- Home

- »

- Advanced Interior Materials

- »

-

U.S. Point of Entry PFAS Treatment Systems Market Report, 2033GVR Report cover

![U.S. Point of Entry PFAS Treatment Systems Market Size, Share & Trends Report]()

U.S. Point of Entry PFAS Treatment Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Reverse Osmosis, Granular Activated Carbon), By Application (Commercial, Industrial), And Segment Forecasts

- Report ID: GVR-4-68040-648-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Point of Entry PFAS Treatment Systems Market Summary

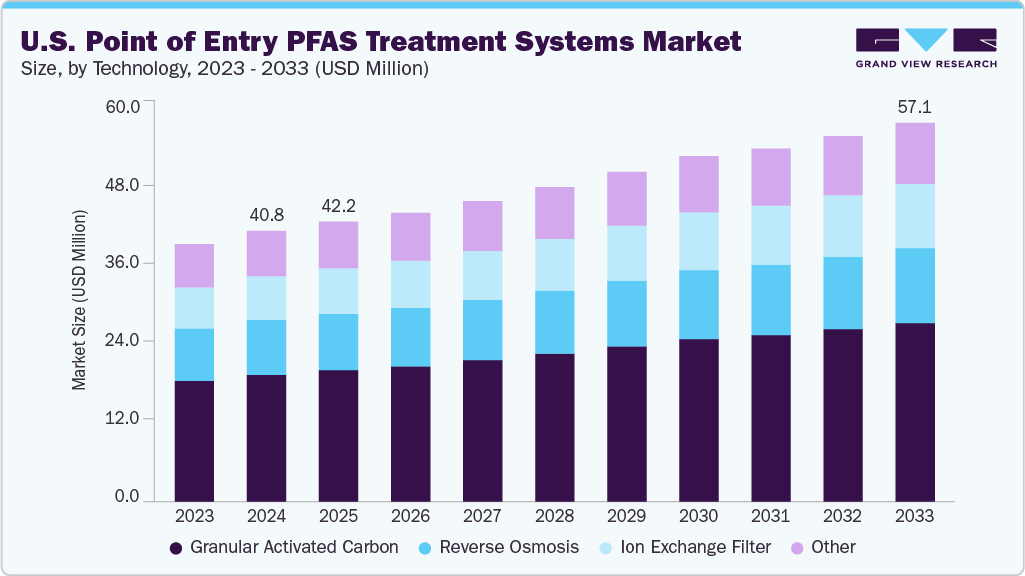

The U.S. point of entry PFAS treatment systems market size was estimated at USD 40.8 million in 2024 and is projected to reach USD 57.1 million by 2033, growing at a CAGR of 3.8% from 2025 to 2033. The market is being strongly driven by newly implemented EPA regulations that set strict limits for multiple PFAS compounds in water. These rules require utilities to monitor, report, and treat affected water sources, prompting increased investment in certified POE systems.

Key Market Trends & Insights

- The point of entry PFAS treatment systems market in the U.S. is expected to grow at a substantial CAGR of 3.8% from 2025 to 2033.

- By technology, Ion exchange filter segment is expected to grow at a considerable CAGR of 4.4% from 2025 to 2033 in terms of revenue.

- By application, commercial segment is expected to grow at a considerable CAGR of 4.2% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 40.8 Million

- 2033 Projected Market Size: USD 57.1 Million

- CAGR (2025-2033): 3.8%

The market is experiencing robust growth, driven by increasingly stringent regulations and rising public pressure to address per- and polyfluoroalkyl substances (PFAS) contamination in industrial and municipal water supplies. While PFAS have been widely used in firefighting foams, chemical manufacturing, and various industrial processes, their persistence in the environment has made them a priority for federal and state-level regulatory agencies, including the EPA.

As a result, industrial facilities such as chemical plants, metal finishers, and textile manufacturers are investing in dedicated POE treatment systems to ensure compliance with discharge limits and protect downstream water sources.

