- Home

- »

- Beauty & Personal Care

- »

-

U.S. Perfume Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Perfume Market Size, Share & Trends Report]()

U.S. Perfume Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Mass, Premium), By End User (Men, Women), By Distribution Channel (Offline, Online) And Segment Forecasts

- Report ID: GVR-4-68040-803-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Perfume Market Summary

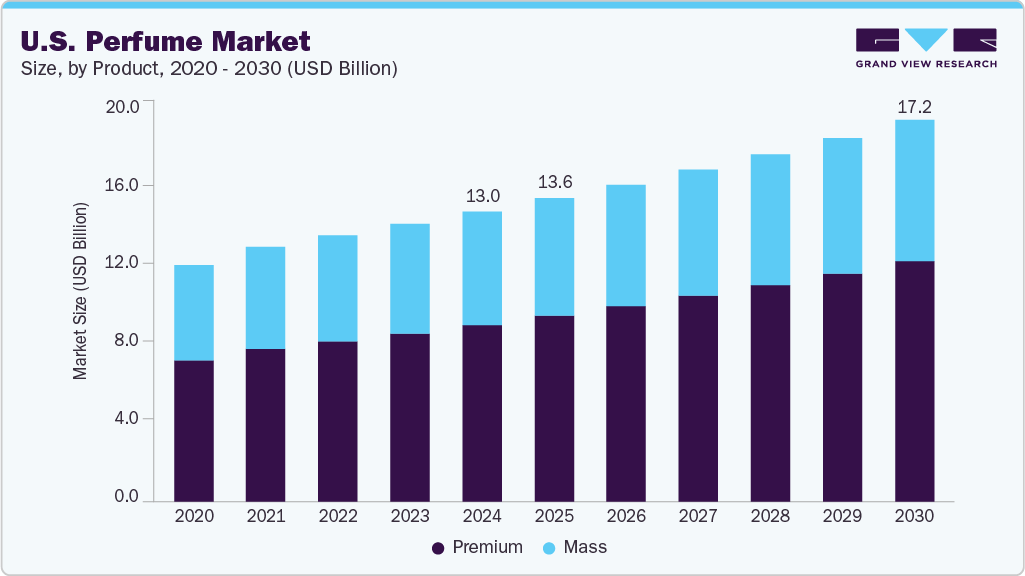

The U.S. perfume market size was estimated at USD 13.04 billion in 2024 and is projected to reach USD 17.18 billion by 2030, growing at a CAGR of 4.7% from 2025 to 2030. Increasing consumer spending on personal care and grooming products, as well as the rising popularity of perfumes, are key factors driving market expansion.

