- Home

- »

- Medical Devices

- »

-

U.S. Pharmaceutical Contract Development & Manufacturing Organization Market, 2033GVR Report cover

![U.S. Pharmaceutical Contract Development & Manufacturing Organization Market Size, Share & Trends Report]()

U.S. Pharmaceutical Contract Development & Manufacturing Organization Market (2025 - 2033) Size, Share & Trends Analysis Report By Type, By Product, By Services, By Workflow, By Therapeutic Area, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-754-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Pharmaceutical Contract Development & Manufacturing Organization Market Summary

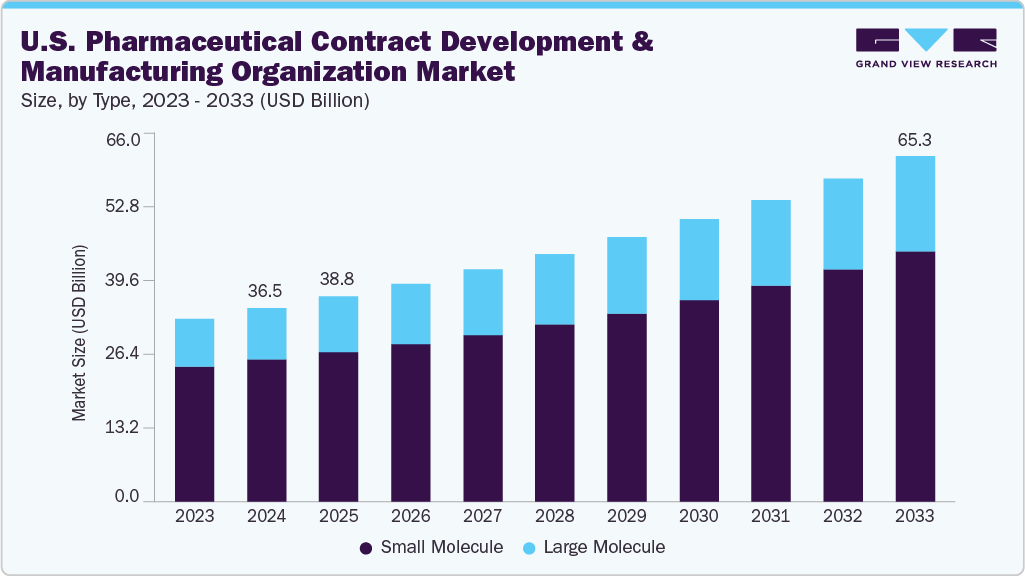

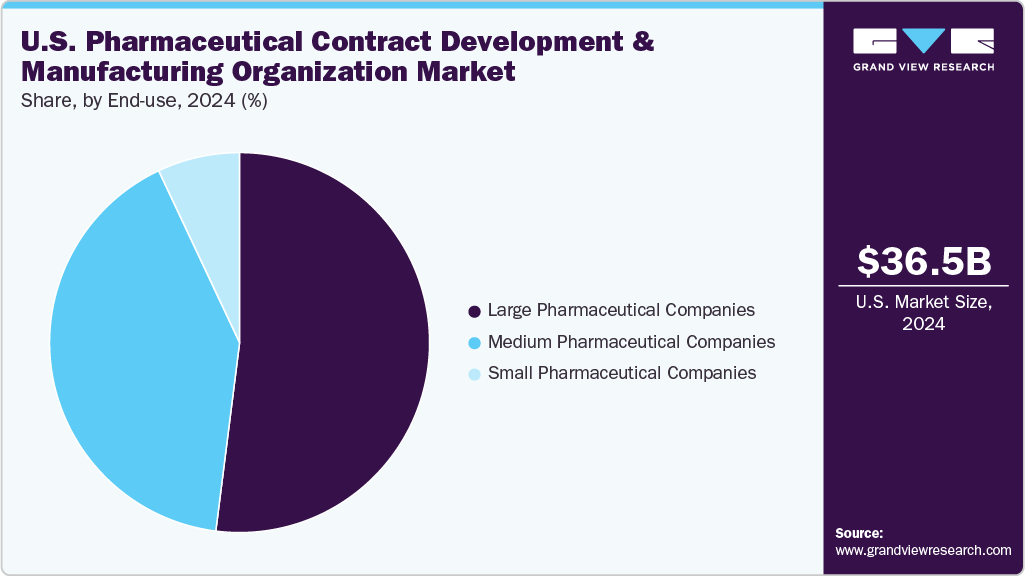

The U.S. pharmaceutical contract development and manufacturing organization market size was estimated at USD 36.5 billion in 2024 and is projected to reach USD 65.3 billion by 2033, growing at a CAGR of 6.74% from 2025 to 2033. The U.S. pharmaceutical contract development & manufacturing organization (CDMO) is advancing, driven by the growth of biologics, biosimilars, and advanced therapies, rising demand for outsourcing in drug development, and increasing clinical trial activity and pipeline expansion.

