- Home

- »

- Smart Textiles

- »

-

U.S. Nitrile Gloves Market Size, Share Analysis Report, 2030GVR Report cover

![U.S. Nitrile Gloves Market Size, Share & Trends Report]()

U.S. Nitrile Gloves Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Powdered, Powder-free), By Product (Disposable, Durable Head Protection), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-130-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

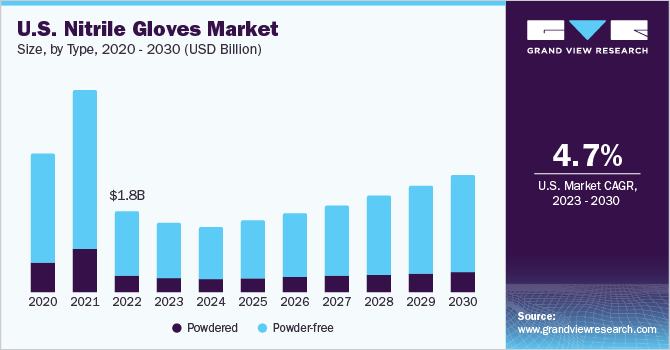

The U.S. nitrile gloves market size was estimated at USD 1.8 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.7% from 2023 to 2030. Rising awareness among industry players regarding the significance of ensuring worker safety and security in workplaces are the factors contributing to the growth. This heightened awareness is attributed to strict regulations and the substantial expenses linked to workplace hazards, both of which are poised to act as drivers for market expansion. The growing emphasis on safety and security in workplaces across the U.S. positively influences the market. Nitrile gloves, made from synthetic rubber, have become indispensable in various industries due to stringent occupational safety regulations and standards. Employers are increasingly focused on providing a safe working environment for their employees, making durable and chemically resistant nitrile gloves a crucial protective measure.

According to the Centers for Disease Control and Prevention (CDC), the number of hospital-acquired infection (HAI)-related cases observed a 7% increase in CLABSI, a 5% increase in CAUTI, a 14% increase in hospital-onset MRSA bacteremia, and a 12% increase in VAE between 2020 and 2021. Moreover, the COVID-19 pandemic has heightened the risk of HAIs.

Proper hygiene and adherence to aseptic techniques by healthcare workers are some of the methods that can be adopted to avoid the transmission of microbes, thereby preventing these infections. As patient awareness regarding infection risks grows and healthcare services expand into various environments, nitrile gloves remain a cornerstone of infection control measures, safeguarding patients as well as healthcare professionals.

The increasing healthcare expenditures in the U.S. are pivotal in driving the nitrile glove market growth. As healthcare activities surge in response to greater funding and resources allocated to the industry, there is a growing need for essential medical supplies, including nitrile gloves. These gloves, known for their superior barrier protection and infection control properties, are in high demand across healthcare settings.

Factors such as the expansion of public healthcare systems, increased economic power, and population growth are anticipated to augment healthcare spending in the country. Furthermore, the aging population, rising number of people with chronic, and long-term conditions, increasing labor costs, and staff shortages, and the growing demand for broader ecosystem services are expected to boost healthcare expenditure across the U.S.

The healthcare industry in the U.S. is expected to grow significantly, so the demand for medical & healthcare products is expected to witness exponential growth over the forecast period. Growing health concerns caused by unhealthy lifestyles are expected to drive the demand for healthcare services and the need for advanced medical infrastructure, which, in turn, will boost the demand for medical products and devices over the forecast period.

Type Insights

The powdered type segment accounted for a market share of 21.2%, in terms of revenue, in 2022. The powdered form makes it easier to put on and take off gloves, which can be important for workers who frequently change gloves during their tasks. The healthcare sector is a major consumer of disposable gloves, including nitrile gloves. The demand for powdered nitrile gloves is driven by the need for personal protective equipment (PPE) in hospitals, clinics, and other healthcare facilities.

The powder-free type segment is likely to witness lucrative growth with a CAGR of 5.3% over the forecast period. Powder-free nitrile gloves are expected to dominate the market over the forecast period owing to their increasing preference across numerous industries, including medical, food processing, and chemical. Moreover, strict regulations on powdered gloves by many governments worldwide are likely to positively impact the powder-free nitrile gloves market over the forecast period.

Product Insights

The disposable product segment accounted for the largest revenue share of 80.6% in 2022. The U.S. disposable nitrile gloves market has witnessed significant growth over the past several years. This growth can be attributed to several key factors, including heightened awareness of hygiene and safety measures, increased demand from healthcare facilities and professionals, and the expansion of the food processing and service industry

The durable product segment is likely to witness a lucrative CAGR of 7.7% over the forecast period. The U.S. durable nitrile gloves market has exhibited remarkable growth in recent years, driven by various factors contributing to its expansion and evolving consumer preferences. Durable nitrile gloves, known for their robustness and extended lifespan, have found applications in a wide range of industries, including manufacturing, automotive, construction, and chemical handling.

