- Home

- »

- Next Generation Technologies

- »

-

U.S. Multi-Access Edge Computing Market Size Report, 2033GVR Report cover

![U.S. Multi-Access Edge Computing Market Size, Share & Trends Report]()

U.S. Multi-Access Edge Computing Market (2025 - 2033) Size, Share & Trends Analysis Report By Solution (Hardware, Software, Services), By End Use (IT & Telecom, Healthcare, Others), And Segment Forecasts

- Report ID: GVR-4-68040-196-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

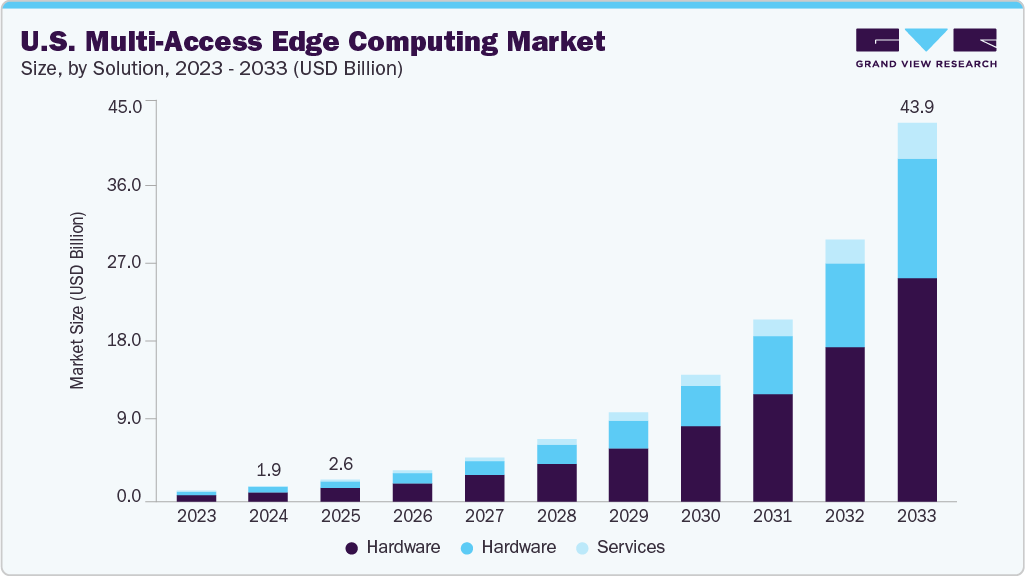

The U.S. multi-access edge computing market size was estimated at USD 1.88 billion in 2024 and is projected to reach USD 43.89 billion by 2033, growing at a CAGR of 42.2% from 2025 to 2033, driven by the growth of smart city initiatives, the U.S. multi-access edge computing industry is gaining momentum. Cities are deploying edge-enabled infrastructure to support connected traffic systems, surveillance, and real-time environmental monitoring. These systems require distributed computing power for responsive and autonomous operation. The push toward intelligent urban ecosystems is propelling further investment in edge-enabled services.

The U.S. multi-access edge computing industry is experiencing strong growth due to the rising need for ultra-low latency in applications such as autonomous vehicles, AR/VR, and real-time analytics. Businesses increasingly invest in edge infrastructure to ensure faster data processing closer to the user. This shift is critical for mission-critical services where even milliseconds matter. The demand for latency-sensitive applications pushes telecom providers and cloud players to innovate faster at the network edge.

Data privacy regulations and the need for localized processing drive adoption in the U.S. multi-access edge computing industry. By processing data locally, companies reduce the risks of transmitting sensitive information across broader networks. This aligns with evolving compliance mandates and sector-specific regulations. Businesses in finance, government, and healthcare sectors are particularly keen on maintaining control over data residency.

The surge in real-time video streaming, online gaming, and immersive media accelerates the U.S. multi-access edge computing industry. Content providers are moving computing resources closer to end users to reduce buffering, improve video quality, and lower latency. Edge-enabled content delivery networks (CDNs) are helping meet the explosive bandwidth demand. This is especially crucial in densely populated urban areas where streaming usage peaks.

The advancement of autonomous vehicle ecosystems drives substantial investment in the U.S. multi-access edge computing industry. Real-time navigation, collision avoidance, and traffic analysis decision-making require localized computing power. Deploying edge infrastructure along transportation corridors allows data to be processed closer to the vehicle, which is vital for ensuring safety and meeting the latency thresholds required for vehicle autonomy.

