- Home

- »

- Alcohol & Tobacco

- »

-

U.S. Nicotine Pouches Market Size, Industry Report, 2030GVR Report cover

![U.S. Nicotine Pouches Market Size, Share & Trend Report]()

U.S. Nicotine Pouches Market (2025 - 2030) Size, Share & Trend Analysis Report By Product (Tobacco Derived, Synthetic), By Flavor (Original/Unflavored, Flavored), By Strength, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-241-9

- Number of Report Pages: 131

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Nicotine Pouches Market Size & Trends

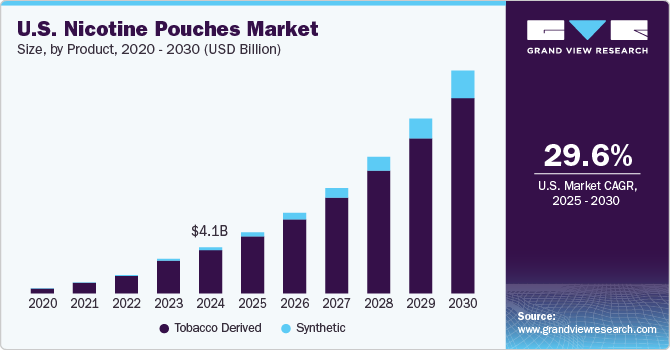

The U.S. nicotine pouches market size was estimated at USD 4.09 billion in 2024 and is expected to grow at a CAGR of 29.6% from 2025 to 2030. The growing number of health-conscious consumers and their altered perception of smoking has paved the way for nicotine pouches in the U.S. According to the U.S. Centers for Disease Control and Prevention (CDC) data published in October 2024, cigarette smoking ranks number 1 risk factor for lung cancer, and about 80% to 90% lung cancer deaths are caused due to cigarette smoking in the U.S. Such rising prevalence’s fuel the market growth for nicotine pouches industry in the U.S.

The smoking rates in the U.S. are declining and are fueling the industry growth for alternatives such as nicotine pouches. According to the American Lung Association data published, nearly smoking rates have declined from 42.6% in 1965 to 11.6% in 2022. With the decline in cigarette smoking, people are looking for alternative ways to satisfy their nicotine cravings. Nicotine pouches have become a popular choice for former smokers to fulfill their nicotine cravings and avoid risks associated with smoking.

The rising demand for nicotine pouches is encouraging involved key players to innovate a range of product offerings. These nicotine pouches come in various products, including variations in strength doses, flavors, and forms of tobacco-derived and synthetic. The variety of flavors and nicotine strengths offered by nicotine pouches appeals to a broad audience, including those who want a customized experience. For instance, in September 2023, Premier Manufacturing Inc. collaborated with Enorama Pharma Inc. to launch tobacco-free nicotine pouches called NIC-S in the U.S. The products are available in unflavored and flavored varients such as mint, berry, orange, cinnamon, and wintergreen, in strengths of 3 milligrams, 6 milligrams, and 9 milligrams.

Younger adults, especially those between the ages of 18 and 34, have been a driving force behind the increased popularity of nicotine pouches. For instance, according to the U.S. Food & Drug Administration (FDA), in October 2024, approximately 29.3% of young consumers in the U.S. reported using the product for at least 20 of the last 30 days. Such rising indulgence of nicotine pouches boosts market growth in the U.S.

Product Insights

Tobacco-derived nicotine pouches held a share of 93.6% of the U.S. nicotine pouch industry in 2024. The driving factors for the growth are attributed to rising health concerns related to smoking, the convenience offered by nicotine pouches, and a wide product offering appealing to young consumers and people looking for cigarette smoking alternatives. Moreover, tobacco-derived nicotine pouches are often marketed as part of a modern, active lifestyle, with sleek, discreet packaging appealing to the target audience. For instance, according to the U.S. Centers for Disease Control and Prevention (CDC ) data published in September 2024, about 2.9% of adults in the U.S. reported using nicotine pouches. Such factors and increasing adoption of the product boost the nicotine pouches industry in the U.S.

The demand for synthetic nicotine pouches is expected to grow at a CAGR of 46.5% from 2025 to 2030. The driving factors contributing to the growth are increased consumer awareness, rising demand for cigarette smoking alternatives, diverse product offerings, and various strength formulations appealing to various consumers. Additionally, in response to the growing demand, key players in the nicotine pouches industry are introducing new products. For instance, in October 2024, British American Tobacco (BAT) announced the launch of synthetic nicotine pouches, a new version of Velo- -Velo Plus product in the U.S. The Velo Plus product is scheduled to launch in 2025, offering synthetic nicotine pouches and more nicotine strength in the product.