Key Market Trends & Insights

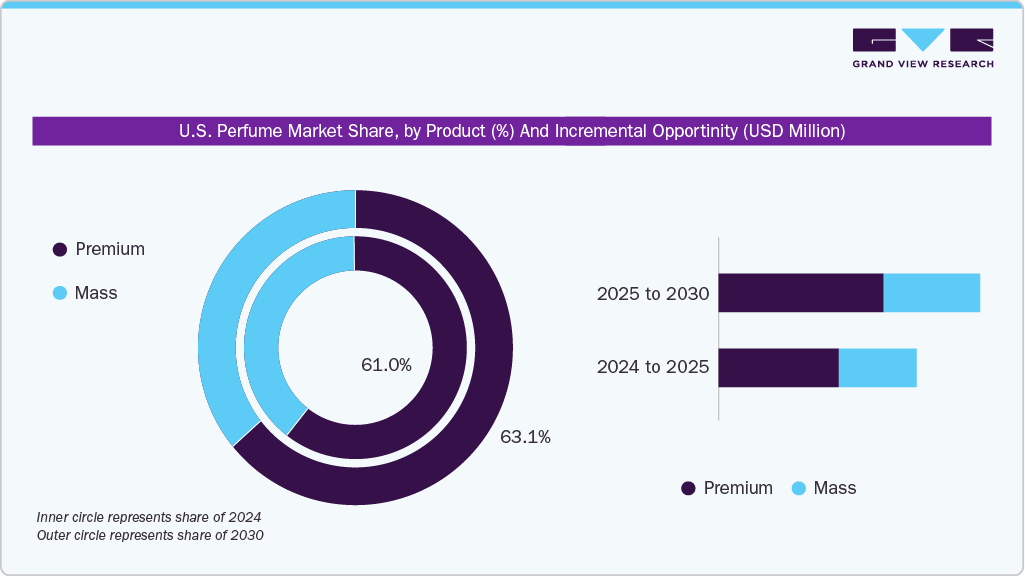

- Based on products, the premium segment accounted for the largest revenue share of over 61.0% in 2024.

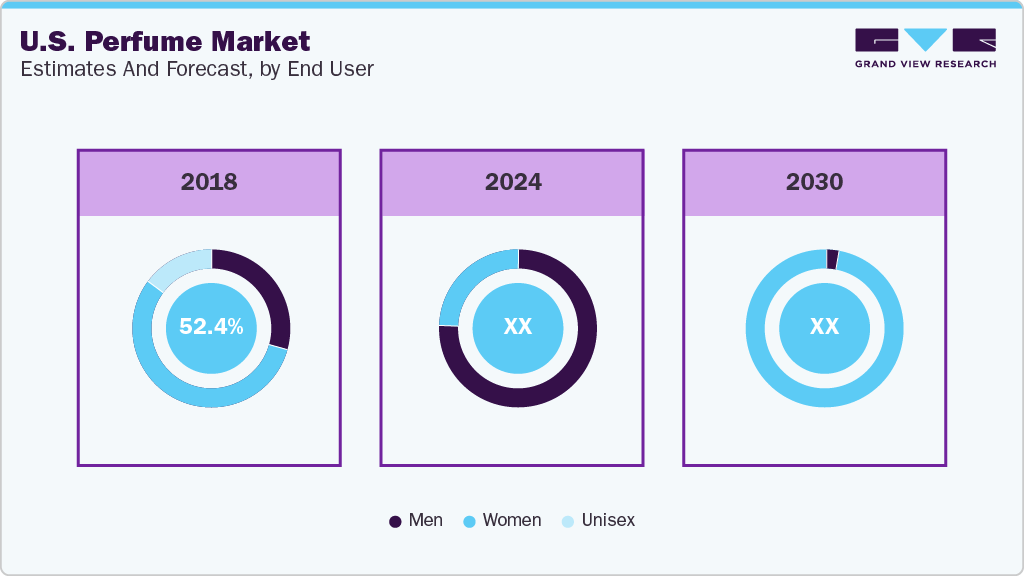

- By end user, the women end-user segment held the largest share of 50.2% in 2024.

