- Home

- »

- Medical Devices

- »

-

U.S. Orthopedic Braces And Supports Market, Industry Report, 2030GVR Report cover

![U.S. Orthopedic Braces And Supports Market Size, Share & Trends Report]()

U.S. Orthopedic Braces And Supports Market Size, Share & Trends Analysis Report By Product (Braces & Supports Type, Pain Management Products), By End-user (Orthopedic Clinics, Over The Counter, Hospitals, DME Dealers, Others), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-291-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

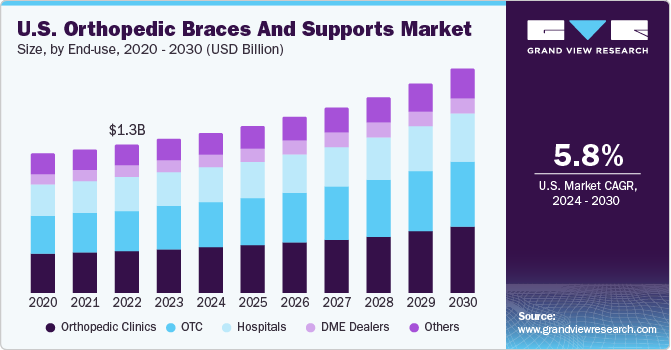

The U.S. orthopedic braces and supports market size was valued at USD 1.34 billion in 2023 and is expected to grow at a CAGR of 5.8% from 2024 to 2030. The increasing geriatric population, technological developments, prevalence of chronic and acute conditions, and initiatives by major companies are some of the key drivers for the market growth.

In 2023, U.S. orthopedic braces and supports market accounted for a market share of over 30% in the global orthopedic braces and supports market. Increasing amateur sports and activity levels, and number of elective orthopedic surgeries (such as knee replacement) are some of the factors anticipated to drive the demand for high-end products. These products include the Unloaded OA bracing products and postoperative bracing solutions. Rising incidences of osteoarthritis is further fueling the product demand. It is the most common form of arthritis affecting populations of all ages. According to the estimates of Centers for Disease Control and Prevention (CDC), over 78 million U.S. adults are likely to be diagnosed with arthritis by 2040.

The geriatric population largely contributes to increasing demand for orthopedic braces and support. This population is highly prone to musculoskeletal disorders. As bones and connecting tissues, including ligaments and cartilage, weaken naturally with age there is a high risk for muscle injury, primarily in the knees and shoulders. This also causes stiffness in joints, which boosts the need for braces and supports to enhance mobility. ACL tears and sprains are the other commonly affecting conditions impacting the people involved in activities such as gymnastics, football, downhill skiing, soccer, and basketball.

Market Characteristics & Concentration

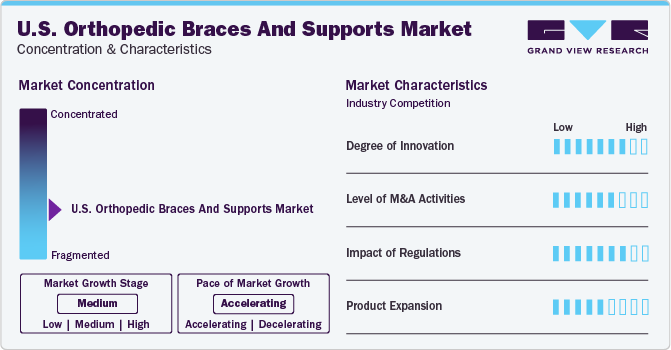

The industry growth stage is medium (CAGR 5-10%) and pace of the growth depicts an accelerating trend. The U.S. orthopedic braces and supports industry is moderately fragmented, which is marked by the presence of large number of companies competing for the market share.

Continued investment in new technologies to expand the capabilities of orthopedic braces and support products and services is anticipated to create new growth avenues for the industry. Technological innovations enable the customization of braces and supports, catering to individual patient needs and improving treatment effectiveness. The rapid pace of innovation is likely to result in the reduced prices of older versions, leading to significant business opportunities for key companies in the emerging economies.

The key companies are acquiring niche players and engaging in M&A activities to strengthen their market positions. Several companies are undertaking various strategies to improve their portfolio of orthopedic braces. For instance, in December 2022, Enovis (DJO, LLC) acquired the EXCYABIR hip brace and the CryoKnee knee brace to enhance its product portfolio in braces. Adopting such strategies is expected to support the industry growth in the upcoming years.

Regulatory bodies like the FDA are intensifying their scrutiny of orthopedic devices and demanding more rigorous testing and safety data before approving new devices. There is a growing emphasis on post-market surveillance to ensure that orthopedic devices remain safe and effective over time. It includes the collection of real-world data on performance and safety. The market is increasingly adopting new technologies, such as 3D printing, robotics, and artificial intelligence, changing the regulatory landscape and creating new challenges for regulatory bodies.

Product Insights

The braces & supports type segment held the largest market revenue share of 74.4% in 2023. The segment is also expected to witness the fastest growth rate during the forecast period. The growth in product demand is attributed to increased injuries and orthopedic disorders including arthritis. The braces & supports type segment is further segmented into the knee, ankle, back, upper extremity braces and supports, and walking boots.

The rising prevalence of knee, ankle, and upper extremity-related disorders and injuries has increased demand for these products. Factors facilitating the rapid adoption of knee treatments, rising geriatric population, and increased incidence of chronic diseases such as diabetes & obesity, is opportunistic for the market growth.

