- Home

- »

- Medical Devices

- »

-

U.S. Nerve Repair And Regeneration Market, Industry Report, 2030GVR Report cover

![U.S. Nerve Repair And Regeneration Market Size, Share & Trends Report]()

U.S. Nerve Repair And Regeneration Market Size, Share & Trends Analysis Report By Surgery (Nerve Grafting, Stem Cell Therapy), By Product (Biomaterials Neurostimulation & Neuromodulation Device), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-233-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

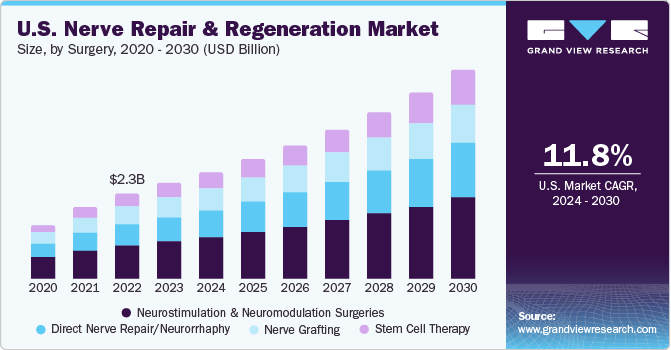

The U.S. nerve repair and regeneration market size was valued at USD 2.58 billion in 2023 and is expected to grow at a CAGR of 11.8% from 2024 to 2030. This is due to the rising prevalence of neurological disorders coupled with the increasing geriatric population in the region. Moreover, stimulation therapy is being increasingly preferred over conventional therapies owing to the presence of Medicare and third-party insurers. Furthermore, the presence of key market players involved in extensive R&D of new products is fueling the market growth.

The U.S. accounted for 28.28% of the nerve repair and regeneration market in 2023. The presence of major competitors & sophisticated healthcare infrastructure and supportive government initiatives are also responsible for market growth in the country. For instance, in 2019, the FDA designated the Checkpoint BEST (Brief Electrical Stimulation Therapy) system as a Breakthrough Device which is intended to deliver electrical stimulation of peripheral nerves to encourage nerve regeneration, and to speed and improve patient recovery.Furthermore, the National Institute of Neurological Disorders and Stroke (NINDS) supports research activities on deep brain stimulation devices as an alternative treatment for PD.

Furthermore, increasing investments for conducting R&D on PD has helped raise awareness and boost the development of new & innovative products and therapies for the treatment of this disease. For instance, the National Parkinson Foundation (NPF) funds researchers and scientists intending to make advancements in this field. Extensive research activities for the inclusion and approval of stimulation devices in new application areas, such as depression and full-body MRI scans, are anticipated to boost market growth over the forecast period.

As per a research article published in Technology Networks, peripheral nerve damage is projected to affect more than 20 million people in the U.S. The same source states that every year, around 700,000 people in the U.S. have surgical treatments to repair severe peripheral nerve injury. Thus, the increasing incidence of nerve injuries is leading to a high demand for nerve repair and regeneration products. Additionally, geriatrics are an important segment of the entire patient pool because of their greater vulnerability. Thus, the increase in the geriatric population boosts the need for nerve repair and regeneration therapy, thereby driving market growth.

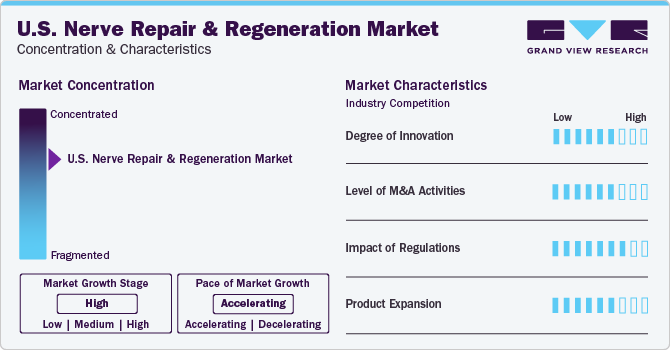

Market Characteristics & Concentration

The industry is concentrated in nature with a few companies accounting for the large market share. Rising awareness about mental disorders and their treatment is anticipated to increase opportunities for key players in the coming years. Increasing funding by both private and public organizations is anticipated to play a vital role in market growth.

