- Home

- »

- Medical Devices

- »

-

U.S. Pharmaceutical Contract Manufacturing And Research Services Market, Industry Report, 2030GVR Report cover

![U.S. Pharmaceutical Contract Manufacturing And Research Services Market Size, Share & Trends Report]()

U.S. Pharmaceutical Contract Manufacturing And Research Services Market Size, Share & Trends Analysis Report By Service (Manufacturing, Drug Delivery Formulations, Finished Dose Formulations, Research), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-223-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

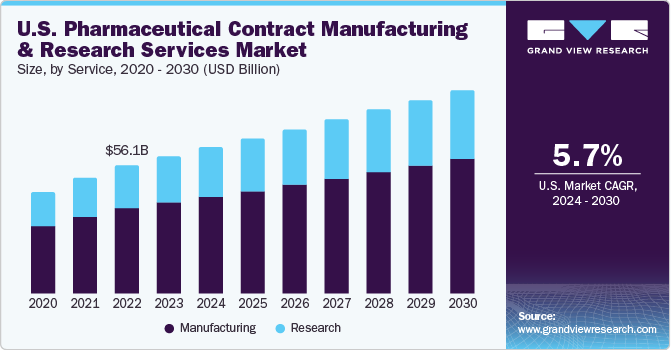

The U.S. pharmaceutical contract manufacturing and research services market size was estimated at USD 59.85 billion in 2023 and is expected to grow at a CAGR of 5.7% from 2024 to 2030. This growth is driven by the advantages of cost and time efficiency associated with outsourcing. Companies are consistently investing in facilities, workforce, and technology to secure a larger share of the outsourcing income. Presence of comprehensive service providers, who offer additional services as part of a unified or risk-sharing business model, is anticipated to stimulate market growth. However, initial impact of the COVID-19 pandemic disrupted the supply chain, potentially hindering market expansion.

The U.S. pharmaceutical contract manufacturing and research services market accounted for over 24.5% of the global pharmaceutical contract manufacturing and research services market in 2023. The anticipated growth of Contract Manufacturing Organizations (CMOs) is driven by their diverse product offerings, positioning them as a convenient "one-stop-shop”. Larger CMOs are shifting their focus towards specialized areas of pharmaceutical development and establishing regulatory pathways for the development of products based on transgenic methods. However, companies, due to precise needs, lean towards in-house production for complex and substantial components, potentially posing a challenge to the outsourcing market.

Companies involved in R&D and manufacturing of products related to healthcare, including those that supply hardware and services, are increasing their investments due to an increase in demand for quick development, testing, and deployment of COVID-19 vaccines. Pharmaceutical-related contract manufacturers have continued operating despite some minor disruptions, while there has been an increase in long-term capital-intensive mergers and acquisitions. In addition, governments are working together with pharmaceutical companies to produce vaccines against COVID-19 through initiatives like Operation Warp Speed, which is supported by funding from the US federal government.

The outbreak of COVID-19 has led to a surge in demand for treatments and vaccines due to widespread transmission of this virus. Consequently, numerous pharmaceutical companies have collaborated with Contract Manufacturing Organizations (CMOs) to accelerate drug production. For example, in December 2020, Recipharm, a Contract Development and Manufacturing Organization (CDMO), entered into a partnership with Moderna, a pharmaceutical company. Under this agreement, Recipharm facilitated the fill-finish process for Moderna's COVID-19 vaccine intended for distribution outside the U.S. In addition, various public institutions have allocated funding to bolster research efforts on COVID-19 vaccines.

Market Characteristics & Concentration

The market is characterized by a high level of competition and concentration. Companies are tactically concentrating on product launches, regional expansions, partnerships, collaborations, and takeovers to bolster their market standing. This strategy is in line with the country’s pattern in the pharmaceutical sector where businesses are increasingly outsourcing research and manufacturing tasks to expert organizations. The market is anticipated to witness substantial growth, driven by elements such as rising demand for specialty drugs, progress in cell and gene therapies, and demand for nuclear medicine sector.

