- Home

- »

- Advanced Interior Materials

- »

-

U.S. Point of Exit PFAS Treatment Systems Market 2033GVR Report cover

![U.S. Point of Exit PFAS Treatment Systems Market Size, Share & Trends Report]()

U.S. Point of Exit PFAS Treatment Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Reverse Osmosis, Granular Activated Carbon), By Application (Commercial, Industrial), And Segment Forecasts

- Report ID: GVR-4-68040-650-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

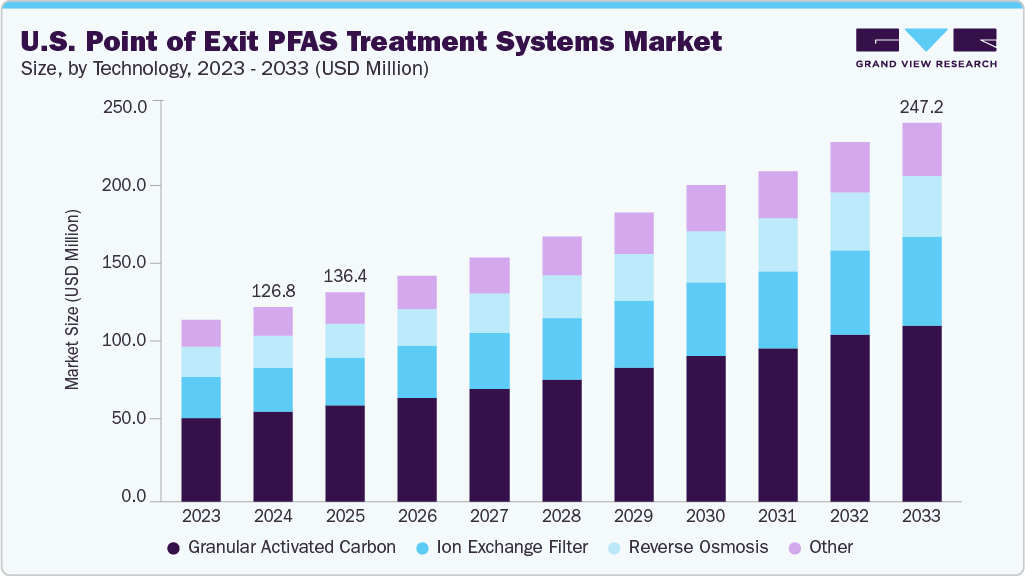

The U.S. point of exit PFAS treatment systems market size was estimated at USD 126.8 million in 2024 and is projected to reach USD 247.2 million by 2033, growing at a CAGR of 7.7% from 2025 to 2033. The rising awareness of the health risks associated with PFAS contamination has led to stricter federal and state regulations, driving the demand for point of exit treatment systems.

Key Market Trends & Insights

- The point of exit PFAS treatment systems market in the U.S. is expected to grow at a substantial CAGR of 7.7% from 2025 to 2033.

- By technology, Ion exchange filter segment is expected to grow at a considerable CAGR of 8.1% from 2025 to 2033 in terms of revenue.

- By application, commercial segment is expected to grow at a considerable CAGR of 8.6% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 126.8 Million

- 2033 Projected Market Size: USD 247.2 Million

- CAGR (2025-2033): 7.7%

The U.S. EPA’s regulations under the Safe Drinking Water Act and updated advisories for PFAS levels in water have compelled utilities and industries to adopt advanced removal technologies. Technological advancements in filtration methods such as granular activated carbon (GAC) and ion exchange resins have made point of exit systems more efficient and cost-effective. Government funding initiatives, including infrastructure bills with clean water allocations, are also contributing to the market expansion. Increasing PFAS detection in groundwater and surface water near industrial and military sites has amplified the urgency for localized treatment solutions. Lastly, the shift towards long-term, sustainable water purification strategies continues to favor the deployment of point of exit systems across the U.S.

Market Concentration & Characteristics

The U.S. point of exit PFAS treatment systems market is moderately concentrated, with a few key players dominating the market due to their technological expertise and large-scale production capabilities. Leading companies leverage proprietary filtration technologies and strong distribution networks, creating high entry barriers for new entrants. However, niche players continue to emerge, offering customized solutions for specific regions or contamination levels.

The U.S. point of exit PFAS treatment market exhibits a high degree of innovation, driven by the need for more effective, compact, and energy-efficient solutions. Companies are investing in advanced materials, AI-enabled monitoring, and hybrid filtration systems. R&D efforts are focused on improving removal efficiency for emerging PFAS compounds. Continuous product upgrades are essential to meet evolving regulatory and performance demands.

The market has seen a moderate to high level of mergers and acquisitions, as larger firms aim to expand their portfolios and geographic presence. Strategic acquisitions target startups with innovative technologies or regional market access. M&A activities also support vertical integration, allowing control over both manufacturing and service delivery. This trend helps to consolidate market share and reduce competition.

