- Home

- »

- Personal Care & Cosmetics

- »

-

U.S. Personal Care Contract Manufacturing Market, Report 2030GVR Report cover

![U.S. Personal Care Contract Manufacturing Market Size, Share & Trends Report]()

U.S. Personal Care Contract Manufacturing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Skin Care, Hair Care), By Service (Manufacturing, Custom Formulation And R&D, Packaging), And Segment Forecasts

- Report ID: GVR-4-68038-119-1

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

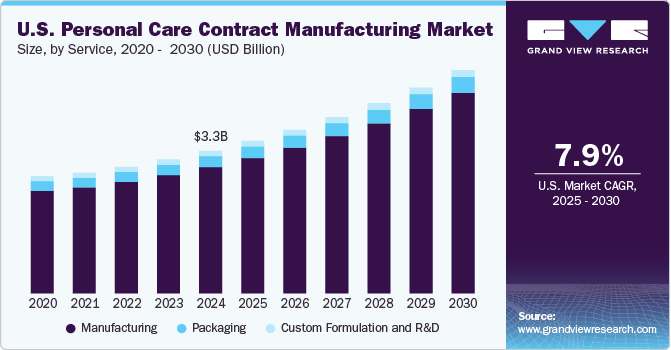

The U.S. personal care contract manufacturing market size was estimated at USD 3.33 billion in 2024 and is anticipated to expand at a CAGR of 7.9% from 2025 to 2030. Increasing demand for advanced beauty treatments and skin care products drives the market. In addition, with major personal care companies channeling resources toward R&D and marketing initiatives, the outsourcing of production tasks such as manufacturing and packaging through contract manufacturers is expected to rise over the forecast period. The rising demand for skincare products, mainly from millennials, to delay signs of aging is expected to propel the personal care contract manufacturing market growth in the U.S.

Personal care products are further divided into personal hygiene and cosmetic products. Personal hygiene products are necessary, while cosmetics are luxury goods solely used for beautification. Introducing new product formats and gender-specific products is expected to drive the demand for personal care products. Increasing use of hair sprays, styling mousses, and deodorants by male consumers, in addition to the heightened demand for lip colors, lip gloss, and other cosmetic products from female consumers, is expected to augment the market growth.

Drivers, Opportunities & Restraints

The growing demand for customized and innovative personal care products primarily drives the market. As consumer preferences shift towards natural and organic formulations, brands increasingly seek contract manufacturers that can provide tailored solutions, including product development, formulation expertise, and sustainable packaging options. In addition, the rise of e-commerce and social media has accelerated the need for rapid product launches and smaller batch sizes, further fueling the demand for contract manufacturing services.

One significant restraint in the market is the regulatory complexity associated with product formulation and labeling. Navigating various regulations across different regions can pose challenges for both manufacturers and brands, leading to potential delays in product launches and increased costs. Furthermore, maintaining compliance with evolving safety standards and ingredient transparency demands can strain resources, particularly for smaller manufacturers lacking the necessary infrastructure or expertise.

The increasing trend toward sustainability and eco-friendly products presents a substantial opportunity for market growth. As consumers become more environmentally conscious, there is a rising demand for manufacturers who can offer sustainable sourcing, biodegradable packaging, and cruelty-free formulations. By embracing innovative production techniques and sustainable practices, contract manufacturers can differentiate themselves in the market and attract brands looking to align with consumer values, thereby driving further growth and collaboration.

Service Insights

“The demand for the manufacturing service segment is expected to grow at a significant CAGR of 5.7% from 2025 to 2030 in terms of revenue.”

Manufacturing dominated the market, accounting for a revenue share of 88.6% in 2024, and is expected to register the fastest CAGR during the forecast period. Manufacturing refers to third-party production of personal care products outsourced by OEMs such as P&G, Unilever, or any other company to the contract manufacturer. It also refers to products manufactured by the contractor under the label or brand of another firm.

The market is witnessing a shift toward clean and sustainable beauty, with personal care contract manufacturers incorporating eco-friendly practices, cruelty-free testing, and green packaging solutions. Furthermore, brands and consumers are increasingly seeking personalized products. Personal care contract manufacturers are adapting to this trend by offering customizable formulations and bespoke packaging. These aforementioned factors are anticipated to augment the demand for the manufacturing service segment in the coming years.

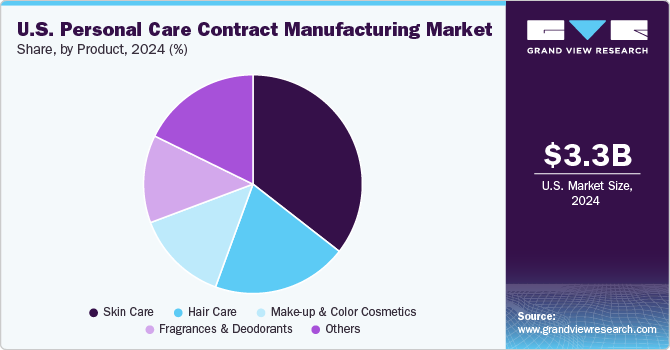

Product Insights

“The demand for the skin care product segment is expected to grow at a significant CAGR of 5.7% from 2025 to 2030 in terms of revenue.”

