- Home

- »

- Electronic Devices

- »

-

U.S. Non-destructive Testing Market Size, Share Report 2030GVR Report cover

![U.S. Non-destructive Testing Market Size, Share & Trends Report]()

U.S. Non-destructive Testing Market (2024 - 2030) Size, Share & Trends Analysis Report By Test Method (Traditional NDT Method, Digital/Advanced NDT Method), By Offering (Services, Equipment), By Vertical, And Segment Forecasts

- Report ID: GVR-4-68040-197-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Non-destructive Testing Market Trends

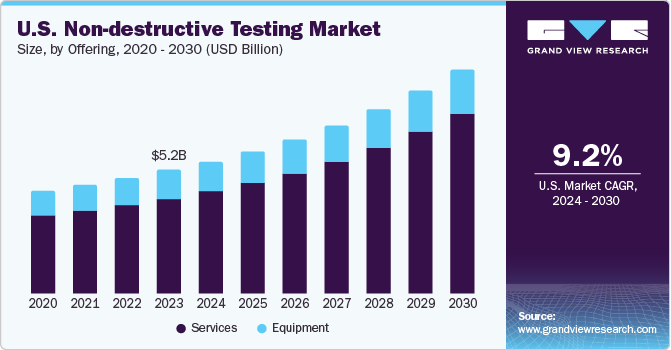

The U.S. non-destructive testing market size was estimated at around USD 5.2 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.2% from 2024 to 2030. The increasing technological developments in advanced non-destructive testing (NDT) processes have resulted in better and more precise safety & fault detection. With the presence of a large manufacturing sector in the U.S. and the increasing awareness among manufacturers regarding the adoption of NDT techniques, the U.S. market is anticipated to witness growth in the coming years.

The implementation of NDT techniques in projects saves time and resources due to the detection of faults in complex areas and irregular surfaces, which results in the early completion of projects. This detection and reduction in failures is projected to fuel the demand for non-destructive testing in the coming years. In addition, the ease of operating and efficiency in fault detection provided by ultrasonic equipment, compared to other NDT equipment, is a significant factor contributing to the increasing adoption of the ultrasonic test method. Moreover, advancements in ultrasonic technology anticipated within the next seven years are likely to further boost the adoption of this testing procedure due to its simplicity.

The market is projected to experience significant growth during the forecast period. This growth can be attributed to the increasing construction and manufacturing projects in the U.S. The fast pace of such projects necessitates the implementation of testing processes to ensure the quality of work. This trend is expected to have a positive impact on the growth of NDT in the U.S. market.

Increasing oil and gas projects in the U.S. are expected to deploy NDT techniques to complete the projects in prescribed timelines and with finesse, thus fueling the demand for NDT equipment in the U.S. In addition, the advancements in non-destructive testing technology have led to the development of radiographic testing equipment such as industrial CT scanners, which precisely detect faults in machinery and components. However, the cost of the NDT equipment and the expertise required to perform the tests increases the complexity and difficulty of deploying the radiographic testing method.

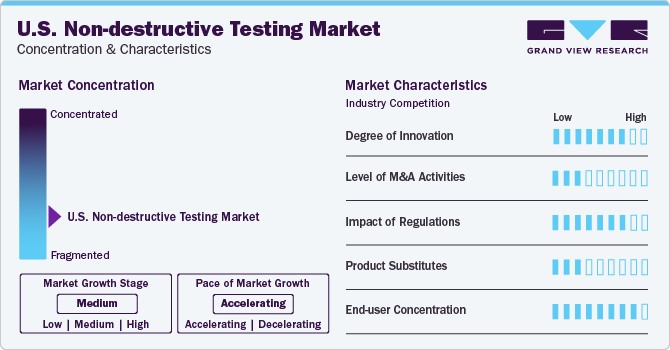

Market Concentration & Characteristics

The market growth stage is medium and the rate of growth is accelerating. With increasing technological advancements in the methods implemented in non-destructive testing, the market is anticipated to witness growth in the coming years. For instance, the development of radiographic testing equipment in NDT process has increased the efficiency of detecting faults.

With the increasing regulations in various industries in the U.S., which recommend the standards and quality of products within the stipulated guidelines, the NDT market is anticipated to grow in the U.S. market as fault detecting within a product has become rapid and efficient with the latest NDT techniques. Non-destructive testing agencies and regulatory bodies such as The American Society for Nondestructive Testing (ASNT), American Society for Testing and Materials (ASTM) International, and American Welding Society (AWS), among others, set specific codes, specifications, regulations, standards, and recommended practices, subject to the industry and country performing NDT.

