- Home

- »

- Next Generation Technologies

- »

-

Multi-access Edge Computing Market Size Report, 2033GVR Report cover

![Multi-access Edge Computing Market Size, Share & Trends Report]()

Multi-access Edge Computing Market (2025 - 2033) Size, Share & Trends Analysis Report By Solution (Hardware, Software, Services), By Enterprise Size, By Network Type, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-437-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Multi-access Edge Computing Market Summary

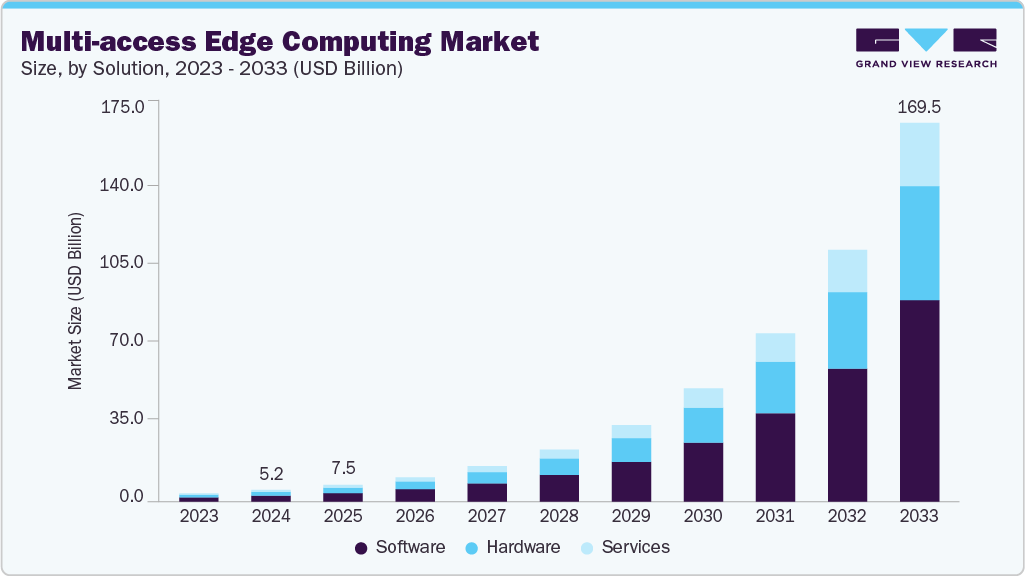

The global multi-access edge computing market size was estimated at USD 5.23 billion in 2024 and is projected to reach USD 169.53 billion by 2033, growing at a CAGR of 47.6% from 2025 to 2033. The market growth is primarily driven by the rising demand for ultra-low latency applications, the expansion of 5G networks, increasing enterprise adoption of private edge infrastructures, and the growing integration of AI and real-time analytics at the edge.

Key Market Trends & Insights

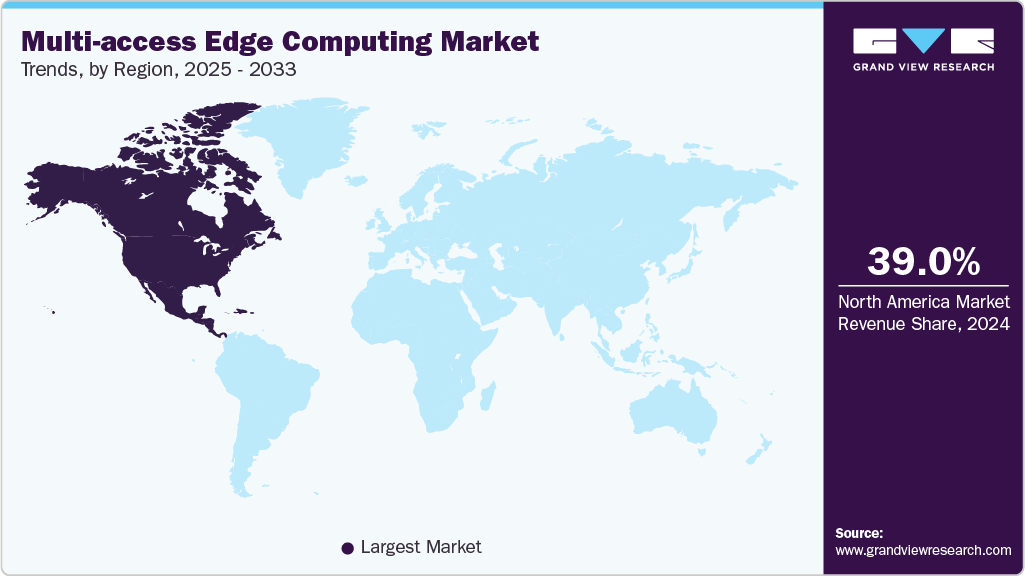

- North America dominated the global multi-access edge computing market with the largest revenue share of over 39% in 2024.

