- Home

- »

- Medical Devices

- »

-

U.S. Physician Groups’ Practice Management Systems Market, Industry Report, 2030GVR Report cover

![U.S. Physician Groups’ Practice Management Systems Market Size, Share & Trends Report]()

U.S. Physician Groups’ Practice Management Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Practice Type (Single Specialty Group, Multi-specialty Group), And Segment Forecasts

- Report ID: GVR-4-68040-217-2

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

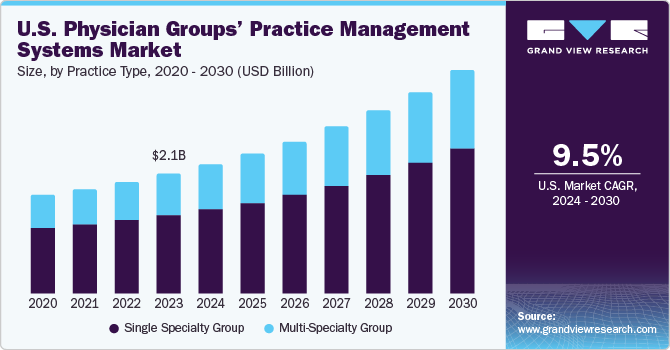

The U.S. physician groups’ practice management systems market size was estimated at USD 2.11 billion in 2023 and is expected to grow at a CAGR of 9.47% from 2024 to 2030. The major factor expected to drive the market growth is the rising adoption of practice management systems, driven by the growing demand for cost reduction in healthcare. In addition, government initiatives and the expanding integration of IT in the healthcare sector are anticipated to drive the market growth for practice management systems.

The rising trend of solo practitioners transitioning to larger physician groups is positively contributing to the U.S. physician groups’ practice management systems market growth. Cost-effectiveness is one of the main factors that increased the number of solo practitioners joining the larger physician group in the U.S. The implementation of the Health Information Technology for Economic and Clinical Health (HITECH) Act incentivizes EHR system adoption, which is expected to drive this trend.

Moreover, value-added services contribute to the adoption and utilization of Practice Management Systems (PMS) within physician groups’. PMS software helps streamline administrative tasks, such as appointment scheduling, billing, and Electronic Health Record (EHR) management. By integrating value-added services into PMS platforms, physician groups’ enhance the overall patient experience, optimize workflow efficiency, and improve practice profitability.

For instance, in December 2023, Veradigm LLC launched a conversational Artificial Intelligence (AI) agent for Practice Fusion Billing Services. The AI can help answer questions in a conversational format and simplify the billing process for independent healthcare providers. This enhancement optimizes financial management for healthcare providers and meets their needs.

Market Concentration & Characteristics

There is a growing number of mobile health applications that enable patients to track their health metrics, schedule appointments, and communicate with their healthcare providers more easily. For instance, in December 2021, OfficeAlly Inc. was acquired by Francisco Partners, an investment firm that specializes in partnering with technology businesses. This acquisition aimed to help capitalize on market growth and drive product innovation.

The market players are leveraging the strategies such as collaborations, partnerships, and acquisitions, to promote reach of their offerings and increase their product capabilities in the country. For instance, in January 2024, CareCloud, Inc. collaborated with Kovo HealthTech Corporation, a healthcare technology and billing-as-a-service company. This collaboration aims to empower healthcare providers with the latest technology and streamline their operations for improved patient care with advanced PM software, EHR solutions, and other solutions.

Physicians express dissatisfaction with payer prior authorization processes, prompting the government to propose new regulations for digitizing & streamlining the process, including API requirements. CMS's proposed rule aims to automate prior authorization via EHR or PM systems, with MIPS incorporating Electronic Prior Authorization measures by 2026, while ONC is set to release EHR certification updates, impacting both EHR vendors and providers upon finalization.

Market players leverage the strategy of product expansion to increase their product capabilities and promote the reach of their product offerings. For instance, in December 2023, Veradigm LLC launched a conversational AI agent for Practice Fusion Billing Services. The AI can help answer questions in a conversational format and simplify the billing process for independent healthcare providers. This enhancement aimed to optimize financial management for healthcare providers and meet their needs.

The level of geographical expansion is significant in the market as various government programs and initiatives. some prominent companies in the market are implementing various strategies, such as launching new products and geographical expansion to consolidate their market position across the country. For instance, in October 2023, Bone & Joint of Albany announced the adoption of Athenahealth, Inc.’s cloud-based suite of integrated EHR, patient engagement, and medical billing solutions. This implementation aims to provide enhanced care quality and accelerate operational efficiency.