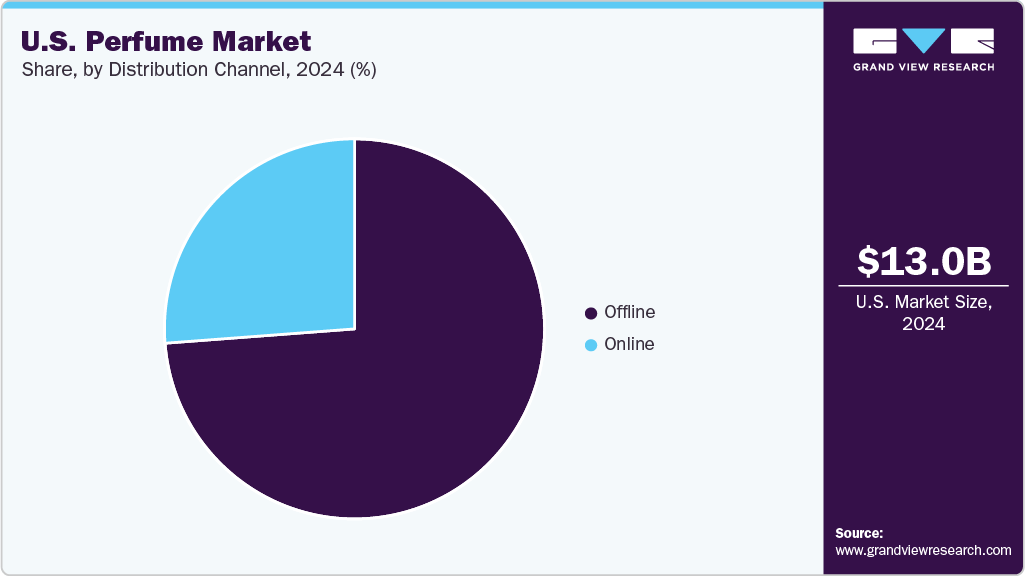

- By distribution channel, the offline segment dominated the perfume market, with a share of 73.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 13.04 Billion

- 2030 Projected Market Size: USD 17.18 Billion

- CAGR (2025-2030): 4.7%

The U.S. market is driven by increasing consumer spending on personal care, cosmetics, and grooming products. Rising disposable incomes, evolving lifestyle preferences, and increasing awareness of premium and niche fragrances are boosting the demand for perfumes. The market benefits from a diverse product portfolio catering to a wide consumer base, including mass, luxury, and celebrity-endorsed fragrances. Retail channels such as specialty stores, department stores, and e-commerce platforms are expanding product distribution and enhancing consumer accessibility. In addition, innovations in scent formulations, packaging, and sustainable ingredients increase market competitiveness. Celebrity endorsements, social media influencers, and other marketing and digital engagement strategies continue to influence consumer purchase behavior and impact their buying decisions.

Product Insights

The premium perfume segment accounted for the largest revenue share of 61.0% in 2024, driven by consumer demand for premium scent experiences, personalization, and digital engagement. Luxury brands are stepping up with immersive launches and limited-edition offerings that blend craftsmanship with storytelling. E-commerce and social media enhance accessibility, allowing niche and designer fragrances to reach a wider audience. For instance, in 2024, Chanel launched its premium fragrance Chance Eau Splendide in the U.S., with an immersive pop-up at The Grove in Los Angeles. Rising disposable incomes and lifestyle shifts toward self-expression and wellness fuel demand for premium fragrances. Innovative presentation and formats, such as layering kits, refillable bottles, and interactive pop-ups, further enhance product appeal. As brands such as Chanel deploy experiential marketing and engage directly with consumers, the U.S. market remains dynamic for fragrance innovation and growth.

The mass perfume segment is driven by growing consumer preference for affordable yet appealing fragrances across developing markets. These products, including body mists, sprays, deodorants, and colognes, offer accessible options that suit diverse consumer lifestyles and budgets. Rising urbanization, increased popularity among young consumers, and the growing influence of celebrity-endorsed brands play a crucial role in boosting their adoption. For instance, Khloé Kardashian’s XO Fragrance exemplifies the marketing power of celebrity-driven perfume lines, offering luxury-inspired scents at accessible price points. The combination of affordability, accessibility, and variety remains the key growth driver for the mass segment in the market.

End User Insights

The women segment accounted for the largest share of 50.2% in 2024. The women’s market in the U.S. continues to grow, driven by strong brand loyalty, frequent purchases, and an increasing preference for designer and experimental fragrances. Women seek signature scents that reflect their individuality, boosting demand for premium and innovative launches. For instance, in 2024, Marc Jacobs launched Daisy Wild, a refillable eau de parfum featuring banana-blossom top notes, jasmine heart, and a sandalwood‑vetiver base. The fragrance’s eco-conscious refillable design aligns with evolving consumer expectations for sustainability. In addition, rising disposable incomes, growing online retail channels, and the influence of social media enhance accessibility and market penetration. These factors collectively drive the market expansion, making it a dynamic segment focused on personalization, luxury, and experiential consumption.