End-user Insights

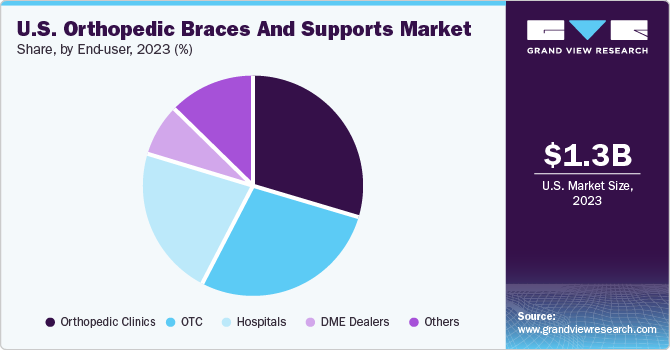

The orthopedic clinics held the largest market share of 29.4% in 2023. Orthopedic clinic is the primary point of care for patients suffering from musculoskeletal pain. Many patients seek treatment at orthopedic clinics, especially cases of traumatic injuries. These may range from spinal injuries, bone fractures, and injuries suffered in road accidents. These clinics serve as essential points of care where patients can receive personalized assessments and recommendations for orthopedic braces and supports.

The availability of specialized orthopedic physicians and therapists in orthopedic clinics ensures patients receive solutions, including custom-made braces, based on their specific needs. Furthermore, these clinics often maintain a wide range of braces and supports from various manufacturers, providing patients with a diverse selection of products.

Over the counter (OTC) is expected to grow significantly during the forecast period, as the products are readily available in retail pharmacies. Patients with acute muscle pain prefer OTC products. These products reduce the recovery time and facilitate rapid treatment for the damaged parts of muscles and joints.

Key U.S. Orthopedic Braces And Supports Company Insights

U.S. orthopedic braces and supports companies include BREG, Inc., Össur, DeRoyal Industries, Inc., and DJO, LLC (Enovis). The companies are focusing on adopting growth strategies, including collaborations, partnerships, mergers, and new product launches. Furthermore, market players are also focusing on business strategies such as marketing and promotions, broadening product portfolio to expand the availability and reach of their product offerings. Continuous R&D efforts are being undertaken by industry players companies for safe and effective products in treatment of orthopedic conditions.

Key U.S. Orthopedic Braces And Supports Companies:

- Össur

- BREG, Inc.

- DeRoyal Industries, Inc.

- Bauerfeind

- DJO Global, Inc.

- Otto Bock

- Fillauer LLC

- Frank Stubbs Company Inc.

- McDavid

- Hely & Weber

Recent Developments

-

In April 2023, DJO Global Inc. (currently operating as Enovis) expanded its ankle and foot product portfolio with a knotless syndesmotic repair system by introducing Enofix with Constrictor technology. This technology helps stabilize syndesmosis, thereby proving an effective contribution to orthopedic braces and supports.

-

In March 2023, BREG Inc. partnered with HealthMe to introduce patient direct-pay solutions for orthopedic cold therapy products. This initiative aimed to digitize and modernize the orthopedic braces and support the sector by offering patients access to the required equipment.

U.S. Orthopedic Braces And Supports Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.34 billion

Revenue forecast in 2030

USD 1.95 billion

Growth Rate

CAGR of 5.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, product outlook

Segments covered

Product, end-use

Country Scope

U.S.

Key companies profiled

BREG, Inc.; Frank Stubbs Company Inc.; DeRoyal Industries, Inc.; Össur; Fillauer LLC; Ottobock; McDavid; Bauerfeind; Weber Orthopedic LP; DJO, LLC (Enovis)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Orthopedic Braces And Supports Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. orthopedic braces and supports market report based on product, and end-user.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Braces & Supports Type

-

Knee Braces & Supports

-

Knee Braces for Osteoarthritis and Ligament Injuries

-

Post-operational Knee Braces

-

-

Back Braces & Supports

-

Upper Spine Orthoses

-

TLSOs

-

LSOs

-

Others

-

-

Ankle Braces & Supports

-

Soft Braces

-

Hinged Braces

-

-

Walking Boots

-

Pneumatic Walking Boots

-

Non-pneumatic Walking Boots

-

-

Upper Extremity Braces & Supports

-

Elbow Braces & Supports

-

Wrist Braces & Supports

-

Others

-

- Others

-

-

Pain Management Products

-

Cold Therapy Products

-

DVT Products

-

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic Clinics

-

Over the Counter (OTC)

-

Hospitals

-

Durable Medical Equipment (DME) Dealers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. orthopedic braces and support market size was estimated at USD 1.34 billion in 2023 and is expected to reach USD 1.39 billion in 2024.

b. The U.S. orthopedic braces and support market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 1.95 billion by 2030.

b. The braces & supports type segment held the largest market revenue share in 2023. The segment is also expected to witness the fastest growth rate during the forecast period. The growth in product demand is attributed to increased injuries and orthopedic disorders including arthritis.

b. Some key players operating in the market include BREG, Inc.; Frank Stubbs Company Inc.; DeRoyal Industries, Inc.; Össur; Fillauer LLC; Ottobock; McDavid; Bauerfeind; Weber Orthopedic LP; DJO, LLC (Enovis)

b. Key factors that are driving the market growth include increasing geriatric population, technological developments, prevalence of chronic and acute conditions, and initiatives by major companies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."