The market is highly innovative and is influenced by a variety of elements. These encompass a growing focus on drug discovery and manufacturing outsourcing, robust investments in R&D, and technological progress in fields such as Active Pharmaceutical Ingredient (API) manufacturing, development, and manufacturing of finished dosage formulation (FDF), secondary packaging, among others. The market is also marked by intense competition among leading companies, resulting in ongoing enhancements in the processes and services provided.

The market has witnessed a consistent rise in mergers and acquisitions (M&A) activities since 2018. The period from 2018 to 2022 saw a substantial increase in merger and acquisition (M&A) deals involving contract manufacturing organizations (CMOs), with numerous CMOs incorporating specialized skills such as controlled substance and containment manufacture. For instance, in June 2021, Charles River Laboratories International, Inc acquired a gene therapy Contract Development and Manufacturing Organization (CDMO), Vigene Biosciences, Inc., to expand its capabilities in gene therapy.

Regulations play a significant role in shaping the landscape of this market. Presence of regulations, such as FD&C Act, which monitors and refrains any individual from introducing adulterated or misbranded drugs, is expected to positively influence the growth of this market in the coming years. The regulations related to the market are governed by FDA, Food, Drug, and Cosmetic Act (FD&C Act), Drug Enforcement Administration (DEA), and Occupational Safety and Health Administration (OSHA). These regulatory bodies set the standards and guidelines for contract manufacturers of pharmaceutical companies.

The market growth is driven by regional expansion and has led to a rise in the outsourcing of drug development and manufacturing processes. This change has brought about greater efficiency and cost reductions for pharmaceutical firms, enabling them to concentrate on their primary skills while still reaping the benefits of the advanced technologies and expertise provided by dedicated contract manufacturers. For instance, in August 2021, Lonza declared plans to set up a c-GMP mammalian facility in China, complete with an aseptic drug fill and finish production line. This move is expected to broaden the availability of clinical trials and commercial batches in China, which will, in turn, allow the company to increase its manufacturing units at a reduced cost.

Service Insights

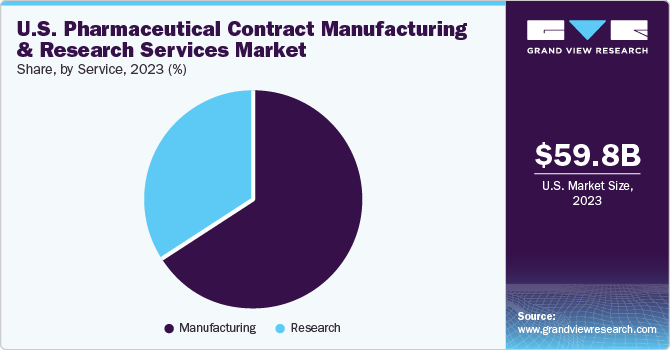

Manufacturing dominated the market and held the largest revenue share of over 66.3% in 2023, owing to a rising trend of companies choosing to outsource the production of drug substances, APIs, and completed drug products or clinical trial materials. Contract manufacturers offer a range of services to the pharmaceutical industry, such as safety evaluation, development of dosage and formulation, regulatory support, development of analytical assays, and conducting release and stability tests. These contract manufacturers are frequently selected as a temporary fix for limitations in production capacity.This sector is further divided into several sub-sectors, including manufacturing of API/bulk drugs, the creation of advanced drug delivery formulations, packaging, and production of finished dose formulations. Companies are actively involved in establishing large-scale manufacturing facilities, both at the pilot and commercial levels.

Research is anticipated to witness the fastest CAGR during the forecast period. The growth in this segment is driven by the presence of numerous multinational and established contract service providers, such as Charles River Laboratories, Pharmaceutical Product Development Inc. (PPD), Covance, and Quintiles. These market players are poised to gain from the increasing trend of outsourcing. The Contract Research Organization (CRO) sector has seen a surge in mergers and acquisitions, leading to heightened competition among CROs. This has spurred the CROs to enhance their capabilities to cater to the needs of drug developers. Services provided by CROs span from the inception of drug development to the final marketing approval. The segment is further divided into oncology, vaccines, inflammation & immunology, cardiology, neuroscience, and others.

