- Home

- »

- Renewable Energy

- »

-

U.S. Pink Hydrogen Market Size, Industry Report, 2033GVR Report cover

![U.S. Pink Hydrogen Market Size, Share & Trends Report]()

U.S. Pink Hydrogen Market (2025 - 2033) Size, Share & Trends Analysis Report By Process (PEM Electrolysis, Alkaline Electrolysis, Solid Oxide Electrolysis), By End Use, And Segment Forecasts, Key Companies And Competitive Analysis

- Report ID: GVR-4-68040-656-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Pink Hydrogen Market Summary

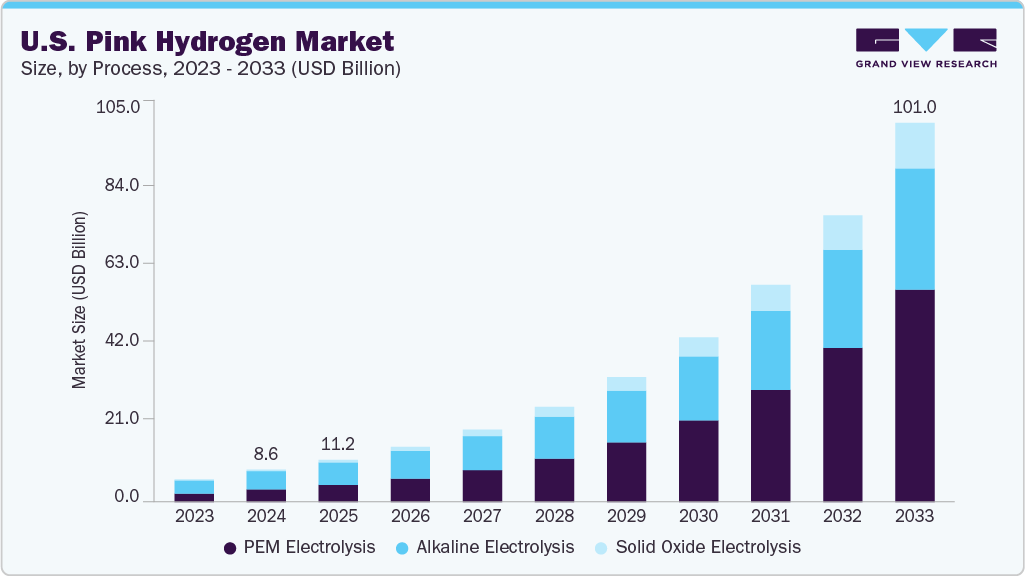

The U.S. pink hydrogen market size was estimated at USD 8.60 billion in 2024 and is projected to reach around USD 101.01 billion by 2033, growing at a CAGR of 31.58% from 2025 to 2033. Pink hydrogen, produced via electrolysis powered by nuclear energy, offers a zero-emission and high-reliability hydrogen source that aligns closely with the U.S. dual decarbonization and energy security objectives.

Key Market Trends & Insights

- The pink hydrogen market in the U.S. is expected to grow at the fastest CAGR over the forecast period.

- By process, the alkaline electrolysis segment led the market with the largest revenue share of 57.00% in 2024.

