- Home

- »

- Healthcare IT

- »

-

U.S. Oncology Information Systems Market Size Report, 2030GVR Report cover

![U.S. Oncology Information Systems Market Size, Share & Trends Report]()

U.S. Oncology Information Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Product & Service (Software, Professional Services), By Application (Medical Oncology, Surgical Oncology, Radiation Oncology), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-287-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

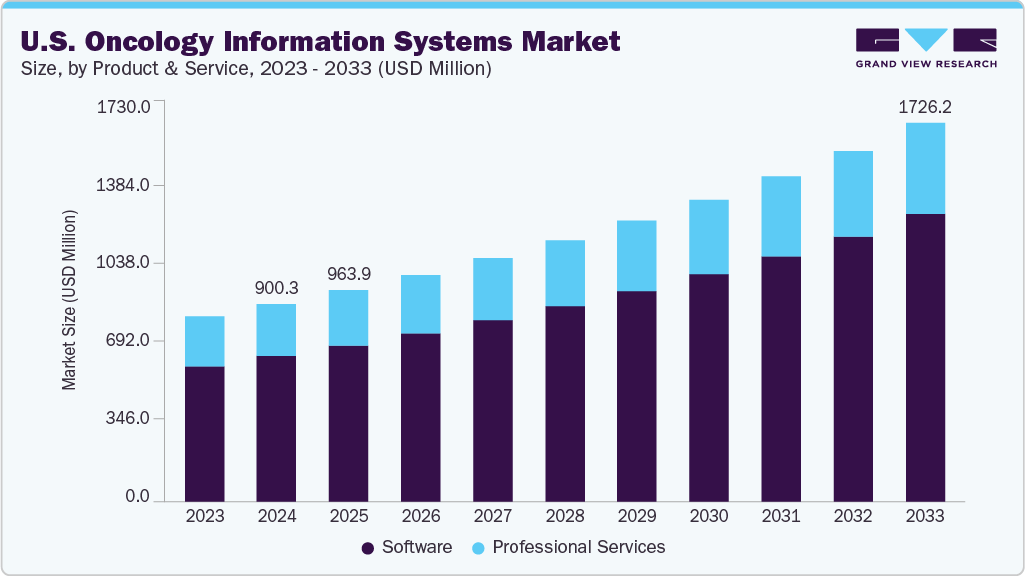

The U.S. oncology information systems market size was estimated at USD 900.29 million in 2024 and is projected to grow at a CAGR of 7.56% from 2025 to 2033. The growing prevalence of cancer among various demographics and the rising demand for advanced innovative oncology information systems (OIS) are some of the driving factors for the U.S. market. Oncology information solutions deployment is high in hospitals & cancer research institutes in the U.S. due to the rise in the prevalence of cancer and the increase in healthcare expenditure budget.

The U.S. oncology information system (OIS) market is poised for significant growth, driven by the rising cancer burden and the increasing integration of advanced healthcare IT solutions. According to the National Cancer Institute, over 2 million new cancer cases are projected to be diagnosed in the U.S. in 2024, with an estimated 611,720 cancer-related deaths. This escalating disease incidence necessitates robust data management and clinical decision support systems, thereby accelerating the demand for OIS platforms across healthcare facilities.

Moreover, the healthcare sector in the U.S. has witnessed a surge in the adoption of digital technologies aimed at optimizing workflows, administrative functions, and patient care delivery. Oncology information systems, equipped with advanced functionalities such as treatment planning, data visualization, and patient tracking, have emerged as critical tools for improving clinical outcomes and operational efficiency.

Furthermore, increased investment in oncology R&D, supported by both public and private organizations, is fostering product innovation. For instance, the American Brachytherapy Society (ABS), a prominent nonprofit founded in 1978, actively supports the advancement of brachytherapy through professional education, research promotion, and awareness-building initiatives. Such organizations play a pivotal role in driving innovation and knowledge dissemination in oncology care.

The growing integration of artificial intelligence (AI) into oncology workflows is expected to further propel the expansion of the U.S. oncology information systems industry. In October 2024, Ontada, a McKesson Corporation subsidiary, partnered with Microsoft to utilize Azure AI, including Azure OpenAI Service, to enhance the processing of unstructured oncology data. This collaboration aims to extract actionable insights from complex clinical documents, ultimately supporting data-driven treatment planning and real-time decision-making.

