- Home

- »

- Advanced Interior Materials

- »

-

U.S. Natural Stone Market Size, Share, Industry Report 2030GVR Report cover

![U.S. Natural Stone Market Size, Share & Trends Report]()

U.S. Natural Stone Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Marble, Sandstone, Limestone, Granite, Travertine), By End Use (Residential-New Construction), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-521-1

- Number of Report Pages: 92

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Natural Stone Market Size & Trends

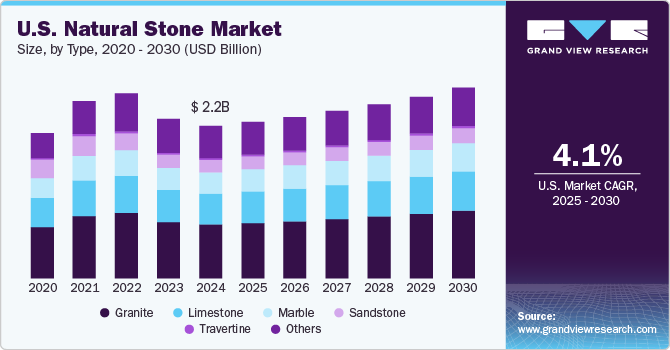

The U.S. natural stone market size was estimated at USD 2.20 billion in 2024 and is projected to grow at a CAGR of 4.1% from 2025 to 2030. Natural stone is a naturally occurring material quarried from the earth and used in construction, landscaping, and interior design. It includes varieties such as granite, marble, limestone, sandstone, and slate, each with unique characteristics and applications. Known for its durability, aesthetic appeal, and sustainability, natural stone is widely used in countertops, flooring, facades, and monuments.

Drivers, Opportunities & Restraints

The U.S. natural stone market is projected to grow due to increasing demand for high-quality, long-lasting materials in residential and commercial construction. Rising consumer preference for durable and aesthetically appealing surfaces is encouraging wider adoption in flooring, countertops, and facades. In addition, sustainability concerns are fostering interest in domestically sourced materials, reducing reliance on imports. Advancements in quarrying and fabrication techniques are expected to enhance product accessibility and affordability. The integration of automated cutting and finishing technologies is also anticipated to improve production efficiency and minimize waste in the natural stone industry.

Expanding urbanization and infrastructure development create significant prospects for premium surface materials in public and private projects. The shift toward green building certifications is likely to drive preference for eco-friendly and recyclable options. Emerging design trends emphasizing natural aesthetics are projected to support demand across high-end commercial spaces and luxury housing. Moreover, growth in e-commerce and digital platforms is providing manufacturers with direct-to-consumer sales channels, improving market reach. Increasing innovation in surface treatments and sealants may further enhance durability and widen potential applications in high-traffic environments.

Fluctuations in raw material extraction costs and transportation expenses for natural stone could pose challenges to industry expansion. Stringent environmental regulations governing quarrying practices are anticipated to increase compliance costs, impacting profitability for smaller players. Competition from engineered alternatives, offering lower prices and consistent finishes, might restrict market penetration in budget-conscious segments. Dependence on skilled labor for precision cutting and installation is another limiting factor, as workforce shortages can affect overall supply chain efficiency. In addition, economic downturns and fluctuations in construction activity are expected to influence demand, particularly in the non-essential remodeling sector.

Type Insights

On the basis of types, the industry has been further categorized into marble, limestone, sandstone, granite, travertine, and others. The U.S. granite market is anticipated to grow due to rising demand in residential and commercial construction, particularly for countertops, flooring, and facades. Increased infrastructure spending and preference for durable, natural materials are likely to drive market expansion. Domestic quarrying is projected to benefit from sustainability trends and tariffs on imported stone, reducing reliance on foreign sources. Advancements in processing technologies are expected to enhance product customization and affordability. However, competition from engineered alternatives may limit growth in price-sensitive segments.

Based on type, marble is expected to remain fastest growing segment from 2025 to 2030. The U.S. marble market is projected to grow, driven by increasing demand in luxury residential and high-end commercial spaces. Rising disposable income and consumer preference for premium aesthetics are anticipated to support expansion, particularly in countertops, flooring, and wall cladding applications. The hospitality sector is also likely to contribute to demand, with hotels and resorts incorporating elegant surfaces to enhance interior appeal.

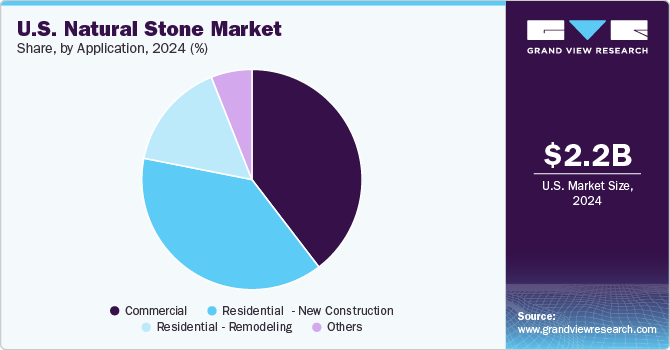

Application Insights

Natural stone is projected to play a crucial role in commercial construction, with applications in flooring, cladding, countertops, and decorative facades. High durability and aesthetic appeal make it a preferred choice for office buildings, hotels, and retail spaces, where premium finishes are prioritized. The use of granite and marble in lobbies and reception areas is anticipated to grow, enhancing brand image and property value.

