- Home

- »

- Clinical Diagnostics

- »

-

U.S. Oncology Based Molecular Diagnostics Market, 2033GVR Report cover

![U.S. Oncology Based Molecular Diagnostics Market Size, Share & Trends Report]()

U.S. Oncology Based Molecular Diagnostics Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Breast Cancer, Lung Cancer), By Product (Instruments, Reagents), By Technology (PCR, Sequencing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-716-2

- Number of Report Pages: 136

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

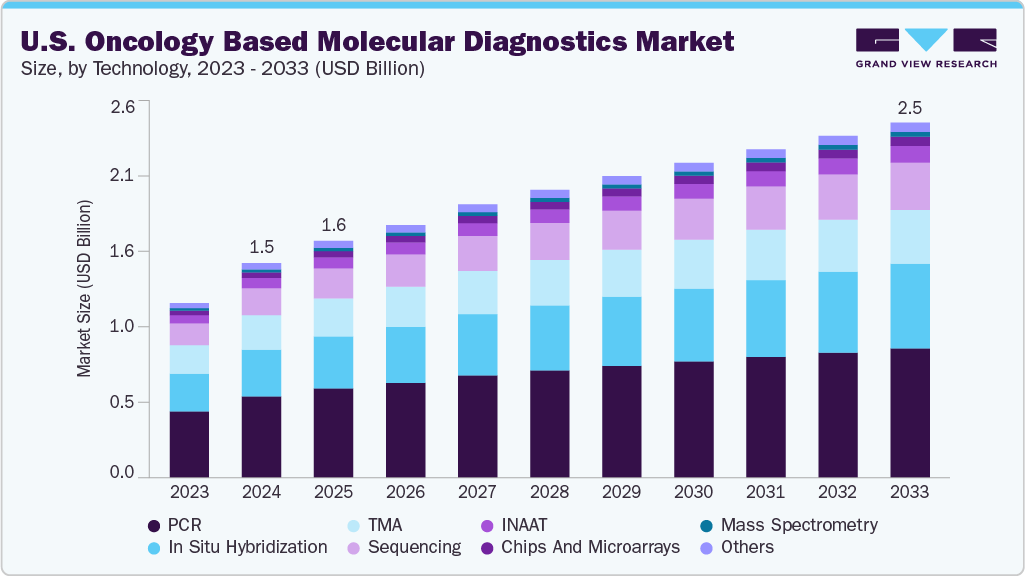

The U.S. oncology based molecular diagnostics market size was estimated at USD 1.49 billion in 2024 and is expected to grow at a CAGR of 5.2% from 2025 to 2033. Key market driving factors for the market include the rapid evolution of sequencing technologies (e.g., shift from Sanger to NGS, adoption of long-read platforms like Nanopore and SMRT), enabling high-throughput, comprehensive genomic profiling. Increased availability of targeted therapies and pan-cancer biomarkers (e.g., HER2, EGFR, NTRK fusions) fuels demand for companion diagnostics. Rising adoption of minimally invasive methods, such as liquid biopsy/ctDNA testing, supports real-time disease monitoring and early detection. Advances in high-sensitivity platforms like ddPCR and RNA-seq improve the detection of low-frequency mutations and fusions, while AI/ML integration enhances tumor origin prediction. The growing clinical utility across multiple tumor types-from lung adenocarcinoma to breast cancer-combined with regulatory approvals for large-panel CDx assays (e.g., FoundationOne CDx, MSK-IMPACT), further accelerates market growth.

The U.S. oncology-based molecular diagnostics (MDx) market is experiencing strong growth momentum, fueled by rapid technological advancements, increasing integration of precision medicine into routine cancer care, expanding payer coverage, and a steady rise in clinically validated biomarkers. Over the past decade, the market has evolved from single-gene, low-throughput assays such as Sanger sequencing to comprehensive, high-throughput next-generation sequencing (NGS) platforms capable of detecting a broad range of mutations, fusions, copy number variations, and microsatellite instability in a single workflow. This technological shift has shortened turnaround times, improved sensitivity, and allowed clinicians to make treatment decisions faster, directly impacting patient outcomes.

