- Home

- »

- Nutraceuticals & Functional Foods

- »

-

U.S. Nootropics Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Nootropics Market Size, Share & Trends Report]()

U.S. Nootropics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Natural, Synthetic), By Form (Powder, Drinks, Gummies), By Application, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-550-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Nootropics Market Size & Trends

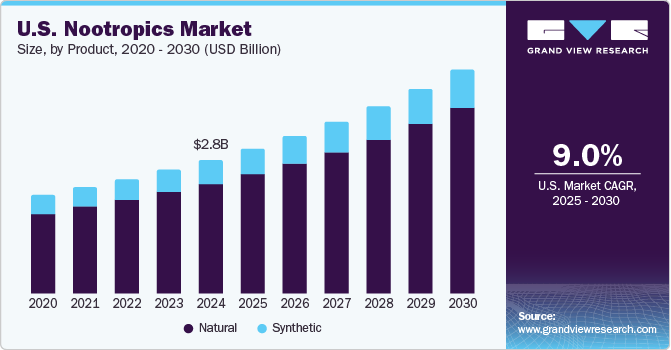

The U.S. nootropics market size was estimated at USD 2.81 billion in 2024 and is expected to grow at a CAGR of 9.0% from 2025 to 2030. This growth is driven by the increasing consumer awareness and demand for cognitive health enhancements, particularly among professionals and students seeking to improve focus and productivity. For instance, the popularity of nootropic ingredients such as Bacopa monnieri, known for enhancing memory and cognitive function, has contributed to this trend. In addition, the ease of access to these supplements through online platforms has further fueled market expansion.

Moreover, the growth of the U.S. nootropics industry is driven by the rising awareness of cognitive health and its importance in maintaining overall well-being. As consumers become more health conscious, they are increasingly turning to nootropics to support brain health and improve mental performance. The integration of technology in the nootropics industry, such as personalized cognitive assessments and tailored supplement recommendations, is also driving market growth by offering consumers more effective and personalized solutions.

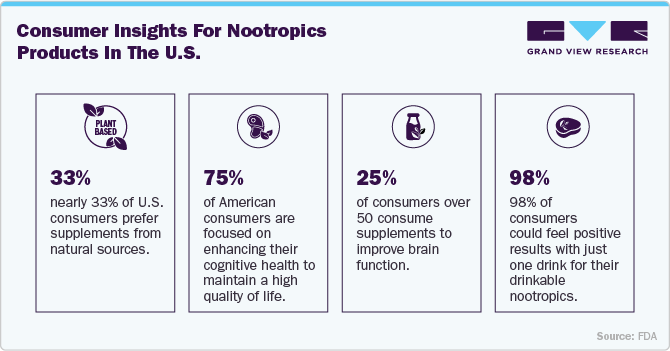

Source: FDA

The U.S. market for nootropics has seen a significant surge in interest over the recent years, driven by a growing consumer focus on cognitive enhancement and overall mental well-being. This trend is largely fueled by the increasing awareness of mental health issues and the rise of the wellness movement. Consumers, particularly millennials and Gen Z, are actively seeking solutions to enhance focus, memory, and productivity.

Another notable preference among consumers is the desire for personalized supplements. With advancements in technology, including DNA and microbiome testing, there’s a growing interest in tailored nootropic stacks that cater to individual cognitive profiles and needs. Companies such as Thesis offer customized nootropics, helping consumers boost their cognitive ability and enhance productivity.

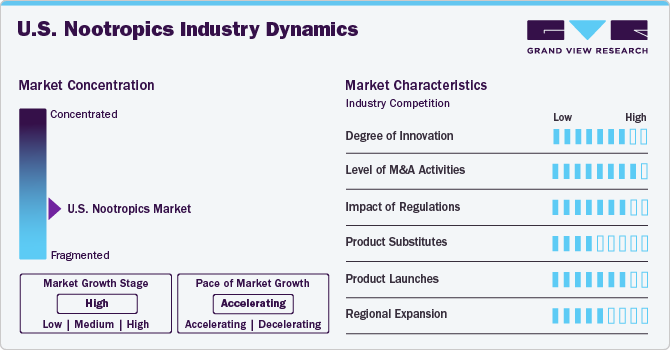

Market Concentration & Characteristics

Product innovation in the U.S. nootropics industry is characterized by a notable degree of advancement, driven by the exploration of novel compounds, sophisticated delivery mechanisms, and synergistic formulations. Companies are actively engaged in researching and developing innovative nootropic stacks that aim to provide targeted cognitive benefits, often leveraging cutting-edge research in neuroscience and nutritional science.