These factors, such as rising cancer prevalence, expanding healthcare IT adoption, increased R&D activities, and AI-driven innovation, are collectively expected to drive sustained growth of the U.S. oncology information system market over the forecast period.

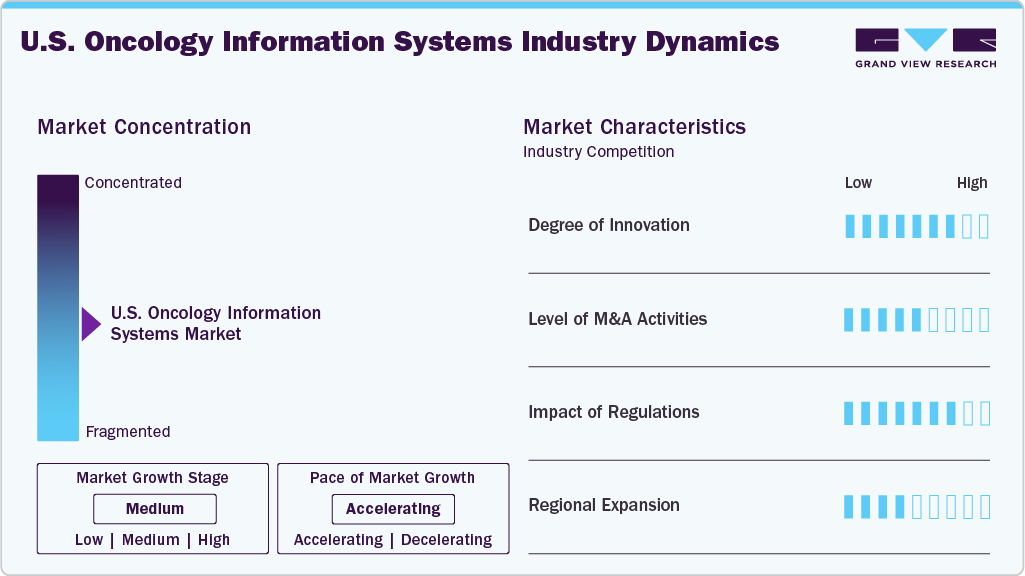

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, characteristics, and participants. The X-axis represents the level of market concentration, ranging from low to high. The Y-axis represents various market characteristics, including industry competition, degree of innovation, level of mergers & acquisition activities, regulatory impact, product substitutes, and regional expansion. For instance, the U.S. oncology information systems market is slightly fragmented, with many players entering the market and launching new innovative products.

An increase in investments in cancer research by companies is driving industry growth. A wide range of novel technologies is being developed, which have the potential to drastically change the treatment regime. The OIS helps organizations and healthcare centers in managing the treatment of cancer. For instance, in May 2022, Elekta launched Elekta Espirit, a next-generation automated treatment planning system with enhanced precision & accuracy that offers more personalized care.

“Esprit will allow clinicians to take radiosurgery to the next level and treat patients with the highest accuracy, protecting their mind and memories and enabling a higher quality of life.”

- Gustaf Salford, Elekta’s President and CEO.

The market is experiencing a moderate level of merger and acquisition activities undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market. For instance, in May 2022, RaySearch Laboratories collaborated with GE Healthcare to develop an advanced radiation therapy simulation that incorporates the latest advancements in treatment planning systems technology.

Government regulations are favoring the market growth. The regulations for Healthcare Information Systems in the U.S. are primarily focused on protecting Personal Health Information (PHI) and ensuring secure data exchange. In addition, the Office of the National Coordinator for Health Information Technology (ONC) enforces interoperability requirements critical to OIS platforms.

The U.S. oncology information systems industry is witnessing moderate regional expansion, driven by an increasing customer base for OIS systems. For instance, in March 2025, Trial Library and American Oncology Network (AON) partnered to enhance patient access to cancer clinical trials.