One of the most notable technological drivers is the adoption of rapid, fully automated platforms such as the Idylla system by Biocartis, which has steadily expanded its oncology test portfolio since its U.S. introduction in 2015. The Idylla KRAS Mutation Test (U.S. launch in 2016) and EGFR Mutation Test (U.S. launch in 2017) enabled same-day biomarker results directly from FFPE tissue without complex laboratory infrastructure. More recently, the Idylla GeneFusion Assay, launched in 2023 in the U.S., provided detection of ALK, ROS1, RET, and NTRK gene fusions as well as MET exon 14 skipping in non-small cell lung cancer (NSCLC) with a turnaround time of under 3 hours. At the USCAP 2025 Annual Meeting (March 22-27, 2025), multiple independent studies from institutions such as Memorial Sloan Kettering and MD Anderson Cancer Center confirmed high concordance between Idylla™ assays and NGS for KRAS, EGFR, and BRAF mutations, while highlighting Idylla’s ability to identify additional clinically relevant mutations not detected by certain competitor panels. The platform’s rapid testing of cytology supernatants and fine needle aspiration samples, which would otherwise be discarded, underscores its role in expanding testable specimen types and accelerating targeted therapy initiation.

The expansion of precision medicine and companion diagnostics is another major growth driver. Since the FDA approved the first companion diagnostic for trastuzumab in 1998, the market has seen an increasing number of targeted therapies tied to specific molecular tests. For example, in 2012, the FDA approved the cobas 4800 BRAF V600 Mutation Test to guide vemurafenib therapy in melanoma, establishing a precedent for biomarker-driven oncology treatment. Today, KRAS mutation testing in metastatic colorectal cancer-integrated into standard clinical practice since NCCN guideline updates in 2009-prevents the use of costly anti-EGFR therapies in the approximately 40% of patients who harbor KRAS mutations. Similarly, BRAF mutation testing in melanoma ensures that only patients with the V600E mutation are given vemurafenib, improving response rates and reducing unnecessary drug exposure.

Liquid biopsy is rapidly becoming a standard component of oncology diagnostics due to its non-invasive nature and ability to monitor disease dynamics in real time. DiaCarta’s RadTox test, deployed statewide in Florida in 2023, is a cfDNA-based assay that measures treatment response and tumor progression between cycles of chemotherapy or radiotherapy. This allows oncologists to modify treatment strategies early in cases of resistance, avoiding ineffective regimens and mitigating adverse events. DiaCarta has also launched other specialized oncology assays such as Oncuria for bladder cancer recurrence monitoring and BCG therapy response prediction, addressing treatment optimization in the face of drug shortages. The company’s ColoScape test, launched in 2022, detects methylation patterns and mutations specific to colorectal cancer with high sensitivity, enabling early intervention in patients with advanced adenomas.

Naveris’ NavDx test, first clinically introduced in 2020 and designated an Advanced Diagnostic Laboratory Test (ADLT) by CMS in early 2024, represents another milestone in viral oncology diagnostics. NavDx detects Tumor Tissue Modified Viral (TTMV)-HPV DNA in blood, enabling earlier detection of HPV-driven cancers before clinical or imaging evidence emerges. In July 2024, Blue Shield of California began covering NavDx, expanding access to this non-invasive, highly sensitive test. The coverage decision was based on data from over 30 peer-reviewed publications demonstrating its utility in detecting molecular residual disease and informing surveillance strategies for HPV-related head and neck cancers.

The operational efficiency of modern molecular diagnostics is also transforming oncology workflows. While NGS remains the gold standard for comprehensive genomic profiling, its longer turnaround times can delay treatment initiation in aggressive cancers. Rapid PCR-based assays such as the Idylla MSI Test, launched in the U.S. in 2019, deliver same-day MSI status for colorectal and other cancers, enabling timely decisions on immunotherapy eligibility. At USCAP 2025, studies from Icahn School of Medicine at Mount Sinai and the Mayo Clinic demonstrated high concordance between Idylla™ MSI testing and traditional methods, with the added benefit of resolving classification discrepancies in rare endometrial carcinoma subtypes.

From an economic perspective, molecular diagnostics align with the U.S. healthcare system’s shift toward value-based care. Studies showed that pre-treatment KRAS testing in metastatic colorectal cancer could save hundreds of millions of dollars annually by avoiding ineffective anti-EGFR therapy. Similarly, predictive tests such as Oncuria ensure that limited supplies of drugs like BCG are allocated to patients most likely to respond, reducing waste and maximizing clinical benefit.