The skin care product segment dominated the market and accounted for a revenue share of 35.5% in 2024. Personal care contract manufacturers specializing in skin care products are crucial in developing a wide range of products designed to enhance and maintain skin health. These include various formulations, including cleansers, moisturizers, serums, masks, and specialized treatment products. For instance, McBride is a private label and contract manufacturer of personal care and household products. It provides a variety of skincare products, including body lotions, creams, and facial skincare solutions.

Hair care is a significant segment of the U.S. personal care contract manufacturing market as it encompasses a variety of products designed to address consumers' diverse requirements in terms of hair health, styling, and maintenance. For instance, KIK Custom Products is a contract manufacturer that offers a variety of personal care and hair care products. It works with different brands to formulate and create hair coloring products, including traditional hair dyes and specialty color treatment products.

Key U.S. Personal Care Contract Manufacturing Company Insights

Some of the key players operating in the U.S. personal care contract manufacturing market are Intercos S.p.A., 220 Laboratories, Verla International Ltd., Eco Lips, Inc., and Accupack Midwest, Inc.

-

Intercos S.p.A., was established in 1972 and is headquartered in Italy. The company manufactures and supplies cosmetic products across the globe. The company is involved in the research, development, manufacturing, and marketing of cosmetics for well-known brands in the industry. The company’s product category includes makeup, skincare, and personal care products. The company specializes in color cosmetics, skincare, personal care products, nail polish, and pencils. The company has 16 commercial offices and 16 production facilities located in Europe, North America, South America, and Asia. Due to these factors, the company is dominating the market.

-

220 Laboratories was established in 1991 and is headquartered in California, U.S. The company manufactures uniquely formulated skin, hair, and body products. It also manufactures specialty liquid products and aerosols used in the personal care industry. The company offers skincare, cosmetics, and hair products with the help of in-house microbiologists, chemists, and custom formulations that enable clients to meet the customer’s demands.

Biogenesis, C-Care, Fareva, Bright International, and NuWorld are some of the emerging market participants in the U.S. personal care contract manufacturing industry.

-

Biogenesis was established in 1997 and is headquartered in Paterson, U.S. The company is an FDA-registered contract manufacturer of OTC (over-the-counter) preparations, skincare, and color cosmetics products. Its core capability is in skincare, specializing in products such as body care, anti-aging face care, color, acne, SPF products, beauty cosmetics, and body care. The company also offers complete procurement of raw materials and manufacturing and filling services by utilizing recent technology in its state-of-the-art laboratories. The company also provides flexible solutions for a speedy route to market for a significant range of products, including powders, creams, liquids, ointments, and gels. As the company has a high product mix with close product consistency, the company is considered an emergent player.

-

C-Care was established in 1995 and is headquartered in Maryland, U.S. The company is a CAG Holding company. It manufactures and customizes skin care, hair care, hair color, personal care products, and OTC products. The company has an in-house R&D lab, manufacturing plant, quality control testing lab for filling, bulk and ingredient storage, compounding, customer service, warehouse & logistics, to name a few of the company's services. It is a registered cGMP and FDA site. The company is one of the few contract manufacturers certified by the USDA's National Organic Program to create organic products. The business is ISO 22716-accredited and Ecovadis Platinum-rated. Due to these reasons, the company is considered an emerging player in the market.

Key U.S. Personal Care Contract Manufacturing Companies:

- NuWorld

- Biogenesis

- Bright International

- Fareva

- Intercos S.p.A.

- 220 Laboratories

- C-Care

- Accupack Midwest, Inc.

- Eco Lips, Inc.

- Verla International, Ltd

Recent Developments

-

In August 2023, Eco Lips broadened its range of organic lip care products by introducing the first-ever OTC-certified organic medicated lip balm. This innovative product provides soothing relief and protection for painful fever, blisters, and cold sores. The inclusion strengthens confidence in Eco Lip's offerings and addresses consumer demand in this category.

U.S. Personal Care Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.57 billion

Revenue forecast in 2030

USD 5.22 billion

Growth rate

CAGR of 7.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, product

Key companies profiled

NuWorld; Biogenesis; Bright International; Fareva; Intercos S.p.A.; 220 Laboratories; C-Care; Accupack Midwest, Inc.; Eco Lips, Inc.; Verla International, Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Personal Care Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. personal care contract manufacturing market based on product, and service:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Skin Care

-

Hair Care

-

Make-up & Color Cosmetics

-

Fragrances & deodorants

-

Others

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

Custom Formulation and R&D

-

Packaging

-

Frequently Asked Questions About This Report

b. The U.S. personal care contract manufacturing market size was estimated at USD 3.33 billion in 2024 and is expected to reach USD 3.57 billion in 2025.

b. The U.S. personal care contract manufacturing market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.9% from 2025 to 2030 to reach USD 5.22 billion by 2030.

b. The skin care product segment dominated the market and accounted for a revenue share of 35.5% in 2024. Personal care contract manufacturers that specialize in skin care products play a crucial role in developing a wide range of products designed to enhance and maintain skin health. These include various formulations, including cleansers, moisturizers, serums, masks, and specialized treatment products.

b. Some of the key players operating in the U.S. personal care contract manufacturing market include NuWorld; Biogenesi; Bright International; Fareva; Intercos S.p.A.; 220 Laboratories; C-Care; Accupack Midwest, Inc.; Eco Lips, Inc.; Verla International, Ltd, among others.

b. Increasing demand for advanced beauty treatments and skin care products is driving the market. In addition, with major personal care companies channeling resources toward R&D and marketing initiatives, the outsourcing of production tasks such as manufacturing and packaging through contract manufacturers is expected to rise over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.