Product & Service Insights

The software segment led the U.S. oncology information systems market with the largest share of 73.64% in 2024. These software solutions facilitate the exchange of patient information across healthcare organizations to create a bridge between practitioners and radiology centers, which helps improve the safety and efficiency of cancer treatment. Companies such as Varian (Siemens Healthineers), Flatiron, and Elekta are developing innovative products by integrating solutions, including oncology-specific EMR. Hence, the software segment dominates the market as it helps streamline patient and data management processes, which can otherwise compromise data quality & participant safety.

The professional services segment is expected to witness growth at a significant CAGR over the forecast period. As hospitals and clinics lack the in-house resources and skills required for the deployment of OIS software, these services are outsourced. Outsourcing can be a short-term project or a long-term contract. Companies such as Varian (Siemens Healthineers), Elekta, eviCore Healthcare, and Asclepius Consulting are some of the major players providing professional services for cancer care globally.

Application Insights

The medical oncology segment dominated the U.S. oncology information systems industry with the largest share of 60.98% in 2024. This modality offers a comprehensive and efficient approach to treating cancer. Furthermore, the increasing prevalence of cancer is expected to drive market growth. Increasing usage of chemotherapy, immunotherapy, targeted therapy, and hormonal therapy for effective treatment of cancer is expected to drive market growth.

The surgical oncology segment is expected to witness the fastest CAGR over the forecast period. Surgery is no longer the treatment for most solid malignancies. However, the combination of surgery and multi-modal therapies, mostly focused on radiotherapy, targeted molecular therapies, and chemotherapy, is the preferred treatment. Some of the surgical procedures, such as cytoreductive surgery, isolated limb perfusion, laparoscopic cancer surgery, and sarcoma surgery, can be performed in highly specialized healthcare centers. Thus, increasing complexity in surgical treatments for solid malignancies is expected to drive the growth of the surgical oncology OIS market.

End Use Insights

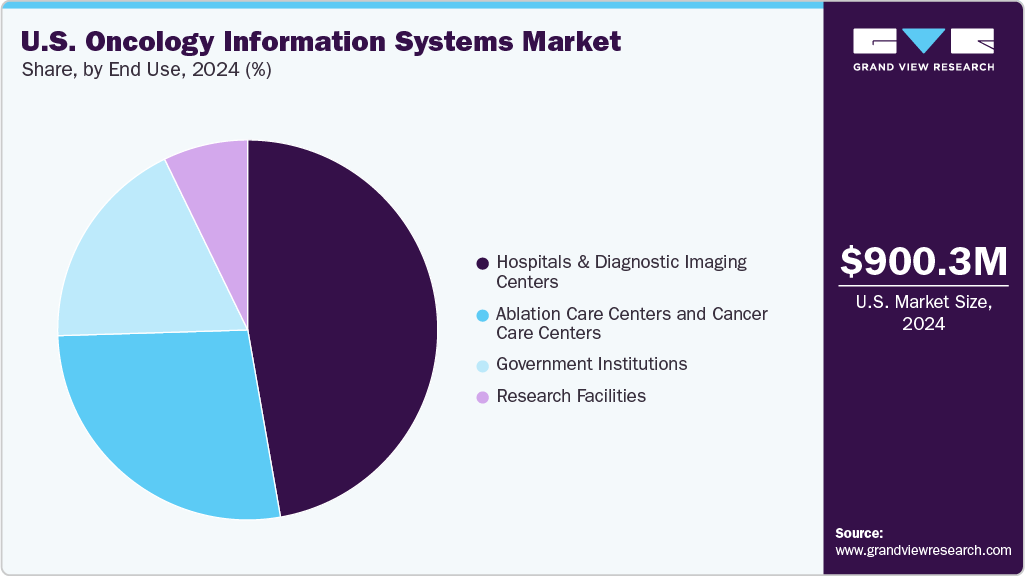

The hospitals & diagnostic imaging centers segment dominated the U.S. oncology information systems market with the largest revenue share of 47.24% in 2024. The adoption of OIS in hospitals is driven by the need to reduce oncology care costs, which are often increased by manual workflows and fragmented data. For instance, integrating OIS with EHRs allows seamless access to patient histories, imaging results, and treatment responses, minimizing unnecessary tests and delays. Moreover, hospitals and medical centers are leveraging their radiation oncology services to enhance cancer treatment.