The key players are engaged in increasing and maintaining their market share. Key players employ various initiatives and strategies, such as signing partnerships, making investments engaging in mergers and acquisitions, launching new products and services, and quoting competitive prices. Therefore, the level of M&A activities is comparatively high in the U.S. market as compared to the global market.

The threat of substitutes in the non-destructive testing market can be considered low because NDT procedures are critical to the component or raw material testing process. Moreover, the benefits offered by NDT techniques in inspecting materials, systems, or components without permanently altering their structure are not provided by other testing/inspection methods.

Offering Insights

The services segment dominated the market with the largest revenue share of 77.1% in 2023 and is expected to remain dominant over the forecast period. Due to the significant upfront cost associated with non-destructive equipment as well as the technicalities involved in deployment and installation, most of the end-users outsource their NDT operations. Furthermore, stringent government regulations pertaining to workplace safety further encourage end-users to outsource their NDT operations to third-party service providers.

The equipment segment is anticipated to witness a steady CAGR from 2024 to 2030. This growth is mainly due to technological advancements, which have resulted in the availability of state-of-the-art equipment variants. The availability of these advanced equipment variants has broadened the range of applications for NDT equipment, thereby generating additional demand.

Test Method Insights

The traditional test method segment dominated the U.S. market with the largest revenue share of 79.0% in 2023. This market growth is due to increasing adoption of traditional non-destructive testing (NDT) methods, including visual testing, magnetic particle testing, liquid penetrant testing, eddy current testing, ultrasonic testing, and radiographic testing. The ultrasonic testing sub-segment dominates the market due to its portability, easy usability, and better accuracy compared to other traditional NDT techniques. The adoption of ultrasonic testing is experiencing significant growth and is expected to dominate in the forthcoming years.

Within the ultrasonic testing segment, phased array ultrasonic testing (PAUT) has emerged as the dominant segment with the largest revenue share of 22.6% in 2023. With the detailed visualization feature offered by the PAUT, which enables the identification of defect size, depth, shape, and orientation, PAUT is the most preferred method and is considered an advanced version of ultrasonic testing as it employs multiple transducers and sets of ultrasonic testing (UT) probes comprised of numerous smaller elements.

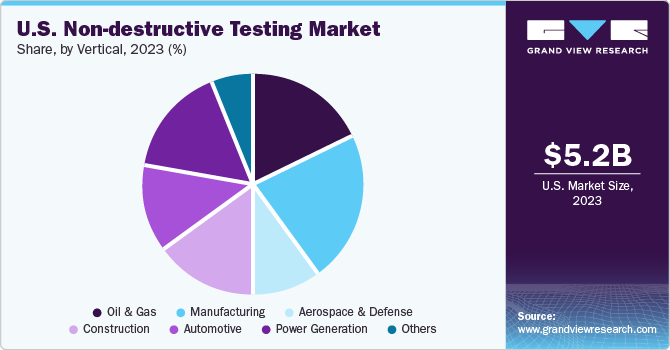

Vertical Insights

The manufacturing vertical segment dominated the market with the largest revenue share of 21.6% in 2022. This growth is a result of the increasing volume of the manufacturing sector in the U.S. The manufacturing vertical is expected to deploy numerous NDT processes thereby leading to an increase in demand for non-destructive testing services in the U.S. Moreover, non-destructive testing has been traditionally used extensively in oil and gas applications. Test methods such as ultrasonic and eddy current have been used to detect cracks in the pipes both underground and elevated. However, with increasing awareness, non-destructive testing techniques are being deployed in several other applications such as aerospace, defense, and automotive.

The oil & gas vertical is further sub-segmented into upstream, midstream, & downstream. The downstream activities in the oil & gas industry include refining petroleum products to produce end products, such as gasoline and kerosene. Refineries and petrochemical plants work with large volumes of oil flowing through tubing, pressure vessels, storage tanks, and pipes. Hence, downstream oil & gas companies particularly need to ensure the safety of the environment, workers, and the facility by ensuring the integrity of equipment and spot welding.

Key U.S. Non-destructive Testing Company Insights

Some of the key market players include Bureau Veritas, Mistras Group, and Fischer Technologies.

