- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Phosphate Conversion Coatings For Oil & Gas Market Report, 2027GVR Report cover

![U.S. Phosphate Conversion Coatings For Oil & Gas Market Size, Share & Trends Report]()

U.S. Phosphate Conversion Coatings For Oil & Gas Market Size, Share & Trends Analysis Report By Product (Manganese, Iron, Zinc), By Substrate (Cast Iron, Steel), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-413-0

- Number of Report Pages: 46

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Bulk Chemicals

Report Overview

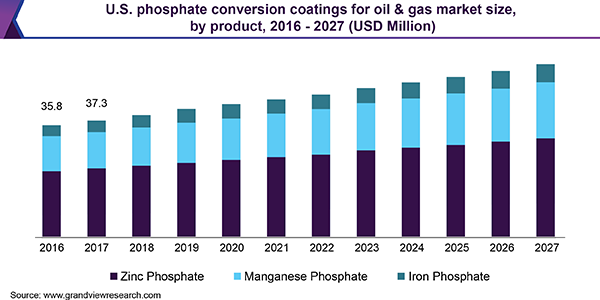

The U.S. phosphate conversion coatings for oil and gas market size was estimated at USD 40.8 million in 2019 and is expected to register a CAGR of 3.9% over the forecast period. Rising demand from oil and gas industry is potentially driving the market growth.

Phosphate conversion coatings are applied over various surfaces including cast iron, zinc, and aluminum to ensure protection from the external environment that could damage the function or integrity of an item or part. Rising penetration of the products derived from petroleum in day-to-day applications is anticipated to propel the need for more production of crude oil over the forecast period.

According to the U.S. Energy Information Administration (EIA) forecast, in 2020, the U.S. petroleum and other liquid fuel consumption is expected to reach 20.6 million barrels per day, which is 0.8% more than that in 2019.

The oil and gas industry is facing new challenges with its gradual expansion. Deeper offshore installations, complex refinery equipment processing, and more unconventional oil and gas transporting through pipelines are triggering more challenges related to corrosion. Thus, to control and prevent corrosion of the components in the underground pipelines, offshore rigs, and petrochemical equipment, the companies are focusing on the pre-surface treatment, such as conversion coatings. This is expected to positively impact market growth in the country in the coming years.

However, the recent consumer shift toward environment-friendly such as nano-ceramic conversion coatings is anticipated to hamper the overall market growth. These coatings are phosphorus-free and composed of dilute hexafluorozirconic acid, which acts as a basic ingredient substituting the conventional phosphate liquid. They provide both economic and ecological benefits and are shorter & simpler compared to iron or zinc phosphate processes. In addition, they perform extremely well on all substrates such as steel, zinc, and aluminum, which makes them a viable alternative to phosphate conversion coating.

Rising inclination of pre-treatment coating manufacturers toward eco-friendly and phosphorous-free conversion coatings, specifically in developed nations such as the U.S., owing to stringent regulations on toxic and heavy metals usage during the manufacturing process is anticipated to be a major restraint for the phosphate conversion coating market in the coming years. Moreover, various restrictions by National Emission Standards for radon emissions (a type of cancer-causing, radioactive gas) during the processing of phosphate ore to make phosphoric acid are expected to hinder the market growth over the forecast period.

Product Insights

Based on product, the U.S. phosphate conversion coatings for the oil and gas market is segmented into zinc, manganese, and iron. Zinc was the largest product segment occupying over 58.0% market share in 2019 followed by manganese. Zinc phosphate coatings are widely used owing to their long-lasting corrosion protection properties.

These coatings are highly suitable for the products that are exposed to hard weather conditions. Furthermore, the coatings can be used on a broad range of metallic surfaces including electro-galvanized steel, galvanized steel, zinc-alloy-coated steel, zinc, cadmium, aluminum, silver, and tin. In addition, zinc phosphate coatings are lighter than manganese phosphate conversion coatings, which gives them an advantage for the application on heavy equipment such as drilling pipes and motors.