- The multi-access edge computing market in the U.S. led the North America market and held the largest revenue share in 2024.

- By solution, the software segment led the market, holding the largest revenue share of over 50% in 2024.

- By network type, the wireless multi-access edge computing segment held the dominant position in the market and accounted for the largest revenue share of over 56% in 2024.

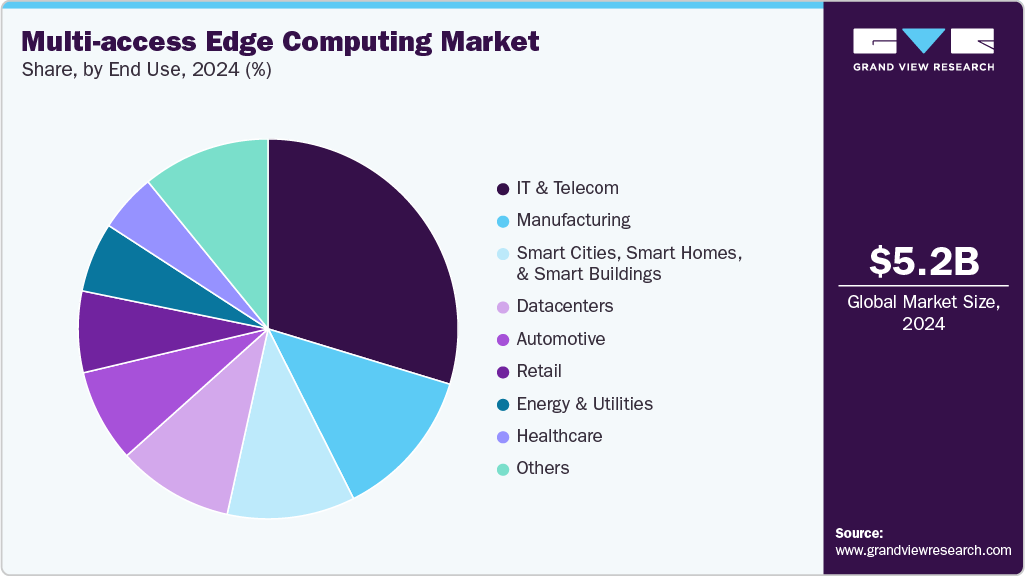

- By end use, the IT & Telecom segment is expected to grow at the fastest CAGR of over 29% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 5.23 Billion

- 2033 Projected Market Size: USD 169.53 Billion

- CAGR (2025-2033): 47.6%

- North America: Largest market in 2024

The expansion of 5G networks is accelerating deployments in the multi-access edge computing industry. Telecom operators are leveraging MEC to offload network traffic and enable time-sensitive services such as cloud gaming and remote surgeries. MEC address the data deluge generated by high-speed networks by processing it closer to the user. This strategic alignment between 5G and edge infrastructure is becoming a priority investment area. The industry trend reflects how MEC is positioned as a foundational layer of 5G monetization.Smart city projects are becoming a major driver in the multi-access edge computing industry. Governments and urban planners are deploying MEC to support traffic monitoring, public safety surveillance, and environmental sensors. MEC enhances decision-making by enabling data to be processed near the source, ensuring real-time responsiveness for civic applications. These projects demand scalable and secure edge nodes to handle massive volumes of urban data. The trend signals growing public-sector investment in edge-based infrastructure to modernize urban environments.

The automotive industry is rapidly advancing the use of edge computing through applications in connected vehicle communication and autonomous driving. Edge computing enhances the safety and responsiveness of autonomous operations by enabling low-latency processing of data from sensors, infrastructure, and navigation systems. Automakers and transport agencies are investing in this technology to support vehicle-to-everything (V2X) communication networks. The shift is driven by the growing complexity of in-vehicle data and the rising demand for intelligent mobility solutions.

Telecom providers are emerging as key enablers in the multi-access edge computing industry by offering edge-based services to enterprises. MEC allows telcos to provide differentiated solutions such as network slicing, localized cloud services, and low-latency application hosting. These offerings are becoming valuable as enterprises seek customized, responsive IT environments. Operators are positioning MEC as a revenue-generating layer beyond traditional connectivity. The industry trend reflects telecom firms’ strategic shift toward service-based business models.