-

Bureau Veritas: BUREAU VERITAS specializes in offering a wide range of NDT solutions and services to diverse industries worldwide. With their extensive expertise and advanced technologies, BUREAU VERITAS provides comprehensive NDT techniques to assess the integrity and quality of various assets. The company's NDT services encompass inspection, testing, and analysis of components, structures, equipment, and materials.

-

MISTRAS Group: MISTRAS Group is one of the leaders in the non-destructive testing (NDT) market. They specialize in providing comprehensive NDT solutions and services to various industries. With their expertise and advanced technologies, MISTRAS Group offers a wide range of NDT techniques, including ultrasonic testing, radiographic testing, magnetic particle testing, liquid penetrant testing, and visual inspection

Some of the emerging players in the U.S. market are Sonatest and Comet Group

-

Sonatest: Sonatest is a provider of non-destructive testing equipment. The company caters to various industries ranging from manufacturing, marine, oil & gas, power generation, and chemical, to railways.

-

Comet Group (YXLON International): The company caters to a diverse range of industries including automotive, foundries, science & research, metrology, aerospace, electronics, and weld inspection, among others.

Recent Developments

-

Nikon: Nikon IMBU has launched three new models in its VOXLS range of X-ray CT (computed tomography) systems for non-destructive inspection. The 30 Series specifically addresses the need in the industry for an automation-ready system to meet a wide range of industrial applications.

-

Sonatest: Sonatest announced the launch of WheelProbe2 128 Elements (WP2 E128). This addition to the WheelProbe products is built upon the success of its predecessor, the WP2, and redefines the boundaries of scan mapping capabilities for large-scale inspections.

Key U.S. Non-destructive Testing Companies:

The following are the leading companies in the U.S. non-destructive testing market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these U.S. non-destructive testing companies are analyzed to map the supply network.

- Bureau Veritas

- Fischer Technologies Inc.

- Mistras Group, Inc

- Comet Group (YXLON International GmbH)

- MME Group

- TWI Ltd

- Nikon Metrology Inc.

- Olympus Corporation

- Sonatest

- Zetec Inc.

U.S. Non-destructive Testing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.6 billion

Revenue forecast in 2030

USD 9.5 billion

Growth rate

CAGR of 9.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, test method, vertical

Country scope

U.S.

Key companies profiled

Bureau Veritas; Fischer Technologies Inc.; MISTRAS Group, Inc.; Comet Group (YXLON International GmbH); MME Group; TWI Ltd; Nikon Metrology Inc.; Olympus Corporation; Sonatest; Zetec Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Non-Destructive Testing Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2024 to 2030. For this study, Grand View Research has segmented the U.S. non-destructive testing market based on offering, test methods, and vertical:

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Services

-

Equipment

-

-

Test Method Outlook (Revenue, USD Million, 2017 - 2030)

-

Traditional NDT Method

-

Visual Testing

-

Magnetic Particle Testing

-

Liquid Penetrant Testing

-

Eddy Current Testing

-

Ultrasonic Testing

-

Radiographic Testing

-

-

Digital/Advanced NDT Method

-

Digital Radiography (DR)

-

Phased Array Ultrasonic Testing (PAUT)

-

Pulsed Eddy Current (PEC)

-

Time-Of-Flight Diffraction (TOFD)

-

Alternating Current Field Measurement (ACFM)

-

Automated Ultrasonic Testing (AUT)

-

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Oil & Gas

-

Upstream

-

Midstream

-

Downstream

-

-

Manufacturing

-

Aerospace and Defense

-

Construction

-

Automotive

-

Power Generation

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. non-destructive testing market size was estimated at USD 5.2 billion in 2023 and is expected to reach USD 5.60 billion in 2024.

b. The U.S. non-destructive testing market is expected to grow at a compound annual growth rate of 9.2% from 2024 to 2030 to reach USD 9.50 billion by 2030.

b. Services dominated the U.S. non-destructive testing market with a share of over 77.0% in 2023. The regulatory requirements and industry standards in the country are driving the growth of NDT services.

b. Some key players operating in the U.S. non-destructive testing market include Bureau Veritas, Fischer Technologies Inc., Mistras Group, Inc, Comet Group (YXLON International GmbH), MME Group, TWI Ltd, Nikon Metrology Inc., Olympus Corporation, Sonatest, and Zetec Inc.

b. Key factors driving the market growth include the presence of numerous market players and high manufacturing activities in the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.