Substrate Insights

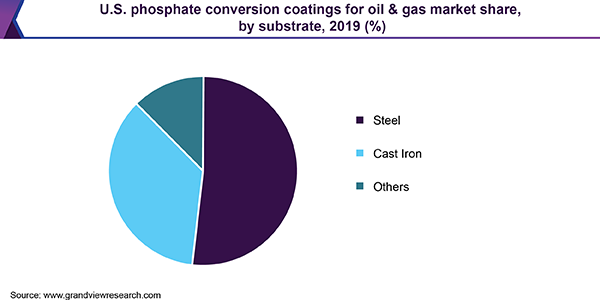

Major substrate segments are steel, cast iron, and others. Steel was the dominant substrate segment in 2019 and is anticipated to witness substantial growth over the forecast period owing to the surge in product application to promote adhesion of paints and prevent corrosion. It offers high durability, recyclability, and strength.

It has the capability to withstand its exposure to oils, fuels, bleach, sodium hydroxide, and sulfuric acid. Crude oil extracted from the ground consists of substances, such as hydrogen sulfide and sulfur, which induce corrosion in pipelines. Therefore, steel substrate is widely used in the manufacturing of pipelines, heavy equipment, and oil and gas wells. The surging demand for products that offer longer performance against corrosion protection in oil and gas industry is anticipated to boost the demand for steel substrate in the industry over the forecast period.

U.S. Phosphate Conversion Coatings For Oil & Gas Market Share Insights

The market is consolidated in nature with the presence of a limited number of key players such as PPG Industries, Inc.; The Sherwin Williams Company; Axalta Coating Systems; and BASF SE along with some small and medium regional players. The market players face intense competition from each other and from regional players, who have strong distribution networks and good knowledge about suppliers and regulations. Companies in the market compete on the basis of product quality offered and technology used for the production of phosphate conversion coatings.

Strategic partnerships, capacity expansions, and new product developments are popular strategies adopted by the majority of the players operating in the market. Major players are involved in the expansion of their manufacturing facilities, development of infrastructure, mergers and acquisitions, and seeking opportunities to vertically integrate across their value chain. In January 2018, BASF’s coatings division acquired Chemetall, a global supplier of surface treatment technologies. This acquisition will be integrating across the value chain of surface treatment products and assist BASF SE to strengthen its customer base in the coating market.

Report Scope

Attribute

Details

Base year for estimation

2019

Actual estimates/Historical data

2016 - 2018

Forecast period

2020 - 2027

Market representation

Revenue in USD Million & CAGR from 2020 to 2027

Country scope

The U.S.

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of the customization

Segments Covered in the ReportThis report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the U.S. phosphate conversion coatings for oil and gas market report on the basis of product and substrate:

-

Product Outlook (Revenue, USD Million, 2016 - 2027)

-

Zinc

-

Manganese

-

Iron

-

-

Substrate Outlook (Revenue, USD Million, 2016 - 2027)

-

Steel

-

Cast Iron

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. phosphate conversion coatings for oil and gas market size was estimated at USD 40.8 million in 2019 and is expected to reach USD 42.4 million in 2020.

b. The U.S. phosphate conversion coatings for oil and gas market is expected to grow at a compound annual growth rate of 3.9% from 2020 to 2027 to reach USD 55.3 million by 2027.

b. Steel dominated the U.S. phosphate conversion coatings for oil and gas market with a share of 51.61% in 2019. This is attributable to rising surge in product application to promote adhesion of paints and prevent corrosion.

b. Some key players operating in the U.S. phosphate conversion coatings for oil and gas market include PG Industries, Inc.; The Sherwin Williams Company; Axalta Coating Systems; and BASF SE.

b. Key factors that are driving the market growth include rising penetration of the products derived from petroleum in day-to-day usages, and its application to control and prevent corrosion of the components in the underground pipelines, offshore rigs, and petrochemical equipment.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."