Key Market Trends & Insights

- The pharmaceutical contract development and manufacturing organization market in the U.S. is expected to grow significantly over the forecast period.

- By type, the small molecule segment led the market with the largest revenue share of 73.47% in 2024.

- By product, the API segment led the market with the largest revenue share in 2024.

- By service, the contract manufacturing segment led the market with the largest revenue share in 2024.

- Based on workflow, the commercial segment held the highest market share in 2024.

- Based on therapeutic area, the oncology segment held the highest market share in 2024.

- Based on end-use, the large pharmaceutical companies segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 36.5 Billion

- 2033 Projected Market Size: USD 65.3 Billion

- CAGR (2025-2033): 6.74%

The U.S. market is witnessing significant growth in biologics, biosimilars, and advanced cell and gene therapies, fueling demand for specialized CDMO services. Developing and manufacturing these therapies requires advanced capabilities like single-use bioprocessing systems, viral vector production, and personalized medicine expertise, which many pharma companies lack in-house.CDMOs provide infrastructure, regulatory knowledge, and innovation platforms to accelerate development while meeting FDA standards. With rising approvals of biologics and biosimilars in the U.S., CDMOs are becoming indispensable partners in scaling production, ensuring supply chain resilience, and enabling faster time-to-market for complex, high-value therapeutics.

Furthermore, established firms' strategic measures are expected to hasten market expansion. For example, Lonza and HaemaLogiX worked together in January 2022 to develop the monoclonal antibody KappaMab, which targets myeloma. Likewise, Innovent Biologics, Inc. extended its licensing agreement with Synaffix B.V., a Lonza subsidiary, in December 2023 to promote clinical-stage antibody-drug conjugate (ADC) technologies with enhanced therapeutic indices. These partnerships in the biopharmaceutical industry highlight the increasing dependence on contract development and manufacturing services, bolstering innovation channels, and propelling the pharmaceutical CDMO market's expansion over the projected period.

Sr No.

Drug Name

Active Ingredient(s)

Approval Date

FDA-Approved Use on Approval Date

1

Alhemo

concizumab-mtci

12/20/2024

For routine prophylaxis to prevent bleeding episodes in hemophilia A and B

2

Alyftrek

vanzacaftor, tezacaftor, and deutivacaftor

12/20/2024

For the treatment of cystic fibrosis (CF) in patients 6 years of age and older

3

Tryngolza

olezarsen

12/19/2024

To treat familial chylomicronemia syndrome

4

Ensacove

ensartinib

12/18/2024

To treat non-small cell lung cancer

5

Crenessity

crinecerfont

12/13/2024

To treat classic congenital adrenal hyperplasia

6

Unloxcyt

cosibelimab-ipdl

12/13/2024

To treat cutaneous squamous cell carcinoma

7

Bizengri

zenocutuzumab-zbco

12/4/2024

To treat non-small cell lung cancer and pancreatic adenocarcinoma

8

Iomervu

iomeprol

11/27/2024

For use as a radiographic contrast agent

9

Rapiblyk

landiolol

11/22/2024

To treat supraventricular tachycardia

Source: US Food and Drug Administration’s (FDA) Center for Drug Evaluation and Research (CDER), Grand View Research

In addition, to cut expenses, shorten turnaround times, and concentrate on core skills like research and development and marketing, pharmaceutical corporations in the United States are increasingly contracting with CDMOs to handle drug development and manufacture. Small and mid-sized biotech companies, which make up the majority of the U.S. innovation scene, can obtain specialized knowledge, innovative technologies, and regulatory support through outsourcing without making significant infrastructure investments. CDMOs are essential partners in the changing pharmaceutical value chain because they provide flexible capacity, scalability, and compliance with strict FDA standards. As biologics, cell and gene therapies, and specialty medication formulations become more sophisticated, this trend is anticipated to pick up speed.