Solution Insights

The software segment dominated the market with a share of over 50% in 2024, fueled by the rising need to manage distributed infrastructure in real time. Enterprises are embracing orchestration, virtualization, and automation tools to enhance efficiency and minimize latency at the edge. These software solutions support dynamic resource allocation, seamless application deployment, and smooth integration with cloud and on-premises systems. This trend underscores the increasing demand for scalable and interoperable platforms that enable high-performance, localized computing.

The services segment is expected to register a significant CAGR of over 47% from 2025 to 2033, primarily due to the growing complexity involved in deploying and managing edge infrastructure. Organizations are increasingly turning to consulting, integration, and managed services to accelerate adoption and ensure smooth implementation across varied environments. These services play a vital role in bridging skill gaps, enhancing edge performance, and shortening time-to-market for critical applications. The rising need for comprehensive, end-to-end support in planning, deployment, and maintenance is driving this upward trend.

Enterprise Size Insights

The large enterprises segment dominated the market in 2024. The growing need for real-time data processing, operational efficiency, and advanced digital services is driving large enterprises to adopt edge computing solutions. These organizations utilize MEC to manage complex workloads across dispersed locations, enabling faster decision-making and alleviating network congestion. As data volumes surge from IoT devices, connected assets, and mission-critical applications, scalable and secure edge infrastructure has become essential. This trend underscores MEC’s strategic importance in modernizing IT operations and sustaining competitive advantage for large-scale enterprises.

The small and medium-sized enterprises (SMEs) segment is expected to grow at the fastest CAGR during the forecast period, owing to constraints on on-site IT infrastructure and a rising need for real-time digital capabilities. Small and medium-sized enterprises are increasingly adopting edge computing to enhance operational agility and responsiveness. By enabling data processing closer to the end-user, MEC reduces latency and lessens dependency on centralized cloud architectures. This empowers SMEs to support critical functions such as local analytics, remote monitoring, and secure transactions without substantial capital investment. The trend underscores a growing recognition of the strategic and cost-efficient benefits that edge computing brings to competitive business environments.

Network Type Insights

The wireless MEC segment dominated the market in 2024, driven by the surge in mobile connectivity and the rapid rollout of 5G networks. Enterprises are increasingly deploying wireless edge solutions to support real-time processing for use cases such as autonomous systems, AR/VR experiences, and mobile video analytics. This approach offers enhanced flexibility and scalability, making it ideal for dynamic environments such as smart cities, logistics centers, and outdoor industrial sites. The trend reflects a growing demand for agile, high-performance computing at the edge, free from the constraints of fixed infrastructure.

The wired MEC segment is expected to register the fastest CAGR in the coming years, driven by the need for consistent bandwidth, minimal signal interference, and stable connectivity. Organizations with fixed infrastructure, such as data centers, manufacturing facilities, and healthcare institutions, are increasingly adopting wired edge solutions to ensure reliable, high-speed processing. This configuration is especially suited for latency-sensitive and security-critical applications, where wireless networks may fall short in terms of reliability. The trend highlights the growing prioritization of wired MEC in environments demanding dependable, high-throughput edge performance.

End Use Insights

The IT & telecom segment dominated the market in 2024, owing to the rapid proliferation of data-intensive applications and increasing network traffic. The segment is ramping up investment in edge computing solutions. MEC allows telecom operators to offload congestion from core networks, minimize latency, and deliver localized services such as content streaming, mobile gaming, and enterprise-grade solutions. For IT service providers, edge computing enhances data processing speeds, application responsiveness, and overall user experience. This trend reflects how IT and telecom players are strategically leveraging MEC to optimize service delivery and boost network efficiency in increasingly competitive markets.

The manufacturing segment is expected to grow at the fastest CAGR over the forecast period.The growing demand for real-time process control, predictive maintenance, and industrial automation is accelerating MEC adoption in the sector. Manufacturers are implementing edge computing directly on the factory floor to enable immediate decision-making and reduce operational downtime. This localized approach supports advanced technologies such as robotics, digital twins, and AI-driven quality control, without dependency on remote cloud infrastructure. The trend highlights MEC’s pivotal role in advancing smart manufacturing strategies aimed at enhancing efficiency, agility, and precision in operations.

Regional Insights

North America multi-access edge computing market dominated the market with a share of over 39% in 2024, driven by early 5G deployments, cloud native infrastructure maturity, and high enterprise digitization. North America is leading MEC adoption. Companies across the telecom, automotive, and healthcare sectors are implementing edge solutions to reduce latency and support real time operations. The region continues to attract heavy investments in MEC R&D and commercial rollouts, especially from U.S. based technology firms.