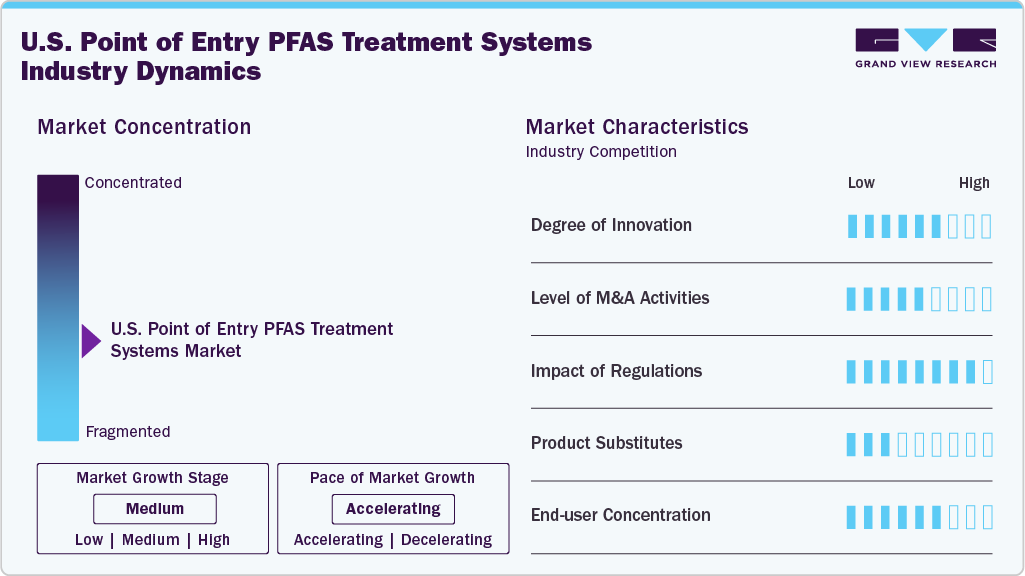

Market Concentration & Characteristics

The U.S. point of entry PFAS treatment systems industry is moderately fragmented, with a mix of established players and emerging regional firms. While a few major companies hold significant market share through advanced technologies and contracts, numerous smaller providers compete locally. Varied state regulations and the need for site-specific solutions drive the market’s fragmentation, creating opportunities for both large-scale providers and niche specialists to coexist.

The U.S. point of entry PFAS treatment systems industry is witnessing steady innovation, particularly in adsorption and membrane-based technologies. Advancements focus on improving contaminant removal efficiency and reducing operational costs. Companies are also developing modular and compact systems for residential use. R&D investment is rising in response to evolving federal and state water quality standards.

The market has seen a moderate level of mergers and acquisitions, as larger water treatment companies seek to expand PFAS-specific capabilities. Strategic acquisitions are often aimed at integrating innovative startups with proprietary technologies. This consolidation helps companies strengthen distribution networks and regulatory compliance. However, the fragmented nature of the market still leaves room for independent players.

Regulations significantly shape the PFAS treatment systems market, especially the recent enforcement of maximum contaminant limits by the U.S. EPA. Compliance pressure is prompting utilities and private well users to adopt certified treatment solutions. State-level policies also vary, creating region-specific demand spikes. Regulatory clarity is driving long-term investments and the adoption of proven technologies.

Drivers, Opportunities & Restraints

The U.S. point-of-entry (POE) PFAS treatment systems market is gaining momentum, driven by increasing awareness of the health and environmental risks of PFAS-contaminated water in industrial, municipal, and commercial settings. Regulatory pressure from the U.S. EPA-particularly the enforcement of newly established Maximum Contaminant Levels (MCLs)-alongside state-level mandates, is accelerating the deployment of POE systems at facilities such as schools, hospitals, commercial buildings, and municipal wellheads.

The growing frequency of PFAS detection in non-residential water sources, including fire stations, airports, and industrial sites, further fuels market demand. At the same time, technological advancements in ion exchange, granular activated carbon (GAC), and high-efficiency membrane systems are improving cost-effectiveness and performance for large-scale, distributed POE applications. Significant federal and state funding for clean water initiatives-such as those under the Bipartisan Infrastructure Law-creates new opportunities for municipal utilities and public institutions to invest in decentralized PFAS mitigation strategies.