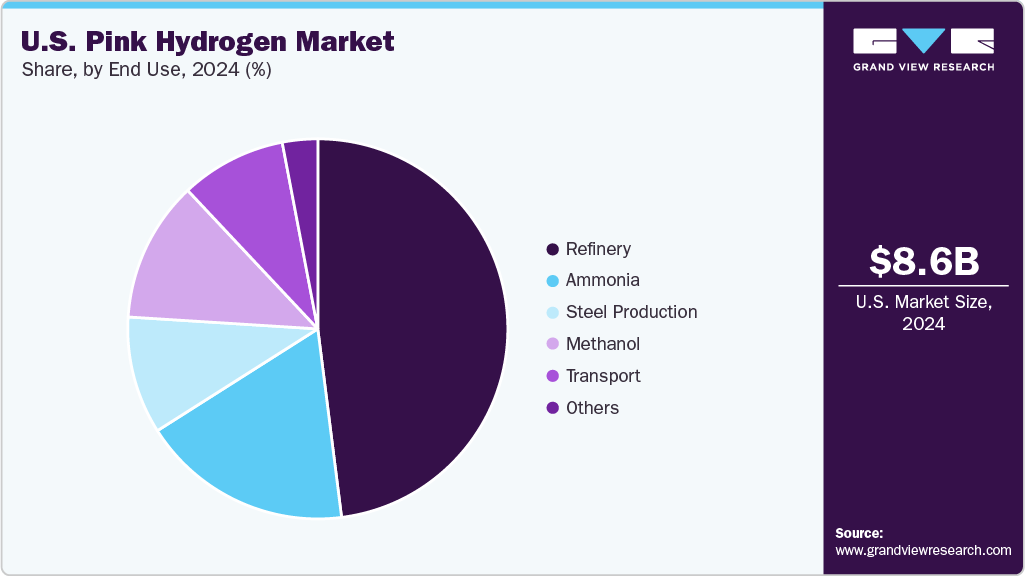

- Based on end use, the refinery segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.60 Billion

- 2033 Projected Market Size: USD 101.01 Billion

- CAGR (2025-2033): 31.58%

With the United States aiming for net-zero emissions by 2050 and investing heavily in clean hydrogen hubs, pink hydrogen is emerging as a critical complement to green and blue hydrogen in supporting deep industrial decarbonization and grid resilience.

The U.S. pink hydrogen industry is gaining momentum through growing investments in nuclear-powered electrolysis infrastructure, particularly under the Department of Energy's hydrogen strategy. Supportive policies, such as production tax credits (PTCs) under the Inflation Reduction Act and funding through the Bipartisan Infrastructure Law, are accelerating technology demonstrations and pilot deployments. Advancements in solid oxide and high-temperature electrolysis, along with collaborative efforts between nuclear utilities and hydrogen technology firms, are expanding the commercial viability of pink hydrogen. The stable output of atomic plants makes pink hydrogen especially attractive for applications demanding uninterrupted hydrogen supply, such as ammonia production, refining, and long-haul mobility. As states like Illinois, Virginia, and Michigan leverage their nuclear assets in clean hydrogen strategies, the U.S. pink hydrogen industry is set to become a key pillar in the country's broader hydrogen economy.

Drivers, Opportunities & Restraints

In the United States, the pink hydrogen industry is driven by climate policy, energy security priorities, and technological advancements. Federal and state-level decarbonization mandates, including the U.S. net-zero emissions goal by 2050, are spurring investment in low-carbon hydrogen pathways. With a well-established nuclear fleet, the largest in the world, the U.S. is uniquely positioned to leverage existing atomic infrastructure for clean hydrogen production. The Department of Energy’s Hydrogen Shot initiative and financial incentives under the Inflation Reduction Act further propel research, pilot programs, and commercialization efforts. Moreover, the reliability of nuclear-powered electrolysis offers a strategic advantage for industries requiring continuous hydrogen supply, such as refining, chemical manufacturing, and heavy transport.

Opportunities in the U.S. pink hydrogen industry are expanding with advancements in small modular reactors (SMRs), which offer flexible, distributed nuclear generation ideal for integrating electrolysis systems. High-temperature electrolysis (HTE) technologies are gaining traction through national lab partnerships and joint ventures between nuclear utilities and hydrogen innovators. The development of regional hydrogen hubs, including nuclear-hydrogen integration, presents promising avenues for domestic use and future exports. However, barriers remain. High upfront capital costs, nuclear waste concerns, and public opposition to atomic projects may temper adoption. Regulatory uncertainties around licensing, grid interconnection, and hydrogen classification under federal guidance also pose challenges. Addressing these issues will be essential to unlocking the full potential of pink hydrogen in the U.S. clean energy transition.

Process Insights

The alkaline electrolysis segment led the market with the largest revenue share of 57.00% in 2024. It is projected to grow at the fastest CAGR during the forecast period, due to its proven reliability, lower capital cost, and long-standing commercial use. Alkaline electrolysis has emerged as a foundational technology in the U.S. clean hydrogen space, particularly for nuclear-integrated projects where operational stability and cost-effectiveness are critical. Its robust performance and established supply chain make it an attractive option for utilities and developers seeking to scale up pink hydrogen production.

In the U.S., alkaline systems are deployed alongside nuclear energy assets, enabling large-scale hydrogen generation with consistent output. Their tolerance to impurities and durable cell components allows for prolonged operation, making them well-suited for baseload energy applications powered by nuclear plants. Government support through initiatives like the Inflation Reduction Act and funding for hydrogen hubs is driving interest in commercially mature technologies like alkaline electrolysis.