U.S. leads globally in clinical research, with thousands of active clinical trials supported by a robust biotech and pharmaceutical ecosystem. The growing number of innovative drugs in the pipeline, particularly in oncology, rare diseases, and immunotherapies, drives demand for CDMO services across preclinical, clinical, and commercial stages. CDMOs provide essential expertise in formulation development, manufacturing clinical trial material, analytical testing, and regulatory submissions. As small biotech firms dominate innovation but lack in-house production facilities, they increasingly rely on CDMOs to accelerate time-to-market, reduce risks, and ensure compliance with evolving FDA guidelines, reinforcing their critical role in the pharmaceutical landscape.

Opportunity Analysis

The U.S. pharmaceutical CDMO market presents significant opportunities driven by the increasing complexity of drug development and the rising demand for outsourcing to reduce costs and accelerate timelines. Growth in biologics, cell and gene therapies, and highly potent APIs creates strong prospects for specialized CDMOs offering advanced manufacturing capabilities. Strategic partnerships, investments in continuous manufacturing, and the adoption of digital technologies further strengthen expansion opportunities. In addition, a strong regulatory framework and increasing demand for personalized medicine position U.S. CDMOs to capture global clients seeking innovation, reliability, and scalability, thereby fostering long-term growth across the pharmaceutical outsourcing ecosystem.

Impact of U.S. Tariffs on the Pharmaceutical Contract Development and Manufacturing Organization Market

The pharmaceutical contract development and manufacturing organization industry has seen changes and problems due to U.S. tariffs. Due to rising production costs brought on by tariffs on foreign-sourced raw materials, intermediates, and active pharmaceutical ingredients, CDMOs are under pressure to review their vendor relationships and supply chains. There is now more emphasis on regional manufacturing and domestic sourcing to reduce risks, albeit at higher upfront costs. Tariffs may promote domestic investment and lessen reliance on foreign suppliers, but they also restrict flexibility for CDMOs that depend on international networks, which could impact project delivery schedules, margins, and competitiveness in the US market.

Market Concentration & Characteristics

The U.S. pharmaceutical contract development and manufacturing organization industry growth stage is moderate, and growth is accelerating. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, service expansion, and regional expansion.

The U.S. pharmaceutical CDMO market is structured by continuous innovation in biologics, cell and gene therapies, and advanced drug delivery systems. Adoption of AI, automation, and continuous manufacturing boosts efficiency and quality. For instance, in April 2025, Regeneron expands U.S. biologics manufacturing with FUJIFILM Diosynth, investing over USD 3 billion to double capacity and drive innovation.

Mergers and acquisitions remain high in the U.S. CDMO market, driven by the need to expand biologics capacity, advanced technologies, and geographic reach. For instance, in August 2025, ESTEVE acquired Regis Technologies, expanding U.S. CDMO presence and strengthening small-molecule API development and manufacturing capabilities across global facilities. Strategic deals allow CDMOs to integrate end-to-end services, enhance supply chain resilience, and broaden expertise.

The U.S.'s changing regulatory landscape and stringent FDA regulations greatly impact CDMO operations. Although compliance guarantees product efficacy, safety, and market acceptance, it also lengthens turnaround times and increases operating expenses. While smaller businesses could find it difficult to meet strict criteria, CDMOs with strong regulatory knowledge gain a competitive edge by helping sponsors navigate complicated approval processes.

Service expansion in the U.S. CDMO market is driven by demand for integrated offerings covering preclinical development, clinical trials, commercial-scale production, and packaging. CDMOs are increasingly offering customized formulations, high-potency APIs, and biologics production. In long-term pharmaceutical pipelines, increasing capabilities guarantees client retention, lessens outsourced fragmentation, and establishes CDMOs as strategic partners rather than transactional vendors.

End-user concentration affects U.S. CDMOs because large pharmaceutical companies dominate contract quantities while biotech startups generate demand driven by innovation. A strong reliance on a small number of large clients ensures consistent, high-value projects, despite raising revenue risks. Since diversifying clients among small biotechs and mid-sized pharmaceutical businesses enhances stability, CDMO success depends on flexibility, scalability, and tailored services.

Type Insights

On the basis of type, in 2024, the small molecules segment held the largest revenue share of 73.47% and is also the fastest-growing segment over the forecast period. The market is driven by high demand for generic drugs, oral solid dosages, and active pharmaceutical ingredients (APIs). Pharmaceutical businesses are drawn to contract development and manufacturing services for small molecules because they provide streamlined production, cost-effective solutions, and assistance with regulatory compliance. The segment benefits from extensive outsourcing trends, patent expirations, and rising R&D in specialty and generic small-molecule drugs. This segment is further strengthened by CDMOs' proficiency with complicated and high-potency formulations, which firmly establishes its dominance in revenue creation within the pharmaceutical contract development and manufacturing industry in the U.S.