Key U.S. Pharmaceutical Contract Manufacturing And Research Services Company Insights

Companies in the U.S. pharmaceutical contract manufacturing and research services market are focusing on strategies such as agreements, partnerships, collaborations, and acquisitions to fortify their market standing. For example, in January 2021, Boehringer Ingelheim initiated a collaboration and licensing agreement with Enara Bio to advance research in innovative targeted cancer immunotherapies, utilizing Enara Bio’s Dark Antigen discovery platform. Moreover, factors like escalating costs of drug development, high-priced raw materials, and intense industry competition have prompted numerous U.S.-based pharmaceutical firms to outsource substantial parts of the drug development process. In addition, the clientele of U.S.-based pharmaceutical contract manufacturing companies is both domestic and international, which further contributes to the market growth.

Key U.S. Pharmaceutical Contract Manufacturing And Research Services Companies:

- Catalent

- Pfizer (CentreOne)

- Charles River Laboratories International, Inc.

- Albany Molecular Research, Inc.

- Laboratory Corporation of America Holdings (LabCorp)

- IQVIA

- Baxter BioPharma Solutions

- Lingand Pharmaceuticals

- Thermo Fisher Scientific, Inc.

- AbbVie, Inc.

- West Pharmaceutical Services

Recent Developments

-

In January 2023, Pfizer, a leading pharmaceutical company, entered into an agreement to acquire Abzena's manufacturing site located in Sanford, North Carolina. Once finishing the construction, the cutting-edge facility will be equipped with comprehensive features to produce biologics drug substance. This will enhance Pfizer’s manufacturing capacity, thereby speeding up its innovative pipeline.

-

In April 2022, Catalent, Inc. acquired a facility from Vaccine Manufacturing and Innovation Centre UK Limited. The intention of this acquisition was to expand its manufacturing capabilities in producing biologics in the UK.

-

In March 2022, Albany Molecular Research, Inc. (CURIA) entered into a cooperative Agreement with biomedical Advanced Research and Development Authority (BARDA) to add a high-speed line to expand its sterile fill-finish capabilities.

-

In July 2021, Catalent, Inc. launched GPEx Lightning Cell Line Expression Technology to reduce the time for Drug Substance Development. This technology leverages company’s GPEx expression platform in the knock-out Chinese Hamster Ovary (CHO) cell line system, and Glutamine Synthase (GS). This technology includes novel gene insertion technology which shortens the drug development by up to three months.

U.S. Pharmaceutical Contract Manufacturing And Research Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 63.68 billion

Revenue forecast in 2030

USD 88.81 billion

Growth rate

CAGR of 5.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service

Country scope

U.S.

Key companies profiled

Catalent; Pfizer (CentreOne); Charles River Laboratories International, Inc.; Albany Molecular Research, Inc.; Laboratory Corporation of America Holdings (LabCorp); IQVIA; Baxter BioPharma Solutions; Lingand Pharmaceuticals; Thermo Fisher Scientific, Inc.; AbbVie, Inc.; West Pharmaceutical Services

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pharmaceutical Contract Manufacturing And Research Services Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. pharmaceutical contact manufacturing and research services market based on service:

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Manufacturing

-

API/Bulk Drugs

-

Advanced Drug Delivery Formulations Packaging

-

Packaging

-

Finished Dose Formulations

-

Solid Formulations

-

Liquid Formulations

- Semi-solid Formulations

-

-

-

Research

-

Oncology

-

Vaccines

-

Inflammation & Immunology

-

Cardiology

-

Neuroscience

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. pharmaceutical contract manufacturing and research services market size was estimated at USD 59.85 billion in 2023 and is expected to reach USD 63.68 billion in 2024.

b. The U.S. pharmaceutical contract manufacturing and research services market is expected to grow at a compound annual growth rate of 5.7% from 2024 to 2030 to reach USD 88.81 billion by 2030.

b. Manufacturing dominated the market and held the largest revenue share of over 66.3% in 2023, owing to a rising trend of companies choosing to outsource the production of drug substances, APIs, and completed drug products or clinical trial materials.

b. Some key players operating in the U.S. pharmaceutical contract manufacturing and research services market include

b. The market is propelled by the advantages of cost and time efficiency that come with the adoption of outsourcing. Market players are consistently investing in facilities, workforce, and technology to secure a larger portion of the outsourcing income.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."