Solution Insights

The hardware segment dominated the market with a share of over 60% in 2024, owing to rising demand for edge servers, gateways, and micro data centers that support real-time data processing. This demand is fueled by applications in autonomous vehicles, smart cities, and industrial IoT that require localized computing power. Hardware is becoming more compact, rugged, and AI-enabled to support deployment in diverse environments and reduce reliance on centralized cloud infrastructure. Although its growth rate is lower than that of software and services, hardware remains a foundational element driving edge computing adoption across critical sectors.

The services segment is expected to register the fastest CAGR of 43.3% from 2025-2033, driven by the complexity of deploying and managing edge infrastructure. Businesses increasingly rely on integration, consulting, and managed services to implement customized MEC solutions that align with their specific use cases. As organizations expand their edge deployments across healthcare, automotive, and manufacturing sectors, demand for lifecycle services—from design to maintenance—is rising sharply. This shift toward service-led models reflects the need for scalability, continuous optimization, and reduced operational burden in edge computing environments.

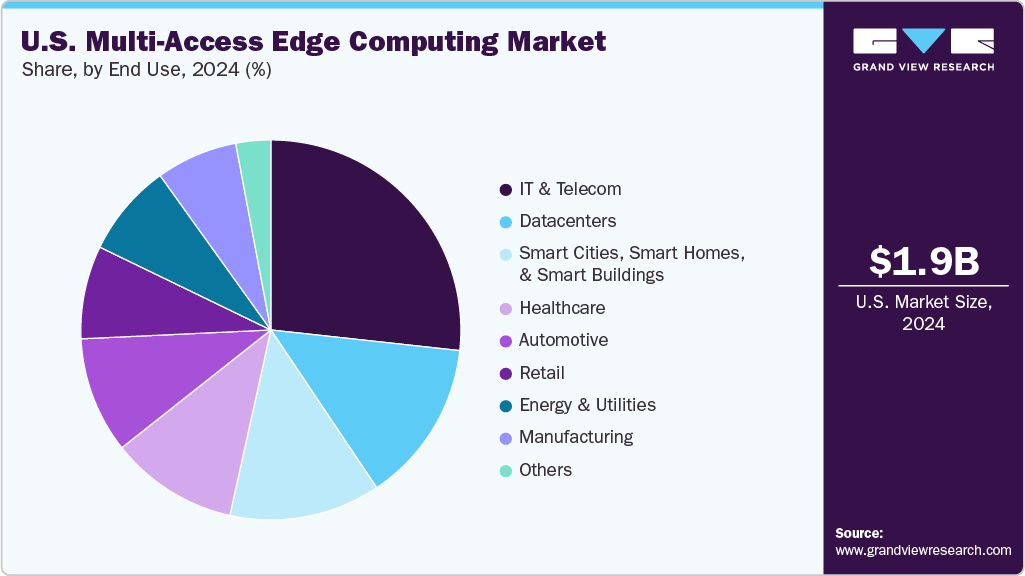

End Use Insights

The IT & telecom segment dominated the market in 2024, driven by its central role in building and operating edge networks. Telecom operators are deploying MEC infrastructure alongside 5G rollouts to enable ultra-low latency services like video conferencing, cloud gaming, and AR/VR. Cloud service providers also integrate edge capabilities to support distributed computing for enterprise customers. However, while still dominant, the segment's growth is gradually being outpaced by vertical-specific applications in sectors such as healthcare and automotive, leading to a relative decline in market share over time.

The healthcare segment is expected to grow at the fastest CAGR in the coming years, driven by the need for real-time data processing in critical applications like remote patient monitoring, AI-assisted diagnostics, and robotic surgeries. MEC enables healthcare providers to process sensitive medical data locally, ensuring low latency, enhanced privacy, and compliance with regulations like HIPAA. The rise of telemedicine and wearable health devices further accelerates demand for edge infrastructure within hospitals and clinics. As digital health adoption expands, edge computing is essential for delivering secure, responsive, and efficient care.

Key U.S. Multi-Access Edge Computing Company Insights

Some of the key players operating in the market include Cisco Systems, Inc. and Amazon Web Services (AWS), among others.

-

Amazon Web Services (AWS) is a dominant player in the U.S. MEC market through its AWS Wavelength platform. The company integrates edge computing capabilities directly into 5G networks, allowing developers to build ultra-low latency applications. AWS collaborates with major telecom operators like Verizon and Vodafone to expand edge zones. Its global scale and integration with the AWS ecosystem make it a preferred partner for enterprise MEC deployments.

-

Cisco Systems, Inc. plays a critical role in the U.S. MEC market with its edge networking, computing, and orchestration solutions. The company enables secure, low-latency edge infrastructure through its Cisco Edge Intelligence and IOx platforms. Cisco also collaborates with telecoms and cloud partners to deliver end-to-end edge computing solutions. Its leadership in enterprise networking strengthens its MEC value proposition.