Increasing research for nerve regeneration and repair is contributing to industry growth. Furthermore, the presence of key players involved in extensive R&D of new products is fueling the industry's growth. For instance, in 2022, the class III device, the AccelStim healing bone therapy gained FDA pre-market approval in the U.S., according to Orthofix Medical, Inc., a global medical device company specializing in orthopedics and spine.

Key players are trying to carve out their niche through various business strategies such as mergers and acquisitions, collaborations, and partnerships. For instance, in February 2020, Vernacare Limited was acquired by Neuraptive Therapeutics to strengthen its international presence through organic growth, along with seeking M&A opportunities in the industry that complement its existing product portfolio.

Stringent regulations may restrain industry growth. U.S. Nerve stimulation and regeneration devices are classified as Class II and Class III devices by the U.S. FDA and are responsible for regulating human cellular and tissue products (HCP). HCP obtained from the marrow is regulated by the Health Resources and Services Administration as HCT/P. Reimbursement for nerve repair products such as DriveABLE Cognitive Assessment Tool (DCAT) is mostly accepted by the payers in the U.S. It is a computerized neurocognitive assessment to evaluate drivers at risk owing to neurological or any other medical disorder.

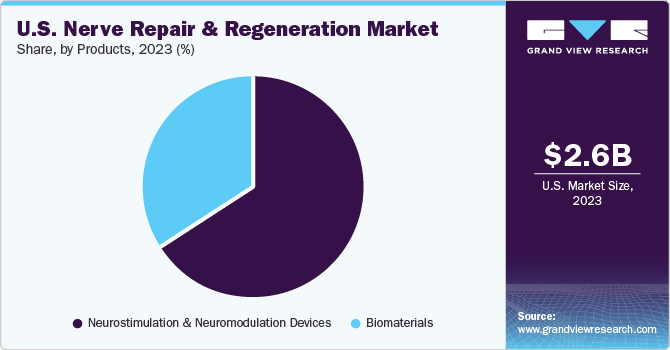

Product Insights

The neurostimulation and neuromodulation devices segment held the largest market share of 66.07 % in 2023 owing to wide applications. These are noninvasive methods used only in cases of unmanageable chronic pain caused by conditions such as Complex Regional Pain Syndrome (CRPS), Intractable Angina Pectoris (IAP), and Peripheral Vascular Disease (PVD). Key industry players are launching new and better technologies which is expected to positively impact the market growth during the forecast period. For instance, in January 2021, Boston Scientific Corporation received U.S. FDA approval for its fourth-generation Vercise Genus Deep Brain Stimulation (DBS) System for conditional use in a magnetic resonance imaging (MRI) environment.

The biomaterials segment is expected to grow at the highest CAGR during the forecast period. This growth is attributed to technological advancements, a wide range of applications, government funding for innovations, and a rise in implantable device applications. Advanced products such as biodegradable polymers are expected to enhance spinal stabilization, healing of fractures, and reduce hospitalization which is projected to further enhance the market growth.

Surgery Insights

The neurostimulation and neuromodulation surgeries segment held the largest market share of 39.02 % in 2023. The rising number of lower back pain patients is accompanying the high rates of disabilities. The regular approvals and wider applications of these surgeries are promoting regenerative surgeries. FDA approvals for deep brain stimulation devices are fueling the market growth. For instance, in March 2020, NeuroPace, Inc. received approval from the U.S. FDA for MRI labeling for its Responsive Neurostimulation Device (RNS) system.

The stem cell therapy segment is expected to grow at the highest CAGR during the forecast period as it is perceived as the backbone of regenerative medicine. The segment also witnesses several R&D activities along with an increase in government initiatives and approvals to conduct clinical trials. These factors are also anticipated to fuel the market growth.

