- Home

- »

- Pharmaceuticals

- »

-

U.S. PRP & Stem Cell Alopecia Treatment Market Size Report, 2030GVR Report cover

![U.S. PRP & Stem Cell Alopecia Treatment Market Size, Share & Trends Report]()

U.S. PRP & Stem Cell Alopecia Treatment Market Size, Share & Trends Analysis Report By Treatment (Platelet Rich, Plasma Therapy, Stem Cell Therapy), By Indication, By End Use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-594-6

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Report Overview

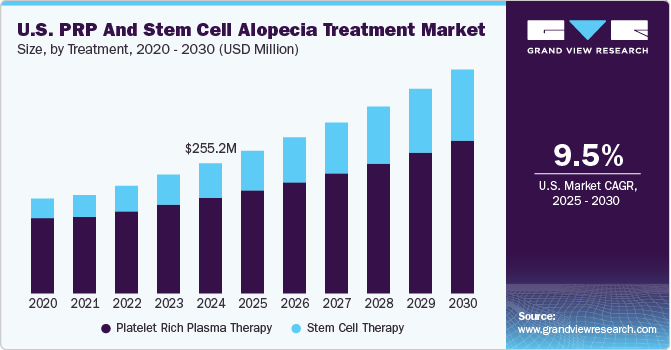

The U.S. PRP and stem cell alopecia treatment market size was valued at USD 212.7 million in 2023 and is anticipated to exhibit a CAGR of 5.4% from 2024 to 2030. This growth is attributed to the increasing number of people suffering from alopecia and rising awareness of novel treatment procedures. PRP and stem cell treatments are preferred over conventional drugs, such as corticosteroids, due to their efficiency, faster hair regrowth, and ease of administration. In addition, the growing preference for minimally invasive procedures over surgeries contributes to market expansion. Furthermore, most alopecia treatments are performed by dermatologists in private clinics, further boosting the market's growth in the U.S.

Alopecia, characterized by localized hair loss, occurs when the immune system attacks hair follicles. This condition can lead to noticeable patches as hair falls out. Treatments such as stem cell therapy and platelet-rich plasma (PRP) are gaining traction as regenerative medicine options. These minimally invasive therapies stimulate and strengthen hair regrowth rather than surgically removing damaged tissue. The increasing preference for such non-invasive procedures over traditional surgeries is expected to significantly enhance the U.S. market for PRP and stem cell alopecia treatments.

Patients and dermatologists increasingly favor these advanced therapies over conventional medications such as corticosteroids due to their effectiveness and quicker results in promoting hair regrowth. Furthermore, the ease of administering these treatments contributes to their growing popularity. As awareness of alopecia rises and more patients seek effective solutions, the demand for PRP and stem cell therapies is anticipated to grow.

Furthermore, the increasing prevalence of alopecia and advancements in treatment technologies provide a tremendous growth opportunity for the market. The proliferation of specialized dermatology clinics offering tailored therapies at lower costs than hospitals is also a significant growth factor. Moreover, ongoing research into these treatments' efficacy and potential applications may drive market interest. With a favorable regulatory environment and a shift towards patient-centered care, the PRP and stem cell alopecia treatment market is poised for substantial growth in the coming years.

Treatment Insights

The platelet rich plasma therapy led the market and accounted for the largest revenue share of 63.4% in 2023 attributed to the growing acceptance of regenerative medicine practices among healthcare professionals and patients, highlighting PRP's potential for enhancing healing procedures in various medical fields, including orthopedics and dermatology. In addition, the autologous nature of PRP derived from the patient's blood eliminates risks of disease transmission and allergic reactions, making it a safer option. Furthermore, ongoing research reveals its effectiveness in treating conditions such as alopecia, which further fuels interest and investment in this therapy.

Stem cell therapy is expected to grow significantly at a CAGR of 5.8% over the forecast period, owing to its promising applications in treating various conditions, including hair loss and degenerative diseases. The increasing understanding of stem cells' ability to regenerate damaged tissues and their potential to provide long-term solutions drives demand. In addition, technological advancements and methodologies for isolating and utilizing stem cells have also improved treatment outcomes, making these therapies more appealing to practitioners and patients. Furthermore, growing public awareness and acceptance of stem cell treatments contribute to their rising popularity as patients seek innovative solutions for chronic ailments.

Indication Insights

Androgenic alopecia dominated the market and accounted for the largest revenue share in 2023 attributed to its high prevalence, affecting approximately 50 million men and 30 million women. As the population ages, particularly baby boomers and Gen X, the demand for effective treatments increases. In addition, advances in understanding the genetic and hormonal factors contributing to this condition have led to innovative therapies, including PRP and stem cell treatments, which offer promising results in hair restoration.

Cicatricial or scarring alopecia is expected to grow at a CAGR of 5.4% over the forecast period, owing to the growing recognition of their impact on patient's quality of life. This form of alopecia can be caused by various underlying conditions, leading to permanent hair loss if untreated. In addition, the growing emphasis on personalized medicine has spurred research into targeted therapies that address the specific causes of scarring alopecia, including inflammation and autoimmune responses. Furthermore, advancements in PRP and stem cell therapies present new hope for patients looking for effective solutions, driving interest and investment in this segment of the alopecia treatment market.