The men end user segment is estimated to register the fastest CAGR during the forecast period, driven by increasing awareness of personal grooming and lifestyle expression. Consumers are increasingly interested in designer, niche, and premium fragrances that offer distinctive, long-lasting scents. Influencer endorsements, celebrity collaborations, and targeted marketing campaigns boost engagement and brand loyalty. E-commerce platforms and subscription-based offerings make high-end fragrances more accessible. New product innovations, such as versatile body sprays and eau de parfums, cater to evolving preferences, driving demand for products in the men’s segment.

Distribution Channel Insights

The offline segment accounted for the largest share of 73.4% in 2024, driven by consumer preference for in-store shopping. Shoppers value the ability to test fragrances, explore product ranges, and receive personalized consultations before making a purchase. Specialty stores, department stores, and standalone brand boutiques dominate this channel, offering curated collections and luxury experiences. Promotional activities, seasonal launches, and exclusive in-store editions further enhance consumer engagement. Despite the rise of e-commerce, the tactile and immersive nature of offline retail sustains its relevance, supporting brand visibility and fostering customer loyalty.

The online distribution channel segment is expected to record the fastest CAGR from 2025 to 2030, driven by increasing internet penetration, convenience, and the growing popularity of e-commerce platforms. Consumers appreciate the ability to browse an extensive range of products, compare prices, read reviews, and access limited-edition or niche fragrances from the comfort of their homes. Subscription services, direct-to-consumer brand websites, and digital marketing campaigns enhance reach and engagement. Integrating personalized recommendations and virtual scent experiences boosts online adoption, making this segment an increasingly important channel in the U.S.

Key U.S. Perfume Company Insights

Some of the initiatives by players operating in the industry include new product launches and collaborations. Leading companies are primarily focusing on creating fragrances that seamlessly adapt to individual consumer preferences to stay abreast of the competition.

Key U.S. Perfume Companies:

- International Flavors & Fragrances Inc.

- Alpha Aromatics

- Coty Inc.

- The Estée Lauder Companies

- Revlon

- The Fragrance Shop

- Elizabeth Arden

- Interparfums, Inc

- Bath & Body Works Direct, Inc.

Recent Developments

-

In October 2025, Bath & Body Works and Milk Bar collaborated to launch a limited-edition holiday fragrance and treat menu, featuring five new fragrances available in stores and online.

-

In February 2025, Bath & Body Works launched an extensive Disney Princess fragrance collection, marking its most expansive collaboration. The collection features six new scents inspired by beloved Disney Princesses: Ariel, Belle, Cinderella, Jasmine, Moana, and Tiana, each designed to embody their unique personalities and stories.

U.S. Perfume Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.64 billion

Revenue forecast in 2030

USD 17.18 billion

Growth rate

CAGR of 4.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, end user, distribution channel

Key company profiled

International Flavors & Fragrances Inc.; Alpha Aromatics; Coty Inc.; The Estée Lauder Companies; Revlon; The Fragrance Shop; Elizabeth Arden; Inter Parfums, Inc.; Bath & Body Works Direct, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Perfume Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. perfume market report based on product, end user, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass

-

Premium

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

Unisex

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The U.S. perfume market size was estimated at USD 13.04 billion in 2024 and is expected to reach USD 13.64 billion in 2025.

b. The U.S. perfume market is projected to grow at a compound annual growth rate (CAGR) of 4.7% from 2025 to 2033, reaching USD 17.18 billion by 2030.

b. By distribution channel, the offline segment dominated the perfume market, accounting for 73.4% of the market share in 2024.

b. Some of the key players operating in the U.S. perfume market are International Flavors & Fragrances Inc., Alpha Aromatics, Coty Inc., The Estée Lauder Companies, Revlon, The Fragrance Shop, Elizabeth Arden, Inter Parfums, Inc., and Bath & Body Works Direct, Inc.

b. Increasing consumer spending on personal care and grooming products, as well as the rising popularity of perfumes, are key factors driving market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.