Large-scale initiatives such as the U.S. Precision Medicine Initiative, announced in 2015, continue to drive biomarker discovery and validation, further expanding the market’s testable targets. As NGS costs decline and automation improves, the integration of artificial intelligence into molecular diagnostics-particularly for tumor origin prediction and resistance mechanism analysis-is expected to enhance clinical utility and accelerate adoption. The combination of regulatory support for companion diagnostics, payer recognition of clinical utility, and an expanding body of evidence from real-world implementation solidifies molecular diagnostics as a central pillar in the future of oncology care in the U.S., with 2023-2025 marking a pivotal period of market expansion, technological maturation, and broader clinical integration.

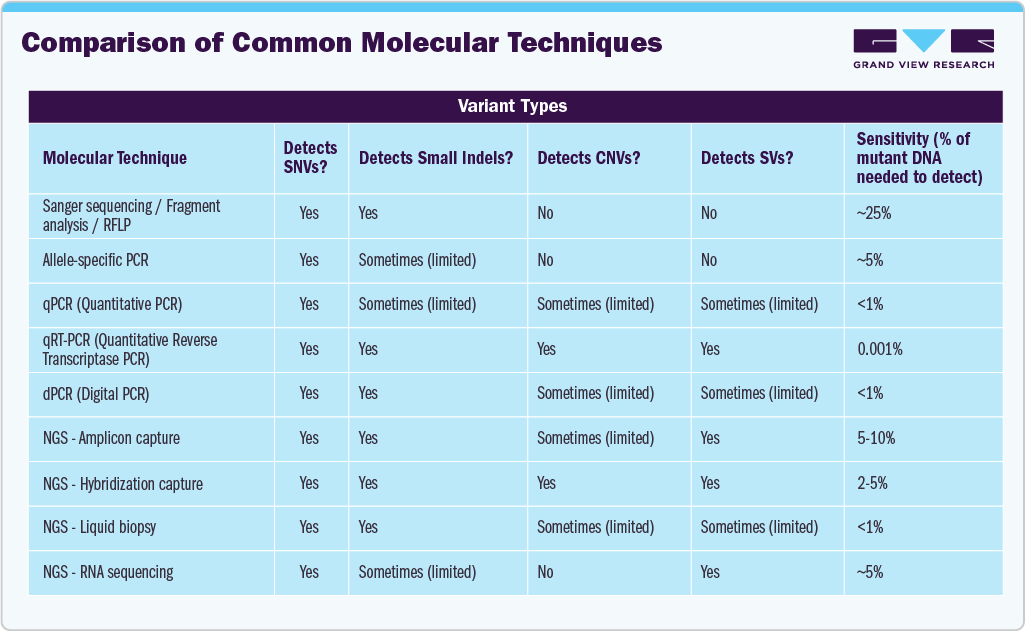

Legend:

-

SNV = Single-Nucleotide Variant

-

Small indels = Small insertions or deletions

-

CNV = Copy Number Variation

-

SV = Structural Variant (e.g., large rearrangements, fusions)

-

“Sometimes (limited)” means the method may detect that variant type, but with reduced accuracy or only in certain cases.

This comparison highlights how each molecular technique’s detection range and sensitivity align with evolving market needs in oncology diagnostics. High-sensitivity methods like dPCR and NGS-based liquid biopsy (<1% detection) are driving growth in minimal residual disease monitoring and early cancer detection, while comprehensive platforms such as NGS hybridization capture capable of identifying SNVs, indels, CNVs, and SVs in a single assay are expanding adoption of large genomic panels and pan-cancer companion diagnostics. As precision medicine advances, technologies offering broader variant coverage and lower detection limits are positioned to capture the fastest-growing segments of the U.S. oncology-based molecular diagnostics market.