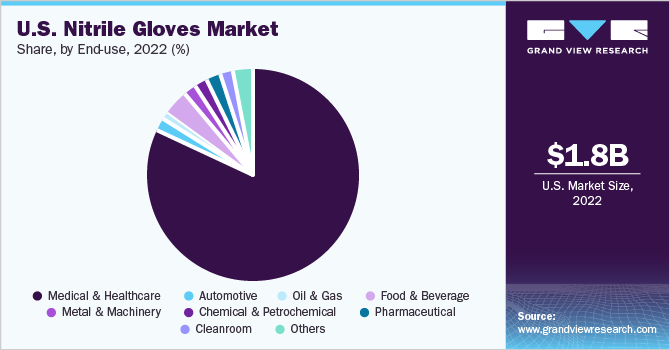

End-use Insights

The medical & healthcare end-use segment accounted for the largest revenue share of 81.8% in 2022 and is likely to continue its dominance over the forecast period. Nitrile gloves are widely used across medical and healthcare industries to aid doctors and patients in preventing cross-contamination and transmission of pathogens during medical examinations and surgeries. These gloves provide a barrier of protection against risks associated with on-the-job transmission of blood-borne pathogens, germs, and other environmental contaminants.

The increasing automotive production necessitates the usage of nitrile gloves for hand protection of employees as nitrile gloves are manufactured with synthetic polymer and are latex-free. Nitrile gloves have a longer shelf life as compared to latex gloves and are frictionless and puncture-resistant. Furthermore, nitrile gloves offer excellent chemical resistance, especially to grease, oil, and gasoline

The production of crude oil in the U.S. shows an increasing trend from 2019 to 2022. The data further shows that the production increased from 12,311 thousand barrels per day (bpd) in 2019 to 11,911 thousand barrels per day (bpd) in 2022. The production of crude oil is projected to rise by 850,000 bpd to a record 12.76 billion bpd in 2023, according to a monthly report from the Energy Information Administration. Increased offshore and onshore drilling activities, as well as increased shale gas production in the U.S., are expected to boost nitrile gloves demand to protect employees from job dangers.

In addition, numerous government agencies such as the Food and Drug Administration (FDA), the National Institute for Occupational Safety and Health (NIOSH), and the Occupational Safety and Health Administration (OSHA) have provided standards and guidelines outlining the use of gloves in food & beverage industry, which, in turn, is anticipated to drive the demand for nitrile gloves in food & beverage industry over the forecast period.

Key Companies & Market Share Insights

The industry is extremely competitive due to the presence of both international and local players. Nitrile gloves manufacturers use a variety of strategies to increase market penetration and meet the dynamic technological demands of end-use industries, such as medical & healthcare, automotive, oil & gas, food & beverage, metal & machinery, chemical & petrochemical, cleanroom, and others

For instance, in June 2023, ANSELL LTD. launched its manufacturing facilities in Sri Lanka. Ansell Textiles Lanka is now the company's first location to be certified to ISO 50001:2018. This noteworthy achievement demonstrates Ansell's dedication to integrating energy-efficient practices and technologies into its manufacturing processes. Some prominent players in the U.S. nitrile gloves market include:

-

Ansell Ltd.

-

Top Glove Corporation Bhd

-

Hartalega Holdings Berhad

-

Superior Gloves

-

Kimberly-Clark Corporation

-

The Glove Company

-

US Glove Supply

-

Supermax Corporation Berhad (Supermax Healthcare Inc.)

-

SHOWA GROUP

-

SafeSource Direct.

U.S. Nitrile Gloves Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.6 billion

Growth rate

CAGR of 4.7 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Billion, volume in million pairs, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Key companies profiled

Ansell Ltd.; Top Glove Corporation Bhd; Hartalega Holdings Berhad; Superior Gloves; Kimberly-Clark Corporation; The Glove Company; US Glove Supply; Supermax Corporation Berhad (Supermax Healthcare Inc.); SHOWA GROUP; SafeSource Direct

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Nitrile Gloves Market Report Segmentation

This report forecasts volume & revenue growth at the country level and analyzes the industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. nitrile gloves market report based on type, product, and end-use:

-

Type Outlook (Volume, Million Pairs; Revenue, USD Billion, 2018 - 2030)

-

Powdered

-

Powder-free

-

-

Product Outlook (Volume, Million Pairs; Revenue, USD Billion, 2018 - 2030)

-

Disposable

-

Durable Head Protection

-

-

End-use Outlook (Volume, Million Pairs; Revenue, USD Billion, 2018 - 2030)

-

Medical & Healthcare

-

Surgical

-

Examination

-

-

Automotive

-

Oil & Gas

-

Food & Beverage

-

Metal & Machinery

-

Chemical & Petrochemical

-

Pharmaceutical

-

Cleanroom

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. nitrile gloves market size was estimated at USD 1.8 billion in 2022 and is expected to reach USD 1.5 billion in 2023.

b. The U.S. nitrile gloves market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.7% from 2023 to 2030 and reach USD 2.6 billion by 2030.

b. Powdered product segment dominated the U.S. Nitrile Gloves Market with a revenue share of 21.2% in 2022. The demand for powdered nitrile gloves is driven by the need for personal protective equipment (PPE) in hospitals, clinics, and other healthcare facilities.

b. Some of the key players operating in the U.S. nitrile gloves market include Ansell Ltd., Top Glove Corporation Bhd, Hartalega Holdings Berhad, Superior Gloves, Kimberly-Clark Corporation, The Glove Company, US Glove Supply, Supermax Corporation Berhad (Supermax Healthcare Inc.), SHOWA GROUP, SafeSource Direct., among others.

b. The key factors that are driving the U.S. nitrile gloves market include the market growth is expected to be driven by the growing healthcare expenditure, increased significance of workplace safety, and the rising awareness regarding healthcare-associated infections.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.