Key U.S. Nerve Repair And Regeneration Company Insights

Some of the prominent U.S. nerve repair and regeneration companies include NeuroPace, Inc., Medtronic, Stryker, AxoGen Corporation, Abbott (ST. Jude Medical), Baxter International (Synovis Micro Companies Alliance, Inc.), Boston Scientific Corporation, Polyganics, and Integra LifeSciences. New product launches and mergers & acquisitions are the key strategic undertakings of the participants in this vertical.

Innovation and new product development are expected to play a crucial role for the market players. Market players are in the process of introducing advanced products to capture a higher market share. There is a high demand for advanced specialized products with high technical capabilities which require more capital, and this is expected to restrict the entry of new players.

Key U.S. Nerve Repair And Regeneration Companies:

- AxoGen, Inc.

- Stryker Corporation

- St. Jude Medical, Inc.

- Baxter International, Inc.

- Polyganics B.V.

- Boston Scientific, Inc.

- Integra Lifesciences Corporation

- Cyberonics, Inc.

- Medtronic plc.

- Comp10

Recent Developments

-

In January 2022, the U.S. FDA approved the rechargeable Intellis neurostimulator and the recharge-free Vanta neurostimulator by Medtronic plc for the treatment of Diabetic Peripheral Neuropathy (DPN)-related chronic discomfort

-

In March 2022, Integra LifeSciences launched NeuraGen 3D Nerve Guide Matrix, a resorbable implant for the repair of peripheral nerve discontinuities. It is a nerve repair product specifically engineered to create an optimized environment that may allow for a more complete functional recovery following mid-gap nerve repair when compared to hollow nerve conduits alone

-

In September 2023, Axogen, Inc. announced the complete launch of Axoguard HA+ Nerve Protector which is an important extension of our nerve protection platform designed to provide both short- and long-term protection for peripheral nerve injuries

U.S. Nerve Repair And Regeneration Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 5.64 billion

Growth rate

CAGR of 11.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, surgery

Country scope

U.S.

Key companies profiled

AxoGen, Inc.; Stryker Corporation; St. Jude Medical, Inc.; Baxter International, Inc.; Polyganics B.V.; Boston Scientific, Inc.; Integra Lifesciences Corporation; Cyberonics, Inc.; Medtronic plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Nerve Repair And Regeneration Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. nerve repair and regeneration market report based on product, and surgery:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Biomaterials

-

Neurostimulation And Neuromodulation Devices

-

Spinal Cord Stimulation Devices

-

Deep Brain Stimulation Devices

-

Sacral Nerve Stimulation Devices

-

Vagus Nerve Stimulation Devices

-

Gastric Electric Stimulation Devices

-

-

-

Surgery Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct Nerve Repair/Neurorrhaphy

-

Nerve Grafting

-

Stem Cell Therapy

-

Neurostimulation And Neuromodulation Surgeries

-

Frequently Asked Questions About This Report

b. The U.S. nerve repair and regeneration market size was estimated at USD 2.58 billion in 2023 and is expected to reach USD 2.8 billion in 2024.

b. The U.S. nerve repair and regeneration market is expected to grow at a compound annual growth rate of 11.5% from 2024 to 2030 to reach USD 5.64 billion by 2030.

b. Neurostimulation and neuromodulation devices segment held the largest market share of 66.07 % in 2023 owing to wide applications. Investments by key companies to develop more effective devices are likely to propel market growth in the coming years.

b. Some of the key players in the U.S. nerve repair and regeneration market include are AxoGen, Inc.; Stryker Corporation; St. Jude Medical, Inc.; Baxter International, Inc.; Polyganics B.V.; Boston Scientific, Inc.; Integra Lifesciences Corporation; Cyberonics, Inc.; Medtronic plc.

b. Rising cases of neurological disorders and a strong product pipeline by the major companies are the key factors driving the market. Improved treatment efficiency for neurological disorders due to several technological advancements is also likely to contribute to the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."