End Use Insights

The refinery segment led the market with the largest revenue share of 48.00% in 2024. This leadership position is driven by the U.S. refining industry's increasing shift toward decarbonizing hydrogen use, particularly in hydrogen-intensive operations such as hydrocracking, hydrotreating, and desulfurization. Traditionally reliant on grey hydrogen, U.S. refineries are now exploring pink hydrogen as a clean, dependable, and scalable alternative that aligns with national emissions reduction targets. With tightening federal and state-level environmental regulations, such as the Low Carbon Fuel Standard (LCFS) and the Clean Hydrogen Production Tax Credit (PTC), refineries are strategically integrating low-carbon hydrogen to reduce their overall carbon intensity.

The refinery segment is expected to witness at the fastest CAGR over the forecast period, as nuclear-powered hydrogen production offers a stable baseload supply capable of meeting continuous industrial demand. Several hydrogen hub projects supported by the U.S. Department of Energy are exploring refinery integration as a key end-use. While infrastructure adaptation and cost remain barriers, advances in electrolysis efficiency and supportive government funding are accelerating adoption. Other sectors, such as transportation and power generation, are ramping up hydrogen deployment, but refineries remain early adopters due to their high volume, 24/7 hydrogen consumption. As the U.S. intensifies its focus on industrial decarbonization and clean fuel production, pink hydrogen is poised to play a growing role in transforming the refining landscape.

Key U.S. Pink Hydrogen Company Insights

Some of the key players shaping the U.S. pink hydrogen industry include Air Products and Chemicals, Exelon Corporation, Constellation Energy, Linde Plc, Bloom Energy, Cummins Inc., Plug Power Inc., Westinghouse Electric Company, SGH2 Energy, and ExxonMobil. These companies leverage the nation’s robust nuclear fleet and invest in advanced electrolysis technologies to scale up clean hydrogen production. Their initiatives target decarbonizing high-emission sectors such as refining, steel, chemicals, and long-haul transportation.

Key U.S. Pink Hydrogen Companies:

- Air Products & Chemicals

- Exelon Corporation

- Constellation Energy

- SGH2 Energy

- Linde plc

- Bloom Energy

- Westinghouse Electric Company

- Plug Power Inc.

- Cummins Inc.

- ExxonMobil

Recent Developments

- In February 2024, Constellation Energy, a leading U.S. nuclear power operator, launched the nation's first pink hydrogen production pilot at its Nine Mile Point nuclear facility in New York. Supported by the U.S. Department of Energy funding, the project utilizes a low-temperature PEM electrolyzer to convert nuclear-generated electricity into clean hydrogen. This milestone marks a significant step in demonstrating the feasibility of integrating nuclear energy with hydrogen production to reduce carbon emissions in industrial applications.

U.S. Pink Hydrogen Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.24 billion

Revenue forecast in 2033

USD 101.01 billion

Growth rate

CAGR of 31.58% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Process, end use

Country scope

U.S.

Key companies profiled

Air Products & Chemicals; Exelon Corporation; Constellation Energy; SGH2 Energy; Linde plc; Bloom Energy; Westinghouse Electric Company; Plug Power Inc.; Cummins Inc.; ExxonMobil

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pink Hydrogen Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the U.S. pink hydrogen market report based on the process, and end use.

-

Process Outlook (Revenue, USD Billion, 2021 - 2033)

-

PEM Electrolysis

-

Alkaline Electrolysis

-

Solid Oxide Electrolysis

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Refinery

-

Ammonia

-

Methanol

-

Steel Production

-

Transport

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. pink hydrogen market size was estimated at USD 8.60 billion in 2024 and is expected to reach USD 11.24 billion in 2025.

b. The U.S. pink hydrogen market is expected to grow at a compound annual growth rate of 31.58% from 2025 to 2033 to reach USD 101.01 billion by 2033.

b. Based on the process segment, the Alkaline Electrolysis subsegment held the largest revenue share, more than 57%, in the U.S. pink hydrogen market in 2024.

b. Some of the key players in the U.S. pink hydrogen market include Air Products and Chemicals, Exelon Corporation, Constellation Energy, Linde Plc, Bloom Energy, Cummins Inc., Plug Power Inc., Westinghouse Electric Company, SGH2 Energy, and ExxonMobil among others.

b. The key factors driving the U.S. pink hydrogen market include the increasing emphasis on decarbonization and the need for stable, large-scale hydrogen production using low-emission energy sources. Pink hydrogen, produced through electrolysis powered by nuclear energy, offers a carbon-free alternative that ensures consistent output regardless of weather conditions unlike solar or wind.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.