Merger and acquisition activity in the U.S. nootropics market is moderately robust, as larger supplement and wellness companies strategically acquire promising nootropics brands to expand their offerings and capture a share of the growing cognitive enhancement market. This reflects a trend of consolidation as the market matures and established players seek to diversify into specialized niches.

The regulatory landscape exerts a considerable impact on the U.S. market for nootropics, with agencies like the FDA scrutinizing product safety, labeling accuracy, and marketing claims, particularly given the detailed nature of cognitive enhancement and the need to ensure consumer protection. While the nootropics market does face competition, the prevalence of direct product substitutes is relatively limited.

Traditional stimulants such as caffeine or energy drinks offer some overlapping benefits but do not fully replicate the targeted cognitive effects sought by nootropics users. Finally, the U.S. nootropics industry exhibits a moderate degree of end-user concentration, with a significant portion of consumers consisting of specific demographics such as professionals seeking performance enhancement, students aiming to improve focus, and health-conscious individuals exploring cognitive wellness solutions, indicating a market that is specialized yet with expanding appeal.

Product Insights

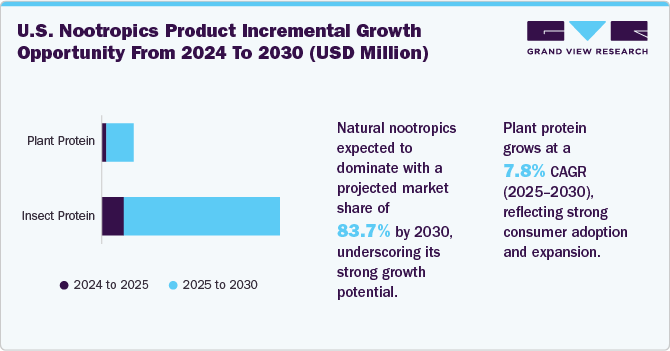

The natural product segment accounted for a revenue share of 82.0% in 2024. A strong consumer preference for natural and organic products drives the growth. This trend aligns with broader health and wellness shifts, where consumers increasingly seek out natural remedies over synthetic alternatives. For instance, herbal nootropics such as Ginkgo biloba, known for enhancing cognitive function, have gained popularity due to their natural origins and perceived health benefits. The segment growth is also supported by a cultural shift toward preventive healthcare and wellness, where consumers prioritize natural supplements as part of their proactive health management strategies. In addition, the availability of natural nootropics through diverse retail channels, including online platforms, has enhanced accessibility and contributed to their market dominance.

The synthetic segment is projected to grow at a CAGR of 7.8% from 2025 to 2030. The growth is driven by the increasing demand for precision and efficacy in cognitive enhancement products, which synthetic nootropics can provide through their standardized formulations. In addition, advancements in research and development have led to the creation of more sophisticated synthetic compounds that offer targeted benefits, such as improved focus and memory. For instance, modafinil, a synthetic nootropic, is popular among professionals and students due to its ability to enhance alertness and concentration, contributing to the growth of this segment. Furthermore, the availability of these products through both online and offline channels enhances their accessibility and appeal to a broader consumer base.

Form Insights

The drinks segment accounted for a revenue share of 37.7% in 2024. The convenience and appeal of functional beverages, which combine cognitive benefits with refreshing flavors, make them an attractive option for consumers seeking mental clarity and focus. For instance, energy drinks infused with nootropic ingredients such as caffeine and B vitamins have become popular among students and professionals looking for a quick cognitive boost. In addition, the rise of e-commerce and online marketing platforms has increased the visibility and accessibility of these products, allowing consumers to purchase and consume nootropic drinks easily.