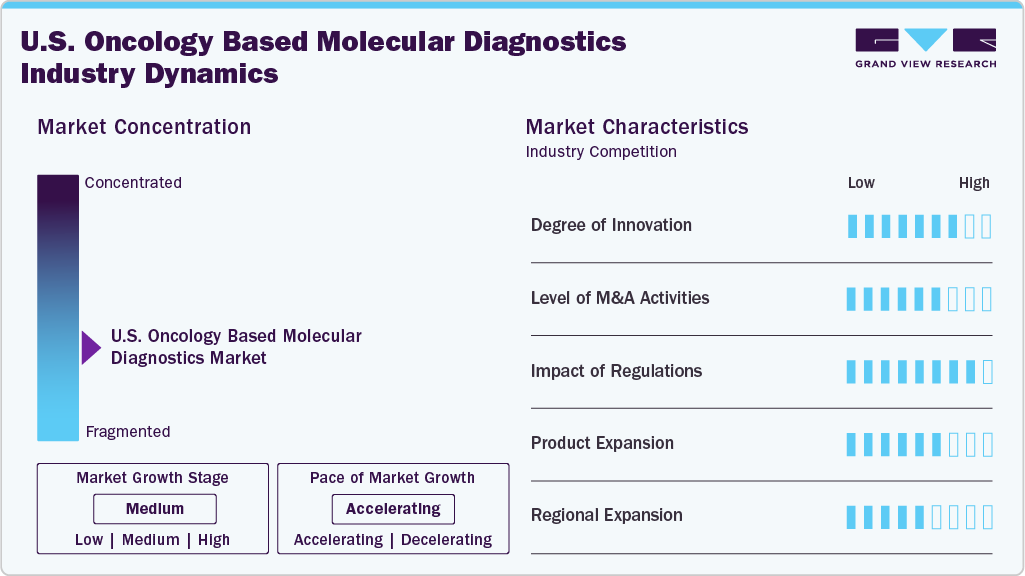

Market Concentration & Characteristics

Innovation in U.S. oncology molecular diagnostics is high and accelerating. The market has shifted from single-gene Sanger confirmations to comprehensive NGS panels that read SNVs, indels, CNVs, and fusions in one run, while ultra-sensitive dPCR and cfDNA assays enable sub-1% detection for minimal residual disease and real-time therapy monitoring. Rapid, cartridge-based systems (e.g., same-day PCR fusion and MSI tests) compress turnaround from weeks to hours, supporting faster, decentralized decisions. Long-read sequencing (SMRT, nanopore) is unlocking complex rearrangements and isoforms, and targeted RNA-seq improves fusion calling beyond DNA limits. AI/ML models now infer tumor origin and resistance patterns from large panels, elevating the clinical utility of test data. Pan-cancer CDx approvals, ADLT designations, and expanding payer coverage reinforce commercialization, while emerging CRISPR readouts and single-cell/multi-omics signal a robust pipeline that will keep raising clinical impact and market value.

M&A activity in the U.S. oncology-based molecular diagnostics market has been driven by the need to expand test portfolios, secure proprietary technologies, and strengthen market access. High-profile deals include Exact Sciences’ $2.8B acquisition of Genomic Health (2019) to combine Cologuard and Oncotype DX into a comprehensive cancer diagnostics offering, and Illumina’s $8B purchase of Grail (completed 2023) to enter the multi-cancer early detection (MCED) space with Galleri. Guardant Health’s acquisition of Bellwether Bio (2021) bolstered liquid biopsy capabilities for early detection, while NeoGenomics’ $150M acquisition of Inivata (2021) added leading ctDNA technology for minimal residual disease testing. These consolidations reflect a trend toward integrating tissue- and liquid-based platforms, expanding into pan-cancer applications, and achieving scale in high-growth segments like MRD monitoring and population screening.

Regulatory developments in the U.S. have significantly shaped the oncology molecular diagnostics market by setting quality, clinical validity, and reimbursement benchmarks. FDA approvals of comprehensive genomic profiling assays-such as FoundationOne CDx (2017) and Guardant360 CDx (2020)-validated large NGS panels as companion diagnostics, driving clinical adoption and payer confidence. The agency’s tumor-agnostic therapy approvals for MSI-H/dMMR (2017), NTRK fusions (2018), and TMB-High (2020) reinforced the demand for multi-biomarker testing in a single assay. CMS reimbursement policies, including ADLT (Advanced Diagnostic Laboratory Test) designations for certain liquid biopsy and MRD assays, have improved access and commercial viability. Ongoing discussions around LDT (Laboratory Developed Test) regulation under the VALID Act may further standardize test performance, potentially favoring established players with FDA-cleared platforms.