U.S. Multi-access Edge Computing Market Trends

The U.S. multi-access edge computing market dominated the market with a share of over 90% in 2024, owing to its advanced telecommunications infrastructure and the strong presence of leading cloud service providers. The U.S. serves as a key growth driver in the multi-access edge computing landscape. Enterprises across various industries are leveraging MEC to enable applications such as autonomous mobility, remote healthcare, and industrial automation. A strong emphasis on innovation and early commercialization is accelerating the rollout of edge deployments nationwide. This momentum reflects the country's strategic focus on integrating next-generation technologies to enhance operational performance and competitiveness.

Europe Multi-access Edge Computing Market Trends

The Europe multi-access edge computing market is expected to grow at a CAGR of over 45% from 2025 to 2033, driven by digital transformation policies, expanding smart city initiatives, and rising demand for localized data processing. Europe is rapidly advancing MEC adoption, particularly in key sectors such as energy, automotive, and public services. These industries are utilizing MEC to enhance network performance and develop smarter infrastructure. In addition, regulatory focus on data sovereignty encourages more regional edge deployments.

The Germany multi-access edge computing market is expected to grow at a significant rate in the coming years, primarily driven by its strong industrial base and leadership in manufacturing technologies, Germany is emerging as a core adopter of MEC in Europe. German firms are integrating edge computing into factory floors for automation, robotics, and predictive analytics. The government's focus on Industrie 4.0 is reinforcing enterprise investment in edge based capabilities.

The multi-access edge computing market in UK is expected to grow at a significant rate during the forecast period, owing to growing investments in telecom infrastructure and increased demand for real time digital services. The UK is experiencing a rapid uptake of MEC technologies. Telecom operators and enterprises are collaborating on edge-based service delivery for retail, financial services, and media applications. The market is supported by supportive regulatory frameworks and innovation funding.

Asia Pacific Multi-access Edge Computing Market Trends

The Asia Pacific multi-access edge computing market is expected to grow at the fastest CAGR of over 53% from 2025 to 2033, driven by large-scale 5G rollouts, high mobile internet usage, and government-backed digitalization initiatives. The Asia Pacific region is becoming a dynamic hub for MEC growth. Countries across the region are adopting MEC to support urban mobility, industrial IoT, and immersive consumer applications. The increasing number of edge data centers is accelerating the commercial viability of MEC.

The China multi-access edge computing market is primarily driven by aggressive 5G deployment and smart infrastructure investments. China is rapidly expanding its MEC footprint. Telecom giants and tech firms are launching edge nodes to enable real-time services in urban transport, surveillance, and factory automation. State-led programs are further incentivizing the integration of edge computing into national digital strategies.

The multi-access edge computing market in Japan is expected to grow in the coming years, owing to its advanced robotics industry and demand for ultra-reliable low-latency communication. Japan is actively adopting MEC to modernize enterprise networks. Use cases in manufacturing, public safety, and remote diagnostics are gaining momentum with local edge processing. Government initiatives promoting Society 5.0 are reinforcing the adoption of next-generation edge solutions.

Key Multi-Access Edge Computing Company Insights

Some of the key players operating in the market include Hewlett Packard Enterprise Development LP (HPE) and Huawei Technologies Co., Ltd., and among others.

-

Hewlett Packard Enterprise Development LP (HPE) is a leading force in the MEC market, offering edge optimized infrastructure and edge to cloud platforms through its HPE Edgeline and Aruba portfolios. The company focuses on enabling real time data processing at the edge for industries such as manufacturing, telecom, and energy. HPE’s deep integration with hybrid cloud solutions allows seamless orchestration between core, edge, and cloud environments. Its collaborations with telecom operators and 5G ecosystem players further solidify its position as a trusted enterprise grade edge computing provider.

-

Huawei Technologies Co., Ltd. is a dominant player in the MEC landscape, especially in Asia, providing integrated hardware, software, and 5G enabled edge computing solutions. Its MEC Cloud platform supports telco grade low latency services across smart cities, autonomous driving, and industrial automation. Huawei has invested heavily in building a robust MEC ecosystem aligned with its carrier network infrastructure. The company's innovation in AI at the edge and its partnerships with global telecom providers position it as a powerhouse in the MEC domain.

Saguna Network Ltd. and Vapor IO. are some of the emerging market participants in the multi-access edge computing market.