The large molecules segment is advancing in the U.S. pharmaceutical CDMO market, driven by increasing demand for biologics, monoclonal antibodies, and complex protein-based therapies. The rising prevalence of chronic diseases, cancer, and autoimmune disorders fuels the need for innovative biologic treatments, prompting pharmaceutical companies to outsource development and manufacturing to specialized CDMOs. Advanced cell culture, purification, and formulation capabilities enable efficient production of high-value biologics while ensuring regulatory compliance and quality standards. Expanding investment in biopharmaceutical infrastructure, technological advancements, and expertise in handling large molecules further accelerates growth, positioning this segment as a key driver in the U.S. CDMO market.

Product Insights

Based on product segment, in 2024, active pharmaceutical ingredients (APIs) accounted for the largest revenue segment, driven by the growing demand for biologics and complicated compounds. Pharmaceutical companies are increasingly contracting with CDMOs to design and produce APIs to cut expenses, boost productivity, and guarantee regulatory compliance. The need for premium APIs is developing quickly because of the rising incidence of uncommon and chronic diseases. Advanced capabilities, including continuous processing, green chemical solutions, and high-potency API production, are offered by CDMOs. Outsourcing is also fueled by the FDA's strict requirements, which demand infrastructure and knowledge. Because of this high demand, APIs are the leading source of income in the U.S. CDMO market.

On the other hand, the drug product segment is projected to grow at a significant CAGR duringthe forecast period. The need for sterile injectables, biologics, and sophisticated formulations drives the segment. Pharmaceutical firms are increasingly contracting out the creation of new drugs to save costs, gain access to specialist knowledge, and maintain regulatory compliance. For instance, a strategic acquisition made by Simtra BioPharma Solutions in July 2025 to increase the United States' capacity for injectable medications, such as antibody-drug conjugates (ADCs). Simtra demonstrates the growing potential of the industry by establishing itself as the first CDMO in the United States to provide commercial-scale ADC medicinal product manufacturing. The need for outsourced drug product services is increasing because of rising innovation, the expansion of oncology pipelines, and domestic supply chain requirements.

Service Insights

Based on the service segment, contract manufacturing held the largest revenue segment in 2024, supported by strong demand for large-scale biologics and advanced drug production. Companies increasingly outsource to CDMOs to access specialized facilities, expertise, and cost-efficient scalability. In June 2025, developments, such as UCB's USD 5 billion investment in a U.S. biologics facility and its expansion of partnerships with CMOs, highlight the vital role contract manufacturing plays in supporting growth drivers and future pipelines. Contract manufacturing continues to be the backbone of the U.S. CDMO market's revenue leadership by enabling pharmaceutical firms to focus on innovation while ensuring reliable, high-quality output.

On the other hand, the contract development segment is projected to grow at a significant CAGR duringthe forecast period. The segment is driven by rising demand for advanced R&D, drug formulation, and specialized development capabilities. Pharmaceutical firms increasingly seek CDMO partnerships to accelerate pipelines and address complex therapies. Hikma Pharmaceuticals USA's USD 1 billion investment by 2030 to expand U.S. manufacturing and development capacity is a strong development. With over USD 4 billion invested in the past 15 years and proven FDA collaboration, Hikma demonstrates how contract development drives innovation, supports affordable access to medicines, and positions CDMOs as critical partners in shaping the U.S. pharmaceutical landscape.

Workflow Insights

Based on workflow segment, in 2024, the commercial segment represented the largest revenue contributor in the U.S. pharmaceutical CDMO market, fueled by the rising demand for large-scale manufacturing of biologics, generics, and specialty medicines. As pharmaceutical pipelines mature, CDMOs provide the expertise, compliance, and capacity needed to transition from clinical to full-scale production. This includes advanced biologics, oncology therapies, and complex injectables. The commercial stage generates consistent revenue streams through long-term supply agreements and scalability advantages. In addition, increasing FDA approvals and expanding biologics portfolios create opportunities for CDMOs to support lifecycle management and global supply continuity, making commercial manufacturing the dominant and most stable revenue segment.