Flavor Insights

The flavored nicotine pouches held a share of 89.6% in 2024. The driving factors attributed to the rising health concerns regarding tobacco-based products, change in consumer perception, increased demand for tobacco alternative products, increased product appeal to young consumers, and diverse product offerings. According to the ScienceDirect article published in 2021 , flavored tobacco products are nearly 72.7%, much higher compared to non-flavored products among young consumers. The rising demand is encouraging key players to innovate flavored nicotine pouches in the market. For instance, in April 2022, Juice Head launched fruit-forward nicotine pouches that are available in 5 flavors: blueberry lemon mint, watermelon strawberry mint, mango strawberry mint, peach strawberry mint, and raspberry lemonade mint flavors. Such instances propel the nicotine pouches market growth in the U.S.

The demand for original/ unflavored nicotine pouches is expected to grow at a CAGR of 32.6% from 2025 to 2030. The market growth for unflavored nicotine pouches is driven by factors such as consumers seeking alternatives to smoking products and consumers' desire for simple products mimicking the experience of traditional tobacco use without the harmful effects of smoking. The original/ unflavored nicotine pouches appeal to consumers trying to quit smoking for health concerns. For instance, according to the U.S. Centers for Disease Control and Prevention (CDC) data published in July 2024, nearly 67.7% of adults wanted to quit smoking, and approximately one-half tried to quit the habit in the past year. Such health-conscious consumers seek safer alternatives to smoking, and nicotine pouches are an appealing choice as they are available in the market by various brands and in various flavors, boosting the market growth.

Strength Insights

The strong (4-6 mg/pouch) held a share of 44.2% of the U.S. nicotine pouch market in 2024. The rising demand for smoking alternatives and consumers seeking simple products mimicking the experience of traditional tobacco use without the harmful effects of smoking are fueling market growth. For instance, according to the U.S. Centers for Disease Control and Prevention (CDC) data published in September 2024, between 2019 and 2022, nicotine pouches with a strength of 6 mg or less were the most popular and widely sold.

The demand for normal nicotine pouches with a 3mg concentration is expected to grow at a CAGR of 30.7% from 2025 to 2030. Consumers seeking to quit smoking and needing to satisfy their nicotine cravings with fewer harmful effects of smoking are a primary factor in the market's growth. Changes in consumer preferences play a vital role in boosting market growth. The lower nicotine content in normal pouches with a concentration of 3 mg appeals to those looking to reduce their nicotine intake while still satisfying cravings. Recognizing the demand for normal nicotine pouches with 3 mg concentration, key players are making the products available in the U.S. market. For instance, in August 2022 , ZYN (Swedish Match AB) launched tobacco-flavored nicotine pouches, which are available in 2 strengths: 3 mg and 6mg. The company also offers nicotine pouches in 3 mg concentration in various variants such as cool mint (mini dry) and citrus cool mint (mini dry), original (mini dry), apple mint (mini dry), gold sweet tobacco flavor and bellini (mini dry).

Distribution Channel Insights

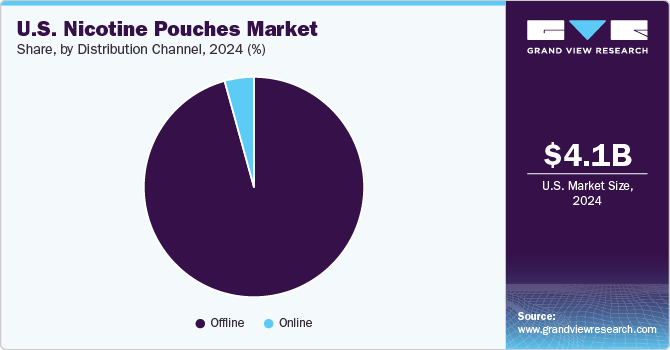

Offline accounted for a revenue share of 95.7% in 2024 in the U.S. nicotine pouches market. The availability of nicotine pouches in various offline retail outlets, such as pharmacies, drug stores, supermarkets, hypermarkets, and convenience stores, makes them easily accessible to a broad range of consumers. Physical stores, especially convenience stores, are prime locations for impulse purchases. Recognizing the demand for the product, companies are expanding their distribution channels offline. For instance, in August 2022 , Haypp Group opened a warehouse in Missouri City, Texas, to enhance the distribution capabilities of nicotine pouches in the southern region of the U.S.

The online distribution channel is expected to grow significantly during the forecast period. This growth is largely driven by the increasing presence of third-party retail platforms and the availability of products directly from brands' websites. New industry entrants often prefer online channels for product distribution. For instance, in March 2021, the synthetic nicotine pouch brand NIIN launched an online store, NIIN Pouches.com. The platform was designed to offer consumers an enhanced shopping experience with educational resources and easy access to high-quality, 100% tobacco-free products. The site aimed to provide a convenient way for customers to purchase their products online.