However, market growth faces challenges including high capital and operating costs, particularly for large commercial or institutional users. Moreover, the lack of national standardization or certification for POE PFAS systems complicates procurement decisions, while the safe disposal of PFAS-laden spent media remains a significant technical and regulatory hurdle for operators.

Technology Insights

Granular Activated Carbon (GAC) dominated the market and accounted for a share of 46.9% in 2024, due to its proven effectiveness in removing long-chain PFAS compounds. Its widespread availability and relatively low operating cost make it a preferred choice for both commercial and industrial applications. EPA guidelines and state-level regulatory standards also support GAC systems. Their ability to handle varying flow rates adds to their suitability across different use cases.

Ion exchange filters are the fastest-growing segment in the U.S. due to their high efficiency in targeting both short- and long-chain PFAS. These systems offer quicker regeneration cycles and longer service life compared to traditional carbon filters. As regulations tighten and treatment performance requirements increase, demand for ion exchange technology is rising. Their compact design also appeals to residential users seeking reliable, space-saving solutions.

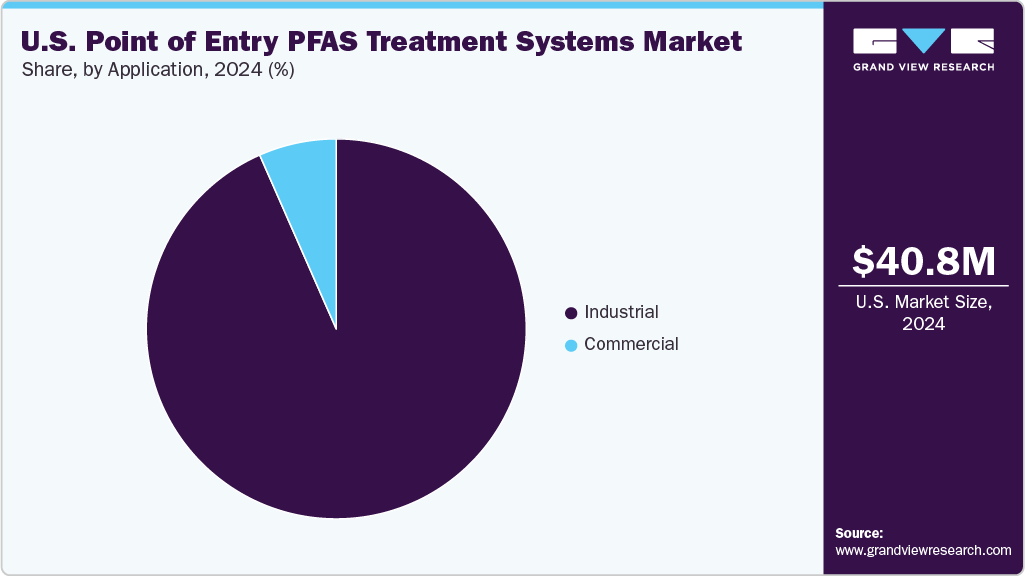

Application Insights

The industrial segment led the market and accounted for over 93.4% of the U.S. revenue in 2024. Due to high water usage and stricter discharge regulations, the industrial segment dominates the U.S. point-of-entry PFAS treatment systems market. Industries such as chemical manufacturing, aerospace, and electronics face direct regulatory pressure to manage PFAS contamination. These sectors require large-scale, continuous treatment systems to meet compliance.

The commercial segment is the fastest growing due to rising regulatory scrutiny of businesses like car washes, laundromats, and food processing units. Increased public awareness and liability risks are prompting proactive adoption of PFAS treatment solutions. Small businesses seek compact, certified systems to ensure water safety and compliance. Incentives and local mandates are further accelerating this trend.

Key U.S. Point of Entry PFAS Treatment Systems Company Insights

Some key players operating in the market include 3M, DuPont, and Pentair plc.

-

Pentair serves diverse markets through its Consumer Solutions and Industrial & Flow Technologies segments. The PFAS treatment domain provides POE systems using granular activated carbon and membrane filtration, alongside under-sink point-of-use systems for targeted removal. Beyond water filtration, its industrial portfolio includes pumps, valves, and separation technologies for water movement and processing in food & beverage, marine, and manufacturing sectors.

