U.S. Pharmaceutical Isolators Market Trends

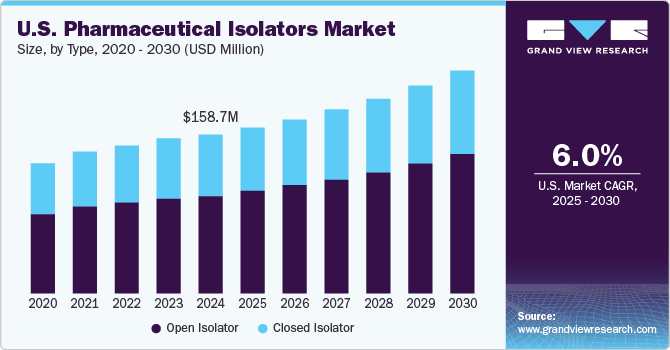

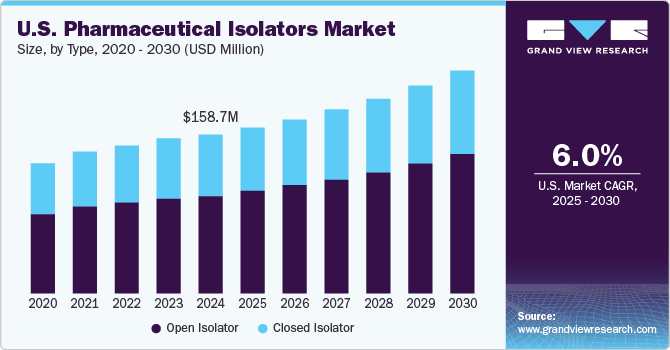

The U.S. pharmaceutical isolators market size was valued at USD 158.7 million in 2024 and is expected to grow at a CAGR of 6.0% from 2025 to 2030. The market growth can be attributed to the rapid expansion of the pharmaceutical industry, and advancements in technology are crucial as they enhance manufacturing processes. In addition, the COVID-19 pandemic has further accelerated demand for aseptic manufacturing, emphasizing the need for isolators to ensure safety and compliance. Furthermore, regulatory pressures and a focus on domestic production are prompting companies to invest in pharmaceutical isolators, fostering market growth through improved efficiency and reduced contamination risks.

Pharmaceutical isolators are specialized enclosures designed to create a controlled environment for safely handling and processing sensitive materials, particularly in the pharmaceutical sector. The demand for high sterility assurance combined with low operational costs is paramount, especially as manufacturers handle potent active pharmaceutical ingredients such as antibiotics and hormones. In addition, the bio-decontamination capabilities of these isolators, often achieved through automated hydrogen peroxide vaporization, enhance their appeal by ensuring consistent sterilization levels superior to traditional cleanrooms.

Furthermore, the increasing focus on worker safety and stringent regulatory requirements are compelling pharmaceutical companies to invest in isolators that mitigate contamination risks. The rise of biotechnology and biopharmaceutical sectors further fuels this demand, as these industries require advanced drug production and quality control solutions. Moreover, ongoing research and development efforts are leading to innovations in isolator technology, promoting efficiency and safety in drug manufacturing processes. As healthcare investments grow, the capability of pharmaceutical isolators to manage hazardous materials effectively becomes even more critical, reinforcing their necessity in maintaining product integrity and compliance with safety standards in the U.S.

Type Insights

The open isolators led the market and accounted for the largest revenue share of 61.9% in 2024. This growth can be attributed to their flexibility and ease of integration into existing processes. In addition, these systems facilitate aseptic compounding and sampling, making them ideal for small-batch manufacturing, which is increasingly in demand due to the rise of personalized medicine. Furthermore, the advantages of faster changeover times and reduced operational costs further enhance their appeal, leading to a growing preference among manufacturers seeking efficient and adaptable solutions.

Closed isolators are expected to grow at a CAGR of 5.7% from 2025 to 2030, owing to their superior sterility assurance and ability to safely handle potent active pharmaceutical ingredients. In addition, the stringent regulatory requirements for maintaining drug quality and preventing contamination are significant drivers for this segment. Furthermore, advancements in automation technology within closed isolators ensure consistent bio-decontamination processes, making them essential for high-stakes environments such as gene therapy production and other critical pharmaceutical applications.