End Use Insights

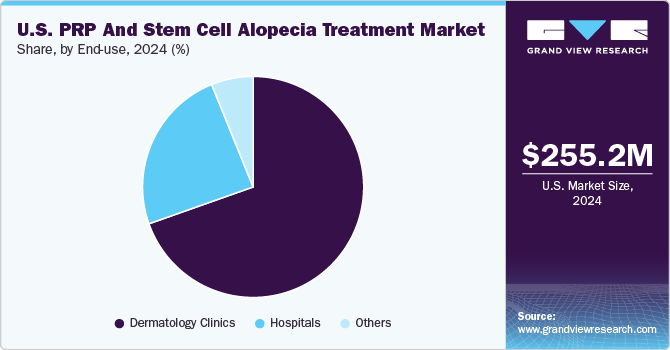

Dermatology cinics dominated the market and accounted for the largest revenue share of 79.5% in 2023 driven by the rising prevalence of skin conditions and hair loss disorders, such as androgenic alopecia. As awareness of advanced treatment options increases, patients seek specialized care in dermatology clinics equipped with the latest technologies for effective treatments. In addition, the aging population, which is more susceptible to skin issues, drives demand for dermatological services, contributing to expanding clinics nationwide.

Hospitals are expected to grow at the fastest CAGR over the forecast period, owing to the increasing incidence of skin diseases and conditions requiring specialized treatment, leading hospitals to expand their dermatology departments. In addition, hospitals are often equipped with cutting-edge facilities for conducting clinical trials and research on innovative therapies such as PRP and stem cell treatments. Furthermore, integrating advanced treatments within hospital settings enhances patient trust and drives growth in this market segment.

Key Companies & Market Share Insights

Some of the key providers in the market are Orange County Hair Restoration Center, Hair Sciences Center of Colorado, Anderson Center for Hair, Evolution Hair Loss Institute, and others. These companies employ various strategies to maintain a competitive edge. These include investing in research and development to enhance treatment efficacy, forming strategic partnerships for technology integration, and expanding service offerings to meet diverse patient needs. Furthermore, companies focus on aggressive marketing campaigns that leverage social media and patient testimonials to raise awareness and attract clientele, ensuring they remain at the forefront of the rapidly evolving regenerative medicine landscape.

-

Orange County Hair Restoration Center specializes in advanced hair restoration techniques, including platelet-rich plasma (PRP) therapy and hair transplant procedures. The center provides personalized treatment plans that utilize patients' biological materials to stimulate hair growth, ensuring natural-looking results. Its commitment to innovative technology and patient care positions it as a U.S. leader in PRP and stem cell alopecia treatment.

-

The Hair Sciences Center of Colorado offers cutting-edge hair restoration solutions, including PRP treatments and the F.U.E. method for hair transplants. Led by Dr. James Harris, the center emphasizes minimally invasive techniques that promote rapid recovery and natural results. Their integration of advanced technologies and comprehensive patient support makes them a key player in the U.S. PRP and stem cell alopecia treatment market.

Key U.S. PRP & Stem Cell Alopecia Treatment Companies:

- Orange County Hair Restoration Center

- Hair Sciences Center of Colorado

- Anderson Center for Hair

- Evolution Hair Loss Institute

- Savola Aesthetic Dermatology Center, PLC

- Virginia Surgical Center

- Hair Transplant Institute of Miami

- Colorado Surgical Center & Hair Institute

Recent Developments

-

In November 2023, The Hair Sciences Center rebranded itself as RESTORE Denver and enhanced its PRP and stem cell alopecia treatment offerings through a strategic partnership with RESTORE Hair. Under the leadership of Dr. James Harris, the center introduced the innovative RESTORE F.U.E. Method, providing patients with advanced hair restoration solutions that minimize recovery time and ensure natural results. This rebranding aims to demonstrate the clinic's commitment to delivering cutting-edge treatments, including PRP therapy, to combat hair loss effectively and improve patient outcomes in the growing market.

U.S. PRP & Stem Cell Alopecia Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 224.2 million

Revenue forecast in 2030

USD 307.8 million

Growth Rate

CAGR of 5.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment, indication, end use

Country scope

U.S.

Key companies profiled

Orange County Hair Restoration Center; Hair Sciences Center of Colorado; Anderson Center for Hair; Evolution Hair Loss Institute; Savola Aesthetic Dermatology Center, PLC; Virginia Surgical Center; Hair Transplant Institute of Miami; Colorado Surgical Center & Hair Institute

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. PRP & Stem Cell Alopecia Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global U.S. PRP & stem cell alopecia treatment market report based on treatment, indication, and end use.

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Platelet Rich Plasma Therapy

-

Stem Cell Therapy

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Androgenic Alopecia

-

Congenital Alopecia

-

Cicatricial or Scarring Alopecia

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Dermatology Clinics

-

Others

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."