Product expansion in the U.S. oncology-based molecular diagnostics market is being driven by the integration of broader biomarker coverage, multi-cancer panels, and new specimen types. Leading companies are extending their portfolios from single-gene assays to comprehensive genomic profiling that detects SNVs, indels, CNVs, fusions, MSI, and TMB in one test-exemplified by Illumina’s TruSight Oncology 500 and Thermo Fisher’s Oncomine Comprehensive Assay Plus. Liquid biopsy offerings have expanded beyond advanced cancer profiling to early detection, MRD monitoring, and recurrence surveillance, with assays like Guardant Reveal and Signatera gaining traction. Platforms originally designed for tissue testing are being adapted for plasma, urine, and even cerebrospinal fluid, widening clinical applications. Rapid, cartridge-based assays are also being introduced for decentralized testing, enabling faster turnaround in community oncology settings.

Regional expansion in the U.S. oncology-based molecular diagnostics market is characterized by companies extending their reach beyond core metropolitan cancer centers into community hospitals, regional reference labs, and integrated health networks. Leading players are partnering with regional healthcare systems to deploy decentralized NGS and rapid PCR platforms, ensuring broader access to advanced testing outside of academic hubs. Collaborations with state cancer screening programs such as those for colorectal and lung cancer-are enabling population-level adoption of genomic assays.

Type Insights

In the U.S., breast cancer accounted for the largest revenue share of 17.75% in the oncology-based molecular diagnostics market in 2024. This leadership is driven by the high national incidence of breast cancer and the strong emphasis on early, personalized diagnosis. Molecular diagnostics are integral to identifying clinically significant biomarkers-such as HER2 overexpression and BRCA1/2 mutations-that guide targeted therapy decisions. Federal and state-level screening programs expanded insurance coverage, and patient preference for minimally invasive testing has accelerated adoption. For example, initiatives aligned with the WHO’s Global Breast Cancer Initiative are being implemented domestically through partnerships between public health agencies and cancer centers, aiming to improve access to advanced diagnostics and reduce mortality.

Liver cancer and prostate cancer segments are also expected to experience substantial growth during the forecast period in the U.S. market. In liver cancer, molecular testing is increasingly used to detect tumor-specific mutations and circulating tumor DNA in high-risk populations, including those with hepatitis B/C or chronic liver disease. For prostate cancer, genomic assays are helping distinguish aggressive tumors from indolent cases, supporting precision treatment strategies and reducing overtreatment. Together, these trends underscore the growing role of molecular diagnostics in enabling earlier detection, more accurate risk stratification, and optimized therapy selection across major cancer types in the U.S.

Technology Insights

In the U.S., the polymerase chain reaction (PCR) technology segment accounted for the largest revenue share of 37.88% in the oncology-based molecular diagnostics market in 2024. Its dominance stems from PCR’s well-established role in rapidly and sensitively detecting cancer-specific genetic alterations, even from minimal DNA or RNA quantities. Clinically, PCR is widely employed for early detection, therapy selection, treatment monitoring, and minimal residual disease (MRD) assessment across tumor types such as breast, lung, colorectal, and hematologic cancers. Its cost-effectiveness, short turnaround times, and compatibility with existing laboratory infrastructure make it a mainstay in both community and academic oncology settings. While advanced platforms like next-generation sequencing (NGS) are gaining ground for comprehensive profiling, PCR maintains a strong foothold due to its scalability, ease of automation, and integration into high-throughput testing workflows. Continued innovations, such as multiplex real-time PCR and droplet digital PCR, are further enhancing its precision and expanding its utility in detecting low-frequency mutations and monitoring disease progression.

The in situ hybridization (ISH) segment in the U.S. oncology-based molecular diagnostics market is projected to experience strong growth over the forecast period, driven by its critical role in detecting and localizing specific DNA or RNA sequences within intact tissue samples. Demand is fueled by the need for precise biomarker assessment-such as HER2 amplification in breast cancer or ALK/ROS1 rearrangements in lung cancer-for targeted therapy selection. ISH offers morphological context alongside molecular data, aiding pathologists in accurate tumor classification. Technological advancements like automated platforms, higher-resolution probes, and multiplexing capabilities are enhancing workflow efficiency and diagnostic accuracy. Additionally, expanding FDA approvals of companion diagnostics using ISH, coupled with rising cancer incidence and increased adoption in both hospital pathology labs and reference laboratories, are reinforcing market growth.