The ablation care centers and cancer care centers segment is expected to grow at the fastest CAGR from 2025 to 2033. Medical centers are expanding their cancer services owing to the growing demand for cancer treatment. For instance, in November 2024, UT Southwestern Medical Center announced the expansion of its services in the Fort Worth Medical District by constructing a new USD 177 million radiation oncology campus offering MRI-guided precision radiation treatment. Similarly, in February 2025, Johns Hopkins expanded its surgical oncology services in the Greater Washington Area. Such factors are expected to boost market growth further.

Key U.S. Oncology Information Systems Company Insights

Key players are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key U.S. Oncology Information Systems Companies:

- Elekta AB

- Accuray Incorporated

- Varian Medical Systems (Siemens Healthineers)

- RaySearch Laboratories

- Oracle Corporation

- BrainLab

- Philips Healthcare

- Prowess, Inc.

- DOSIsoft S.A.

- ViewRay Inc.

- MIM Software

- Flatiron

Recent Developments

-

In July 2025, RaySearch Laboratories signed a contract with AKSM/Oncology to provide its RayCare oncology information system and RayStation treatment planning system for a new multidisciplinary center, Advanced Radiation Therapeutics (ART), in partnership with Urology Associates of the Central Coast in San Luis Obispo, California.

-

In February 2025, Myriad Genetics partnered with PATHOMIQ to incorporate AI technology into its oncology portfolio, specifically enhancing prostate cancer diagnostics. This partnership includes licensing PATHOMIQ's AI platform, which enhances clinical decision-making by revealing insights from cancer pathology, with plans to launch an AI-driven clinical test later in 2025.

-

In October 2023, mTuitive launched mTuitive Insight, a new health informatics solution that consolidates structured cancer data, allowing for improved data sharing and analysis. This innovative tool enables surgeons, pathologists, and researchers to utilize advancements in AI, facilitating better data aggregation and sharing to enhance cancer research and treatment outcomes.

-

In June 2022, Accuray Incorporated and Limbus AI Inc. entered a strategic partnership to amalgamate Limbus’ AI-powered auto-contouring algorithms with Accuray’s adaptive radiotherapy capabilities. The two companies partnered to focus on enhancing the treatment planning process software solutions as part of the agreement.

U.S. Oncology Information Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 963.88 million

Revenue forecast in 2033

USD 1.73 billion

Growth rate

CAGR of 7.56% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, application, end use

Country scope

U.S.

Key companies profiled

Elekta AB; Accuray Incorporated; Varian Medical Systems (Siemens Healthineers); RaySearch Laboratories; Oracle Corporation; BrainLab; Philips Healthcare; Prowess, Inc.; DOSIsoft S.A.; ViewRay Inc.; MIM Software; Flatiron

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Oncology Information Systems Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. oncology information systems market report based on product & service, application, and end use:

-

Product & Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Patient Information Systems

-

Treatment Planning Systems

-

-

Professional Services

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Medical Oncology

-

Radiation Oncology

-

Surgical Oncology

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Diagnostic Imaging Centers

-

Ablation Care Centers and Cancer Care Centers

-

Government Institutions

-

Research Facilities

-

Frequently Asked Questions About This Report

b. The U.S. oncology information systems market size was estimated at USD 900.29 million in 2024 and is expected to reach USD 963.88 million in 2025.

b. The U.S. oncology information systems market is expected to grow at a compound annual growth rate of 7.56% from 2025 to 2033 to reach USD 1.73 billion by 2033.

b. The medical oncology segment dominated the U.S. oncology information systems market and accounted for the largest revenue share of 60.98% in 2024, owing to the rapid advancements in immunotherapy, hormonal therapy, and targeted therapy for effectively treating various cancers.

b. The software segment dominated the U.S. oncology information systems market and accounted for the largest revenue share of 73.64% in 2024, owing to healthcare providers' rising adoption of radiology imaging management solutions. These software solutions facilitate the exchange of patient information across healthcare organizations to create a bridge between practitioners and radiology centers, which helps improve the safety and efficiency of cancer treatment.

b. Key factors driving the U.S. oncology information systems market growth include the growing prevalence of cancer among various demographics, the rising demand for advanced innovative oncology information systems (OIS), increased R&D activities, and AI-driven innovation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.