Product Insights

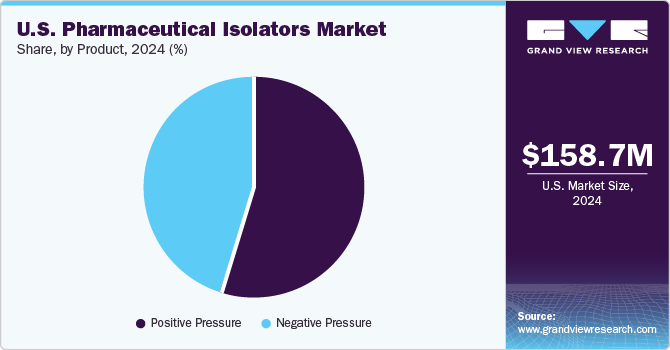

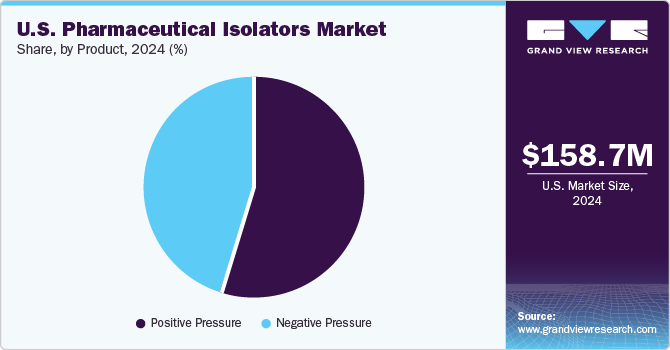

The positive pressure segment dominated the market and accounted for the largest revenue share of 54.6% in 2024, primarily driven by its ability to maintain a sterile environment, crucial for processes requiring high sterility assurance. These isolators are essential in preventing contamination during drug manufacturing, particularly for sensitive products. In addition, the increasing demand for aseptic processing, fueled by advancements in pharmaceutical technologies and the need for efficient production systems, further enhances the appeal of positive pressure isolators, making them a preferred choice for manufacturers focused on maintaining product integrity.

The negative pressure segment is expected to grow at a CAGR of 5.6% over the forecast period, owing to its role in protecting operators and the environment from hazardous substances. Furthermore, these isolators are vital for handling potent active pharmaceutical ingredients and volatile drugs, ensuring that any airborne contaminants are contained within the system. Moreover, as regulatory requirements become stricter regarding safety and contamination control, the demand for negative pressure isolators is expected to rise, driven by their effectiveness in maintaining safety standards in pharmaceutical manufacturing processes.

Key U.S. Pharmaceutical Isolators Company Insights

Key companies in the U.S. pharmaceutical isolators industry include LAF Technologies, Iso Tech Design, Nuaire, and others. These players are adopting various strategies to enhance their competitive edge. New product development is a primary focus, with firms investing in advanced isolator technologies to meet evolving regulatory standards and customer needs. In addition, strategic alliances are also crucial, enabling companies to leverage complementary expertise and resources for innovation. Furthermore, firms are engaging in market expansion initiatives, targeting emerging sectors within the pharmaceutical industry to capitalize on growth opportunities and strengthen their market presence.

-

LAF Technologies manufactures a range of isolators designed for aseptic processes, including laminar airflow systems and particle monitoring equipment. Operating primarily in the pharmaceutical and biotechnology sectors, the company emphasizes innovation and quality to meet stringent regulatory standards and cater to the needs of clients requiring safe and efficient production environments.

-

SKAN AG manufactures a variety of isolators tailored for applications such as aseptic filling and containment of hazardous materials. The company operates within the pharmaceutical, biotech, and healthcare industries, focusing on delivering high-quality solutions that enhance safety and compliance. Their products are integral to maintaining sterility and protecting both operators and products during critical manufacturing processes.

Key U.S. pharmaceutical isolators Companies:

- COMECER S.p.A.

- LAF Technologies

- Iso Tech Design

- Nuaire

- Getinge AB

- SKAN AG

- M. BRAUN INERTGAS-SYSTEME GMBH

- I.M.A. SpA

- AZBIL TELSTAR, S.L.U.

- Syntegon Technologies GmbH

Recent Developments

-

In May 2024, SKAN Group AG increased its stake in Aseptic Technologies to 90%. This acquisition of an additional 5% from Wallonie Entreprendre underscores the strategic importance of Aseptic Technologies, which specializes in automated solutions for filling closed vials. This move also boosts SKAN's indirect interest in Plast4Life to 22.05%, enhancing its commitment to innovative pharmaceutical isolators and services in the global market.

U.S. Pharmaceutical Isolators Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 166.0 million

|

|

Revenue forecast in 2030

|

USD 222.6 million

|

|

Growth rate

|

CAGR of 6.0% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, product

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

COMECER S.p.A.; LAF Technologies; Iso Tech Design; Nuaire; Getinge AB; SKAN AG; M. BRAUN INERTGAS-SYSTEME GMBH; I.M.A. SpA; AZBIL TELSTAR, S.L.U.; Syntegon Technologies GmbH.

|

|

Customization scope

|

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Pharmaceutical Isolators Market Report Segmentation

This report forecasts revenue growth at country level and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. pharmaceutical isolators market report based on type, and product:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Open Isolator

-

Closed Isolator

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Positive Pressure

-

Negative Pressure