Regulation plays a critical role in shaping market dynamics, with EPA standards and state-level mandates driving adoption. New limits on PFAS in water have accelerated demand for certified treatment systems. Regulatory pressure has encouraged municipalities and industries to proactively invest in point of exit solutions. Non-compliance risks and legal liabilities further push end-users toward compliant technologies.

Drivers, Opportunities & Restraints

Tighter U.S. EPA limits on PFAS in drinking and process water, coupled with high-profile detections near industrial and military facilities, are pushing businesses and public institutions to install point-of-exit systems. Advances in granular activated carbon, ion-exchange, and membrane technologies are boosting removal efficiency, while growing investment in decentralized water treatment infrastructure makes on-site solutions more practical and scalable.

Expanded federal and state clean-water funding, Department of Defense remediation programs, and industrial-park redevelopment grants are creating budget pathways for new installations. The need to treat emerging short-chain PFAS is spurring demand for next-generation media, opening doors for technology suppliers. Long-term service contracts with municipalities, utilities, and large multitenant campuses can secure recurring revenue and support market expansion.

High upfront and operating costs remain prohibitive for many small and mid-sized facilities. Limited technical awareness in secondary industrial clusters slows adoption, while complex maintenance and filter-disposal requirements add life-cycle expense. Finally, evolving regulatory thresholds and certification gaps create uncertainty that can delay purchasing decisions.

Technology Insights

Granular Activated Carbon (GAC) dominates the U.S. point of exit PFAS treatment systems market and accounted for the 45.9% share in 2024. Its effectiveness in removing long-chain PFAS compounds, combined with affordability and ease of integration, makes it a widely preferred option in commercial and industrial applications. GAC systems benefit from broad regulatory acceptance, including NSF/ANSI certifications, which support procurement in compliance-driven environments. Additionally, their relatively low maintenance and operational simplicity contribute to sustained use across a range of facilities.

Ion exchange filters represent the fastest-growing segment due to their superior performance in capturing both short- and long-chain PFAS compounds. Advancements in resin technology have enhanced their selectivity, capacity, and regeneration efficiency, making them suitable for high-demand industrial operations. These systems offer longer service life compared to GAC and are gaining traction in facilities requiring compact, high-performance solutions. Growing regulatory pressure to remove short-chain PFAS is also accelerating the shift toward ion exchange in point of exit applications.

Application Insights

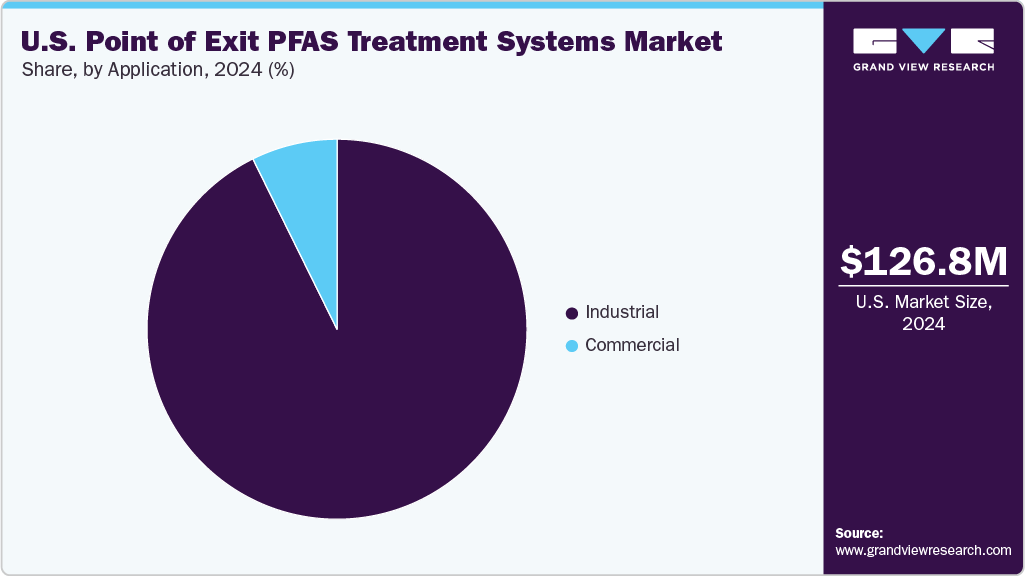

The industrial segment led the market and accounted for 92.7% of the U.S. revenue in 2024. The segment dominates the U.S. point of exit PFAS treatment systems market due to high contamination levels in manufacturing, chemical, and firefighting foam-related facilities. Regulatory pressure on industrial discharge and liability concerns drive widespread adoption. Industries require large-scale, high-capacity systems to ensure compliance and protect operations. The need for customized, site-specific treatment solutions further strengthens demand in this segment.