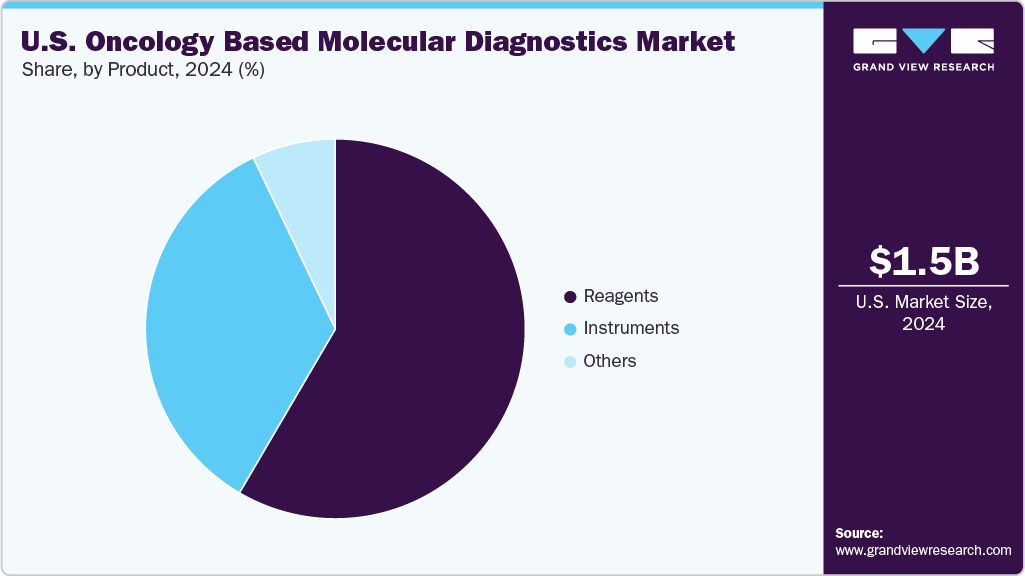

Product Insights

In the U.S., the reagents segment held the largest revenue share in 2024, reflecting its indispensable role in oncology-based molecular diagnostic workflows. Core components such as enzymes, primers, probes, nucleotides, and buffers are integral to widely used techniques, including PCR, next-generation sequencing (NGS), and in situ hybridization. Rising cancer incidence, growing adoption of precision oncology, and the increasing number of biomarker-driven clinical trials have amplified testing volumes in hospital pathology labs, reference laboratories, and academic centers. The shift toward multiplex assays and high-throughput platforms further drives demand for specialized, high-purity reagents to ensure accuracy, reproducibility, and regulatory compliance. Additionally, the steady pipeline of FDA-cleared companion diagnostics and laboratory-developed tests (LDTs) continues to expand the reagent addressable market, supporting sustained revenue growth.

The U.S. reagents segment is projected to grow at a robust CAGR of 5.46% over the forecast period, fueled by rising test volumes and the expanding adoption of molecular assays in oncology. Sustained demand for high-performance, platform-compatible reagents particularly those optimized for PCR, NGS, and ISH continues to drive market momentum. Advances in reagent formulations are enhancing sensitivity, accuracy, and throughput, enabling laboratories to process larger sample volumes with greater reproducibility. Moreover, the shift toward multiplex and multi-analyte testing, alongside the increasing integration of automation in clinical workflows, is boosting demand for specialized reagent kits that meet stringent regulatory and quality standards. These factors position the segment for steady expansion as precision oncology becomes more deeply embedded in routine cancer care.

Key U.S. Oncology Based Molecular Diagnostics Company Insights

Some key players in the oncology-based molecular diagnostics market are adopting various strategies to strengthen their position, such as expanding test menus, forming partnerships with healthcare providers, and investing in advanced technologies like NGS and liquid biopsy. These efforts aim to improve diagnostic accuracy, increase access to personalized cancer testing, and remain competitive in a market shaped by rising cancer burden, evolving clinical guidelines, and the growing emphasis on precision medicine.

Key U.S. Oncology Based Molecular Diagnostics Companies:

- Abbott

- Bayer AG

- BD

- Cepheid

- Agilent Technologies, Inc.