On the other hand, the clinical segment is projected to grow at a significant CAGR duringthe forecast period. The segment is driven by rising demand for specialized manufacturing to support advanced therapies and complex trial requirements. Partnerships such as in September 2025, Hemogenyx Pharmaceuticals' collaboration with Made Scientific for CAR-T therapy HG-CT-1 highlight the growing reliance on CDMOs with expertise in cell and gene therapies, biologics, and oncology drugs. These partnerships accelerate Phase I and II trials, ensure regulatory compliance, and enable flexible manufacturing for smaller batch sizes. Increasing clinical trial activity, particularly in rare diseases and immunotherapies, combined with robust FDA approvals, positions the clinical segment as the most dynamic growth driver.

Therapeutic Area Insights

Based on the therapeutic area segment, in 2024, the oncology segment accounted for the largest revenue segment and fastest growing segment, driven by the growing global cancer burden, projected at 29 million cases by 2040 (Cancer Atlas), and 10 million deaths in 2020 (WHO). Rising demand for innovative oncology therapies-including targeted treatments, immunotherapies, and personalized medicines-fuels CDMO engagement. Increasing R&D investments, patent expirations, and the need for biologic innovations further boost growth. For instance, in January 2024, Theragent Inc secured U.S. FDA clearance of CellVax Therapeutics' IND for FK-PC101, a personalized prostate cancer immunotherapy, with Phase II patient recruitment starting in March 2024.

The growing incidence of autoimmune diseases and the need for novel treatments are driving the advancement of the autoimmune illness segment in the US pharmaceutical CDMO market. CDMOs increasingly focus on developing best-in-class products and supporting rare autoimmune disease treatments. To develop a treatment for myasthenia gravis, for instance, Recipharm teamed up with Ahead Therapeutics in September 2023. Recipharm provided experience in process and analytical development, GLP manufacture of lipid nanoparticles for API encapsulation, and scalable production for commercialization. Such initiatives underscore the critical role of CDMOs in accelerating autoimmune disease drug development and commercialization.

End Use Insights

Based on end use in 2024, large pharmaceutical companies accounted for the largest revenue segment in the U.S. pharmaceutical CDMO market due to their widespread outsourcing of drug development and manufacture to satisfy rising demand. These businesses use CDMOs for cost effectiveness, scalability, and specialist knowledge, especially in difficult small-molecule medicines, oncology, and biologics. Long-term agreements and strategic alliances guarantee CDMOs consistent revenue streams. Large pharmaceutical companies also invest in customized medicine and novel therapeutics, necessitating the enhanced manufacturing capabilities that CDMOs offer. The partnership makes faster time-to-market, regulatory compliance, and risk mitigation possible, firmly establishing this market segment as the main driver of revenue market growth.

Medium pharmaceutical companies segment will grow at the second-fastest CAGR in the U.S. pharmaceutical CDMO market due to increasing outsourcing needs and the need for flexible, cost-effective manufacturing solutions. Since these companies often lack in-house capabilities for large-scale drug development and production, CDMOs are essential partners for analytical services, process development, and commercial-scale manufacturing. By utilizing CDMOs' expertise, medium-sized pharmaceutical firms can reduce costs, accelerate timelines, and effectively bring innovative therapies to market. Collaborations, such as those involving complex biologics and specialty therapies, further reinforce this trend, highlighting the growing reliance of mid-sized pharma on contract development and manufacturing services.

Key U.S. Pharmaceutical Contract Development & Manufacturing Organization Company Insights

The key players operating across the market are adopting strategic initiatives such as service launches, mergers & acquisitions, partnerships & agreements, and expansions to gain a competitive edge. For instance, in June 2025, Agenus Inc. partners with Zydus Lifesciences, exchanging its U.S. biologics CMC facilities for USD 75M plus contingent payments. The collaboration establishes Zydus’ BioCDMO operations, with Agenus as its first customer, supporting global manufacturing, clinical development, and commercialization of botensilimab and balstilimab (BOT/BAL), unlocking asset value and regulatory readiness.

Key U.S. Pharmaceutical Contract Development And Manufacturing Organization Companies:

- Thermo Fisher Scientific, Inc

- Lonza

- Recipharm AB

- Catalent, Inc

- WuXi AppTec, Inc

- Samsung Biologics

- Piramal Pharma Solutions

- Siegfried Holding AG

- Corden Pharma International

- Cambrex Corporation

- Vetter Pharma

- Delpharm

- Jubilant Pharmova / HollisterStier

- Eurofins CDMO

- Almac Pharma Services

Recent Developments

-

In September 2025, Hemogenyx Pharmaceuticals partners with Made Scientific CDMO to advance HG-CT-1 CAR-T therapy for relapsed/refractory AML, leveraging GMP facilities in New Jersey to accelerate Phase I clinical trials and pediatric cohorts.