The commercial sector is the fastest-growing application due to rising PFAS detection in facilities such as schools, hospitals, and office buildings. Similarly, there is a growing adoption among employees and patrons due to the rising awareness of health risks. Businesses are proactively investing in point of exit systems to ensure safe water for consumption and use. Additionally, state regulations mandating water quality in commercial establishments are accelerating growth.

Key U.S. Point of Exit PFAS Treatment Systems Company Insights

Some of the key players operating in the market include Revive Environmental Technology, LLC., DuPont, Pentair plc, and others.

-

Pentair operates through its Consumer Solutions and Industrial & Flow Technologies segments, offering water treatment solutions across residential, commercial, and industrial markets. In the PFAS treatment space, the company provides point of exit systems using granular activated carbon and membrane filtration, suitable for broader building-level applications. Its portfolio also includes pumps, valves, and fluid control systems used in water processing for food & beverage, marine, and manufacturing industries, supporting compliance and operational needs in PFAS-affected sectors.

-

DuPont operates across several key segments including Water Solutions, Electronics & Industrial, and Mobility & Materials, with its Water Solutions division being instrumental in the PFAS treatment market. It offers advanced purification technologies such as reverse osmosis membranes, ion exchange resins, and ultrafiltration systems used in municipal, industrial, and residential applications. In addition to POE PFAS systems, DuPont provides solutions for wastewater reuse, seawater desalination, and zero-liquid discharge operations.

Key U.S. Point of Exit PFAS Treatment Systems Companies:

- Revive Environmental Technology, LLC.

- DuPont

- Pentair plc.

- Aquasana

- Culligan Water

- Ion Exchange

- AECOM

- Calgon Carbon Corporation

- EcoWater Systems LLC

- Veolia

Recent Developments

-

In May 2025, AqueoUS Vets introduced the FoamPro system, a foam fractionation technology designed to treat PFAS-contaminated water using an energy-efficient, vacuum-based process. The system offers a modular, plug-and-play design capable of handling various flow rates and challenging waste types, including firefighting foam residues and landfill runoff. Field performance showed it could remove over 99% of specific PFAS compounds like PFOS and PFOA. This launch expands the company’s treatment offerings with a practical solution for industrial and municipal PFAS mitigation.

-

In June 2024, AECOM partnered with Aquatech to advance the use of its DE-FLUORO technology, designed for effective PFAS destruction. This electrochemical process has been tested in the field and can treat various complex waste streams, including firefighting foam residues and leachate. Aquatech will manage the end-to-end deployment, from assessment to on-site implementation. The collaboration aims to make sustainable PFAS treatment more accessible and scalable for communities and industries.

U.S. Point of Exit PFAS Treatment Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 136.4 million

Revenue forecast in 2033

USD 247.2 million

Growth rate

CAGR of 7.7% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology and application

Country scope

U.S.

Key companies profiled

Revive Environmental Technology, LLC.; DuPont; Pentair plc; Aquasana; Culligan Water; Ion Exchange; AECOM; Calgon Carbon Corporation; EcoWater Systems LLC; Veolia

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Point of Exit PFAS Treatment Systems Market Report Segmentation

This report forecasts revenue growth at the U.S. levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. point of exit PFAS treatment systems market report based on technology and application

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Reverse Osmosis

-

Granular Activated Carbon

-

Ion Exchange Filter

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Industrial

-

Surgical & medical instruments

-

waterproof outerwear

-

Broad woven fabric mills

-

Perfumes & cosmetics

-

Plastic films

-

Carpets and rugs

-

Paints and varnishing

-

Paper mills

-

EV battery manufacturing

-

Packaging paper & plastic

-

Commercial printing

-

Leather & Hide tanning

-

Wire manufacturing

-

Electroplating/polishing

-

Semiconductor

-

-

Frequently Asked Questions About This Report

b. The U.S. point of exit PFAS treatment systems market size was estimated at USD 126.8 million in 2024 and is expected to be USD 136.4 million in 2025.

b. The U.S. point of exit PFAS treatment systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.7% from 2025 to 2033 to reach USD 247.2 million by 2033.

b. The industrial segment led the market and accounted for over 92.7% of the U.S. revenue in 2024. The industrial segment dominates the U.S. point of exit PFAS treatment systems market due to high contamination levels in manufacturing, chemical, and firefighting foam-related facilities.

b. Some of the key players operating in the point of exit PFAS treatment systems market include Revive Environmental Technology, LLC.; DuPont; Pentair plc; Aquasana; Culligan Water; Ion Exchange; AECOM; Calgon Carbon Corporation; EcoWater Systems LLC; Veolia

b. Key factors driving the U.S. point of exit PFAS treatment systems market include stricter environmental regulations, rising detection of PFAS near industrial sites, increasing health concerns, and the need for localized, on-site water treatment solutions to ensure compliance and reduce liability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.