The gummies segment is projected to grow at a CAGR of 9.6% from 2025 to 2030. The increasing consumer preference for convenient and palatable supplement formats aligns with broader health and wellness trends. In addition, the market benefits from a strong retail network and robust e-commerce platforms, enhancing product accessibility. For instance, Nature's Bounty, a well-known brand, offers a range of gummy supplements that cater to diverse consumer needs, such as vitamin and mineral supplements, which are popular due to their ease of consumption and perceived health benefits. The trend towards clean-label and natural ingredients also supports this growth, as consumers increasingly seek out products with fewer artificial additives and more natural formulations.

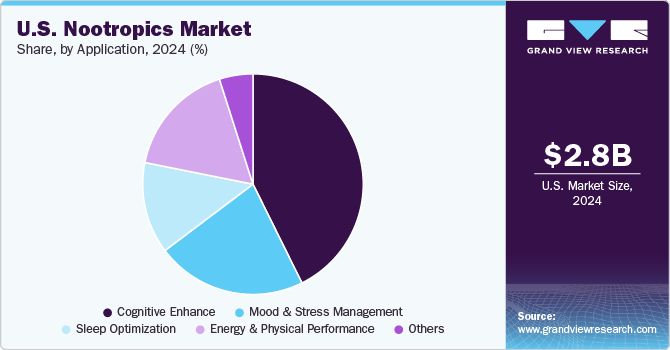

Application Insights

The cognitive enhance accounted for a revenue share of 42.6% in 2024. The growing demand for products that improve focus, memory, and mental clarity, particularly among students and professionals seeking to enhance productivity and performance, has gained a demand. For instance, Bacopa monnieri, a natural nootropic ingredient, is widely used for its cognitive-enhancing properties, such as improving memory retention and recall. In addition, the increasing awareness of cognitive health and the importance of mental well-being have led to a surge in the adoption of nootropics for cognitive enhancement.

The sleep optimization segment is projected to grow at a CAGR of 10.3% from 2025 to 2030, driven by the increasing recognition of sleep as a critical component of overall health and wellness, leading to a rise in proactive strategies for improving sleep quality. In addition, advancements in sleep technology, such as wearable devices and sleep software, have enhanced the ability to monitor and optimize sleep patterns. Furthermore, the growing awareness of the link between sleep quality and mental health, along with rising disposable incomes and increased investment in health technologies, supports this trend. As consumers prioritize holistic wellness, the demand for sleep optimization solutions is expected to continue rising.

Distribution channel Insights

The offline channel accounted for a revenue share of 72.1% in 2024. The growth is driven by the preference for in-person interactions and personalized advice offered by traditional retail outlets such as pharmacies, health food stores, and specialty supplement shops. These physical locations allow consumers to examine products, seek guidance from knowledgeable staff, and make immediate purchases, fostering trust and loyalty among customers. For instance, GNC, a well-known health supplement retailer, provides customers with the opportunity to interact with products and receive expert advice, enhancing the shopping experience and contributing to the dominance of offline channels. In addition, offline channels often facilitate brand engagement through local events and workshops, further freezing their presence in the health and wellness community.

The online segment is projected to grow at a CAGR of 10.6% from 2025 to 2030, driven by the convenience and accessibility offered by e-commerce platforms, which allow consumers to browse and purchase nootropics from anywhere, at any time. In addition, online channels provide a wide variety of products, enabling consumers to compare and select from a broad range of nootropics tailored to their specific needs. For instance, Amazon, a leading online retailer, offers a vast selection of nootropic supplements, often with customer reviews and ratings, which helps build trust and facilitates informed purchasing decisions. Furthermore, the integration of digital marketing strategies and targeted advertising on online platforms enhances product visibility and appeal to a broader audience, contributing to the segment's growth.