-

In June 2025, Hikma Pharmaceuticals USA announceda USD 1 billion investment by 2030 to expand U.S. manufacturing and R&D, enhancing domestic capabilities, producing over 12 billion doses annually, and supporting affordable access to essential medicines.

-

In June 2025, UCB plans a major U.S. investment in a biologics manufacturing facility, which will generate USD 5 billion in economic impact, expand its workforce, and strengthen CMO partnerships to support pipeline growth, innovation, and sustainable healthcare delivery.

U.S. Pharmaceutical Contract Development & Manufacturing Organization Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 38.8 billion

Revenue forecast in 2033

USD 65.3 billion

Growth rate

CAGR of 6.74% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, service, workflow, therapeutic area, end use

Key companies profiled

Thermo Fisher Scientific, Inc.; Lonza; Recipharm AB; Catalent, Inc.; WuXi AppTec, Inc.; Samsung Biologics; Piramal Pharma Solutions; Siegfried Holding AG; Corden Pharma International; Cambrex Corporation; Vetter Pharma; Delpharm; Jubilant Pharmova/HollisterStier; Eurofins CDMO; Almac Pharma Services

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pharmaceutical Contract Development & Manufacturing Organization Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. pharmaceutical CDMO market report based on type, product, service, workflow, therapeutic area, and end use:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Small Molecule

-

Branded

-

Generic

-

-

Large Molecule

-

Biologics

-

Biosimilar

-

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

API

-

Traditional Active Pharmaceutical Ingredient (Traditional API)

-

Highly Potent Active Pharmaceutical Ingredient (HP-API)

-

Biologics

-

Others

-

-

Drug Product

-

Oral solid dose

-

Semi-solid dose

-

Liquid dose

-

Others

-

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Contract Development

-

Pre-formulation & Formulation Development Services

-

Process Development & Optimization

-

Analytical Testing & Method Validation

-

Scale-up & Tech Transfer

-

-

Contract Manufacturing

-

API Manufacturing

-

Finished Drug Products Manufacturing

-

-

Packaging and Labelling

-

Regulatory Affairs

-

Others

-

-

Workflow Outlook (Revenue, USD Million, 2021 - 2033)

-

Clinical

-

Commercial

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Infectious Diseases

-

Neurological Disorders

-

Cardiovascular Disease

-

Metabolic Disorders

-

Autoimmune Diseases

-

Respiratory Diseases

-

Ophthalmology

-

Gastrointestinal Disorders

-

Orthopedic Diseases

-

Dental Diseases

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Small Pharmaceutical Companies

-

Medium Pharmaceutical Companies

-

Large Pharmaceutical Companies

-

Frequently Asked Questions About This Report

b. The U.S. pharmaceutical contract development and manufacturing organization market is expected to grow at a compound annual growth rate of 6.74% from 2025 to 2033 to reach USD 65.3 billion by 2033.

b. Small molecules dominated the U.S. pharmaceutical contract development and manufacturing organization market with a share of 73.47% in 2024. The market growth is attributed to high demand for generic drugs, oral solid dosages, and active pharmaceutical ingredients (APIs). Besides, extensive outsourcing trends, patent expirations, and rising R&D in specialty and generic small-molecule drugs further contribute to market growth.

b. Some key players operating in the U.S. pharmaceutical contract development and manufacturing organization market include Key companies profiled Thermo Fisher Scientific, Inc, Lonza, Recipharm AB, Catalent, Inc, WuXi AppTec, Inc, Samsung Biologics, Piramal Pharma Solutions, Siegfried Holding AG, Corden Pharma International, Cambrex Corporation, Vetter Pharma, Delpharm, Jubilant Pharmova / HollisterStier, Eurofins CDMO, and Almac Pharma Services among others.

b. The market growth is driven by growing requirements for biologics, biosimilars, and advanced therapies, rising demand for drug development, and increasing pipeline expansion, which further contribute to market growth.

b. The U.S. pharmaceutical contract development and manufacturing organization market size was estimated at USD 36.5 billion in 2024 and is expected to reach USD 38.8 billion in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.