-

DuPont operates across several key segments, including Water Solutions, Electronics & Industrial, and Mobility & Materials, with its Water Solutions division being instrumental in the PFAS treatment market. It offers advanced purification technologies such as reverse osmosis membranes, ion exchange resins, and ultrafiltration systems used in municipal, industrial, and residential applications. In addition to POE PFAS systems, DuPont provides solutions for wastewater reuse, seawater desalination, and zero-liquid discharge operations.

Key U.S. Point of Entry PFAS Treatment Systems Companies:

- 3M

- DuPont

- Pentair plc.

- BWT Holding GmbH

- Culligan Water

- Watts

- Aquasana, Inc.

- Calgon Carbon Corporation

- EcoWater Systems LLC

- Veolia

Recent Developments

-

In June 2025, Veolia launched a major PFAS treatment facility at the Stanton Water Treatment Plant in Delaware, designed to handle up to 30 million gallons of water per day. With an investment of $35 million, the plant now supplies clean, PFAS-compliant water to more than 100,000 people. It includes 42 activated carbon filtration units and a dedicated lab for monitoring system performance. This project is part of Veolia’s broader strategy to expand PFAS treatment across North America through scalable and regulatory-aligned solutions.

-

In August 2023, Aquasana launched its SmartFlow Reverse Osmosis system, designed to efficiently remove up to 99.99% of 90 common water contaminants, including PFAS, fluoride, and lead. The system offers improved performance with over 50% greater efficiency and nearly double the daily output compared to its previous model. It is certified to NSF/ANSI standards for comprehensive filtration and includes a remineralization stage to enhance water quality. With a space-saving design and easy-to-replace filters, it has customizable metal faucets to match various kitchen styles.

Point of Entry PFAS Treatment Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 42.2 million

Revenue forecast in 2033

USD 57.1 million

Growth rate

CAGR of 3.8% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application

Country scope

U.S.

Key companies profiled

3M; DuPont; Pentair plc; BWT Holding GmbH; Culligan Water; Watts; Aquasana, Inc.; Calgon Carbon Corporation; EcoWater Systems LLC; Veolia

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Point of Entry PFAS Treatment Systems Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. point of entry PFAS treatment systems market report based on technology and application:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Reverse Osmosis

-

Granular Activated Carbon

-

Ion Exchange Filter

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Industrial

-

Surgical & medical instruments

-

waterproof outerwear

-

Broad woven fabric mills

-

Perfumes & cosmetics

-

Plastic films

-

Carpets and rugs

-

Paints and varnishing

-

Paper mills

-

EV battery manufacturing

-

Packaging paper & plastic

-

Commercial printing

-

Leather & Hide tanning

-

Wire manufacturing

-

Electroplating/polishing

-

Semiconductor

-

-

Frequently Asked Questions About This Report

b. The U.S. point of entry PFAS treatment systems market size was estimated at USD 40.8 million in 2024 and is expected to be USD 42.2 million in 2025.

b. The U.S. point of entry PFAS treatment systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.8% from 2025 to 2033 to reach USD 57.1 million by 2033.

b. The industrial segment led the market and accounted for over 93.4% in 2024. The industrial segment dominates the U.S. point-of-entry PFAS treatment systems market due to high water usage and stricter discharge regulations.

b. Some of the key players operating in the U.S. point of entry PFAS treatment systems market include 3M; DuPont; Pentair plc; BWT Holding GmbH; Culligan Water; Watts; Aquasana, Inc.; Calgon Carbon Corporation; EcoWater Systems LLC; GE Appliances; A.O. Smith.; BRITA PRO; Coway USA, Inc.; Eureka Forbes.; Veolia

b. Key factors driving the U.S. point-of-entry PFAS treatment systems market include stringent EPA and state regulations, rising detection of PFAS in municipal and industrial water sources, growing health concerns, and increased funding for clean water infrastructure. Technological advancements in treatment methods are also supporting wider adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.