Key U.S. Nootropics Company Insights

The U.S. nootropics market is highly competitive and dynamic, with numerous key players driving innovation and shaping market trends. These companies focus on developing a wide range of cognitive enhancement products, from natural supplements to synthetic nootropics, catering to diverse consumer needs. They have gained recognition for their innovative formulations and marketing strategies, which appeal to a broad audience seeking cognitive health benefits. The market leaders have expanded their product lines to include various formats, such as capsules, tablets, and gummies, offering consumers convenient and effective ways to enhance mental clarity and focus. By leveraging advancements in research and technology, these companies continue to evolve and adapt to consumer preferences, contributing to the market's growth and competitiveness.

Key U.S. Nootropics Companies:

- Reckitt Benckiser Group PLC (Schiff RB Health (US) LLC)

- Unilever Onnit Labs, Inc.

- Amway

- GNC Holdings, LLC

- NeuroGum, Inc.

- Qualia Life Sciences, LLC

- NOW Foods.

- Performance Lab USA Corp.

- Natural Stacks

- BrainMD Health

- Nootropics Depot

Recent Developments

-

In October 2024, Monteloeder, S.L., a subsidiary of SUANNUTRA, announced the launch of MINDREVIVE, a botanical compound designed to improve short-term memory and cognitive performance in adults. The proprietary blend combined traditional botanical wisdom with scientific research, featuring sage extract and Japanese pagoda tree extract, both standardized to specific bioactive compounds. Monteloeder conducted extensive research to identify nootropic ingredients with demonstrated mental health benefits in clinical studies. MINDREVIVE was formulated to be a natural, safe, and effective solution for supporting cognitive function.

-

In May 2024, NeuroGum, Inc. announced the launch of its innovative Neuro Mints at Whole Foods Market, expanding its product line aimed at enhancing cognitive function and focus. The mints, which were introduced in early March 2024, featured a blend of nootropics, including L-theanine and caffeine, designed to provide a quick mental boost without the jitters associated with traditional energy products. The company aimed to cater to health-conscious consumers seeking convenient and effective ways to improve their mental clarity.

-

In May 2024, Matador Energy announced its national distribution launch in Circle K stores across the U.S., bringing its functional energy shots to a wider consumer base. The energy shot, formulated with 185 mg of natural caffeine from coffee bean extract, a full daily value of essential B vitamins, and a nootropic mix including 200 mg of Alpha GPC, aimed to provide cleaner, functional energy solutions.

U.S. Nootropics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.04 billion

Revenue forecast in 2030

USD 4.68 billion

Growth rate

CAGR of 9.0% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, application, distribution channel, region, country

Country scope

U.S.

Key companies profiled

Reckitt Benckiser Group PLC (Schiff RB Health (US) LLC); Unilever Onnit Labs, Inc.; Amway, GNC Holdings, LL; NeuroGum, Inc.; Qualia Life Sciences, LLC; NOW Foods.; Performance Lab USA Corp.; Natural Stacks; BrainMD Health; Nootropics Depot

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Nootropics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. nootropics market report based on product, form, application, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Capsules/Tablets

-

Powder

-

Drinks

-

Gummies

-

Others (Liquid, patches, and novel delivery methods)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cognitive Enhance

-

Mood & Stress Management

-

Sleep Optimization

-

Energy & Physical Performance

-

Others (Microcirculation, Anti-Aging & Longevity, Social Anxiety& Confidence Enhancement, Creativity boosting)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The U.S. nootropics market size was estimated at USD 2.81 billion in 2024 and is expected to reach USD 3.04 billion in 2025.

b. The U.S. nootropics market is expected to grow at a compounded growth rate of 9.0% from 2025 to 2030 to reach USD 4.68 billion by 2030.

b. The U.S. nootropic drinks market accounted for a share of 37.8% in 2023 due to the convenience and appeal of functional beverages, which combine cognitive benefits with refreshing flavors, make them an attractive option for consumers seeking mental clarity and focus

b. Some key players operating in the U.S. nootropics market include Amway, GNC Holdings LLC., NeuroGum Inc., NOW Foods and Others

b. Key factors driving market growth include the increasing consumer awareness and demand for cognitive health enhancements, particularly among professionals and students seeking to improve focus and productivity.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.