Practice Type Insights

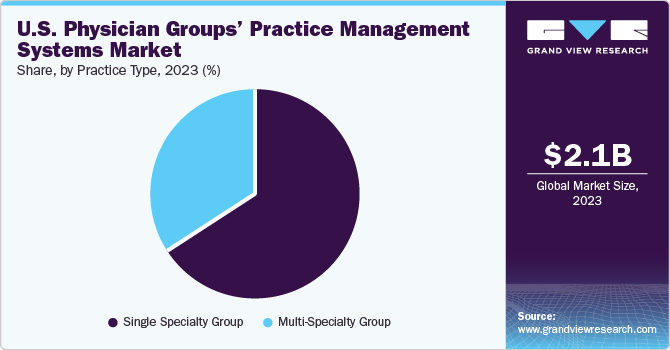

The single specialty group segment dominated the market in 2023 with a revenue share of 65.85%. In the U.S., single specialty group practices are growing and there is a demand for practice management systems that scale and adapt to changing needs. Solutions that offer modular architecture, cloud-based deployment options, and customization capabilities allow practices to tailor the system to their unique requirements and accommodate future growth.

In addition, different vendors offer practice management systems at varying price points, and the pricing model can be based on factors such as the number of users or a subscription-based model. The Government has implemented compliance with healthcare regulations such as the Health Insurance Portability and Accountability Act (HIPAA) and Centers for Medicare & Medicaid Services (CMS) requirements, which is essential for avoiding penalties and ensuring patient data security. Practice management systems that offer robust compliance features, such as audit trails, encryption, and access controls, are preferred by single-specialty group practices.

Multi-specialty group segment expected to grow at the fastest CAGR during the forecast period The growth of this segment can be attributed to various factors, including increased collaboration and care coordination among physicians from different specialties within the same organization, a broader range of medical services under one roof, and the development of advanced technologies, such as EHR, telemedicine, and interoperability solutions.

Key U.S. Physician Groups’ Practice Management Systems Company Insights

The market is fragmented, with the presence of multiple major players. The key players are adopting growth strategies to enhance their market presence, including collaborations and mergers & acquisitions.

Key U.S. Physician Groups’ Practice Management Systems Companies:

- Henry Schein, Inc.

- Veradigm LLC (Allscripts Healthcare, LLC)

- AdvantEdge Healthcare Solutions

- Athenahealth, Inc.

- Cerner Corporation (Oracle)

- GE Healthcare

- McKesson Corporation

- EPIC Systems Corporation

- NXGN Management, LLC.

- eClinicalWorks

- CareCloud, Inc.

- Kareo, Inc.

- AdvancedMD, Inc.

- DrChrono, Inc. (EverCommerce)

- CollaborateMD Inc. (EverCommerce)

- OfficeAlly Inc.

Recent Developments

-

In November 2023, Veradigm LLC launched Veradigm Intelligent Payments to help improve payment time, increase payment rates, and reduce reconciliation time for healthcare provider practices. The solution was included in Veradigm Payerpath through a partnership with RevSpring, a provider of healthcare payment and engagement solutions.

-

In November 2023, Thoma Bravo, a software investment firm for USD 1.8 billion, acquired NextGen Healthcare, Inc.

-

In August 2023, Henry Schein, Inc. acquired majority shares of Large Practice Sales (LPS) LLC, a leading consultant to individual dental practices. LPS aids practices in their sales or partnerships with larger general practices & dental specialists.

U.S. Physician Groups’ Practice Management Systems Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.91 billion

Growth rate

CAGR of 9.47% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Practice type

Country scope

U.S.

Key companies profiled

Henry Schein, Inc.; Veradigm LLC (Allscripts Healthcare, LLC); AdvantEdge Healthcare Solutions; Athenahealth, Inc.; Cerner Corporation (Oracle); GE Healthcare; McKesson Corporation; EPIC Systems Corporation; NXGN Management, LLC.; eClinicalWorks; CareCloud, Inc.; Kareo, Inc.; AdvancedMD, Inc.; DrChrono, Inc. (EverCommerce); CollaborateMD Inc. (EverCommerce); OfficeAlly Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Physician Groups’ Practice Management Systems Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. physician groups’ practice management systems market report based on practice type:

-

Practice Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Single Specialty Group

-

Multi-Specialty Group

-

Frequently Asked Questions About This Report

b. The U.S. physician groups’ practice management system market size was estimated at USD 2.11 billion in 2023 and is expected to reach USD 2.27 billion in 2024.

b. The U.S. physician groups practice management system market is expected to grow at a compound annual growth rate of 9.47% from 2024 to 2030 to reach USD 3.91 billion by 2030

b. Single specialty group segment dominated market in 2023 with market share of 65.85%. In the U.S., single specialty group practices are growing, and there is a demand for practice management systems that scale and adapt to changing needs. Solutions that offer modular architecture, cloud-based deployment options, and customization capabilities allow practices to tailor the system to their unique requirements and accommodate future growth.

b. Some key players operating in the U.S. physician groups’ practice management market include Henry Schein, Inc.; Veradigm LLC (Allscripts Healthcare, LLC); AdvantEdge Healthcare Solutions; Athenahealth, Inc.; Cerner Corporation (Oracle); GE Healthcare; McKesson Corporation; EPIC Systems Corporation; NXGN Management, LLC.; eClinicalWorks; CareCloud, Inc.; Kareo, Inc.

b. Key factors that are driving the U.S. physician groups’ practice management market include increasing healthcare spending and favorable reimbursement policies. This increasing demand for various groups of physicians for early diagnosis & treatment of the surging patient population is expected to propel market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.