- Danaher

- Hologic, Inc.

- Qiagen

- F. Hoffmann-La Roche Ltd.

- Siemens

- Sysmex

Recent Developments

-

In February 2025, Myriad Genetics, Inc., announced a strategic collaboration with Gabbi. This partnership aims to expand access to hereditary cancer risk assessment by integrating Gabbi’s digital risk assessment platform and specialist referral network with Myriad’s MyRisk with RiskScore Hereditary Cancer Test. The initiative offers a seamless patient journey-from risk identification and telehealth consultation to genetic testing, enhancing early detection opportunities and personalized care planning. By combining Myriad’s clinically validated hereditary cancer test, which has been shown to prompt medical management changes in over half of eligible patients, with Gabbi’s outreach and educational capabilities, the collaboration is positioned to improve patient engagement, broaden testing uptake, and strengthen preventive oncology care pathways across the U.S.

-

In September 2024, QIAGEN expanded its presence in the clinical oncology diagnostics space with the launch of the QIAcuityDx Digital PCR System, a 510(k) exempt and IVDR-certified platform designed for precise DNA and RNA quantification in applications such as cancer monitoring and liquid biopsies. This benchtop system integrates partitioning, thermocycling, and imaging into a single streamlined workflow, delivering highly accurate results in just two hours while reducing lab space requirements and operational costs. QIAGEN is building a robust clinical assay portfolio for the platform, including a planned BCR: ABL oncohematology test for FDA submission in 2025 and multiple companion diagnostics through partnerships with pharmaceutical companies. By enabling sensitive detection of molecular changes and minimal residual disease, QIAcuityDx strengthens QIAGEN’s role in precision medicine and offers clinical labs a faster, less invasive alternative to traditional molecular methods.

U.S. Oncology Based Molecular Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.65 billion

Revenue forecast in 2033

USD 2.47 billion

Growth rate

CAGR of 5.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, technology, region

Key companies profiled

Abbott; Bayer AG; BD; Cepheid; Agilent Technologies, Inc.; Danaher; Hologic, Inc.; Qiagen; F. Hoffmann-La Roche Ltd.; Siemens; Sysmex

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Oncology Based Molecular Diagnostics Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. oncology based molecular diagnostics market report based on product, technology, type, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Breast Cancer

-

Prostate Cancer

-

Colorectal Cancer

-

Cervical Cancer

-

Liver Cancer

-

Lung Cancer

-

Blood Cancer

-

Kidney Cancer

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Reagents

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

PCR

-

In situ hybridization

-

INAAT

-

Chips and microarrays

-

Mass spectrometry

-

Sequencing

-

TMA

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. oncology based molecular diagnostics market size was estimated at USD 1.49 billion in 2024 and is expected to reach USD 1.64 billion in 2025.

b. The U.S. oncology based molecular diagnostics market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2033 to reach USD 2.46 billion by 2033.

b. Reagents segment dominated the oncology based molecular diagnostics market with a share of 58.87% in 2024. This is attributable to the presence of large test volumes and an extensive portfolio of commercialized products.

b. Some key players operating in the oncology based molecular diagnostics market include Abbott Laboratories, Bayer Healthcare, Beckton Dickinson, Cepheid, Dako, Danaher Corporation, Gen Probe, Qiagen, Roche Diagnostics, Siemens, and Sysmex Corporation.

b. Key market driving factors for the market include the rapid evolution of sequencing technologies (e.g., shift from Sanger to NGS, adoption of long-read platforms like Nanopore and SMRT) enabling high-throughput, comprehensive genomic profiling. Increased availability of targeted therapies and pan-cancer biomarkers (e.g., HER2, EGFR, NTRK fusions) fuels demand for companion diagnostics. Rising adoption of minimally invasive methods such as liquid biopsy/ctDNA testing supports real-time disease monitoring and early detection. Advances in high-sensitivity platforms like ddPCR and RNA-seq improve detection of low-frequency mutations and fusions, while AI/ML integration enhances tumor origin prediction. The growing clinical utility across multiple tumor types from lung adenocarcinoma to breast cancer—combined with regulatory approvals for large-panel CDx assays (e.g., FoundationOne CDx, MSK-IMPACT) further accelerates market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.