- Home

- »

- Medical Devices

- »

-

U.S. Pharmaceutical Analytical Testing Outsourcing Market, Report, 2030GVR Report cover

![U.S. Pharmaceutical Analytical Testing Outsourcing Market Size, Share & Trends Report]()

U.S. Pharmaceutical Analytical Testing Outsourcing Market (2025 - 2030) Size, Share & Trends Analysis Report By Services, By End Use (Pharmaceutical Companies, Biopharmaceutical Companies, Contract Research Organizations), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-189-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

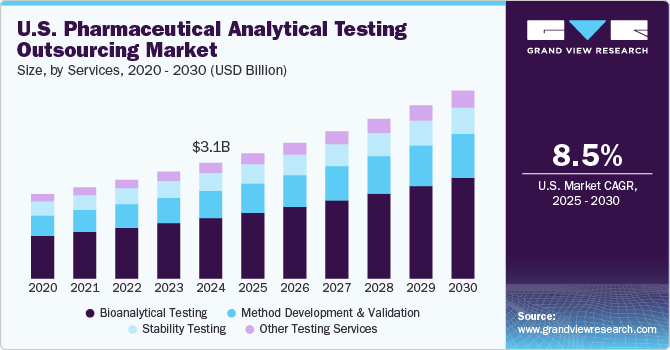

The U.S. pharmaceutical analytical testing outsourcing market size was estimated at USD 3.13 billion in 2024 and is projected to grow at a CAGR of 8.5% from 2025 to 2030. Innovation in the pharmaceutical industry, increasing focus on regulation, safety & quality, rising number of end users, and pricing benefits of outsourcing are key drivers for the lucrative growth. The demand for testing services is directly correlated with innovation or new product development. Furthermore, companies prefer to outsource their testing needs due to pressure from the competition, concerns about pricing, and long lead times to market.

Technology advancements and a growing shift towards personalized care are shortening the product lifecycle, and leading to the innovation of new products. Present demand for particular tests is rising due to the development of biosimilars, combination products, and other novel medicines. Additionally, businesses that diversify their operations in a new location must adhere to local standards, which might necessitate conducting tests unique to that area.

Furthermore, the increasing demand for therapeutics and various vaccines is expected to increase the demand for sustained capabilities in many laboratories to carry out the necessary bioanalytical assays, protocols, and techniques developed during this period. This is anticipated to improve drug development and other related capabilities of these labs in case of future pandemics and all new & existing diseases.

The extractable and leachable services segment is expected to witness aggressive competition over the forecast period, owing to an increase in the number of vendors offering these services at competitive prices. These studies are conducted to comprehend the potential for impurities in formulation to escape after packaging, which will aid in creating the best drug delivery system with the most significant therapeutic impact. For instance, if a product is being investigated for a parenteral route of administration, scientists must conduct the leaching test for the glass vials and ampoules to determine whether any toxicities may arise in the final formulation. Popular categories for services are those based on products. Vendors currently provide the following services:

-

Lyophilized product

-

Nasal sprays

-

Injectables (vials and bags)

-

Packaging components such as tubes, foils, gaskets, etc.

Pharmaceutical industry players frequently shortlist and choose analytical testing companies based on their service offerings, price, domain expertise, and past performance. However, finding prospects and closing deals is challenging for new market entrants. As a result, new businesses are forced to offer their services for less money, which lowers their profit margins and increases their financial burden.

Furthermore, performance is crucial when pharmaceutical companies emphasize outsourcing product testing. Failure to achieve the desired performance levels may result in future disagreements, which would restrict the growth of the U.S. pharmaceutical analytical testing outsourcing market in the forthcoming years.

Services Insights

On the basis of service segment, the market is segmented into bioanalytical testing, method development and validation, stability testing, and other testing services. The bioanalytical testing outsourcing services segment is further sub-segmented to clinical and non-clinical. Similarly, the method development and validation services are segmented to extractable and leachable, impurity method, technical consulting, and other method validation services. In addition, the stability testing services segment is sub-segmented to drug substance, stability indicating method validation, accelerated stability testing, photostability testing, and other stability testing methods.

In 2024, the bioanalytical testing segment dominated the market, accounting for a revenue share of 52.2%. This growth can be attributed to the growing R&D spending by players in the biopharmaceutical industry and a preference for outsourcing analytical testing. The segment for bioanalytical testing has expanded due to the rising number of clinical trial registrations and the entry of new players into the market over the past decades. In bioanalytical testing, drugs, formulations, or active ingredients are analyzed inside biological systems such as blood, urine, serum, and tissue. The segment can be broadly divided into clinical and non-clinical bioanalytical testing and is expected to experience profitable growth during the forecast period. Furthermore, due to strict regulatory frameworks surrounding the process of drug discovery and development and the rising number of clinical trials, bioanalytical testing is anticipated to drive the segment. For instance, in August 2024, SGS introduced its new specialized bioanalytical testing services in Hudson, New Hampshire, North America. Through these services, the company provides advanced bioanalytical services to both biopharmaceutical and pharmaceutical companies.

The method development and validation segment is expected to register the highest CAGR of 8.42% over the forecast period. The robust demand for drug products and growing focus on the quality, safety, and efficacy of pharmaceutical products in drug development are anticipated to drive the segment's growth. Besides, the method validation process demonstrates that an analytical method is suitable for its intended use and is capable of producing reliable & consistent results over time. The validation process involves procedures & tests designed to evaluate the performance characteristics of the method. Such factors are anticipated to drive the segment.