FogHorn Systems Inc. and Vapor IO are some of the emerging market participants in the U.S. Multi-Access Edge Computing market.

-

Vapor IO is an emerging player in the MEC space with a focus on “Kinetic Edge” colocation and edge interconnection services. The company is building edge data centers in key U.S. metro areas to enable real-time applications and autonomous systems. Vapor IO’s platform integrates compute, storage, and network fabric at the edge to reduce latency and improve performance. Its neutral-host model attracts partnerships from telecoms and cloud providers alike.

-

FogHorn SystemsInc. specializes in edge AI and real-time analytics, offering an innovative edge intelligence platform for industrial MEC applications. Its software enables decision-making at the edge for industries like manufacturing, energy, and transportation. FogHorn’s lightweight edge architecture supports low-latency environments and offline operations. The company has gained recognition for bringing advanced AI/ML to constrained edge devices.

Key U.S. Multi-Access Edge Computing Companies:

- Advantech Co., Ltd.

- Amazon Web Services (AWS)

- AT&T Inc.

- Cisco Systems, Inc.

- FogHorn Systems Inc.

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Juniper Networks, Inc.

- Saguna Network Ltd.

- SMART Embedded Computing

- Vapor IO

- Verizon Communications Inc.

- ZephyrTel

Recent Developments

-

In March 2025, Couchbase launched its Edge Server, designed for offline-first applications in resource-constrained edge environments. It operates on devices with as little as 1 GB RAM and supports real-time local data processing. The server syncs seamlessly with Couchbase Lite and Capella, even during network outages. It is ideal for secure, low-latency use cases across retail, aviation, manufacturing, and logistics industries.

-

In February 2025, HEAVY.AI partnered with Ookla to deliver real-time, GPU-accelerated network analytics for telecom and enterprise users. The solution enables ultra-fast geospatial visualization and analysis of massive datasets. It helps identify network issues like congestion and latency while supporting 5G and fiber infrastructure planning. This joint offering empowers governments and service providers with AI-driven insights for better connectivity decisions.

-

In February 2025, Veea Inc. partnered with Vapor IO to launch a turnkey AI-as-a-Service (AIaaS) platform. The solution offers private 5G and edge computing without requiring upfront infrastructure investment. It leverages Veea’s Edge Platform for AI inferencing, cybersecurity, and edge applications. This platform targets low-latency, smart use cases across industries like healthcare, manufacturing, and city services.

U.S. Multi-Access Edge Computing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.62 billion

Revenue forecast in 2033

USD 43.89 billion

Growth rate

CAGR of 42.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million/Billion and CAGR from 2025 to 2033

Report product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, end use

Country Scope

U.S.

Key companies profiled

Advantech Co., Ltd.; Amazon Web Services (AWS); AT&T Inc.; Cisco Systems, Inc.; FogHorn Systems Inc.; Hewlett Packard Enterprise; Development LP; IBM Corporation; Juniper Networks, Inc.; Saguna Network Ltd.; SMART Embedded Computing; Vapor IO; Verizon Communications Inc.; ZephyrTel

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Multi-Access Edge Computing Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. multi-access edge computing market report based on solution and end use.

-

Solution Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

IT & Telecom

-

Smart Cities, Smart Homes, & Smart Buildings

-

Datacenters

-

Energy & Utilities

-

Automotive

-

Manufacturing

-

Retail

-

Healthcare

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. multi-access edge computing market size was estimated at USD 1.88 billion in 2024 and is expected to reach USD 2.62 billion in 2025.

b. The U.S. multi-access edge computing market is expected to grow at a compound annual growth rate of 42.2% from 2025 to 2033 to reach USD 43.89 billion by 2033.

b. Based on the solution, the software segment dominated the market in 2024, driven by increasing demand for edge-native applications, scalable orchestration platforms, and AI-enabled analytics tools in multi-access edge computing environments.

b. Some key players operating in the U.S. multi-access edge computing market include Advantech Co., Ltd., Amazon Web Services (AWS), AT&T Inc., Cisco Systems, Inc., FogHorn Systems Inc., Hewlett Packard Enterprise Development LP, IBM Corporation, Juniper Networks, Inc., Saguna Network Ltd., SMART Embedded Computing, Vapor IO, Verizon Communications Inc., and ZephyrTel.

b. Key factors that are driving the market growth include the rising adoption of U.S. multi-access edge computing (MEC), growing demand for ultra-low latency applications, rapid expansion of 5G networks, and increased deployment of IoT devices across industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.