expenditure for services such as primary care, wound care, rehabilitation, and short-term care services. Furthermore, mobile physician practice services have also reduced the number of non-emergent cases in hospital ER, which leads to unnecessary procedures and tying up of ER staff.

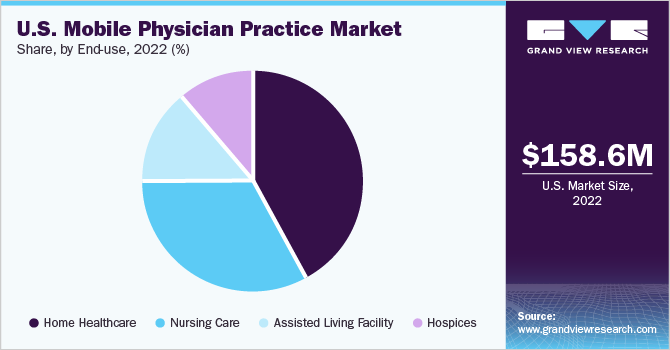

End-use Insights

The home healthcare segment dominated the market with the largest revenue share of 42.1% in 2022. The dominance is attributed to the convenience and comfort offered by mobile physician practice services. Long-term care centers collaborate with mobile physician services instead of maintaining in-house physicians, nursing practitioners, or assistants. Such collaborations allow these facilities to reduce the high cost of maintaining in-house medical practitioners. Most of the people receiving homecare in the U.S., are aged above 65 years, with approximately 97% of them requiring assistance while taking the bath and 91% of them requiring aid while transferring in and out of bed.

Mobile physician practice providers offer group care packages that allow patients to schedule home calls with medical practitioners for routine checkups or medical emergencies. Mobile physicians use telehealth software for remote patient monitoring for residents of these facilities. The payment of such services is generally covered by Medicare or third-party insurance. Uninsured patients can make out-of-pocket payments to service providers.

The hospices segment is expected to grow at the fastest CAGR of 8.3% over the forecast period from 2023 to 2030. Hospice care bring comprehensive medical services and support to patients in their homes, ensuring comfort, dignity, and quality of life in the final stages of illness. Mobile hospice provides personalized care, pain management, symptom control, and emotional support, creating a more compassionate and familiar environment for patients and their families. Therefore, contributing to the growth of the market.

Key Companies & Market Share Insights

The rise in the adoption of home tests has created a huge demand for mobile physician practice. The high demand has created fierce competition in the regional market making space for new companies to venture into this field through advanced services and disruptive technology, opening up space for innovation in this field. Market players implement various strategic initiatives such as mergers and acquisitions to expand their product portfolio and gain a competitive edge. For instance, in January 2022, Parker Health Group, Inc., a non-profit organization providing elderly care through services such as rehab, memory care, and healthcare, announced a partnership with Visiting Nurse Association Health Group, Inc., a non-profit organization providing hospice, visiting physicians, and home health services, to launch the Parker Advanced Care Institute (PACI). PACI's comprehensive service model includes care coordination, specialized services and assistance, advanced care planning, in-home palliative care, and medical advocacy.

Similarly, in May 2021, Doctor On Demand by Included Health, Inc. and Grand Round Health announced the acquisition of Included Health, a health platform specifically catering to the LGBTQ+ community. The acquisition is expected to address health challenges and improve health outcomes in all the communities including LGBTQ+ and BIPOC.

In another instance, in April 2019, Doctor On Demand by Included Health, Inc., in collaboration with Humana Inc., announced the launch of a virtual primary care plan called On Hand. The health plan is aimed at offering patients access to quality medical care at significantly lower monthly premiums. Some of the major participants in the U.S. mobile physician practice market:

-

Mobile Physician Services, Inc.

-

TeamHealth

-

Doctor On Demand by Included Health, Inc.

-

Florida Mobile Physicians, LLC

-

PriveMD

-

PatientPop, Inc.

-

SOS Doctor Housecall

U.S. Mobile Physician Practice Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 168.0 million

Revenue forecast 2030

USD 261.6 million

Growth rate

CAGR of 6.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, services, end-use

Key companies profiled

Mobile Physician Services, Inc.; TeamHealth; Doctor On Demand by Included Health, Inc.; Florida Mobile Physicians, LLC; PriveMD; PatientPop, Inc.; SOS Doctor Housecall

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Mobile Physician Practice Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. mobile physician practice marketon the basis of type, services, and end-use:

-

Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Emergency Medicine

-

Telehealth

-

Others

-

-

Services Outlook (Revenue in USD Million, 2018 - 2030)

-

Primary Care

-

Short-Term Episodic Care

-

Monitoring Services

-

Wound Care

-

Pain Management

-

Rehabilitation Services

-

Palliative Care

-

Others

-

-

End-use Outlook (Revenue in USD Million, 2018 - 2030)

-

Home Healthcare

-

Hospices

-

Nursing Care

-

Assisted Living Facility

-

Frequently Asked Questions About This Report

b. The U.S. mobile physician practice market size was estimated at USD 158.6 million in 2022 and is expected to reach USD 168.0 million in 2023.

b. The U.S. mobile physician practice market is expected to grow at a compound annual growth rate of 6.5% from 2023 to 2030 to reach USD 261.6 billion by 2030.

b. The emergency medicine segment dominated the U.S. mobile physician practice market with a share of around 44.2% in 2022. This is attributable to the presence of the geriatric population, which requires frequent medical interventions. The increasing cost of visits to emergency medical departments, longer wait time, and understaffed Emergency Rooms (ER) have made it difficult for patients to get quality care.

b. Some key players operating in the U.S. mobile physician practice market Visiting Nurse Association (VNA) Health Group; Mobile Physician Services, Inc.; Team Select Home Care; TeamHealth; Mobile Physicians Group; Doctor On Demand, Inc.; Florida Mobile Physicians, LLC; PriveMD; PatientPop, Inc.; and SOS Doctor.

b. Key factors that are driving the U.S. mobile physician practice market growth include the increasing prevalence of chronic disorders, the increasing number of people who require home aid, and the rising cost of visits to healthcare facilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.