U.S. Nicotine Pouches Market Trends

The rising demand for nicotine products in the U.S. has significantly altered market dynamics, boosting the popularity of nicotine pouches. Several factors are driving this trend, including shifts in consumer preferences, the increasing popularity of smokeless alternatives, and the growing awareness of the health risks associated with traditional smoking. These elements and innovations in product offerings have contributed to the expanding market for nicotine pouches. The evolving perception of nicotine consumption, particularly among younger demographics, has driven the demand for alternative, convenient, and discreet delivery methods.

Nicotine pouches offer a smoke-free, odorless, and socially acceptable way to satisfy nicotine cravings, appealing to individuals seeking a less conspicuous form of consumption. For instance, according to a study published in 2023 by the National Library of Medicine, between December 2021 and May 2022, 16% of adolescents and young adults in the U.S. reported having tried nicotine pouches. Furthermore, growing consumer awareness about the risks associated with smoking has compelled many smokers to switch to nicotine pouches. In addition, product innovation is another factor fueling the growth of nicotine pouches in the U.S. market. Companies are continuously innovating new flavors, nicotine strengths, and packaging. Furthermore, new players are entering the market with various products, flavors, and strengths to appeal to a larger consumer base. Such developments in the market are propelling the nicotine pouches market growth in the U.S.

Key U.S. Nicotine Pouches Company Insights

Many brands in nicotine pouches industry have identified untapped opportunities within their product lines and are taking steps to address these market gaps. This often involves developing new product designs or marketing campaigns to meet consumer needs and preferences better.

Key U.S. Nicotine Pouches Companies:

- Velo (British American Tobacco p.l.c)

- On! (Altria Group, Inc.)

- ZYN (Swedish Match AB)

- ZONE (Imperial Brands plc)

- Swisher (Rogue Holdings, LLC)

- FRE POUCH

- Black Buffalo

- Sesh Products

- Cotton Mouth Nicotine

- JUICE HEAD

Recent Developments

-

In September 2024, Tucker Carlson, a former television host, plans to launch a new brand, Alp, in November 2024. The nicotine pouches under the new brand will be offered in 4 unique flavors and three strengths, with one product offering 33% stronger in strength than ZYN’s most powerful product.

-

In September 2022, TJP Labs launched Canada’s first modern oral nicotine contract manufacturing facility for oral nicotine pouches in Pickering, Ontario. TJP Labs will provide international brands with contract manufacturing capacity to service the rapidly expanding category.

U.S. Nicotine Pouches Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.41 billion

Revenue forecast in 2030

USD 19.77 billion

Growth rate (Revenue)

CAGR of 29.6% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, flavor, strength, distribution channel, region

Regional scope

Southeast, Midwest, Northeast, West, Southwest

Country scope

U.S.

Key companies profiled

Velo (British American Tobacco p.l.c), On! (Altria Group, Inc.), ZYN (Swedish Match AB), ZONE (Imperial Brands plc), Swisher (Rogue Holdings, LLC), FRE POUCH, Black Buffalo, Sesh Products, Cotton Mouth Nicotine, JUICE HEAD

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Nicotine Pouches Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. nicotine pouches market report based on product, flavor, strength, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Tobacco derived

-

Synthetic

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Original/Unflavored

-

Flavored

-

Fruit

-

Mint

-

Coffee

-

Cinnamon

-

Others (Cool Cider, Licorice, etc.)

-

-

-

Strength Outlook (Revenue, USD Million, 2018 - 2030)

-

Light (2 mg/pouch)

-

Normal (3 mg/pouch)

-

Strong (4-6 mg/pouch)

-

Extra Strong (More than 8 mg/pouch)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Southeast

-

Midwest

-

Northeast

-

West

-

Southwest

-

-

Frequently Asked Questions About This Report

b. The U.S. nicotine pouches market size was estimated at USD 4.09 billion in 2024 and is expected to reach USD 5.42 billion in 2025.

b. The U.S. nicotine pouches market is expected to grow at a compounded growth rate of 29.6% from 2025 to 2030 to reach USD 19.77 billion by 2030.

b. The strong (4-6 mg/pouch) nicotine pouches market accounted for a revenue share of 44.01% in 2024. American smokers prefer stronger alternatives that have a higher nicotine concentration and generally opt for branded products. The stronger nicotine pouches come in a range of flavors and formats, from a mini coffee pouch to a slim unflavored pouch to suit the preferences of a diverse customer base.

b. Some key players operating in the U.S. nicotine pouches market include Altria Group, Inc.; Triumph Tobacco Alternatives LLC; Nicopods ehf.; Swisher; Philip Morris International; Tobacco Concept Factory; String Free; Next Generation Labs LLC; Skruf; Altria Group, Inc.,

b. Key factors that are driving the U.S. nicotine pouches market growth include growing awareness among consumers about the risks associated with smoking has compelled many smokers to switch to nicotine pouches. Data released by the U.S. Centers for Disease Control and Prevention (CDC) in 2020 revealed that the majority of deaths (55%) in smokers are due to lung cancer (29%) and other respiratory diseases (26%). Another 34.7% of deaths in smokers are attributed to cardiovascular diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.