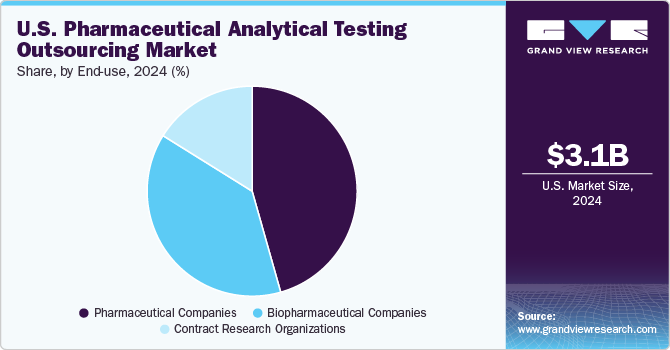

End Use Insights

In 2024, the pharmaceutical companies segment dominated the market, accounting for a revenue share of 45.6%. This growth is fueled by several factors, including increased product development activities, rising corporate R&D spending, and the need to create novel therapies. For instance, in August 2023, Pace Analytical Services announced the acquisition of Alpha Analytical, adding new capabilities such as advanced hydrocarbon analytical support and expanded sediment & tissue testing. Due to the acquisition, the company can help an increasing number of clients who need assistance during the testing process. Such developments would increase the demand in the market.

The biopharmaceutical companies segment is expected to register the highest CAGR of 8.8% over the forecast period. The key factors contributing to market growth are the increasing number of clinical trial registrations and new entrants in the market over the past ten years. The International Council for Harmonization (ICH) Q3D elemental impurities guideline and ICH M7 guideline implementation is among the new regulatory requirements. This regulatory guideline offers a useful categorization, qualification, and identification framework. Thus, pharma companies can enhance the drug development process to these changes in regulatory requirements.

Key U.S. Pharmaceutical Analytical Testing Outsourcing Company Insights

The key players operating across the U.S. market are adopting in-organic strategic initiatives such as service launches, mergers & acquisitions, expansions, partnerships & agreements, and others to increase market presence & and revenue, gain a competitive edge, and drive market growth. Hence, growing strategic initiatives are anticipated to boost the market share of prominent players operating across the market. For instance, in September 2024, Scorpius Holdings, Inc. mentioned the contract to offer bioanalytical services for a clinical-stage immuno-oncology company. This collaboration will allow the company to expand its services, including additional analytical work & future GMP manufacturing after completing the initial phase

Key U.S. Pharmaceutical Analytical Testing Outsourcing Companies:

- West Pharmaceutical Services, Inc.

- SGS SA

- Eurofins Scientific

- Pace Analytical Services Llc

- Intertek Group Plc

- Pharmaceutical Product Development, LLC.

- Wuxi AppTec, Inc.

- Boston Analytical

- Charles River Laboratories

Recent Developments

-

In March 2024, Pace Analytical Services announced the acquisition of Lebanon, a New Jersey laboratory facility from Curia. The acquisition aimed to support emerging drug development partners by providing rapid and expert development and commercial analytical laboratory services across the biopharma industry.

-

In January 2024, Kindeva Drug Delivery expanded its analytical services, with the launch of a business unit offering integrated & stand-alone analytical support to the wider pharmaceutical industry.

U.S. Pharmaceutical Analytical Testing Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.39 billion

Revenue forecast in 2030

USD 5.09 billion

Growth rate

CAGR of 8.5% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, end use

Regional scope

U.S.

Key companies profiled

West Pharmaceutical Services, Inc.; SGS SA; Eurofins Scientific; Pace Analytical Services LLC; Intertek Group Plc; Pharmaceutical Product Development, LLC.; Wuxi AppTec, Inc.; Boston Analytical; and Charles River Laboratories among others

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pharmaceutical Analytical Testing Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. pharmaceutical analytical testing outsourcing market report based on services and end use.

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Bioanalytical Testing

-

Clinical

-

Non- Clinical

-

-

Method Development and Validation

-

Extractable and Leachable

-

Impurity Method

-

Technical Consulting

-

Other Method Validation Services

-

-

Stability Testing

-

Drug Substance

-

Stability Indicating Method Validation

-

Accelerated Stability Testing

-

Photostability Testing

-

Other Stability Testing Methods

-

-

Other Testing Services

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Biopharmaceutical Companies

-

Contract Research Organizations

-

Frequently Asked Questions About This Report

b. The U.S. pharmaceutical analytical testing outsourcing market size was valued at USD 3.13 billion in 2024 and is expected to reach USD 3.39 billion in 2025

b. The U.S. pharmaceutical analytical testing outsourcing market is expected to grow at a compound annual growth rate of 8.5% from 2025 to 2030 to reach USD 5.09 billion by 2030.

b. Bioanalytical testing dominated the U.S. pharmaceutical analytical testing outsourcing market with a share of 52.25% in 2024. This is attributable to the increasing preference for outsourcing analytical testing and growing R&D expenditure by biopharmaceutical industry players.

b. Some key players operating in the U.S. pharmaceutical analytical testing outsourcing market include West Pharmaceutical Services, Inc.; SGS SA; Eurofins Scientific; Pace Analytical Services LLC; Intertek Group Plc; Pharmaceutical Product Development, LLC.; Wuxi AppTec, Inc.; Boston Analytical; and Charles River Laboratories among others

b. Key factors that are driving the U.S. pharmaceutical analytical testing outsourcing market growth include innovation in the healthcare industry, a growing number of end-users, and increasing focus on regulation, safety & quality resulting in growing demand for bioanalytical testing services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.