Natural stone is projected to gain popularity in residential remodeling, particularly for countertops, flooring, and accent walls due to its durability and timeless appeal. Kitchen and bathroom renovations are anticipated to drive demand, with materials such as granite and marble offering both functionality and luxury. Outdoor spaces, including patios and walkways, are also likely to see increased usage as homeowners invest in long-lasting landscape enhancements. According to the Joint Center for Housing Studies of Harvard University (JCHS) in the homeowners in the U.S. spent USD 463 billion in first quarter of 2024, indicating strong renovation activity that supports material demand.

Country Insights

Florida Natural Stone Market Trends

Florida’s natural stone market is projected to expand, fueled by increasing demand in coastal homes, resorts, and commercial spaces. The state’s growing population and tourism-driven economy are likely to boost applications in luxury hotels and waterfront properties. Hurricane-resistant construction is anticipated to encourage the use of durable materials like granite and travertine for exteriors and landscaping.

New York Natural Stone Market Trends

New York’s natural stone market is anticipated to grow due to strong demand in commercial and luxury residential construction. High-rise developments and historic building restorations are likely to drive the need for premium materials such as marble, granite, and limestone. The state’s emphasis on sustainable architecture is projected to support locally sourced stone, aligning with green building standards.

Illinois Natural Stone Market Trends

Illinois is projected to see steady demand for natural stone, primarily in commercial and institutional construction. Chicago’s skyline developments and historic preservation projects are likely to drive the need for limestone and granite in cladding, flooring, and decorative applications. Infrastructure upgrades, including transit station renovations, are anticipated to boost demand for durable stone materials. The Illinois Department of Transportation allocated over USD 3.4 billion for infrastructure improvements in 2023, highlighting ongoing investment in long-lasting construction materials.

Key U.S. Natural Stone Company Insights

Some of the key players operating in the market include Southland Stone USA, Inc., Superior Granite and Marble and A&G Marble Inc

-

Southland Stone USA Inc., established in 1987 and headquartered in North Hollywood, California, specializes in the specification, management, and supply of natural stone for commercial, hospitality, and residential projects. Their offerings include a diverse range of materials such as granite, marble, limestone, basalt, slate, sandstone, travertine, and fossil stones.

-

A&G Marble Inc., established over 40 years ago, is a family-owned and operated company specializing in the manufacturing, fabrication, and installation of natural stones, including marble, limestone, granite, onyx, travertine, and slate.

Key U.S. Natural Stone Companies:

- Southland Stone USA, Inc.

- Superior Granite and Marble

- USA Marble LLC

- A&G Marble Inc

- Levantina y Asociados de Minerales, S.A

- Natural Stones USA

- Polycor Inc.

- Virginia Black Granite

- New Mexico Travertine

- Coldspring

Recent Developments

-

In January 2024, SiteOne Landscape Supply, Inc. announced acquisition of Cohen & Cohen Natural Stone, distributor and supplier of hardscape products. This acquisition will help the company to expand its footprint in Canada market.

-

In November 2022, Outdoor Living Supply, U.S. based company acquired Madbury, which is UK based supplier of natural stone and other bulk materials. The transaction value for this deal was undisclosed.

U.S. Natural Stone Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.26 billion

Revenue forecast in 2030

USD 2.76 billion

Growth rate

CAGR of 4.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Country scope

U.S.

State scope

New York; Florida; Illinois; Rest of the U.S.

Key companies profiled

Southland Stone USA, Inc.; Superior Granite and Marble; USA Marble LLC; A&G Marble Inc; Levantina y Asociados de Minerales, S.A; Natural Stones US; Polycor Inc.; New Mexico Travertine; Virginia Black Granite; Coldspring

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Natural Stone Market Report Segmentation

This report forecasts revenue and volume growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. natural stone market report on the basis of type, application and region.

-

Type Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Marble

-

Limestone

-

Sandstone

-

Granite

-

Travertine

-

Others

-

-

Application Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Residential - New Construction

-

Residential - Remodeling

-

Commercial

-

Others

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

U.S.

-

New York

-

Florida

-

Illinois

-

Rest of the U.S.

-

-

Frequently Asked Questions About This Report

b. The U.S. natural stone market size was estimated at USD 2.20 billion in 2024 and is expected to reach USD 2.26 billion in 2025.

b. The U.S. natural stone market is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2030 to reach USD 2.76 billion by 2030.

b. Based on type, granite accounted for a revenue share of more than 35% in 2024 of the overall market. Rising investments in commercial buildings, transportation infrastructure, and residential projects are driving demand for granite in the U.S.

b. Some of the key vendors of the U.S. natural stone market are Southland Stone USA, Inc., Superior Granite and Marble, USA Marble LLC, A&G Marble Inc, Levantina y Asociados de Minerales, S.A, Natural Stones USA, Polycor Inc., New Mexico Travertine, and Virginia Black Granite, among others

b. Rising preference for high-end natural stone in residential and commercial projects in the U.S. is driving market growth, especially in luxury housing and corporate spaces.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.