-

Vapor IO is pioneering the development of the Kinetic Edge platform, a software defined network of micro data centers positioned at the edge of telecom and urban infrastructure. It specializes in providing edge colocation, interconnection, and networking services that enable true low latency computing. The company’s unique "tower connected edge" strategy is gaining traction in North America, especially in smart city and 5G rollouts. As an infrastructure first startup, Vapor IO is redefining how edge data centers are deployed and operated.

-

Saguna Network Ltd is an innovative company focused on virtualized MEC software platforms tailored for telecom operators. Its Saguna Edge Cloud enables rapid deployment of edge services, including video streaming, IoT analytics, and AR/VR applications. The company emphasizes seamless integration with LTE/5G networks and core systems. Saguna's software centric and telco native approach makes it a strategic partner for network service providers looking to monetize the edge.

Key Multi-Access Edge Computing Companies:

The following are the leading companies in the multi-access edge computing market. These companies collectively hold the largest market share and dictate industry trends.

- ADLINK Technology Inc.

- Advantech Co., Ltd.

- FogHorn Systems Inc.

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- Juniper Networks, Inc.

- Saguna Network Ltd.

- SMART Embedded Computing

- Vapor IO

- ZephyrTel

Recent Developments

-

In June 2025, SoftBank Corporation expanded its Segment Routing IPv6 Mobile User Plane (SRv6 MUP) field trial to include its commercial 4G network, extending beyond its initial 5G deployments in Japan. This advancement enables system wide validation of low latency multi-access edge computing (MEC) and network slicing services across its 4G/5G infrastructure, leveraging SRv6 MUP’s cost effective and easily deployable architecture. During a 130 kilometre drive test using AI powered dashcams, SoftBank demonstrated over 10 milliseconds of latency improvement and stable connectivity, reinforcing its commitment to enhancing mobile communication through next generation edge technologies.

-

In March 2025, Qualcomm acquired Edge Impulse to strengthen its artificial intelligence (AI) and Internet of Things (IoT) capabilities at the edge. By integrating Edge Impulse’s no code, end to end machine learning development platform with Qualcomm’s advanced hardware solutions, the company aims to streamline edge AI deployment across various industries. This strategic acquisition is expected to accelerate digital transformation and enhance developer productivity in sectors such as healthcare, industrial automation, retail, and logistics.

-

In January 2025, Veea Inc. partnered with Lynxspring Inc. to accelerate edge to cloud integration and containerization opportunities across smart building and industrial IoT environments. The collaboration leverages Veea’s advanced edge computing and connectivity solutions alongside Lynxspring’s proven open software, hardware, and automation technologies. This strategic alliance aims to deliver highly secure, scalable, and interoperable edge solutions, enabling real time data processing and improved operational efficiencies across distributed systems.

Multi-access Edge Computing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.53 billion

Revenue forecast in 2033

USD 169.53 billion

Growth rate

CAGR of 47.6% from 2025 to 2033

Base year of estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, enterprise size, network type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

ADLINK Technology Inc.; Advantech Co. Ltd.; FogHorn Systems Inc.; Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd.; Juniper Networks Inc.; SAGUNA; SMART Embedded Computing; Vapor IO; ZephyrTel

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Multi-access Edge Computing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub segments from 2021 to 2033. For this study, Grand View Research has segmented the global multi-access edge computing market report based on solution, enterprise size, network type, end use, and region.

-

Solution Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Small and Medium sized Enterprises (SMEs)

-

Large Enterprises

-

-

Network Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Wireless MEC

-

Wired MEC

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

IT & Telecom

-

Smart Cities, Smart Homes, & Smart Buildings

-

Datacenters

-

Energy & Utilities

-

Automotive

-

Manufacturing

-

Retail

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global multi-access edge computing market size was estimated at USD 5.23 billion in 2024 and is expected to reach USD 7.53 billion by 2025.

b. The global multi-access edge computing market is expected to grow at a CAGR of 47.6% from 2025 to 2033 to reach USD 169.53 billion by 2033.

b. The IT & Telecom segment dominated the global multi-access edge computing market in 2024, propelled by the widespread deployment of 5G networks, surging IoT adoption, and the growing need for real-time data processing through cloud-native and AI-integrated edge infrastructure.

b. Some of the key players in the global multi-access edge computing market include ADLINK Technology Inc., Advantech Co., Ltd., FogHorn Systems Inc., HPE, Huawei Technologies Co., Ltd., Juniper Networks Inc., SAGUNA; Vapor IO, and ZephyrTel.

b. Key factors driving the growth of multi-access edge computing include the rising demand for low-latency applications, the rapid expansion of IoT devices, and increased adoption of 5G networks.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.